Bollinger OTT SpreadBollinger OTT Spread (BOOTS) is a development combining Bollinger Bands with Optimized Trend Tracker (OTT) Indicator by Anıl Özekşi.

Bollinger Bands have originally 3 lines: Simple Moving Average (Middle Line), Upper Band and Lower Band.

BOOTS concentrates on the upper and lower Bollinger band lines.

First, it calculates the OTT using the UPPER and LOWER Bollinger Bands in a period of time (default lengths are 2) instead of closing prices.

After that, Upper and lower bands have more constant values.

There are 2 lines in BOOTS:

-The top (cyan) line is originally an OTT of the Upper Bollinger Band. (BOOTShigh)

-The bottom line (purple) is also an OTT line but conversely uses Lower Bollinger Band in the same period. (BOOTSlow)

Default values:

Bollinger Bands Moving AveragePeriod: 2 Bars

OTT Length: 2 Bars

OTT Optimizing coefficient (percent): %10

Bollinger Bands Standart Deviation Multiplier: 2 (not adjustable)

These values are designed for daily time frame, so they have to be optimized in other timeframes by the user. (Ex: Higher values can be considered in lower time frames)

Originally, Bollinger Bands used a Simple Moving Average in their calculation, but this time, Anıl Özekşi prefers VIDYA (Variable Dynamic Moving Average = VAR) instead of a Simple Moving Average.

Bollinger Bands cannot create significant BUY & SELL signals considering their original logic, but the primary purpose of BOOTS is to have substantial trading signals:

BUY when the price crosses above the BOOTSLower line (purple line)

STOP when the price crosses back below the BOOTSLower line (purple line)

SELL when the price crosses below the BOOTSUpper line (cyan line)

STOP when the price crosses back above the BOOTSUpper line (cyan line)

The price zone between the two lines is the flat zone; traders don't consider taking new positions in that area between the two lines.

Developer Anıl Özekşi advises that traders may have more accurate signals when using a short-period moving average instead of closing prices. So, I added a moving average with the same default length of 2 , which was used in Bollinger Bands calculation. You can check the "SHOW MOVING AVERAGE?" box on the settings tab of the indicator.

OTT

Multiple OTTMultiple OTT (MOTT) is a development on the Optimized Trend Tracker (OTT) indicator of Anıl Özekşi that is shared in his algorithmic trading courses by himself.

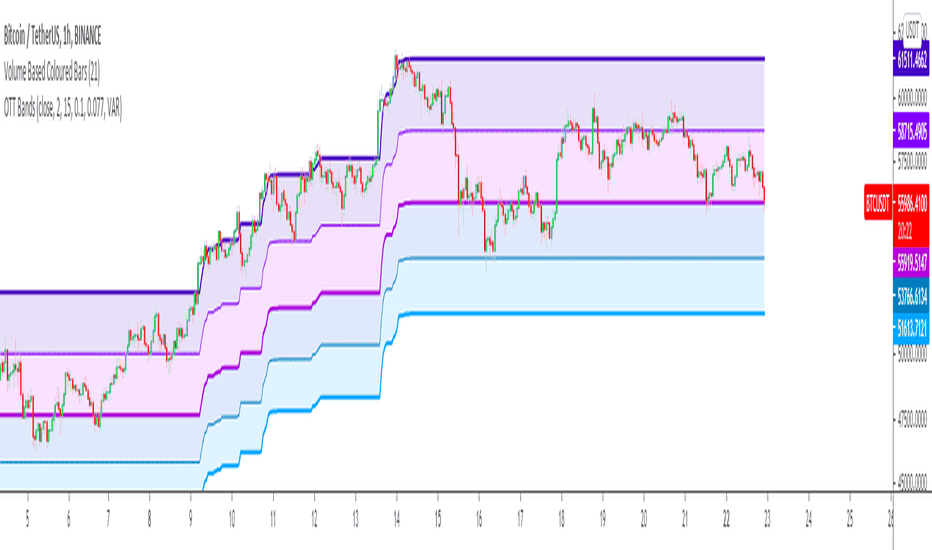

There are 5 lines in MOTT:

-The top (cyan) line is originally an OTT line, which uses the Highest price values in a default length of 80 bars in its calculation.

-The bottom line (purple) is also an OTT line but conversely uses the Lowest prices in the same period.

-The dotted third line in the middle (green) is the exact average of the top and bottom lines.

-The dotted Cyan line: (Top+Middle)/2 and

dotted Purple line: (Bottom+Middle)/2 are also the averages of their two neighbors.

