OPEN-SOURCE SCRIPT

MicroStrategy Metrics

Updated

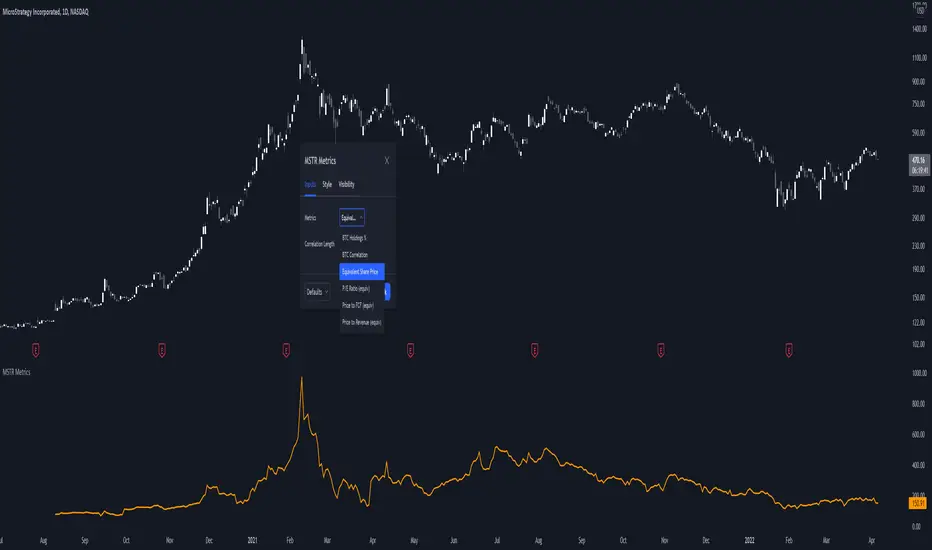

A script showing all the key MSTR metrics. I will update the script every time degen Saylor sells some more office furniture to buy BTC.

All based around valuing MSTR, aside from its BTC holdings. I.e. the true market cap = enterprise value - BTC holdings. Hence, you're left with the value of the software business + any premium/discount decided by investors.

From this we can derive:

- BTC Holdings % of enterprise value

- Correlation to BTC (in this case we use CME futures...may change this)

- Equivalent Share Price (true market cap divided by shares outstanding)

- P/E Ratio (equivalent share price divided by quarterly EPS estimates x 4)

- Price to FCF Ratio (true market cap divided by FCF (ttm))

- Price to Revenue (^ but with total revenue (ttm))

All based around valuing MSTR, aside from its BTC holdings. I.e. the true market cap = enterprise value - BTC holdings. Hence, you're left with the value of the software business + any premium/discount decided by investors.

From this we can derive:

- BTC Holdings % of enterprise value

- Correlation to BTC (in this case we use CME futures...may change this)

- Equivalent Share Price (true market cap divided by shares outstanding)

- P/E Ratio (equivalent share price divided by quarterly EPS estimates x 4)

- Price to FCF Ratio (true market cap divided by FCF (ttm))

- Price to Revenue (^ but with total revenue (ttm))

Release Notes

UpdatedRelease Notes

Updated 27/03/23Release Notes

UpdatedRelease Notes

UpdatedRelease Notes

UpdatedRelease Notes

Saylor found another 593m behind the office furnitureRelease Notes

Updated to include BTC per 100 SharesRelease Notes

UpdatedRelease Notes

Updated to include the share price denominated in BTC/ShareRelease Notes

190,000Release Notes

193,000Release Notes

Convertible Note PurchaseRelease Notes

214,246 BTCRelease Notes

226,331Release Notes

169 BTCRelease Notes

244,800Release Notes

252,220Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.