Swing Sniper by Republic of TradersSwing Sniper: A Comprehensive Market Reversal Indicator

Description:

Swing Sniper, developed by Republic of Traders, is a sophisticated trading indicator designed for traders who require precise market reversal signals. It performs optimally across all trading instruments and timeframes, offering both reliability and precision.

How It Works:

Swing Sniper employs a complex signal generation mechanism that activates only when six distinct conditions align within a specific timeframe. This includes:

A modified Commodity Channel Index (CCI) that helps identify short-term price fluctuations.

A Relative Momentum Index (RMI) utilized for recognizing long-term market trends.

A Supertrend indicator serves as a dynamic trend filter.

Several custom parameters that enhance signal reliability.

These components work synergistically to ensure that each trading signal is robust and well-founded. The indicator specializes in capturing significant market reversals by requiring a confirmation of trend reversal through a break and close above or below a previous supply/demand zone.

Usage Instructions:

Upon a valid signal, Swing Sniper advises traders that a potential market reversal has occurred and an entry may be considered in the direction of the new trend. Traders are recommended to set alerts for "once per candle close," allowing them to monitor multiple charts and timeframes simultaneously. Proper risk management is encouraged by placing stop losses just below or above the previous swing low or high and the signal candle's low or high. Take profits should similarly be set to capitalize on potential swings.

Why Choose Swing Sniper:

Swing Sniper is designed not only as a tool for generating entries but as a strategic component of your trading methodology. It brings a clear, analytical approach to navigating the markets, supported by detailed and logical indicator collaboration. This ensures users understand the underlying mechanics and can apply the tool effectively within their trading strategy.

Commitment to Originality and Utility:

Swing Sniper is a unique creation, adhering to TradingView’s standards by offering actionable insights that are distinct from other indicators available on the platform. It is meticulously crafted, featuring an original combination of technical analysis tools tailored to enhance market reversal detection.

Disclaimer:

Past performance is not indicative of future results. Always exercise due diligence and consider market conditions when trading.

Visualization Aid:

The accompanying chart visualization helps users identify signal examples, marked with a red triangle for market reversals short and a green triangle for market reversals long.

Embrace the strategic depth and precision of Swing Sniper and enhance your trading confidence and accuracy in financial markets.

Indices

US Market Strength IndexIntro:

It is quite a task to track multiple Indices and market internals to decide which way markets are going, especially when you are in a Trade. You may also get conflicting signals making it harder to confidently decide on your trade bias.

US Market Strength Index a.k.a. US MSI indicator aims to simplify decision-making by coloring the lower panel Green when a majority of market participants are bullish and Red when they are bearish. The code analyses the direction and strength of various US indices & market internal futures contracts to decide the color. The shade of color also changes from Dark to Bright when the momentum is relatively strong. A weighted score is assigned to individual contracts and the color (& shade) are selected based on average score in real-time, for changes in direction and momentum.

A Futures contract provides a proxy and generates price & volume data to analyze the direction and strength. Also, they are traded by sophisticated market participants for about 23 hours a day!

Trading with the general market sentiment in your favor can potentially improve a trade's edge. For example, if various market indices (DOW JONES, S&P 500, NASDAQ, etc.) are positive; bullish, or LONG trades might work out in individual stocks. This may occur due to the following reasons:

Seeing prices rise, Sellers may choose to Sell at Higher prices

Buyers might be attracted to buy into stocks, as the prices are trending higher

SHORT sellers might get cautious of rising prices and may not Open SHORT positions until the current bullish sentiment dies off

Existing SHORT sellers may close their positions due to margin squeeze, possibily fueling more buying

The same logic applies when the market indices are in the negative territory, SHORT trades may have a higher probability of working out.

Features:

The bright Green color in the lower panel indicates a strong bullish market strength

The dark Green color in the lower panel indicates bullish market strength, but a relatively weaker

The bright Red color in the lower panel indicates a strong bearish market strength

The dark Red color in the lower panel indicates bearish market strength, but a relatively weaker

Basic Set-Up:

Add the Indicator to the chart

You can change the default colors for Market Bearish, Market Bullish, Market Bearish weak, and Market Bullish weak

Important Notes:

You should analyze the stock’s technical data and use prudent risk management for every trade. Trade entries and exits should always be based on the symbol you are trading.