Default values:

Length of the Highest and Lowest Price period (High & Low Period): 80

OTT optimizing percent: 1.4

OTT Length: 2 (Also Moving Average Length when displayed)

Default Moving Average Type of OTT Calculation: VIDYA(VAR) VARIABLE INDEX DYNAMIC MOVING AVERAGE

These values are designed for daily time frame, so they have to be optimized in other timeframes by the user. (Ex: Higher values can be considered in lower time frames)

BUY when the price crosses above the MOTT lines.

STOP when the price crosses back below the same MOTT line.

SELL when the price crosses below the MOTT lines.

STOP when the price crosses back above the same MOTT line.

As you can see, every line can be considered a trade signal like Fibonacci Levels. If optimized meaningfully, lines can also show users significant support and resistance levels. Traders can use those levels in partial buys and sells.

Developer Anıl Özekşi advises that traders may have more accurate signals when using a short-period moving average instead of closing prices. So, I added the VIDYA moving average with the same default length ( 2 ) used in OTT calculation. You can check the "SHOW MOVING AVERAGE?" box on the settings tab of the indicator.

Progressive Trend TrackerProgressive Trend Tracker (PTT) is a development combining Bollinger Bands with Highest Highs and Lowest Lows by K.Hasan Alpay & Anıl Özekşi.

Bollinger Bands have originally 3 lines: Simple Moving Average (Middle Line), Upper Band and Lower Band.

PTT concentrates on the upper and lower Bollinger band lines.

First, it calculates the bands using the Highest & Lowest prices in a period of time (Faster period and period) instead of closing prices.

Then, PTT takes the lowest values of the calculated upper band and, conversely, the highest values of the calculated lower band in a Slower period.

Default values:

Faster Period: 5

Period: 5

Bollinger Band Moving Average Period: 2

Slower Period: 10

These values are designed for daily time frame, so they have to be optimized in other timeframes by the user. (Ex: Higher values can be considered in lower time frames)

One more significant difference considering original Bollinger Bands is that PTT uses VIDYA (Variable Dynamic Moving Average = VAR) in the calculation instead of a Simple Moving Average.

Bollinger Bands cannot create significant BUY & SELL signals considering their original logic, but the primary purpose of PTT is to have substantial trading signals:

BUY when the price crosses above the PTT Lower line (cyan line)

STOP when the price crosses back below the PTT Lower line (cyan line)

SELL when the price crosses below the PTT Upper line (cyan line)

STOP when the price crosses back above the PTT Upper line (cyan line)

Developer Anıl Özekşi advises that traders may have more accurate signals when using a short-period moving average instead of closing prices, so I added the VIDYA moving average with the same default length ( 2 ), which is used in Bollinger Bands calculation. You can check the "SHOW MOVING AVERAGE?" box on the settings tab of the indicator.

ottlibLibrary "ottlib"

█ OVERVIEW

This library contains functions for the calculation of the OTT (Optimized Trend Tracker) and its variants, originally created by Anıl Özekşi (Anil_Ozeksi). Special thanks to him for the concept and to Kıvanç Özbilgiç (KivancOzbilgic) and dg_factor (dg_factor) for adapting them to Pine Script.

█ WHAT IS "OTT"

The OTT (Optimized Trend Tracker) is a highly customizable and very effective trend-following indicator that relies on moving averages and a trailing stop at its core. Moving averages help reduce noise by smoothing out sudden price movements in the markets, while trailing stops assist in detecting trend reversals with precision. Initially developed as a noise-free trailing stop, the current variants of OTT range from rapid trend reversal detection to long-term trend confirmation, thanks to its extensive customizability.

It's well-known variants are:

OTT (Optimized Trend Tracker).

TOTT (Twin OTT).

OTT Channels.

RISOTTO (RSI OTT).

SOTT (Stochastic OTT).

HOTT & LOTT (Highest & Lowest OTT)

ROTT (Relative OTT)

FT (Original name is Fırsatçı Trend in Turkish which translates to Opportunist Trend)

█ LIBRARY FEATURES

This library has been prepared in accordance with the style, coding, and annotation standards of Pine Script version 5. As a result, explanations and examples will appear when users hover over functions or enter function parameters in the editor.

█ USAGE

Usage of this library is very simple. Just import it to your script with the code below and use its functions.

import ismailcarlik/ottlib/1 as ottlib

█ FUNCTIONS

• f_vidya(source, length, cmoLength)

Short Definition: Chande's Variable Index Dynamic Average (VIDYA).

