INVITE-ONLY SCRIPT

Stock Fair Value (SFV)

Updated

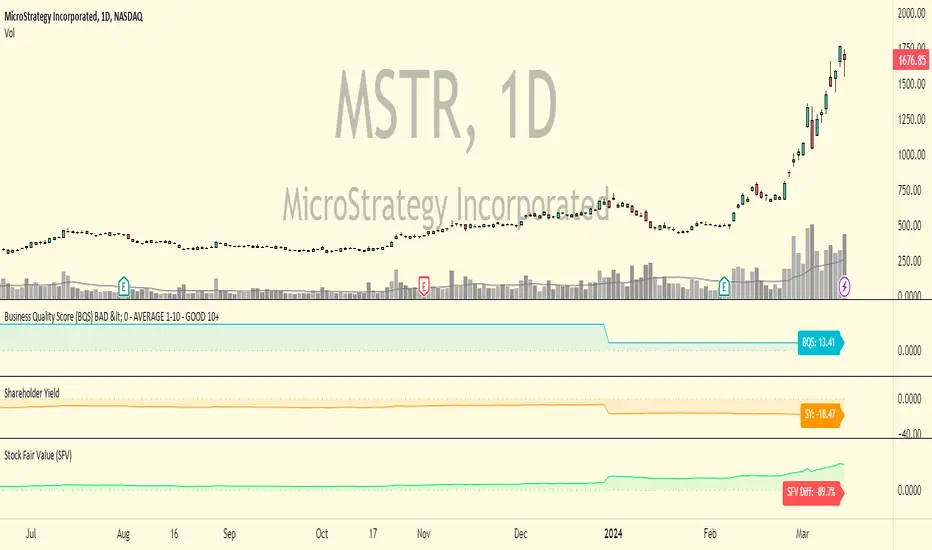

Stock Fair Value (SFV) is an indicator that displays an estimated fair value per share price for the business. It uses fundamental data including future consensus earnings estimates from Wall Street analysts, how fast the business is growing, and the balance sheet to come up with a number that approximates what a fair price would be to pay for the stock. In the top right hand corner of the Indicator is a highlighted box showing the % difference from the current price and the Fair Value price, if the box is green it means the stock is currently undervalued by that much % below the Fair Value price, if the box is red it means the stock is currently overvalued by that much % above the Fair Value price.

The indicator formula also uses the current market price as an input, as there is information about the business baked into the current stock price that isn't apparent in fundamental data that I believe deserves to affect the fair value price. This indicator uses my own unique formula, it is not a standard Discounted Cash flow (DCF) model nor is it based on any other published valuation formula or model. As this indicator uses fundamental data there isn't any changeable settings for the user.

This indicator is designed for stocks only and isn't applicable on other markets like forex, futures or crypto. It can be used on the daily, weekly or monthly time frames as the value doesn't change. It's designed to be part of an overall investment process for stock investors with medium to long term timeframes, it's not suited for short term trading like most valuation strategies.

Please note like any indicator it's not perfect as there's only so much input that can go into it, therefore use it as a rough guide as to what the fair value of a stock could be, there are of course many other factors that can and will affect what a fair price of a business should be. As value investors, we ideally want to buy safe quality growing businesses that are at least 30% below fair value then hold them until the stock trades back up to fair value or above. This indicator can help with what all value investors are trying to do, that is buy low and sell high. It can also be used to avoid expensive stocks as they may have more downside risk with less upside potential.

If you see the Stock Fair Value price make a drastic and significant move overnight that's because some new fundamental data has come into the system, it could be new consensus earnings estimates or a change in business growth rates that causes a sudden and significant shift in the calculated fair value.

As you can see from the chart above of Alibaba BABA the Stock Fair Value indicator is showing a current reading of $385.12 per share. At the current date of this writing, 11th January 2021, the current price of

BABA the Stock Fair Value indicator is showing a current reading of $385.12 per share. At the current date of this writing, 11th January 2021, the current price of  BABA is $132.19 which is 65.68% below the Stock Fair Value price of $385.12 and makes this stock one of the most undervalued large cap stocks listed on the New York Stock Exchange according to this indicator.

BABA is $132.19 which is 65.68% below the Stock Fair Value price of $385.12 and makes this stock one of the most undervalued large cap stocks listed on the New York Stock Exchange according to this indicator.

It's also worth noting that Charlie Munger, Vice Chairman of Berkshire Hathaway BRK.B and long term business partner of Warren Buffett, has recently been accumulating a large position in

BRK.B and long term business partner of Warren Buffett, has recently been accumulating a large position in  BABA which as a lifelong devotee of value investing suggests he sees great value in Alibaba at current prices just as the Stock Fair Value Indicator is suggesting too.

BABA which as a lifelong devotee of value investing suggests he sees great value in Alibaba at current prices just as the Stock Fair Value Indicator is suggesting too.

Other examples of large cap stocks that are currently significantly undervalued according to this indicator are;

AT&T T (40.72% undervalued)

T (40.72% undervalued)

Citigroup C (51.97% undervalued)

C (51.97% undervalued)

Fedex FDX (41.94% undervalued)

FDX (41.94% undervalued)

To get access to this indicator PM or email me to my address shown below.

Enjoy :)

Disclaimer: All my scripts and content are for educational purposes only. I'm not a financial advisor and do not give personal finance advice. Past performance is no guarantee of future performance. Please trade at your own risk.

The indicator formula also uses the current market price as an input, as there is information about the business baked into the current stock price that isn't apparent in fundamental data that I believe deserves to affect the fair value price. This indicator uses my own unique formula, it is not a standard Discounted Cash flow (DCF) model nor is it based on any other published valuation formula or model. As this indicator uses fundamental data there isn't any changeable settings for the user.

This indicator is designed for stocks only and isn't applicable on other markets like forex, futures or crypto. It can be used on the daily, weekly or monthly time frames as the value doesn't change. It's designed to be part of an overall investment process for stock investors with medium to long term timeframes, it's not suited for short term trading like most valuation strategies.

Please note like any indicator it's not perfect as there's only so much input that can go into it, therefore use it as a rough guide as to what the fair value of a stock could be, there are of course many other factors that can and will affect what a fair price of a business should be. As value investors, we ideally want to buy safe quality growing businesses that are at least 30% below fair value then hold them until the stock trades back up to fair value or above. This indicator can help with what all value investors are trying to do, that is buy low and sell high. It can also be used to avoid expensive stocks as they may have more downside risk with less upside potential.

If you see the Stock Fair Value price make a drastic and significant move overnight that's because some new fundamental data has come into the system, it could be new consensus earnings estimates or a change in business growth rates that causes a sudden and significant shift in the calculated fair value.

As you can see from the chart above of Alibaba

It's also worth noting that Charlie Munger, Vice Chairman of Berkshire Hathaway

Other examples of large cap stocks that are currently significantly undervalued according to this indicator are;

AT&T

Citigroup

Fedex

To get access to this indicator PM or email me to my address shown below.

Enjoy :)

Disclaimer: All my scripts and content are for educational purposes only. I'm not a financial advisor and do not give personal finance advice. Past performance is no guarantee of future performance. Please trade at your own risk.

Release Notes

Improved visualization of the indicator to be easier to interpret. Nothing changed to the underlying indicator logic.Invite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact Click-Capital for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Author's instructions

″Contact me using TradingView private chat or email me at scale@greenstonedigital.com to request access to my invite-only scripts.

Want to use this script on a chart?

Warning: please read before requesting access.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.