OPEN-SOURCE SCRIPT

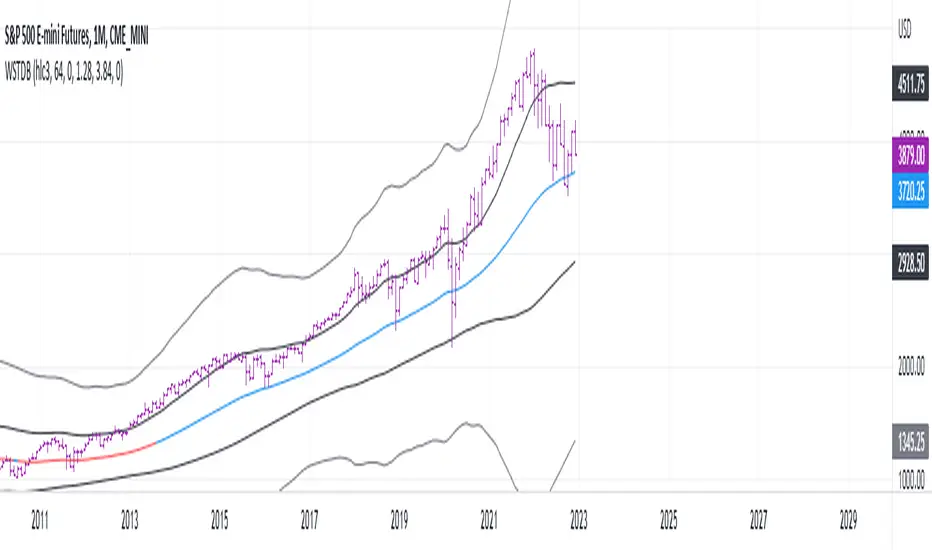

Weighted Standard Deviation Bands

Updated

Linearly weighted standard deviations over linearly weighted mean.

The rationale of the study can be deduced from my latest publications where I go deeper into explaining the benefits of linear weighting, but in short, I can remind that by using linear weighting we are able to increase the information gain by communicating the sequential nature of time series to the calculations via linear weighting.

Note, that multiplier parameters can take both negative and positive values resulting in ability to have, for example, 1st and 6th weighted standard deviations higher than the weighted mean.

Despite the modification of the classic standard deviation formula, I assume that mathematical qualities of standard deviation will hold due to the fact we can alternately weight the window itself, and then apply the classic standard deviation over the weighted window. In both cases, the results will be the same.

Aight that was too formal, but your short strangles should be happy

Here is it, for you

The rationale of the study can be deduced from my latest publications where I go deeper into explaining the benefits of linear weighting, but in short, I can remind that by using linear weighting we are able to increase the information gain by communicating the sequential nature of time series to the calculations via linear weighting.

Note, that multiplier parameters can take both negative and positive values resulting in ability to have, for example, 1st and 6th weighted standard deviations higher than the weighted mean.

Despite the modification of the classic standard deviation formula, I assume that mathematical qualities of standard deviation will hold due to the fact we can alternately weight the window itself, and then apply the classic standard deviation over the weighted window. In both cases, the results will be the same.

Aight that was too formal, but your short strangles should be happy

Here is it, for you

Release Notes

Update:New:

- "Around zero" option. Allows to calculate & plot deviations from zero level. Very useful when you know that your data's population is ~ zero.

Release Notes

Ok so now you can use it out of the box like wassup:- Additional set of bands to be used as targets / liquidation points / strategy change thresholds, it's all about choosing between / trading the volatility comprehension / volatility expansion;

- Properly chosen (ain't no optimized) multipliers (really no need to touch em unless you're pursuing some specific goal you're very aware off), yes and don't waste your time on optimizing em, you'll arrive to ~ the same ones;

- Comparative slope & it's threshold - a native way to measure gradient for zero-order model (means it's not linear regression (1st order), and not quad reg (2nd order));

- Length of 64 is what will work decently on every resolution.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.