█ Overview

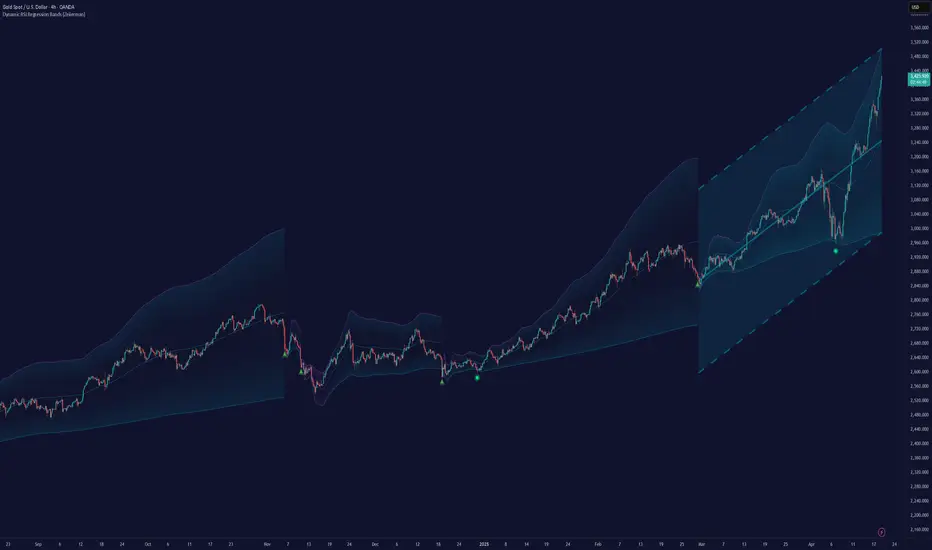

The Dynamic RSI Regression Bands (Zeiierman) is a regression channel tool that dynamically resets based on RSI overbought and oversold conditions. It adapts to trend shifts in real time, creating a highly responsive regression framework that visualizes market sentiment and directional momentum with every RSI-triggered event.

Unlike static regression models, this indicator recalibrates its slope and deviation bands only after the RSI crosses predefined thresholds, helping traders pinpoint new phases of momentum, exhaustion, or reversal.

█ The Assumption:

Instead of using a fixed-length regression (which assumes trend relevance over a static window), this script resets the regression calculation every time RSI crosses into extreme territory. The underlying idea is that extreme RSI levels often represent emotional peaks in market behavior and are statistically likely to be followed by a new price structure.

█ How It Works

█ How to Use

⚪ Detect Trend Shifts

Use the RSI resets to identify when the trend might be starting fresh.

⚪ Watch the Bands for Volatility Extremes

Use the outer bands as soft areas of potential reversal or momentum breakout.

⚪ Spot Rejections for Potential Entry Signals

If price moves outside a band but then quickly returns inside, it often means the breakout failed, and price may reverse.

█ Settings Explained

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

The Dynamic RSI Regression Bands (Zeiierman) is a regression channel tool that dynamically resets based on RSI overbought and oversold conditions. It adapts to trend shifts in real time, creating a highly responsive regression framework that visualizes market sentiment and directional momentum with every RSI-triggered event.

Unlike static regression models, this indicator recalibrates its slope and deviation bands only after the RSI crosses predefined thresholds, helping traders pinpoint new phases of momentum, exhaustion, or reversal.

You’re not just measuring the trend — you’re tracking when and where the trend deserves to be re-evaluated.

█ The Assumption:

"A major momentum shift (RSI crossing OB/OS) signals a potential regime change, and thus, the trend model should be recalibrated from that point."

Instead of using a fixed-length regression (which assumes trend relevance over a static window), this script resets the regression calculation every time RSI crosses into extreme territory. The underlying idea is that extreme RSI levels often represent emotional peaks in market behavior and are statistically likely to be followed by a new price structure.

█ How It Works

⚪ RSI-Based Channel Reset

- RSI is monitored continuously

- If RSI crosses above the Overbought level, the indicator resets and starts a new regression channel

- If RSI crosses below the Oversold level, the same reset logic applies

- These events act as “anchor points” for dynamic trend analysis

⚪ Regression Channel Logic

- A custom linear regression is calculated from the RSI reset point forward

- The lookback grows with each bar after the reset, up to a user-defined max

- Regression lines are drawn from the reset point to the current bar

⚪ Standard Deviation Bands

- Upper and lower bands are plotted around the regression line using the standard deviation

- These serve as dynamic volatility envelopes, great for spotting breakouts or reversals

⚪ Rejection Markers

- If price hits the upper/lower band and then closes back inside it, a rejection marker is plotted

- Helps visualize failed breakouts and areas of absorption or reversal pressure

█ How to Use

⚪ Detect Trend Shifts

Use the RSI resets to identify when the trend might be starting fresh.

⚪ Watch the Bands for Volatility Extremes

Use the outer bands as soft areas of potential reversal or momentum breakout.

⚪ Spot Rejections for Potential Entry Signals

If price moves outside a band but then quickly returns inside, it often means the breakout failed, and price may reverse.

█ Settings Explained

- RSI Length – How many bars RSI uses. Shorter = faster.

- OB / OS Levels – Crossing these triggers a regression reset.

- Base Regression Length – Max number of bars regression can use post-reset.

- StdDev Multiplier – Controls band width from the regression line.

- Min Bars After Reset – Ensures channel doesn’t form immediately; waits for structure.

- Show Reset Markers – Triangles mark where RSI crossed OB/OS.

- Show Rejection Markers – Circles mark where the price rejected the channel edge.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Join Our Free Discord: discord.gg/zeiiermantrading

Access my indicators at: linktr.ee/zeiierman_trading

Earn $15

tradingview.com/gopro/?share_your_love=Zeiierman

SMC Trading

linktr.ee/zeiierman_trading

Access my indicators at: linktr.ee/zeiierman_trading

Earn $15

tradingview.com/gopro/?share_your_love=Zeiierman

SMC Trading

linktr.ee/zeiierman_trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Join Our Free Discord: discord.gg/zeiiermantrading

Access my indicators at: linktr.ee/zeiierman_trading

Earn $15

tradingview.com/gopro/?share_your_love=Zeiierman

SMC Trading

linktr.ee/zeiierman_trading

Access my indicators at: linktr.ee/zeiierman_trading

Earn $15

tradingview.com/gopro/?share_your_love=Zeiierman

SMC Trading

linktr.ee/zeiierman_trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.