Use the US Market Strength Index as one of the factors to decide your trade bias and filter symbols that support your analysis.

Just because Indices and Market Internals point in a certain direction, it does not guaranteed that a stock could behave the same way.

Also, since this script uses futures contracts, you would need real-time futures data subscription for real-time analysis. At the minimum, you need CME/ CBOE exchange data.

This tool is suited for US Regular Trading Session, but since the US MSI is using futures contracts, the tool tracks pre- and post-market sentiment as well.

Sessioned EMA - Frozen EMA in post market hoursWhy I develop this indicator?

In future indices, post market data with little volume distort the moving average seriously. This indicator is to eliminate the distortion of data during low volume post market hours.

How to use?

There is a time session setting in the indicator, you can set the cash hour time, moving average outside the session will be frozen.

What this indicator gives you

This indicator give you a more make sense ema pattern, the ema lines are more respected by the prices when you set the session properly.

Setup

1. Session setting

In US indices, such as NQ, ES etc, when there was data release at 0830 hr, huge volume transaction order appears, that makes the 0830 price data important that should be included in your ema trend line calculating. If that is the case, I will set the session begin from 0830, otherwise, I start the session at 0930. Golden rule : Price with huge volume counts.

2. Time zone

The coding is decided for GMT+8 time zone, you may amend the code to fit your timezone.

V2 Indicator: A Unique IndicatorV2 Indicator: A Unique Indicator Combining Percentage Level and 5MWAP

V2 Indicator is an innovative trading tool developed by Najoomi Ji. It incorporates a combination of percentage levels and the 5MWAP (5 Moving Weighted Average Price) to provide valuable insights into market trends. The concept of percentage chart trading was inspired by the late Gurbachan Singh, the father of Najoomi Ji.

The primary rule of the V2 Indicator involves plotting lines on the chart based on the daily market open level and the percentage levels. At the start, a line is drawn 5% above and below the market open level on both sides. The indicator identifies the direction in which the market breaks out and prompts traders to enter the market accordingly.

To manage risk effectively, trailing stop-loss levels are employed in the V2 Indicator. These levels are set at significant percentage levels, such as 5%, 35%, 65%, and 95%. The market tends to respect these levels, making them crucial points for adjusting stop-loss orders.

Traders utilizing the V2 Indicator gain an advantage by closely monitoring the interplay between percentage levels and the 5MWAP. This indicator allows them to make informed decisions about market entry points, as well as effectively manage their trades by utilizing trailing stop-loss orders.

By combining the expertise of Najoomi Ji and the inspiration from Gurbachan Singh, the V2 Indicator offers a unique approach to trading, providing traders with a comprehensive tool for identifying market trends and managing risk effectively.

Percent of U.S. Stocks Above VWAPThis indicator plots a line reflecting the percentage of all U.S. stocks above or below their VWAP for the given candle. Horizontal lines have been placed at 40% (oversold), 50% (mid-line), and 60% (overbought). I recommend using this indicator as a market breadth indicator when trading individual stocks. In my experience, this indicator is best utilized while trading the major indices (SPX, SPY, QQQ, IWM) or their futures (ES, NQ, RTY) in the following manner:

- When the line crosses 50%, a green or red triangle is plotted indicating the majority of market momentum has turned bullish or bearish based on price positioning vs. VWAP. Look for longs when the line is rising (green) or above 50%, or shorts when the line is falling (red) or below 50%.

- When the line is below 40%, indicator shows red shading; I would not be long anything during this period. When the line exits this level, I begin looking for long entries. This line is adjustable in the indicator settings if you prefer to use a tighter or looser oversold level.

- When the line is above 60%, indicator shows green shading; I would not be short anything during this period. When the line exits this level, I begin looking for short entries. This line is adjustable in the indicator settings if you prefer to use a tighter or looser overbought level.

This indicator uses the TradingView ticker “PCTABOVEVWAP.US”, thus it only updates during NY market hours. If trading futures, I recommend applying VWAP to your chart and using that as the level to trade against in a similar manner, along with your personal price action analysis and other indicators you find useful.

5 Minute TF 200 EMA Retest by Grantwww.tradingview.com

This indicator is a simple script meant to find retests on the 200 period moving average. It's current state is optimized for the 5 minute timeframe.

This works in all markets and all timeframes as long as you adjust certain rules for higher timeframes.

