OPEN-SOURCE SCRIPT

Turbo Scaler - The Art Of Being (too) Early

Updated

Introduction

Fast smooth indicators that produce early signals can sound utopic but mathematically its not a huge deal, the effect of early outputs based on smooth inputs can be seen on differentiators crosses, this is why i propose this indicator that aim to return extra fast signals based on a slightly modified max-min normalization method. The indicator introduce inherent smoothing without having an huge impact on the indicator reactivity.

The Indicator

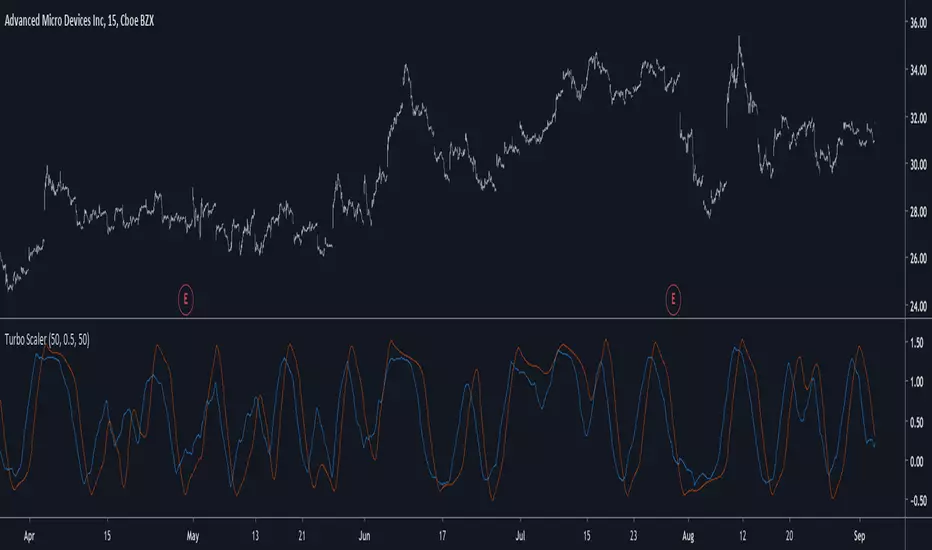

The indicator is based on max-min normalization (like the stochastic oscillator) however instead of using the highest/lowest of the input we use the highest and lowest of the moving average of the input. This process using as input the closing price and the moving average closing price will return two lines, and because of the nature of max-min normalization we can see that the trigger line (in orange) produce earlier crosses. length control the highest/lowest period while smooth control the output lines smoothness (50 by default).

alpha control the scaling amount, with higher values of alpha creating more constrained scale, when alpha = 1 the scale is in a range of (0,1) while lower values of alpha can make the output move more freely.

alpha = 0.25

alpha = 1

Higher values of alpha create earlier signals.

Downsides Of Early Crosses

Of course such indicator make us exposed to the trend as seen below.

We can nonetheless protect ourselves against such cases scenarios by lowering alpha.

lowering alpha allow to catch movements of the trend without loosing much reactivity at the cost of an increased umber of trades.

Possible Uses

The proposed indicator allow for an high number of uses because of its scale, reactive nature...etc. A method that allow us to go with the main trend is by taking into account the crosses between the lines and the sign of the lines, for example :

The first signal (green) happen when the main line (in blue) crossover the trigger (orange) while both are > 0, the same happen with the second signal however both lines are < 0. This method can use certain levels instead of the sign (main line crossover trigger while both > 0.7...etc).

This method is great for the indicator because such cases scenarios does not happen a lot with ranging markets, we can clearly that when trending the trigger can have the tendency to be flat and higher than 0 thus allowing for the main line to produce those signals.

Conclusion

I have presented a super reactive crosses indicator based on max-min normalization with the ability to both be smooth and produce early entries/exits signals, different methods have been presented in order to allow for different setups using this indicator.

The introduction of the alpha parameter allow for more control which is what those kind of indicators needs. I hope you find an use to it :)

Support Me

Making indicators sure is hard, it takes time and it can be quite lonely to, so i would love talking with you guys while making them :) There isn't better support than the one provided by your friends so drop me a message.

Fast smooth indicators that produce early signals can sound utopic but mathematically its not a huge deal, the effect of early outputs based on smooth inputs can be seen on differentiators crosses, this is why i propose this indicator that aim to return extra fast signals based on a slightly modified max-min normalization method. The indicator introduce inherent smoothing without having an huge impact on the indicator reactivity.

The Indicator

The indicator is based on max-min normalization (like the stochastic oscillator) however instead of using the highest/lowest of the input we use the highest and lowest of the moving average of the input. This process using as input the closing price and the moving average closing price will return two lines, and because of the nature of max-min normalization we can see that the trigger line (in orange) produce earlier crosses. length control the highest/lowest period while smooth control the output lines smoothness (50 by default).

alpha control the scaling amount, with higher values of alpha creating more constrained scale, when alpha = 1 the scale is in a range of (0,1) while lower values of alpha can make the output move more freely.

alpha = 0.25

alpha = 1

Higher values of alpha create earlier signals.

Downsides Of Early Crosses

Of course such indicator make us exposed to the trend as seen below.

We can nonetheless protect ourselves against such cases scenarios by lowering alpha.

lowering alpha allow to catch movements of the trend without loosing much reactivity at the cost of an increased umber of trades.

Possible Uses

The proposed indicator allow for an high number of uses because of its scale, reactive nature...etc. A method that allow us to go with the main trend is by taking into account the crosses between the lines and the sign of the lines, for example :

The first signal (green) happen when the main line (in blue) crossover the trigger (orange) while both are > 0, the same happen with the second signal however both lines are < 0. This method can use certain levels instead of the sign (main line crossover trigger while both > 0.7...etc).

This method is great for the indicator because such cases scenarios does not happen a lot with ranging markets, we can clearly that when trending the trigger can have the tendency to be flat and higher than 0 thus allowing for the main line to produce those signals.

Conclusion

I have presented a super reactive crosses indicator based on max-min normalization with the ability to both be smooth and produce early entries/exits signals, different methods have been presented in order to allow for different setups using this indicator.

The introduction of the alpha parameter allow for more control which is what those kind of indicators needs. I hope you find an use to it :)

Support Me

Making indicators sure is hard, it takes time and it can be quite lonely to, so i would love talking with you guys while making them :) There isn't better support than the one provided by your friends so drop me a message.

Release Notes

added min/max values for alpha.Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Check out the indicators we are making at luxalgo: tradingview.com/u/LuxAlgo/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.