Daily Range + Asia Liquidity + FVG + silver Bullet sessionIndicator Description :

This indicator combines several trading concepts to provide an overall view of intraday selling opportunities. It includes the following elements:

Daily Range:

Measures the daily price range between the highest and lowest points of the day.

Helps understand daily volatility and identify potential support and resistance levels.

Asia Liquidity:

Analyzes price movements and volumes during the Asian session (usually from 00:00 to 08:00 GMT).

Identifies liquidity levels where the price has reacted during this period, providing clues on where significant orders are concentrated.

FVG (Fair Value Gap):

A trading concept that identifies areas where the price has moved quickly, creating a "gap" or empty space on the chart.

These areas are often revisited by the price, which can provide potential entry or exit points.

Silver Bullet Session:

Refers to a specific period of the day where a particular strategy or setup is expected to occur. For example, this could be a period where price movements are historically more predictable or volatile.

This session particularly targets price movements that attract sellers.

Using the Indicator

Identifying Selling Levels:

Combine the daily range levels with the liquidity zones identified during the Asian session to spot levels where sellers might be interested.

Use the fair value gaps (FVG) to identify areas where the price might return, providing entry or exit points for selling positions.

Silver Bullet Session:

Focus on this period to observe price movements and reactions to the levels identified earlier.

Look for selling signals (e.g., bearish reversal candlesticks or continuation patterns) during this session to maximize selling opportunities.

Objective :

The objective of this indicator is to provide a systematic approach to identifying selling opportunities based on multiple technical and temporal elements. By combining daily volatility, liquidity levels, value gaps, and specific trading periods, this indicator helps traders pinpoint potential selling points with greater accuracy.

Bestindicator

Abdul Rehman Trading StrategyBest Buy & Sell Indicator for Crypto, Forex and stocks. This indicator is based on Volume, RSI and current support and resistance.

Best Time Frame:

5 Minutes, 15 minutes

Long Positions:

You will see numbers appearing in Green Colour starting from 7,8 and then you can see the LONG position signal.

Short Position:

You will see numbers appearing in Red Colour starting from 7,8 and then SHORT Position Signal.

Important Note:

If you see the bearish trend in 4 hours time frame then always follow SHORT positions and if you see the bullish trend in 4 Hour time frame then always LONG positions.

MAFIA CANDLESMafia Candles is a Exhaustion bar count and candle count indicator, Using the Leledc Candles and 1-3 counting candle play gives you a pretty good idea where a so called "top" will be or a so called "bottom" will be!

In this example, getting the transparent round circles ( either lime or red ) would mean that the move will be a good size move!

EXAMPLE=1 You see a down trend and then the Mafia Candles Flashes a Green Dot on the forming new red candle. This is where in theory you might want to consider going long on the market!

EXAMPLE=2 If you see a RED $ symbol, after a uptrend, this means in theory, there might be room for a short play or room for a small pullback in the price!

THE CIRCLES(RED OR LIME COLORED) ARE INDICATING BIGGER MOVES!

THE $ SYMBOLS (RED OR LIME COLORED) ARE INDICATING SMALLER PULLBACKS OR SMALLER PUMPS IN PRICE!

RED IS CONSIDERED TO BE A SELL!

LIME COLOR IS CONSIDERED TO BE A BUY!

AS MUCH IS BASED OF THE 1-3 CANDLE COUNT AND THE LEDLEC CANDLE DEVIATION STRATEGY, LET ME EXPLAIN THE THEORY ON BOTH THE 1-3 CANDLE COUNT AND THE LELEDC STRATEGY I COMBINE TO BRING YOU THIS ADDITION OF THE INDICATOR....

LELEDC THEORY USAGE...

An Exhaustion Bar is a bar which signals

the exhaustion of the trend in the current direction. In other words an

exhaustion bar is “A bar of last seller” in case of a downtrend and “A bar of

last buyer”in case of an uptrend.

Having said that when a party cannot take the price further in their direction,naturally the other party comes in , takes charge and reverses the direction of the trend.

TO EASIER UNDERSTAND I GIVE YOU A EASY EXAMPLE OF WHAT AN LELEDC EXHAUSTION BAR IS...

1. A wide range bar ( a bar with

long body!!!).

2. A long wick at the bottom of

the bar and no or negligible wick at the top of the bar in case of “Bear exhaustion bar” and

a long wick at the top and no or

negligible wick at the bottom of the bar in case of

“Bull exhuation bar”!!!

3. Extreme volume and.....

4. Bar forming at a key support or resistance

area including a Round Number (RN) and Big Round Number ( BRN ).THE PSYCHOLOGY BEHIND THIS!!!

Now let's assume that we have a group

of people,say 100 people who decides to go for a casual running. After running for few KM's few of

them will say “I am exhausted. I cannot run further”. They will quit running.

After running further, another bunch of runners will say “I am exhausted. I can’t run

further” and they also will quit running.

This goes on and on and then there will be a stage where only few will be left in the running. Now a stage will come where the last person left in the running will say “I

am exhausted” and he stops running. That means no one is left now in the

running.This means all are exhausted in the running.