It's strengths and weaknesses

- Good at trend continuation in strong markets

- Bad in ranging markets (not surprising)

How does it work?

- It first identifies an overall trend by using the 200 ema.

- For long positions, it waits for price to close below the 200 ema, and then shortly closing back above the ema. For short positions its the opposite.

- For lower timeframes there are some other factors that help filter out bad signals that include:

- Makes sure that volume is increasing.

- Makes sure that volume is higher than average volume.

- For higher timeframes, the more specific factors aren't required.

How to use this indicator:

- Green triangles mean long positions

- Red triangles mean short positions

- Always trade with stoplosses and never risk too much of your account, please practice proper risk managment.

DISCLAIMER: Trading is inherently dangerous and carries lot's of risk. What you decide to do with my script has nothing to do with me. I am not responsible for any financial gains or losses made using this script. It is important to recognize other factors in the market to make better decisions.

New York ZonesHello traders, here is a indicator which is based on a strategy I found on a forum. I hope you will find it useful.

Rules to Follow:

1) Wait for signal . Signal appears at 9:30. (New York time)

2) Wait for price to mitigate the zone

3) Sell anywhere in this range after or during zone mitigation.

4) Keep stop Wide to avoid getting stopped out.

5) Target the previous liquidity with minimum 3RR.

6) Look for opposite trade if zone fails to hold , with proper analysis

Note :

1) This Indicator is made specifically for US30 and US100 (Indices) but can be used with other pairs as well (need back testing)

2) I would not recommend to place the trade right away as soon as signal appears , wait for liquidity to be taken out and place a trade after confirmation.

3) Trades can be placed below the zone as well but the probability of entry may decrease ,while increasing the accuracy.

4) Use timeframe <= 5 min to take entries.

Trade scenarios

Perfect trade :

Price failed to hold, you got stopped out and market changes direction :

Price respect zone in future:

Encounters Pro - Free versionThe Encounters Pro indicator is a general-purpose tool to improve the capacity of forecasting future market price moves.

This free version has one engine active and a second engine partially active between 15h and 17h UTC.

This indicator does not provide buy, sell or hold signals ; instead, it helps to determine the future direction of prices .

How to read it:

The engines must be tracked from bottom to the top. Red color is bearish or descending and green color is bullish or ascending. The upper engine (line) is the one that represents the immediate price direction, take it into consideration.

When two or more consecutive engines change, sequentially, from bottom to top, and they have, after this process, the same color, it may indicate that price is about to move in that direction. However, that is not enough, the trend must be already present or you must have a sound technical reason to validate the idea provided by the Encounters Pro indicator.

There are four examples on the image above.

Case 1 is a valid signal because the three upper engines changed from red to green, from bottom to top: firstly the third one, then the second one and, finally, the first one on top.

Case 2 would not be a valid singnal considering that the third engine was red before the first one turned green. However, it was a valid bullish signal because the fourth level was green before the second and the first.

Case 3 is not a valid signal because the first engine is green and the rest are red.

Case 4 is not a valid signal because the sequence goes from top to bottom and it is mandatory that the sequence goes from the bottom or lower engines to the ones on top.

Two engines switching color at the same time are valid. This is the only exception to the bottom to top rule.

The engines

The first one (the top one) leads the rest from the temporal perspective, but it is the weaker one. The sencond and rest of lines, to the bottom, reflect an increasing directional strength, and may represent deeper effects on market prices. You will have to carefully examine the chart, with historical data, and observe how price reacts as you spot different patterns among the engines of the Encounter Pro indicator.

On the main image above, the green arrows show a clear bullish tendency upon London Markets open time, for instance.

The slope and the engine position

The lines should be considered in terms of their slope and position. An ascending line is a bullish strength signal, even if a red color temporarily appears, specially if above the middle level of the engine. When the lines are on top, it means the engine is gauging the maximum possible bullish pressure, but if the line were falling at the same time, above the middle level, the bullish implication of that engine would be significantly lower.

Conversely, when lines are either stalling or close to the bottom, it is a signal of bearish increasing power.

Sort array alphabetically - educational🔶 OVERVIEW

• This educational script will sort an array of tickers alphabetically and place these values in an table , together with the according current price value next to each ticker .