Details: This function computes Chande's Variable Index Dynamic Average (VIDYA), which serves as the original moving average for OTT. The 'length' parameter determines the number of bars used to calculate the average of the given source. Lower values result in less smoothing of prices, while higher values lead to greater smoothing. While primarily used internally in this library, it has been made available for users who wish to utilize it as a moving average or use in custom OTT implementations.

Parameters:

source (float) : (series float) Series of values to process.

length (simple int) : (simple int) Number of bars to lookback.

cmoLength (simple int) : (simple int) Number of bars to lookback for calculating CMO. Default value is `9`.

Returns: (float) Calculated average of `source` for `length` bars back.

Example:

vidyaValue = ottlib.f_vidya(source = close, length = 20)

plot(vidyaValue, color = color.blue)

• f_mostTrail(source, multiplier)

Short Definition: Calculates trailing stop value.

Details: This function calculates the trailing stop value for a given source and the percentage. The 'multiplier' parameter defines the percentage of the trailing stop. Lower values are beneficial for catching short-term reversals, while higher values aid in identifying long-term trends. Although only used once internally in this library, it has been made available for users who wish to utilize it as a traditional trailing stop or use in custom OTT implementations.

Parameters:

source (float) : (series int/float) Series of values to process.

multiplier (simple float) : (simple float) Percent of trailing stop.

Returns: (float) Calculated value of trailing stop.

Example:

emaValue = ta.ema(source = close, length = 14)

mostValue = ottlib.f_mostTrail(source = emaValue, multiplier = 2.0)

plot(mostValue, color = emaValue >= mostValue ? color.green : color.red)

• f_ottTrail(source, multiplier)

Short Definition: Calculates OTT-specific trailing stop value.

Details: This function calculates the trailing stop value for a given source in the manner used in OTT. Unlike a traditional trailing stop, this function modifies the traditional trailing stop value from two bars prior by adjusting it further with half the specified percentage. The 'multiplier' parameter defines the percentage of the trailing stop. Lower values are beneficial for catching short-term reversals, while higher values aid in identifying long-term trends. Although primarily used internally in this library, it has been made available for users who wish to utilize it as a trailing stop or use in custom OTT implementations.

Parameters:

source (float) : (series int/float) Series of values to process.

multiplier (simple float) : (simple float) Percent of trailing stop.

Returns: (float) Calculated value of OTT-specific trailing stop.

Example:

vidyaValue = ottlib.f_vidya(source = close, length = 20)

ottValue = ottlib.f_ottTrail(source = vidyaValue, multiplier = 1.5)

plot(ottValue, color = vidyaValue >= ottValue ? color.green : color.red)

• ott(source, length, multiplier)

Short Definition: Calculates OTT (Optimized Trend Tracker).

Details: The OTT consists of two lines. The first, known as the "Support Line", is the VIDYA of the given source. The second, called the "OTT Line", is the trailing stop based on the Support Line. The market is considered to be in an uptrend when the Support Line is above the OTT Line, and in a downtrend when it is below.

Parameters:

source (float) : (series float) Series of values to process. Default value is `close`.

length (simple int) : (simple int) Number of bars to lookback. Default value is `2`.

multiplier (simple float) : (simple float) Percent of trailing stop. Default value is `1.4`.

Returns: ( [ float, float ]) Tuple of `supportLine` and `ottLine`.

Example:

= ottlib.ott(source = close, length = 2, multiplier = 1.4)

longCondition = ta.crossover(supportLine, ottLine)

shortCondition = ta.crossunder(supportLine, ottLine)

• tott(source, length, multiplier, bandsMultiplier)

Short Definition: Calculates TOTT (Twin OTT).

Details: TOTT consists of three lines: the "Support Line," which is the VIDYA of the given source; the "Upper Line," a trailing stop of the Support Line adjusted with an added multiplier; and the "Lower Line," another trailing stop of the Support Line, adjusted with a reduced multiplier. The market is considered in an uptrend if the Support Line is above the Upper Line and in a downtrend if it is below the Lower Line.

Parameters:

source (float) : (series float) Series of values to process. Default value is `close`.

length (simple int) : (simple int) Number of bars to lookback. Default value is `40`.

multiplier (simple float) : (simple float) Percent of trailing stop. Default value is `0.6`.

bandsMultiplier (simple float) : Multiplier for bands. Default value is `0.0006`.

Returns: ( [ float, float, float ]) Tuple of `supportLine`, `upperLine` and `lowerLine`.