The same way an exhaustion bar works and if we can figure out that

exhaustion bar with all the tools available on hand, we will be in a big trade

for sure!!.The reason is an exhaustion bar is formed at exact tops and bottoms most of the times.In forex with wide variety of pairs available at the counter ,one can trade this technique to make lifetime gains.

NOW LET ME EXPLAIN THE 1-3 CANDLE CORRECTION COUNT THEORY WHICH IS USED TO GET THE SUM UP SIGNALS FROM THIS INDICATOR FROM ITS INPUT LEVELS!!!

1-3 CANDLES....

The 1-3 Candlestick pattern is basically like sequential, aka a candle counting system!

1-3 CANDLE COUNT means you count the number of bullish=green candles or the bearish=red candles!

3 BULL/GREEN CANDLES in a row, each closing its close higher than the previous one before it is the 1-3 candle top count idea!

lets say you get 3 red bear candles, each candle after the first closes its body below the previous red candle before it, then you see 3 red candles with each closing lower bodies lower than the previous candle, THATS A POSSIBLE SIGN OF BEARISH EXHAUSTION, AND YOU MIGHT HAVE SOME BULLS STEP IN TO TAKE THE PRICE UP AFTER THE IMMEDIATE DOWNFALL OF THOSE 3 RED CANDLES!!

PLEASE IF ANYONE HAS QUESTIONS OR NEEDS ANY FURTHER EXPLANATION, DONT HESISITATE TO MESSAGE ME! CHALRES KNIGHT IS THE ORIGINAL AUTHOR OF THE 1-3 CANDLE COUNT AND THE LELEDC EXHAUSTION BAR INDICATOR ON METE-TRADER! R.IP CHARLES F KNIGHT!!! WE LOVE YOU AND MISS YOU BROTHER!

CHARLES KNIGHT PASSED DOWN ALL OF HIS INDICATORS AND SCRIPTS IN ORIGINAL CODE TO MYSELF WHEN HE PASSED AWAY AND I WILL CONTINUE TO HONOR HIS MEMORY BY ENHANCING HIS ORIGINAL SOURCE CODED SCRIPTS TO ENHANCE THE LIFE FOR ALL TRADERS!

CHARLIE LOVED WHEN I WOULD PUT MY OWN SWING ON HIS INDICATORS! HE TAUGHT ME EVERYTHING I KNOW AND I KNOW ONE DAY I WILL SEE HIM AGAIN!

TRADE IN PARADISE CHARLIE!!!

THE BEST TRADER IN THE WORLD!!!

Squeeze MTF HeatmapHere is a multi-timeframe heat map using one of the most apreciated indicators in Tradingview: Squeeze Momentum Indicator by LazyBear.

Study shall be added to 15min chart.

It indicates squeeze and momentum at: 15 min, 30 min, 60 min, 240 min and 1 Day.

Thanks to © azimuthdynamics for inspiration and portion of code

Thanks to Lazy Bear for coding Squeeze Momentum Indicator

BEST MA Cross/MACD ScreenerHello traders

Continuing deeper and stronger with the screeners' educational serie one more time

I - Concept

This is the first flexible screener I'm releasing. Screener detecting a convergence whenever the MACD and MM cross are giving a signal in the same direction.

Those who know me from TradingView ... are aware that I'm big on convergences. I totally think that 1 indicator isn't enough - whatever the timeframe.

But building my own convergence detection systems has been fruitful for me

II - How did I set the screener

The visual signals are as follow:

- square: MACD + MA cross convergence.

- diamond: Only MACD is selected

- circle: Only MA cross is selected

Then the colors are:

- green when bullish

- red when bearish

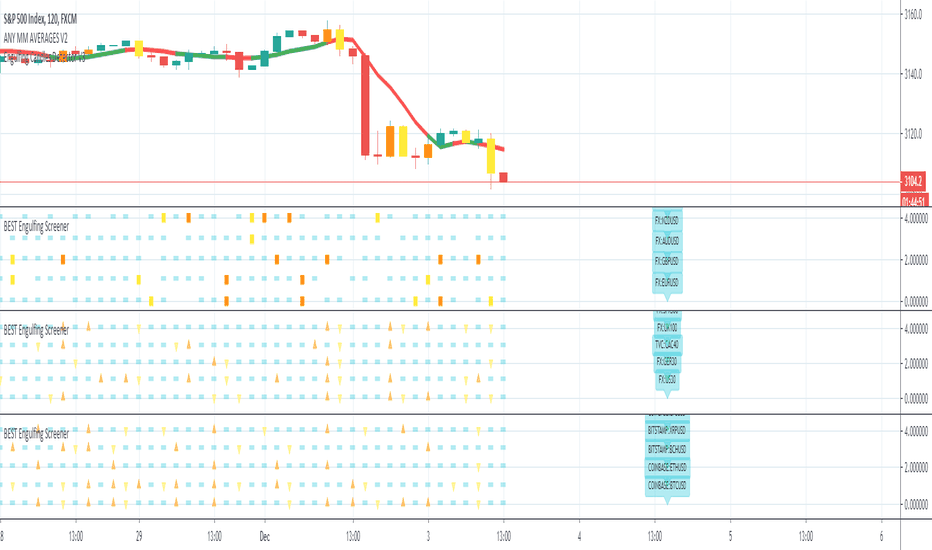

Example

Below, I highlighted why we see diamonds on the top screener panel. This is because I only selected the MACD filter

Cool Hacks

Don't forget that you can add the same indicator multiple times on your chart :)

Wishing you all the BEST trading

Dave

BEST Ultimate Engulfing ScreenerHello traders

Continuing deeper and stronger with the screeners serie. I keep getting requests private messages and requests saying that screeners aren't possible with TradingView.