🔶 SORT ALPHABETICALLY

🔹 I. We make a User Defined Type (UDT) obj , with:

· ticker - the string name of the ticker

· price - the current price (close)

• From this UDT we make an object obj.new() for each ticker

🔹 II. 2 array's are made:

• array of objects aObj , containing obj type obj.new() for every ticker

• array of strings sort , the ticker part of each object obj.new()

🔹 III. Now we make an object of each ticker with the createObject(sym ) function

object_1 = createObject("TICKER")

• the object object_1 consists off:

· ticker -> "TICKER"

· price -> current Daily close through request.security("TICKER") (non-repainting)

• object_1 will be added to the aObj array

• "TICKER" ( string ticker part of object ) will be added to the sort array

🔹 IV. The latter array is sorted alphabetically by using array.sort_indices()

EXAMPLE

originalArray = array.from("B", "A", "C")

indicesArray = // sorted indices

array.get(originalArray, 1) -> "A"

array.get(originalArray, 0) -> "B"

array.get(originalArray, 2) -> "C"

IMPORTANT

Alphabetically sorting is case sensitive , just like Java compareTo(String anotherString) !

• The comparison is based on the Unicode value of each character in the string, the lowest "Dec" values are sorted first in line.

• Comparing the "Dec" values at unicodelookup explains why default CAPITAL lettres will be sorted first,

• Default you would get this (A= 65, B= 66, a= 97, b= 98)

Aa

Ba

ab

bb

• Adding str.lower(string) in the toLowerCase() function will result to the following:

Aa

ab

Ba

bb

• (A= 65 is transformed to a= 97, ...)

• As a side note, should you write "AMZN" as "ÀMZN" this would be placed at the end, even after transforming to lower case the "Dec" values are higher (À= 192, à= 224).

• You can toggle "To Lower Case" to verify.

🔹 V. Values are placed in a table , using these sorted indices.

• With the usage of UDTs and objects , the current price has the same index in the aObj as their ticker ,

giving the advantage it is fairly easy to place every value correctly next to each other.

• The same can be done by make 2 separate arrays , 1 for the current price , the other for "TICKER" .

🔶 OTHER TECHNIQUES USED

• Alternative technique for adding comment

Instead of

// this is a comment

You can also do this:

_=" this is a comment "

• Alternate colour

· During a loop , alternate colour when i is even or odd , using the modulo operation (%) .

· This is the remainder when dividing.

EXAMPLE

· 3 % 2 = 1 -> 3 / 2 -> 1 * 2, 1 left (remainder)

· 4 % 2 = 0 -> 4 / 2 -> 2 * 2, 0 left (remainder)

· 5 % 2 = 1 -> 5 / 2 -> 2 * 2, 1 left (remainder)

for i = 0 to 10

even = i % 2 == 0

col = even ? thisColor : otherColor

• Adjust colour in script by using colour picker

Cheers!

Fiat Currency and Gold Indices (FGXY) CandlesA modification of my previous indicator "Crypto Index (DXY) Candles". The idea was to create a similar currency basket to the standard DXY, but from the perspective of other currencies. Still using the standard DXY weights, this indicator allows you to create a tailored index for other currencies, provided that a currency pair exists for each of the 6 components. This means that even currencies that aren't included should work in theory; just find the 3 character currency prefix used by tradingview and give it a shot! This indicator is useful for gauging how well countries/currencies are holding up and when paired with the standard DXY may help see potential inflection points. For use on longer time frames (~1h-~3d) as some of the data being pulled seems to have issues on lower timeframes.

Background ZonesThis script provides up to 5 zones to apply background colors. This is especially useful for applying to indices such as USI:TICK , USI:ADD , and USI:VOLD , where certain levels provides significant meaning to market sentiment and directions. This script will give you the visual cue to help with your trading.

All levels and colors are fully customizable.

Enjoy~!!

Example:

Deluxo Dow Kill ZonesCAPITALCOM:US30

Edit* under settings remove the plot line its not needed.

Deluxo Capital

Dow Kill Zone Indicator

PLEASE READ ALL

About: This will help you find large moves that happen often on US30. This will work for gj and probably other indices but I've designed this to work for US30 day trades.

If I see a trade I will scalp within the blue zone, besides that the best trades are anywhere outside the colored zones and you will generally find good entry's/exits just as those zones end.

So you're just scalping between these zones. Stay with me tho.

