OPEN-SOURCE SCRIPT

Commitments of Traders Report [Advanced]

Updated

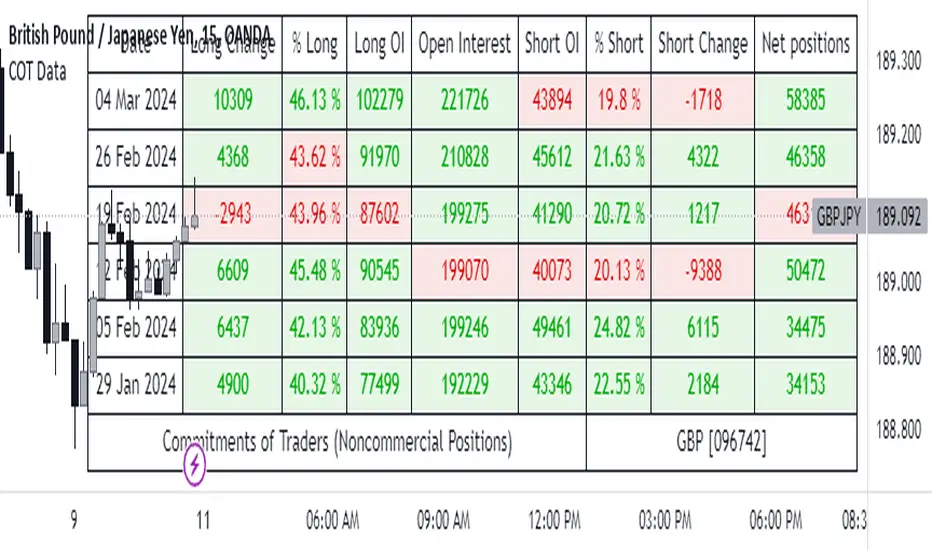

This indicator displays the Commitment of Traders (COT) report data in a clear, table format similar to an Excel spreadsheet, with additional functionalities to analyze open interest and position changes. The COT report, published weekly by the Commodity Futures Trading Commission (CFTC), provides valuable insights into market sentiment by revealing the positioning of various trader categories.

Display:

Trader Categories (Configurable)

CFTC Code: If the indicator fails to retrieve data, you can manually enter the CFTC code for the specific instrument. The code for instrument can be found on CFTC's website.

Using the Indicator Effectively

Disclaimer

Remember, the COT report is just one piece of the puzzle. It should not be used for making isolated trading decisions. Consider incorporating it into a comprehensive trading strategy that factors in other technical and fundamental analysis.

Credit

A big shoutout to Nick from Transparent FX! His expertise and thoughtful analysis have been a major inspiration in developing this COT Report indicator. To know more about this indicator and how to use it, be sure to check out his work.

Display:

- Release Date: When the data was released.

- Open Interest: Shows the total number of open contracts for the underlying instrument held by selected trader category.

- Net Contracts: Shows the difference between long and short positions for selected trader category.

- Long/Short OI: Displays the long and short positions held by selected trader category.

- Change in Long/Short OI: Displays the change in long and short positions since the previous reporting period. This can highlight buying or selling pressure.

- Long & Short Percentage: Displays the percentage of total long and short positions held by each category.

Trader Categories (Configurable)

- Commercials: Hedgers who use futures contracts to manage risk associated with their underlying business (e.g., producers, consumers).

- Non-Commercials (Large Speculators): Speculative traders with large positions who aim to profit from price movements (e.g., hedge funds, investment banks).

- Non-Reportable (Small Speculators/Retail Traders): Smaller traders with positions below the CFTC reporting thresholds.

CFTC Code: If the indicator fails to retrieve data, you can manually enter the CFTC code for the specific instrument. The code for instrument can be found on CFTC's website.

Using the Indicator Effectively

- Market Sentiment Gauge: Analyze the positioning of each trader category to gauge overall market sentiment.

- High net longs by commercials might indicate a bullish outlook, while high net shorts could suggest bearish sentiment.

- Changes in open interest and long/short positions can provide additional insights into buying and selling pressure.

- Trend Confirmation: Don't rely solely on COT data for trade signals. Use it alongside price action and other technical indicators for confirmation.

- Identify Potential Turning Points: Extreme readings in COT data, combined with significant changes in open interest or positioning, might precede trend reversals, but exercise caution and combine with other analysis tools.

Disclaimer

Remember, the COT report is just one piece of the puzzle. It should not be used for making isolated trading decisions. Consider incorporating it into a comprehensive trading strategy that factors in other technical and fundamental analysis.

Credit

A big shoutout to Nick from Transparent FX! His expertise and thoughtful analysis have been a major inspiration in developing this COT Report indicator. To know more about this indicator and how to use it, be sure to check out his work.

Release Notes

Minor bug fixOpen-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.