PROTECTED SOURCE SCRIPT

Morning & Evening Star Pro (Candle Pattern)

Hello Traders!

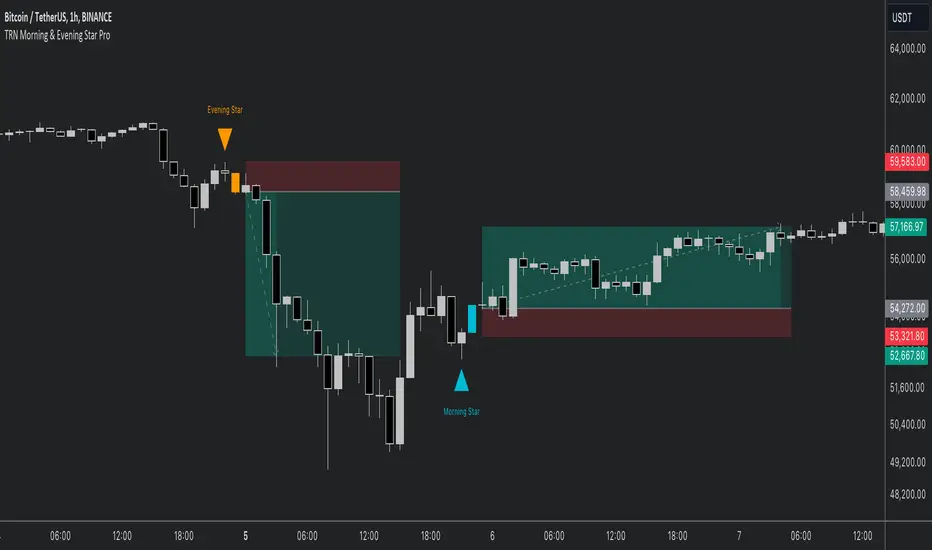

The Morning & Evening Star Pro indicator often catches the absolute top or bottom of a move and is a reliable reversal indicator. It also provides excellent entries in a strong trending market. For example, in an uptrend you can use a morning star as a pullback entry signal.

The indicator is an advanced tool for identifying powerful reversal patterns in the market. It combines traditional candlestick analysis with modern technical indicators to provide traders with high-probability entry and exit signals.

Key features:

Morning Star

Is a bearish reversal (or continuation) pattern consisting of three candles:

Evening Star

Is a bullish reversal (or continuation) pattern consisting of three candles:

Key differences in this implementation

What makes this indicator unique

How to Trade with this Indicator:

This indicator often catches the absolute top or bottom of a move and is a reliable reversal indicator. It also provides excellent entries in a trending market. For example, in a strong uptrend you can use morning star signals to enter in a pullback.

Bullish Opportunities:

Look for Morning Star patterns (aqua-colored candles and labels) as potential buy signals.

Bearish Opportunities:

Watch for Evening Star patterns (orange-colored candles and labels) as potential sell signals.

Trend Alignment:

For conservative trading, only take trades in the direction of the overall trend as indicated by the SMA.

Note: if you want to see candle coloring of the morning and evening star, you must put the indicator to the top of the object tree.

The Morning & Evening Star Pro indicator often catches the absolute top or bottom of a move and is a reliable reversal indicator. It also provides excellent entries in a strong trending market. For example, in an uptrend you can use a morning star as a pullback entry signal.

The indicator is an advanced tool for identifying powerful reversal patterns in the market. It combines traditional candlestick analysis with modern technical indicators to provide traders with high-probability entry and exit signals.

Key features:

- Accurate pattern detection:

Utilizes sophisticated algorithms to identify genuine Morning Star and Evening Star patterns, filtering out false signals. - Trend filter:

Incorporates a customizable Simple Moving Average (SMA) to align signals with the overall market trend, enhancing trade quality. - Volatility awareness:

Integrates Average True Range (ATR) calculations to ensure detected patterns are significant relative to recent price action. - Visual clarity:

Highlights Morning Star and Evening Star patterns with customizable colors and shapes, making them easy to spot on the chart. - Flexible customization:

Offers a wide range of user inputs to tailor the indicator to various trading styles and preferences. - Filtered signal display:

Option to show filtered-out signals, providing insight into the indicator's decision-making process.

Morning Star

Is a bearish reversal (or continuation) pattern consisting of three candles:

- A large bearish candle

- A small-bodied candle like a Doji or Pin bar

- A bullish candle

Evening Star

Is a bullish reversal (or continuation) pattern consisting of three candles:

- A large bullish candle

- A small-bodied candle like a Doji or Pin bar

- A bearish candle

Key differences in this implementation

- The middle candle can be either a Doji or a Pin bar, expanding the traditional definition.

- The second candle can be a Pin bar, and the third candle can be an outside bar reversal, allowing for more flexibility in pattern recognition.

What makes this indicator unique

- Comprehensive pattern analysis:

Goes beyond simple price action by considering multiple factors such as candle body ratios, wick lengths, and relative positions to previous candles. - Adaptive to market conditions:

Uses dynamic thresholds based on recent volatility (ATR) to adjust pattern detection criteria. - Educational value:

The option to display filtered signals helps traders understand why some patterns are rejected, aiding in skill development.

How to Trade with this Indicator:

This indicator often catches the absolute top or bottom of a move and is a reliable reversal indicator. It also provides excellent entries in a trending market. For example, in a strong uptrend you can use morning star signals to enter in a pullback.

Bullish Opportunities:

Look for Morning Star patterns (aqua-colored candles and labels) as potential buy signals.

Bearish Opportunities:

Watch for Evening Star patterns (orange-colored candles and labels) as potential sell signals.

- Entry: At next bar open (after the aqua-colored candle for bullish or orange-colored candle for bearish completes)

- Stop loss: 2 ticks below/above the pattern's low/high.

- Stop loss alternative: If the colored candle is a very strong candle (e.g. for morning star a candle with almost no down wick and a close near the top) the stop goes 2 ticks below/above the colored candle.

- Take profit: 3R or use a trailing stop.

Trend Alignment:

For conservative trading, only take trades in the direction of the overall trend as indicated by the SMA.

Note: if you want to see candle coloring of the morning and evening star, you must put the indicator to the top of the object tree.

Get Instant Access NOW: TRN-Trading.ai

Join Our Free Discord: discord.gg/EYgg9UHJZC

Documentation: docs.trntrading.ai

Join Our Free Discord: discord.gg/EYgg9UHJZC

Documentation: docs.trntrading.ai

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.