How to use: You can trade the blue session or wait it out because that's a high risk area but with time you will enjoy trading it as you get to know how price reacts or how the order blocks/order flow looks.

This works for: Day trades mainly but can be for swing trades.

Time fame USE: 1-15min I like 5-15m

Red Zone = This zone I like to enter shorts or longs all the way to the blue zone depending how price action reacted to the Asian high or low. Was the Asian high taken out?/was the Asian low taken out? Trades are taken around when this zone ends down to the blue zone.

Blue Zone = Modified New York Session hours High vol window good scalps or enter trades after the blue zone to the next zone the

Gray zone = 30 min Pre-Spread Warning. This zone is always the best time to exit your trades its just grays out 30 min before spreads open up. Some of the best trades are after the blue zone to this gray zone.

EXTRA* I also use this indicator and I recommend you to use this aswell these two together work great I use them daily.

AsiaSessionHighLowMidLines by marekmajer

This is my personal system for scalping dow. I hope this helps you as much as it helps me and I'm sure as you see how price reacts you too can see the value in this. Please enjoy!

You can adjust the colors and remove the plot line over the candles I don't code well this is my first time I just tossed this together and I can't remove the plot line so just uncheck it.

Thank you

Deluxo Capital

ICT KillZone [Index futures edition] Guided by new ICT Mentorship I create this versatile timezone or strikezone indicator to identify this without changing timezone (is based on America/New_York timezone, not your current timezone or GMT)

Sessions & Days Of The WeekTraders tend to focus their energy on specific sessions or time periods. This indicator will plot the days of the week, and also highlight the following sessions: Frankfurt (2:00am - 11:00am EST), London (3:00am - 12:00pm EST), New York (8:00am - 5:00pm EST), Sydney (5:00pm - 2:00am EST), Tokyo (7:00pm - 4:00am EST).

It’s important to be aware that Session Open and Close times will vary based on the time of year, as countries shift over to daylight savings time.

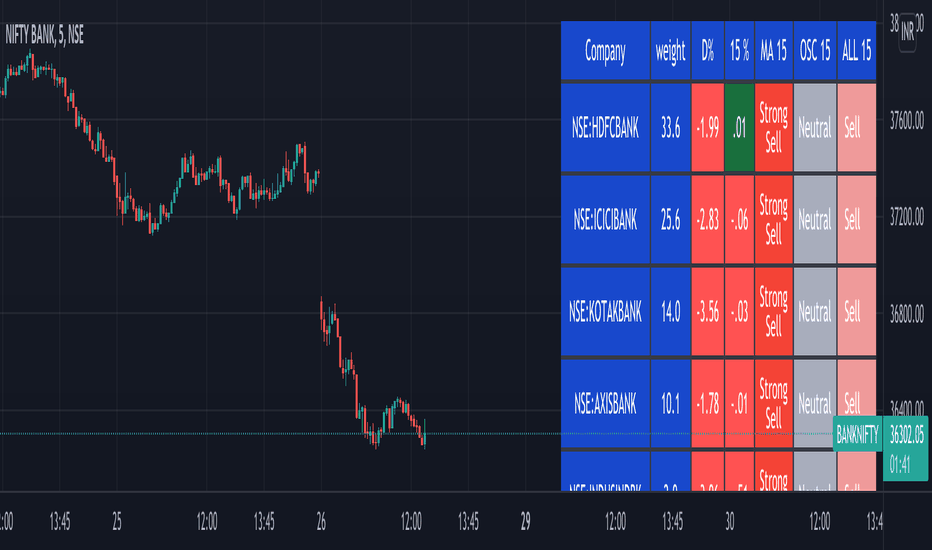

BANK NIFTY Constituents Technical Rating [tanayroy]Banknifty comprises 12 companies listed on the National Stock Exchange of India (NSE). Movement of Banknifty depends on these stocks. The script depicts Technical rating and price change stats of Banknifty constituents.

I have calculated the weight factor using annual floating stock stats available in Tradingview. So, it may differ considerably from the actual weight. It is just for reference.

I have found this useful in my trading.

Please like, share, and comment.

Correlation IndexShows how often and how much the underlying security deviates from the base stock.

Indices that help in the selection of securities:

Lst10 - last 10(long factor parameter) periods average

Aver - fulltime averaged

pwr - total deviation area from base

ust - unstability (drawdown index)

cor - percent of positive bars

cross - fulltime averaged deviation

test Xbr Super Volume 3.0A new update that can be used in liquid markets using graphical analysis.

