Delta-Agnostic Correlation Coefficient (alt)Calculate a sort of correlation between two symbols based only on the sign of their changes, regardless of the amplitude of price change.

When positive, the two symbols tend to move together. When negative, the symbols move in opposite directions.

Since there is no significance calculation, and that the result is binary, keep in mind that correlation will always tend to go towards 1 or -1 even when there is no correlation. To reduce this issue, an EMA or SMA is applied to smooth out transitions: SMA smoothes over the selected length period but adds lag, whereas EMA smoothes amplitude without any additional lag. Hence, to know if the correlation is true or not, try to look at the amplitude and the number of consecutive days the correlation is maintained (both quantities are related), because when the correlation is spurious, it will tend to switch more or less alternatively between 1 and -1 and hence will hover around 0, whereas if the correlation is true, it will get further away from 0 and closer to 1 or -1.

In addition, since there is some time lag for the correlation to switch sign, the area is colored to know the current candle's correlation, regardless of past data's correlation: blue is a positive correlation (1), yellow is negative. The coloring can allow to know a trend reversal early on, but it's noisy.

Finally, symbols with closing days are better accounted for, with the correlation set to 0 on closed days (e.g., on week-ends), and the area is then colored in gray to signal that there is no new correlation data.

This is an improved fork over the original indicator by alexjvale, please show him some love if you like this work:

CC

Delta Agnostic Correlation CoefficientVisually see how well a symbol tracks another's movements, without taking price deltas into account.

For example, a 1% move on the index and a 5% move on the target will return a DCC value of 1. An index move of 0.5% on the index and a 10% move on the target will also return a DCC value of 1. The same happens for downward moves.

The SMA value can be set to smooth the curve. A larger value creates a smoother curve.

Correlation Coefficient(CC) DashboardJapanese below / 日本語説明は下記

This indicator shows Correlation Coefficient(CC) in table with two other ticker symbols.

Strength of association is as per Pearson's Correlation Coefficient as follows.

+0.75 ~ +1 : Strong positive correlation

+0.5 ~ 0.75 : Moderate positive correlation

+0.25 ~ 0.5 : Weak positive correlation

0 ~ 0.25 : Neglible correlation

0 : No correlation

-0.25 ~ 0 : Neglible correlation

-0.5 ~ 0.25 : Weak negative correlation

-0.5 ~ -0.75 : Moderate negative correlation

-0.75 ~ -1 : Strong negative correlation

When you want to analyze CC with multiple assets and/or do not want to disturb sub window.

Example1 : CC between gold and U.S. 10 year government bond yield and dollar index.

It is easier to grasp with which gold has currently more association in price movement.

In the chart below, we can tell that U.S. 10 year government bond yield has stronger correlation.

Example2: CC between USDJPY and Yen crosses.

If correlation is strong, it indicates that Japanese Yen dominates the movement over the pairs.

----------------------

二つの異なるティッカーコードとの相関係数を表形式でメインチャートに表示することのできるインジケーターです。

相関の強さの評価はピアソンの相関係数の通りです。

+0.75 ~ +1 : Strong positive correlation

+0.5 ~ 0.75 : Moderate positive correlation

+0.25 ~ 0.5 : Weak positive correlation

0 ~ 0.25 : Neglible correlation

0 : No correlation

-0.25 ~ 0 : Neglible correlation

-0.5 ~ 0.25 : Weak negative correlation

-0.5 ~ -0.75 : Moderate negative correlation

-0.75 ~ -1 : Strong negative correlation

複数の資産や銘柄との相関を同時に確認したい時、オシレーター欄を増やしたくない場合にどうぞ。

例1 : ゴールドと米国債10年利回りとドルインデックスの相関を同時に把握。現在はどちらと連動して動きやすいかの目安にできる。

以下の例では、利回りとの強い逆相関が働いていることが確認できる。

例2 : ドル円とクロス円の動きの相関を確認。相関が強ければ円が主導で動いていることが推測できる。

Technical Ratings Colored CandlesFor those that want technical ratings but don't want waste valuable screen real estate. Candles are colored to the rating strength. It also plots the results for "total", "MA" and "other" in a table on right of screen. Table and candle coloring can be turned off in style settings. This script uses the built in Technical Ratings indicator. For more informations on Technical Ratings please refer to official documentation.

Chart Champions CC Pocket 0.65 -0.666 Fib levels or commonly know as the CC pocket

Marks Strong Support/Ressitance, Use with conflunce.