Example:

= ottlib.tott(source = close, length = 40, multiplier = 0.6, bandsMultiplier = 0.0006)

longCondition = ta.crossover(supportLine, upperLine)

shortCondition = ta.crossunder(supportLine, lowerLine)

• ott_channel(source, length, multiplier, ulMultiplier, llMultiplier)

Short Definition: Calculates OTT Channels.

Details: OTT Channels comprise nine lines. The central line, known as the "Mid Line," is the OTT of the given source's VIDYA. The remaining lines are positioned above and below the Mid Line, shifted by specified multipliers.

Parameters:

source (float) : (series float) Series of values to process. Default value is `close`

length (simple int) : (simple int) Number of bars to lookback. Default value is `2`

multiplier (simple float) : (simple float) Percent of trailing stop. Default value is `1.4`

ulMultiplier (simple float) : (simple float) Multiplier for upper line. Default value is `0.01`

llMultiplier (simple float) : (simple float) Multiplier for lower line. Default value is `0.01`

Returns: ( [ float, float, float, float, float, float, float, float, float ]) Tuple of `ul4`, `ul3`, `ul2`, `ul1`, `midLine`, `ll1`, `ll2`, `ll3`, `ll4`.

Example:

= ottlib.ott_channel(source = close, length = 2, multiplier = 1.4, ulMultiplier = 0.01, llMultiplier = 0.01)

• risotto(source, length, rsiLength, multiplier)

Short Definition: Calculates RISOTTO (RSI OTT).

Details: RISOTTO comprised of two lines: the "Support Line," which is the VIDYA of the given source's RSI value, calculated based on the length parameter, and the "RISOTTO Line," a trailing stop of the Support Line. The market is considered in an uptrend when the Support Line is above the RISOTTO Line, and in a downtrend if it is below.

Parameters:

source (float) : (series float) Series of values to process. Default value is `close`.

length (simple int) : (simple int) Number of bars to lookback. Default value is `50`.

rsiLength (simple int) : (simple int) Number of bars used for RSI calculation. Default value is `100`.

multiplier (simple float) : (simple float) Percent of trailing stop. Default value is `0.2`.

Returns: ( [ float, float ]) Tuple of `supportLine` and `risottoLine`.

Example:

= ottlib.risotto(source = close, length = 50, rsiLength = 100, multiplier = 0.2)

longCondition = ta.crossover(supportLine, risottoLine)

shortCondition = ta.crossunder(supportLine, risottoLine)

• sott(source, kLength, dLength, multiplier)

Short Definition: Calculates SOTT (Stochastic OTT).

Details: SOTT is comprised of two lines: the "Support Line," which is the VIDYA of the given source's Stochastic value, based on the %K and %D lengths, and the "SOTT Line," serving as the trailing stop of the Support Line. The market is considered in an uptrend when the Support Line is above the SOTT Line, and in a downtrend when it is below.

Parameters:

source (float) : (series float) Series of values to process. Default value is `close`.

kLength (simple int) : (simple int) Stochastic %K length. Default value is `500`.

dLength (simple int) : (simple int) Stochastic %D length. Default value is `200`.

multiplier (simple float) : (simple float) Percent of trailing stop. Default value is `0.5`.

Returns: ( [ float, float ]) Tuple of `supportLine` and `sottLine`.

Example:

= ottlib.sott(source = close, kLength = 500, dLength = 200, multiplier = 0.5)

longCondition = ta.crossover(supportLine, sottLine)

shortCondition = ta.crossunder(supportLine, sottLine)