The logic of this indicator is to automatically carry out the analysis of points where there is volume absorption, indicating on the graph through an arrow and lines from which defenses and fights can be generated.

Using this methodology we can find good moments to negotiate.

INDICES against BTC & ETHThe idea is the following; you can easily chart the FTX perp indices against (currently) two baselines, ETH & BTC.

I always choose ETH since it is way harder to outperform ETH at the moment. Doing this helps me see certain trends and/or fractal that might happen again in the future.

Since I already made D.A.M (Defi against Majors / Pricing Defi categories against BTC & ETH: ) I came across the idea of doing the same thing but with the perp indices that FTX offer. At first, I wanted to add this to D.A.M but it has no place in this indicator since this will not only look at Defi but the macro market as a whole.

The indicator currently only looks at the following indexes (weighting can be found here: https:// help. ftx. com/hc/en-us/articles/360027668812-Index-Calculation) :

DRGN: THE DRAGON INDEX

ARPA, BTM, IOST, NEO, NULS, ONT, QTUM, TRX, VET

ALT: ALTCOIN INDEX

BCH, BNB, EOS, ETH, LTC, XRP, TRX, DOT, LINK, ADA

MID: THE MID CAP INDEX

ALGO, ATOM, BAT, CRO, DASH, DCR, DOGE, HT, IOTA, LEO, NEO, OKB, ONT, QTUM, VET, XEM, XLM, XMR, XTZ, ZEC, ZRX, OMG, COMP, BSV, FTT, YFI, UNI, SNX, MKR, AAVE

SHIT: THE SHITCOIN INDEX

AE, AION, ARDR, ARPA, BCD, BEAM, BTG, BTM, BTS, BTT, CHZ, CKB, DGB, ELF, ENJ, GNT, GRIN, GT, HBAR, HC, ICX, IOST, KMD, KNC, LAMB, LRC, LSK, MANA, MATIC, MCO, NANO, NULS, OMG, POWR, PUNDIX, REN, REP, RVN, SC, SNT, STEEM, THETA, TOMO, VSYS, WAVES, XVG, XZC, ZEN, ZIL, ZRX

PRIV: THE PRIVACY INDEX

BEAM, DCR, GRIN, KMD, XMR, XVG, XZC, ZEC, ZEN

DEFI: THE DECENTRALIZED FINANCE INDEX

KNC, MKR, ZRX, REN, REP, SNX, COMP, TOMO, RUNE, CRV, DOT, LINK, MTA, SOL, CREAM, BAND, SRM, SUSHI, SWRV, AVAX, YFI, UNI, WNXM, AAVE, BAL

Indices Sector SigmaSpikes█ OVERVIEW

“The benchmark Dow Jones Industrial Average is off nearly 300 points as of midday today...”

“So what? Is that a lot or a little? Should we care?”

-Adam H Grimes-

This screener aims to provide Bird-Eye view across sector indices, to find which sector is having significant or 'out-of-norm' move in either direction.

The significance of the move is measured based on Sigma Spikes, a method proposed by Adam H. Grimes, where Standard Deviation of returns used as a baseline.

*You can google his blog or read his book, got some gold in there, especially on how he use indicators for trading

█ Understanding Sigma Spikes

As described by Grimes, moves in markets are only meaningful when we consider what “normal” is for that market.

Without that baseline, the daily change number, and even the percent change on the day doesn’t really mean much.

To overcome that problem, Sigma Spikes, as a measure of volatility, attempt to put todays change in price (aka return) in context of the standard deviation of 20 days daily's return.

Refer chart below:

1. The blue bars refer to each days return

2. The orange line is 1 time standard deviation of past 20days daily's return (today not included)

3. The red line is 2 time standard deviation of past 20days daily's return (today not included)

Using the ratio of today's return over the Std Deviation, determining your threshold (1,2,3,etc) will be the key that tells if today's move is significant or not.

*Threshold referring to times standard deviation, and different market may require different threshold.

*20 Days period are based on the Lookback Period, adjustable from user input window.

