PROTECTED SOURCE SCRIPT

PivotBoss Tool (PART 2)

Hello Everyone,

This indicator is being published on TradingView to help traders solve their multiframe EOD analysis issue and at the same time get additional information of other crucial information - CandleStick Patterns, Candlestick Midpoint and ATR Trails for trailing your SL's all under one single frame.

This indicator is based on the concepts of Secrets of Pivot Boss by Mr.Frank Ochoa and strives to provide more insightful information of pivot points and other general indicators being used by traders on day-to-day basis in the simplest format possible so that traders of all kinds can relate to the same.

And, this is purely dedicated to EOD analysis.

What is the moat of this Indicator?

This particular indicator is designed to help the traders in their EOD analysis as this indicator is well equipped to provide the next session trading pivot points well in advance at the end of the current day trading session. A trader has everything required for an EOD analysis in this particular indicator.

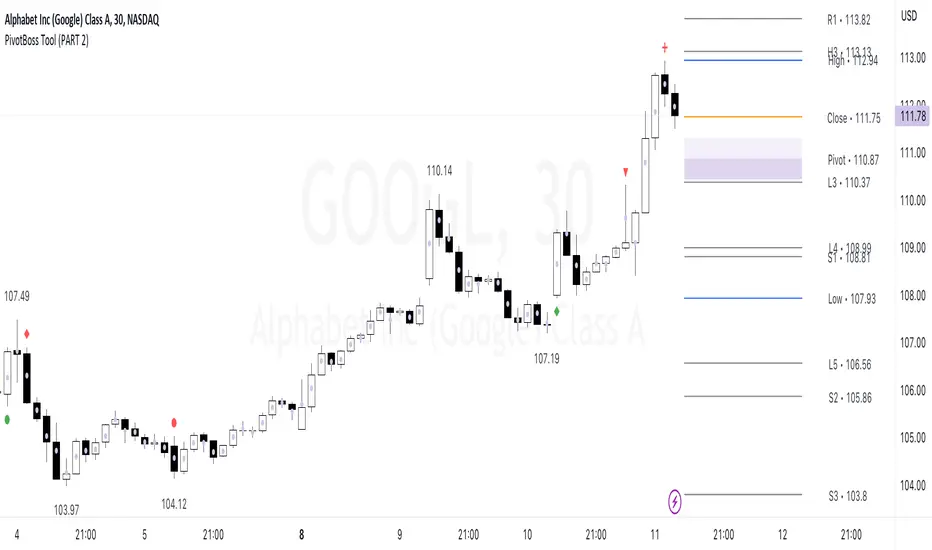

Below is the brief information of the indicator table you see in the layout of the above chart -

#Next Session Pivots

One can plot this feature to find out the developing pivot levels for upcoming D/W/M/Q/Y alongside it's additional pivot levels such as:

- Future Camarilla Pivots (H3/H4/H5 & L3/L4/L5)

- Future Floor Pivots (R1/R2/R3 & S1/S2/S3)

- Future CPR levels (TC/PIVOT/BC)

#Developing Pivot Cloud

One can check the developing CPR in Intraday itself by enabling the pivot cloud feature which can tell you multiple information to be with the trend and it's participants.

Basically a live extension of the current trading CPR according with the progress of the trading day.

#CandleStick Mid-Point

This can plot the midpoint of each candlestick on any timeframe for better understanding of buyer/seller's absorption!

#Candlestick Pattern Scans

So one can now easily filter out the candlesticks patterns which helps in decoding the chart in a better format for entry and exits. There are 4 candlesticks patterns included -

- Wick Reversal Pattern -

This pattern basically tells the wick strength which is actually a liquidity absorption by the stronger hand and the intensity and further direction of the move depends on the position of wick candle being formed indicated by green (bull) or red (bear) signal.

- Doji Reversal Pattern -

This pattern basically is used to identify the biasness of the market participants and further identifies a pause in the ongoing trend or a pause for the trend to get further liquidity for broader strength.

- Outside Reversal Pattern -

This pattern depicts the range of the previous candle of a specific timeframe has been tested at both the extreme and probably the price will consolidate in the that visible range for a while.