Lookback Length is adjustable

Let me know any suggestions or ideas which could help improve

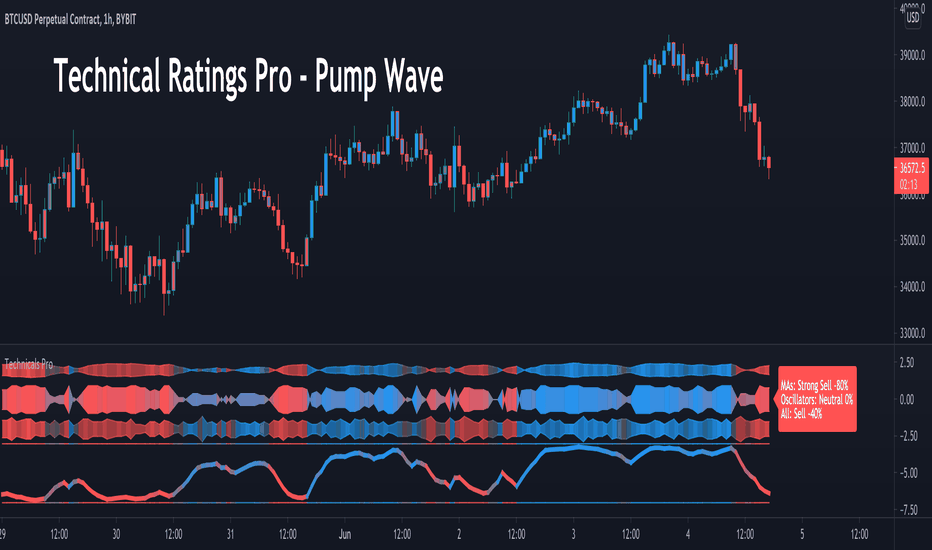

Technical Ratings Pro - Pump WaveThis script uses the built in Technical Ratings indicator but interprets the data visually. It plots the results for "total", "MA" and "other" as pump waves. It uses MA to plot a trend line (can be turned off in settings) . Candles are colored to the rating strength and a percentage number was added to the results. For more informations on the Technical Ratings indicator please refer to official documentation.

Forex Insight Pro 2.0

Forex Insight Pro 2.0 for TradingView gives you abilities to see the stories hiding in the graphs of markets. It marks important parameters that are happening on the graph including:

Helps you to label the numbers from sequential counting of CCX which compares the Close price of the right bar to the Close price of the left bar in a group of X price bars. For example CC5 will compare the Close of right bar (current bar) to the Close of left bar in a group of 5 price bars (right, left and other 3 bars in the middle). If the close of right bar is higher than the close of left bar, an increasing number will be printed above the right bar. On the other hand, an increasing number will be printed below the right bar if the close of right bar is lower than the close of left bar. Sequences of consecutive increasing numbers above or below the price bars indicate buying or selling pressure in the market.

Helps you to generate CCX Support and Resistance levels which are the highest or lowest prices in the range of settable number of bars. For example, if 9 consecutive CC5 below the price bars is specified, the resistance line will be plotted at the highest price of the most recent 9 bars. Similarly, if 9 consecutive CC5 above the price bars is specified, the support line will be plotted at the lowest price of the most recent 9 bars. These CC5 support and resistance levels often become important price structures in the graph for breakout or trend reversal later on.

Helps you to notice whether the level of MACD is increasing or decreasing by plotting Bollinger bands with the middle band coded in colors. The red middle band means the MACD is decreasing and the green middle band means the MACD is increasing. Increasing or decreasing MACD values may warn you of following increasing or decreasing prices. The Bollinger middle band also play an important role in determination of the price trend. The prices below and above the middle Bollinger band often indicate on going downtrend and uptrend, respectively. Increasing MACD while the Bollinger bands are squeezed often followed by band expansion and price breakout upward. On the other hand, decreasing MACD while the Bollinger bands are squeezed often followed by band expansion and price breakout downward.

Helps you to notice high level of RSI value by printing "H RSI" above the price bar if the RSI value is greater than the preset value such as 70% or notice low level of RSI value by printing "L RSI" below the price bar if the RSI value is less than the preset value such as 30%. The "H RSI" and "L RSI" could be used as warning signs that the reversal of the price trend might follow in the near future.

Helps you to notice the crossing of MACD line and its smoothing Signal line by printing "MACD > Sig" below the price bar if the MACD line crosses above the Signal line and printing "MACD < Sig" above the price bar if the MACD line crosses below the Signal line. Crossing of MACD and Signal lines could be used as warning signs that the reversal of the price trend might follow in the near future.

Helps you to notice the crossing of MACD line between the positive and negative zones by printing "MACD > 0" below the price bar if the MACD line changes to positive region and printing "MACD < 0" above the price bar if the MACD line crosses into the negative region. Changing the sign of MACD value could be used as warning signs that the reversal of the price trend might follow in the near future.

Helps you to notice the crossing of the fast simple moving average line and slow simple moving average line by printing "F > S" below the price bar if the fast SMA line crosses above the slow SMA line and printing "F < S" above the price bar if the fast SMA line crosses below the slow SMA line. Crossings of fast and slow SMA often indicate reversal of the price trends.

Helps you to label the Local Maximum and Local Minimum bars. If the high price of the middle bar inside a group of 3 bars is higher than its left and right neighbors, the label "Max" is printed above that middle price bar. Similarly, the label "Min" is printed below that middle price bar if the low price of it inside a group of 3 bars is lower than those of its left and right neighbors. Local Maximum and Minimum helps a lot in drawing the most recent supply and demand lines in which the price may breakout from.

Parameters of features in the above list could be changed, or turned on/off easily in the input options.

The source code of Forex Insight Pro 2.0 custom indicator is protected. Only invited TradingView members can apply this indicator to their forex, crypto currencies and stock price charts. Lifetime invitation is for 100 USD with free future upgrade and online support. Rental invitation is for 10 USD/month. Paypal and Bitcoin payments are welcome.

The author (Nimit Chomnawang, Ph.D) can be contacted at