█ Features

- Scan up to 13 symbols at a time (Bursa (MYX) indices are defaulted, but you may change to any symbols/index from the user input setting)

█ Limitation

- Due to multiple use of security() function required to call other symbols, expect the screener to be slow at certain times

- Custom Timeframe currently accept only Daily and Weekly. I'll try to include lower timeframe in the next update

█ Disclaimer

Past performance is not an indicator of future results.

My opinions and research are my own and do not constitute financial advice in any way whatsoever.

Nothing published by me constitutes an investment recommendation, nor should any data or Content published by me be relied upon for any investment/trading activities.

I strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Any ideas to further improve this indicator are welcome :)

PpSIgnal Quantile Band 4.0Quantile band: In statistics and the theory of probability, quantiles are cutpoints dividing the range of a probability distribution into contiguous intervals with equal probabilities, or dividing the observations in a sample in the same way.

Quantitative Qualitative Estimation is based on a rather complex calculation of the smoothed RSI indicators.

The QQE indicator consists of a smoothed Relative Strength Index ( RSI ) indicator and two volatility-based trailing levels (fast and slow). The Fast Trailing Level (TL) and Slow TL are constructed by calculating the ATR of the smoothed RSI over n-periods and then further smoothing the ATR using an additional n-periods Wilders smoothing function. This smoothed ATR of RSI is then multiplied by the Fast and Slow ATR Multipliers to calculate the final Fast and Slow Trailing Levels.

Buy when the Quantile band is green.

Sell when the Quantile band is red.

when the quantile band is gray hold

Relative Strength Auto ComparisonRelative Strength Comparison with automatic selection of relevant index

Added support for most european and north american exchanges.

Terminal : Important U.S Indices Change (%) DataHello.

This script is a simple U.S Indices Data Terminal.

You can also set the period to look back manually in the menu.

In this way, an idea can be obtained about Major U.S Indices.

Features

Value changes on a percentage basis (%)

Recently, due to increasing interest, the NQNACE index has been added.

Index descriptions are printed on the information panel.

Sentiment NYSE ARCA and AMEX indices added.

Indices

SP1! : S&P 500 Futures Index

DJI : Dow Jones Industrial Average Index

NDX : Nasdaq 100 Index

RUT : Russell 2000 Index

NYA : NYSE Composite Index

OSX : PHLX Oil Service Sector Index

HGX : PHLX Housing Sector Index

UTY : PHLX Utility Sector Index

SOX : PHLX Semiconductor Sector Index

SPSIBI : S&P Biotechnology Select Industry Index

XNG : NYSE ARCA Natural Gas Index

SPGSCI : S&P Goldman Sachs Commodity Index

XAU : PHLX Gold and Silver Sector Index

SPSIOP : S&P Oil and Gas Exploration and Production Select Industry Index

GDM : NYSE ARCA Gold Miners Index

DRG : NYSE ARCA Pharmaceutical Index

TOB : NYSE ARCA Tobacco Index

DFI : NYSE ARCA Defense Index

NWX : NYSE ARCA Networking Index

XCI : NYSE ARCA Computer Technology

XOI : AMEX Oil Index

XAL : AMEX Airline Index

NQNACE : Nasdaq Yewno North America Cannabis Economy Index

Terminal : USD Based Stock Markets Change (%)Hello.

This script is a simple USD Based Stock Markets Change (%) Data Terminal.

You can also set the period to look back manually in the menu.

In this way, an idea can be obtained about Countries' Stock Markets.

And you can observe the stock exchanges of relatively positive and negative countries from others.

Features

Value changes on a percentage basis (%)

Stock exchange values are calculated in dollar terms.

Due to the advantage of movement, future data were chosen instead of spot values on the required instruments.

Stock Markets

Usa : S&P 500 Futures

Japan: Nikkei 225 Futures

England: United Kingdom ( FTSE ) 100

Australia: Australia 200

Canada: S&P / TSX Composite

Switzerland: Swiss Market Index

New Zealand: NZX 50 Index

China: SSE Composite (000001)

Denmark: OMX Copenhagen 25 Index

Hong-Kong: Hang Seng Index Futures

India: Nifty 50

Norway: Oslo Bors All Share Index

Russia: MOEX Russia Index

Sweden: OMX Stockholm Index

Singapore: Singapore 30

Turkey: BIST 100

South Africa: South Africa Top 40 Index

Spain: IBEX 35

France: CAC 40

Italy: FTSE MIB Index

Netherlands: Netherlands 25

Germany : DAX

Regards.