My answer is always... "Reallyyy ??" (I never find a better answer than that...)

I'll publish a few screeners just for everyone to understand what can be done with Pinescript. We don't have to wait for TradingView to allow screener based on custom indicator - we can build our own ^^

I - What is an engulfing pattern

Let's start with a screener to check for a very famous candlestick pattern called engulfing

Engulfing candles tend to signal a reversal of the current trend in the market. This specific pattern involves two candles with the latter candle ‘engulfing’ the entire body of the candle before it.

The engulfing candle can be bullish or bearish depending on where it forms in relation to the existing trend

Source and more info here

These engulfing candles indicate a strong shift in direction, and when combined with observation of the price-trending direction that precedes it, this shift creates the opportunity for a trading strategy.

II - How did I set the screener

I added an optional filter being Price vs SMA. The idea is to select only the engulfing whenever the price also breaks an SMA - this usually translates a stronger move - but could sometimes give the signal too late (#meh #trading #ain't #easy)

The visual signals are as follow:

- square: whenever the engine detects an engulfing and an SMA breakout

- triangle: the engine only detects an engulfing

- dash: none of the above

Then the colors are:

- orange when bullish

- yellow when bearish

- aqua/dash when none of the above

Cool Hacks

"But sir... what can we do with only 5 instruments for a screener?" I agree not much but...

even if I allow only 5 instruments per indicator - nothing prevents you from adding multiple times the same indicator and changing the selected instruments for each. I also show why the SPX500 gave a yellow triangle (bearish engulfing) and how to match it with the screener.

=> imgur.com

Wishing you all the BEST trading

Dave

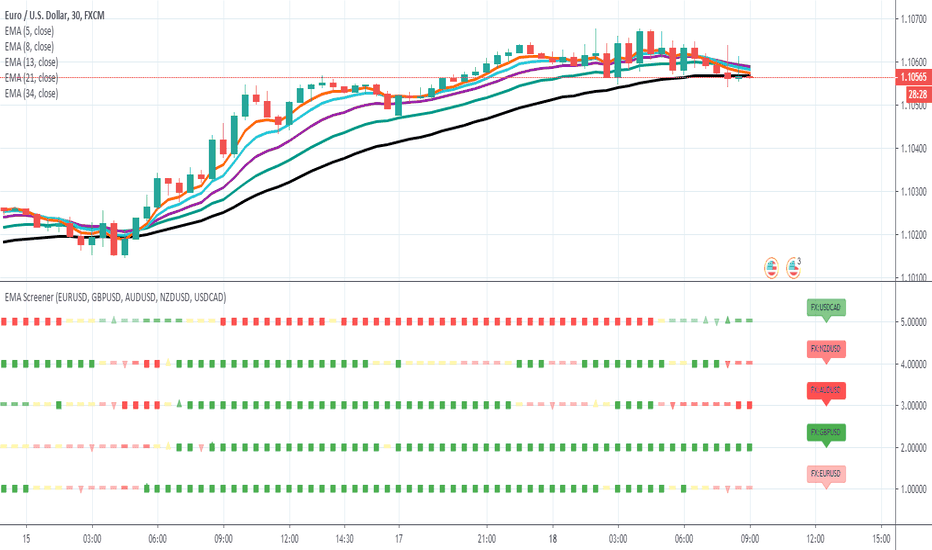

Ultimate EMA ScreenerHello traders

Very busy preparing a few stuff for Black Friday but wanted to remind that I still know Pinescript and how to step up my game :)

My master @RicardoSantos once again showed me how to push the pinescript limits one step/dimension further. Kudo also to my client (Judy) for this amazing idea.

I inspired myself from his script () to display multiple assets in the same panel - without breaking the chart scaling.

In that case, I'm comparing 5 EMAs relatively to each other and display:

- a square if they're stacked properly

- a triangle if two of them are stacked properly

- a dash otherwise

For those interested, the conditions are in the f_securitys function.

I posted in the past a few screeners using labels but we're limited to 50 labels per script. There isn't such limitation when using the plotshape function - giving us more complete screeners. #uhuuuu

I'll post a few more examples this week with different trading strategies/combinations. The possibilities here are (close to) limitless.

I'm using the security built-in function to call external assets (here different forex pairs) and we're limited to 40 security calls per script.

But nothing preventing us from duplicating the same script a few times and calling different assets each time :) If you'd like to display 10 forex pairs, you only need to add that script on your chart twice and select 5 pairs for the first panel, 5 other pairs for the second panel.

You're welcome <3

All the BEST

Dave