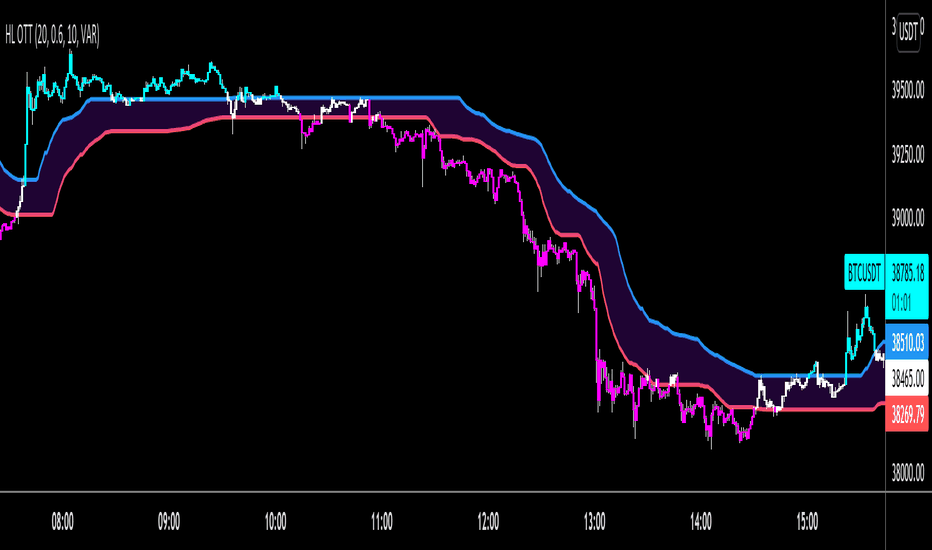

• hottlott(length, multiplier)

Short Definition: Calculates HOTT & LOTT (Highest & Lowest OTT).

Details: HOTT & LOTT are composed of two lines: the "HOTT Line", which is the OTT of the highest price's VIDYA, and the "LOTT Line", the OTT of the lowest price's VIDYA. A high price surpassing the HOTT Line can be considered a long signal, while a low price dropping below the LOTT Line may indicate a short signal.

Parameters:

length (simple int) : (simple int) Number of bars to lookback. Default value is `20`.

multiplier (simple float) : (simple float) Percent of trailing stop. Default value is `0.6`.

Returns: ( [ float, float ]) Tuple of `hottLine` and `lottLine`.

Example:

= ottlib.hottlott(length = 20, multiplier = 0.6)

longCondition = ta.crossover(high, hottLine)

shortCondition = ta.crossunder(low, lottLine)

• rott(source, length, multiplier)

Short Definition: Calculates ROTT (Relative OTT).

Details: ROTT comprises two lines: the "Support Line", which is the VIDYA of the given source, and the "ROTT Line", the OTT of the Support Line's VIDYA. The market is considered in an uptrend if the Support Line is above the ROTT Line, and in a downtrend if it is below. ROTT is similar to OTT, but the key difference is that the ROTT Line is derived from the VIDYA of two bars of Support Line, not directly from it.

Parameters:

source (float) : (series float) Series of values to process. Default value is `close`.

length (simple int) : (simple int) Number of bars to lookback. Default value is `200`.

multiplier (simple float) : (simple float) Percent of trailing stop. Default value is `0.1`.

Returns: ( [ float, float ]) Tuple of `supportLine` and `rottLine`.

Example:

= ottlib.rott(source = close, length = 200, multiplier = 0.1)

isUpTrend = supportLine > rottLine

isDownTrend = supportLine < rottLine

• ft(source, length, majorMultiplier, minorMultiplier)

Short Definition: Calculates Fırsatçı Trend (Opportunist Trend).

Details: FT is comprised of two lines: the "Support Line", which is the VIDYA of the given source, and the "FT Line", a trailing stop of the Support Line calculated using both minor and major trend values. The market is considered in an uptrend when the Support Line is above the FT Line, and in a downtrend when it is below.

Parameters:

source (float) : (series float) Series of values to process. Default value is `close`.

length (simple int) : (simple int) Number of bars to lookback. Default value is `30`.

majorMultiplier (simple float) : (simple float) Percent of major trend. Default value is `3.6`.

minorMultiplier (simple float) : (simple float) Percent of minor trend. Default value is `1.8`.

Returns: ( [ float, float ]) Tuple of `supportLine` and `ftLine`.

Example:

= ottlib.ft(source = close, length = 30, majorMultiplier = 3.6, minorMultiplier = 1.8)

longCondition = ta.crossover(supportLine, ftLine)

shortCondition = ta.crossunder(supportLine, ftLine)

█ CUSTOM OTT CREATION

Users can create custom OTT implementations using f_ottTrail function in this library. The example code which uses EMA of 7 period as moving average and calculates OTT based of it is below.

Source Code:

//@version=5

indicator("Custom OTT", shorttitle = "COTT", overlay = true)

import ismailcarlik/ottlib/1 as ottlib

src = input.source(close, title = "Source")

length = input.int(7, title = "Length", minval = 1)

multiplier = input.float(2.0, title = "Multiplier", minval = 0.1)

support = ta.ema(source = src, length = length)

ott = ottlib.f_ottTrail(source = support, multiplier = multiplier)

pSupport = plot(support, title = "Moving Average Line (Support)", color = color.blue)

pOtt = plot(ott, title = "Custom OTT Line", color = color.orange)

fillColor = support >= ott ? color.new(color.green, 60) : color.new(color.red, 60)

fill(pSupport, pOtt, color = fillColor, title = "Direction")

Result:

█ DISCLAIMER

Trading is risky and most of the day traders lose money eventually. This library and its functions are only for educational purposes and should not be construed as financial advice. Past performances does not guarantee future results.

super SSL [ALZ]This script is designed and optimized for MULTI TIME

by Ali Zebardast (ALZ)

1.in part of ssl

Original Version credits to Mihkel00

Actual Version i just set alerts and change the parameters for BTCUSDT 1min Chart.