- Extreme Reversal Pattern -

This pattern basically points at a setup that looks for an extreme pattern of selling pressure and then looks to fade this behavior to capture a bullish move higher (reverse for shorts) and vice versa .

#ATR Trails

This a just a supertrend indicator sourced with ATR to track a short/long term trend change and can be used for trailing SL's when they are kept tight for big positions!

#CPR Trails

This is the most interesting feature with multiple permutations & combinations and can be used to analyse intraday as well as EOD and positional trends. Moreover, THIS FEATURE CAN ALSO INDENTIFY MICRO INTRADAY TREND AS SMALL AS EACH 5M TREND!!

This indicator will be updated with time and depending on community's feedback and requirements.

Credits -

- Mr. Frank Ochoa (Concepts and ideas from the book 'Secrets of PivotBoss' )

- TradingView (Providing a platform to traders to simply their trading through 'PineScript')

Regards,

Mukkull

This indicator is being published on TradingView to help traders solve their multiframe EOD analysis issue and at the same time get additional information of other crucial information - CandleStick Patterns, Candlestick Midpoint and ATR Trails for trailing your SL's all under one single frame.

This indicator is based on the concepts of Secrets of Pivot Boss by Mr.Frank Ochoa and strives to provide more insightful information of pivot points and other general indicators being used by traders on day-to-day basis in the simplest format possible so that traders of all kinds can relate to the same.

And, this is purely dedicated to EOD analysis.

What is the moat of this Indicator?

This particular indicator is designed to help the traders in their EOD analysis as this indicator is well equipped to provide the next session trading pivot points well in advance at the end of the current day trading session. A trader has everything required for an EOD analysis in this particular indicator.

Below is the brief information of the indicator table you see in the layout of the above chart -

#Next Session Pivots

One can plot this feature to find out the developing pivot levels for upcoming D/W/M/Q/Y alongside it's additional pivot levels such as:

- Future Camarilla Pivots (H3/H4/H5 & L3/L4/L5)

- Future Floor Pivots (R1/R2/R3 & S1/S2/S3)

- Future CPR levels (TC/PIVOT/BC)

#Developing Pivot Cloud

One can check the developing CPR in Intraday itself by enabling the pivot cloud feature which can tell you multiple information to be with the trend and it's participants.

Basically a live extension of the current trading CPR according with the progress of the trading day.

#CandleStick Mid-Point

This can plot the midpoint of each candlestick on any timeframe for better understanding of buyer/seller's absorption!

#Candlestick Pattern Scans

So one can now easily filter out the candlesticks patterns which helps in decoding the chart in a better format for entry and exits. There are 4 candlesticks patterns included -

- Wick Reversal Pattern -

This pattern basically tells the wick strength which is actually a liquidity absorption by the stronger hand and the intensity and further direction of the move depends on the position of wick candle being formed indicated by green (bull) or red (bear) signal.

- Doji Reversal Pattern -

This pattern basically is used to identify the biasness of the market participants and further identifies a pause in the ongoing trend or a pause for the trend to get further liquidity for broader strength.

- Outside Reversal Pattern -

This pattern depicts the range of the previous candle of a specific timeframe has been tested at both the extreme and probably the price will consolidate in the that visible range for a while.

- Extreme Reversal Pattern -

This pattern basically points at a setup that looks for an extreme pattern of selling pressure and then looks to fade this behavior to capture a bullish move higher (reverse for shorts) and vice versa .

#ATR Trails

This a just a supertrend indicator sourced with ATR to track a short/long term trend change and can be used for trailing SL's when they are kept tight for big positions!

#CPR Trails

This is the most interesting feature with multiple permutations & combinations and can be used to analyse intraday as well as EOD and positional trends. Moreover, THIS FEATURE CAN ALSO INDENTIFY MICRO INTRADAY TREND AS SMALL AS EACH 5M TREND!!

This indicator will be updated with time and depending on community's feedback and requirements.

Credits -

- Mr. Frank Ochoa (Concepts and ideas from the book 'Secrets of PivotBoss' )

- TradingView (Providing a platform to traders to simply their trading through 'PineScript')

Regards,

Mukkull

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.