PROTECTED SOURCE SCRIPT

SMT @joshuuu

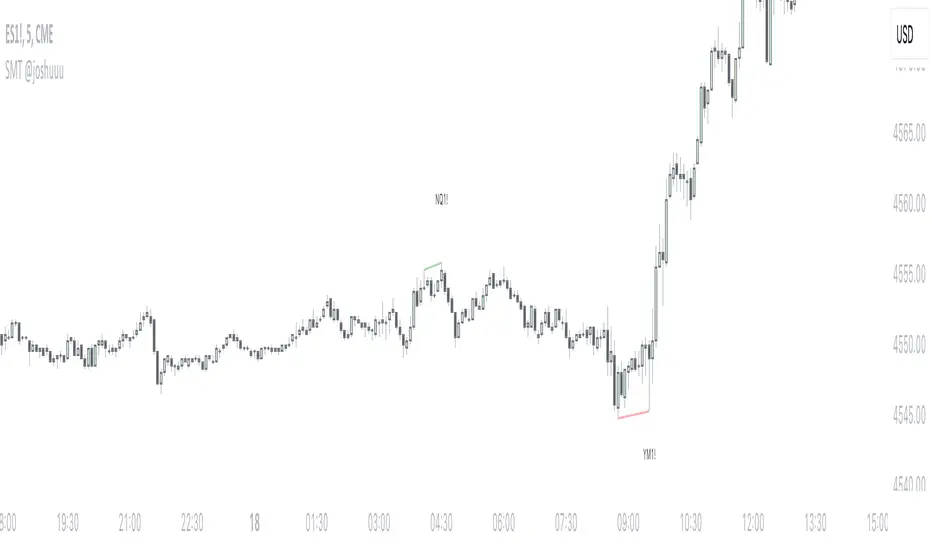

Smart Money Tool / Smart Money Technique is a concept taught by ICT (The InnerCircleTrader).

It compares correlated assets and if the correlation gets disrupted, we call it a smt divergence.

Correlated assets are for example the nasdaq, the sp500 and the dow.

A bullish scenario would be if one of those three makes a lower low and the other two make a higher low. In this case, that would form a divergence.

https://www.tradingview.com/x/9jg6IzLL/

Another example would be the dxy (dollar-index), the eurusd and gbpusd. what's special about dxy compared to eurusd or gbpusd, is that dxy is inversely correlated to eurusd and gbpusd.

For inversely correlated assets the script has the option to inverse symbols.

https://www.tradingview.com/x/VBW6f54R/

Besides the option to inverse symbols, the script is also able to track smts between the two other symbols, that are not on the current chart and it's possible to filter smts only for certain time periods.

Options for those time periods are

ICT Killzones (all mentioned times are in ny time)

London Killzone : 0200-0500

forex:

NewYork Killzone : 0700-1000

indices:

NYAM Killzone : 0830-1100

NYPM Killzone : 1330-1600

ICTs Index SMT Times

AM - 0500-0930

PM - 1200-1500

To detect smts, the script compares swing highs with previous swing highs and swing lows with previous swing lows on all three symbols. To determine swing points, the user is able to input the amount of

candles to detect swing points, usually 1-3 is enough.

It compares correlated assets and if the correlation gets disrupted, we call it a smt divergence.

Correlated assets are for example the nasdaq, the sp500 and the dow.

A bullish scenario would be if one of those three makes a lower low and the other two make a higher low. In this case, that would form a divergence.

https://www.tradingview.com/x/9jg6IzLL/

Another example would be the dxy (dollar-index), the eurusd and gbpusd. what's special about dxy compared to eurusd or gbpusd, is that dxy is inversely correlated to eurusd and gbpusd.

For inversely correlated assets the script has the option to inverse symbols.

https://www.tradingview.com/x/VBW6f54R/

Besides the option to inverse symbols, the script is also able to track smts between the two other symbols, that are not on the current chart and it's possible to filter smts only for certain time periods.

Options for those time periods are

ICT Killzones (all mentioned times are in ny time)

London Killzone : 0200-0500

forex:

NewYork Killzone : 0700-1000

indices:

NYAM Killzone : 0830-1100

NYPM Killzone : 1330-1600

ICTs Index SMT Times

AM - 0500-0930

PM - 1200-1500

To detect smts, the script compares swing highs with previous swing highs and swing lows with previous swing lows on all three symbols. To determine swing points, the user is able to input the amount of

candles to detect swing points, usually 1-3 is enough.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.