He designed for daily time. I tried to optimize 1 min time-frame .

And fix the errors with OTT

"This script has a SSL / Baseline (you can choose between the SSL or MA), a secondary SSL for continiuation trades and a third SSL for exit trades.

Alerts added for Baseline entries, SSL2 continuations, Exits.

Baseline has a Keltner Channel setting for "in zone" Gray Candles

Added "Candle Size > 1 ATR" Diamonds from my old script with the criteria of being within Baseline ATR range."

2.in part of Range

two Filter Buy and Sell for 3min

Wait For Bar close

ssl2 :Be under the candle for buy

and The bar color must confirm the order of purchase (Blue)

3.in part of OTT

when candles close over HOTT, means an UPTREND SIGNAL

and to Fuchia when candles begin closing under LOTT line to indicate a DOWNTREND SIGNAL.

FLAT ZONE is highlighted also to have the maximum concentration on sideways market conditions.

There are three quantitative parameters in this indicator:

The first parameter in the OTT indicator set by the two parameters is the period/length.

OTT lines will be much sensitive to trend movements if it is smaller.

And vice versa, will be less sensitive when it is longer.

As the period increases it will become less sensitive to little trends and price actions.

In this way, your choice of period, will be closely related to which of the sort of trends you are interested in.

The OTT percent parameter in OTT is an optimization coefficient. Just like in the period

small values are better at capturing short term fluctuations, while large values

will be more suitable for long-term trends.

The final adjustable quantitative parameter is HIGHEST and LOWEST length which is the source of calculations.

Credits go to:

SSL Hybrid www.tradingview.com

HIGH and LOW OTT : www.tradingview.com

Range Filter www.tradingview.com

RSI_OTT - TP/SLWhile creating this strategy, I was inspired by "ott(by Anıl Özekşi)" and "RSI + Bollinger Double Strategy(by ChartArt)".

Basically, the strategy uses ott bands instead of bollinger bands in the "RSI+Bollinger Double Strategy".

User can select take profit, stop loss, position direction(long, short or both) and the other ott parameters via interface.

OTT-Stoch-TP/SLThis strategy combines stochastic oscillator and OTT (OTT is originally owned by Anıl Özekşi).

The strategy is triggered at fast OTT and slow OTT crossing points. User can select the "Evaluate Stoch OTT" option which is validate the crossing points through stochastic oscillator.

In the same way, user can select "take profit", "stop loss" and position direction(long, short or both) via interface.

By the way, Stoch OTT is not classic Stochastic oscillator. Actually, it is also combined classic stochastic oscillator and OTT for long term validation to base strategy.

Optimized Trend Tracker Oscillator OTTOOTTO - Optimized Trend Tracker Oscillator is a derivative of Anıl Özekşi's OTT - Optimized Trend Tracker:

It is more sensitive to price movements when compared to its ancestor OTT.

There are 2 more parameters of VIDYA moving average lengths FAST and SLOW.

Fast VIDYA has length of 10 bars and Slow VIDYA has 25.

Correction Constant is a crucial parameter to make the calculation more stable.

you can use 1000 to 100000000 by the powers of ten to obtain more accurate graphic values.

Buy and Sell signals make indicator more meaningful.

HOTT and LOTTA brand new indicator adaptation via ott from OTT developer Anıl Özekşi.

Optimized Trend Tracker, OTT is an indicator that provides traders to find an existing trend or in another words to ser which side of the current trend we are on. Kıvanç Özbilgiç coded OTT from the matrix program and adapted it to tradingview.

This indicator adaptation works with patch logic. Ott is created with the support of 10 bars Highest High and Lowest Low. The settings that the creator uses are the standard existing settings.

Here is the HighestOTT (HOTT) Line,

In general, what you need to see here is that prices tend to touch prices as they go up.

If the prices are rising, it tries to go below them, if it cannot, at least it tries to move within it.

When the price is flat or falling, it stays above the prices without touching them. This shows that our patch can do its job, which we wanted at the beginning, to protect us from horizontals and falls during purchase.

Here is the LowestOTT (LOTT) Line,

As you can notice, it uses similar construction as a structure. The only difference is that what we just did with Highest High, we are now trying to bring out the opposite effect by doing it with Lowest Low.

Now let's see hott and lott together. The places I want to draw your attention to are that prices are always above LOTT where they are on the up and sideways, and below HOTT when they are on the downtrend.

In this case, you must have understood the working principles of our patches.

If the prices are above the blue line, that is, HOTT, our buying door is opened, and as long as it is below, the buying door will remain closed.

Likewise, if the prices are below the purple line, that is, LOTT, our sales door is opened, and as long as it is above the sales door will remain closed.

Bar colors are also designed accordingly.

There is an Extra Plot Candle option in the settings tab of the indicator. This option is designed so that you can use bar colors efficiently while using normal candles. In order to use this option properly, you need to turn off the candle, border and wick colors in the symbol section of the graphic settings.

Built in Moving Average type defaultly set as VAR but users can choose from 8 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Moving Average

WMA : Weighted Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average a.k.a. VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

Best regards to Anıl Özekşi and Kıvanç Özbilgiç.

HIGH and LOW Optimized Trend Tracker HOTT LOTTAnıl Özekşi's latest development on his precious OTT - Optimized Trend Tracker:

In this version, there are two lines of OTT which are derived from HIGHEST price values (HOTT) and LOVEST price values (LOTT) which were originally sourced to CLOSE values on default OTT.

Another significant difference is there is no Support Line (Moving Average) in this version.

The area between HOTT and LOTT is FLAT ZONE which developer advises to do nothing.

Bars will be highlighted to Turquoise when candles close over HOTT, means an UPTREND SIGNAL

and to Fuchia when candles begin closing under LOTT line to indicate a DOWNTREND SIGNAL.

FLAT ZONE is highlighted also to have the maximum concentration on sideways market conditions.

There are three quantitative parameters in this indicator:

The first parameter in the OTT indicator set by the two parameters is the period/length.

OTT lines will be much sensitive to trend movements if it is smaller.

And vice versa, will be less sensitive when it is longer.

As the period increases it will become less sensitive to little trends and price actions.

In this way, your choice of period, will be closely related to which of the sort of trends you are interested in.

The OTT percent parameter in OTT is an optimization coefficient. Just like in the period

small values are better at capturing short term fluctuations, while large values

will be more suitable for long-term trends.

The final adjustable quantitative parameter is HIGHEST and LOWEST length which is the source of calculations.

Anıl Özekşi generally works on 1 minute charts so I personally advise traders to optimize parameters to have more accurate signals. Just concentrate on FLAT price zones and indicator will do the rest in trends.

Built in Moving Average type defaultly set as VAR but users can choose from 10 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Moving Average

DEMA : Double Exponential Moving Average

WMA : Weighted Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average a.k.a. VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

HULL : Hull Moving Average

Stochastic Optimized Trend Tracker *Strategy*Stochastic OTT is Anıl Özekşi's latest derived version of Optimized Trend Tracker on Stochastic Oscillator.

He tried to solve the fake signals of Stochastic Oscillator by adopting OTT on the indicator.

He advised users to set the stochastic smoothing parameters to 500 and 200 on his latest video about SOTT.

He personally uses 1 min charts on stock market so the parameters of the indicator might have to be optimized for other time frames nad markets.

He exaggerated the Stochastic to 1000's to have better signals of percent values of OTT .

Also hes used VIDYA in both calculations of OTT and Stochastic smoothing.

Said, Kıvanç Özbilgiç.

I just made a Strategy version of the script so that we lads can backtest it. The codes for that are yet again from Kıvanç Özbilgiç :) I just copy-pasted a few and did some adjustments. Hope you enjoy!

#betonyetmez

Stochastic OTTStochastic OTT is Anıl Özekşi's latest derived version of Optimized Trend Tracker on Stochastic Oscillator.

You might like to view the original version of the indicator if you don't know about OTT yet:

He tried to solve the fake signals of Stochastic Oscillator by adopting OTT on the indicator.

He advised users to set the stochastic smoothing parameters to 500 and 200 on his latest video about SOTT.

He personally uses 1 min charts on stock market so the parameters of the indicator might have to be optimized for other time frames nad markets.

He exaggerated the Stochastic to 1000's to have better signals of percent values of OTT.

Also hes used VIDYA in both calculations of OTT and Stochastic smoothing.

Hope you'll enjoy the SOTT in your profitable trades.

Kıvanç

Optimized Trend Tracker BandsDerived from Anıl Özekşi's Optimized trend tracker Indicator OTT:

by himself on his last youtube video with subtitles.

OTT Bands tries to determine accurate support and resistance levels after users manually set the 2 optimization coefficients (for UPPER AND LOWER BANDS) just by having the highest and lowest price levels inside the OTT Bands.

After that user can enjoy the fibonacci coefficiented levels just by selecting from indicator settings.

A message from the developer Anıl Özekşi to all traders:

"Hope you are always on the winning side ..."

Kıvanç Özbilgiç

Twin Optimized Trend Tracker Strategy TOTTAnıl Özekşi's new strategy which is a combination of 2 Optimized Trend Tracker lines which are vertical displaced from original version with a COEFFICIENT to cope with sideways' false signals which he explained in "Toy Borsacı İçin OTT Kullanım Kılavuzu 2"

original version of OTT:

OTT Strategy and Screener:

You can find a detailed explanation with subtitles from the developer of OTT Anıl Özekşi himself as: "Toy Borsacı İçin OTT Kullanım Kılavuzu 2"

Optimized Trend Tracker STRATEGY & SCREENEROptimized Trend Tracker - OTT STRATEGY & SCREENER screens the BUY and SELL signals (trend reversals) for 20 user defined different tickers in Tradingview charts.

Simply input the name of the ticker in Tradingview that you want to screen.

Terminology explanation:

Confirmed Reversal: OTT reversal that happened in the last bar and cannot be repainted.

Potential Reversal: OTT reversal that might happen in the current bar but can also not happen depending upon the timeframe closing price.

Downtrend: Tickers that are currently in the sell zone

Uptrend: Tickers that are currently in the buy zone

Screener has also got a built in OTT indicator which users can confirm the reversals on graphs.

Screener explores the 20 tickers in current graph's time frame and also in desired parameters of the OTT indicator.

Also you can optimize the parameters manually with the built in STRATEGY version.

Optimized Trend Tracker indicator :

Built in Moving Average type defaultly set as VAR but users can choose from 8 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Movin Average

WMA : Weighted Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average aka VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

Tip: In sideways VAR would be a good choice

You can use OTT default alarms and Buy Sell signals like:

1-

BUY when Prices are above OTT

SELL when Prices are below OTT

2-

BUY when OTT support Line crosses over OTT line.

SELL when OTT support Line crosses under OTT line.

3-

BUY when OTT line is Green and makes higher highs.

SELL when OTT line is Red and makes lower lows.

IMPORTANT: SCREENER ONLY EXPLORES AND SCREENS FOR THE 2nd SIGNAL TYPE:

BUY when OTT support Line crosses over OTT line.

SELL when OTT support Line crosses under OTT line.

Optimized Trend Tracker - Strategy VersionA brand new indicator from the developer of MOST (Moving Stop Loss) indicator Anıl Özekşi.

Optimized Trend Tracker OTT is an indicator that provides traders to find an existing trend or in another words to ser which side of the current trend we are on.

The original indicator was coded and published by Kıvanç Özbilgiç. You can access it from this link:

I transformed the indicator into a strategy and made some changes:

- You can run two different strategies. In the Settings section, you can test two different strategies, "Support Line Crossing Signals" and "Price / OTT Crossing Signals".

- Fixed the issue where BUY/SELL labels from the indicator script would hang in the air.

- I added a setting where you can hide BUY/SELL labels if you want.

- I painted the bars for BUY/SELL states, you can open and close in the settings section.

- As I do with every strategy script, I added a start and end date for the strategy test. You can specify the range you want to see working in the Settings section.

In addition, there were cases when the OTT line was reduced to zero in non-voluminous symbols; I changed this situation by making a small change in the code. I asked Kıvanç about the subject, I can update according to his answer.

Note : Strategy BUY / SELL tags and indicator BUY / SELL tags do not operate in the same bar because indicator tags are added when the next bar occurs. If you replay bars, you can observe label formations.

TÜRKÇE AÇIKLAMA

Orjinal indikatör Kıvanç Özbilgiç tarafından kodlanmış ve yayımlanmıştır. Bu linkten erişebilirsiniz:

İndikatörü strateji dönüştürdüm ve bazı değişiklikler yaptım:

- İki farklı strateji çalıştırabilirsiniz. Ayarlar kısmında Condition bölümünde "Support Line Crossing Signals" ve "Price/OTT Crossing Signals" olarak iki farklı stratejiyi test edebilirsiniz.

- İndikatör scriptinden gelen BUY/SELL etiketlerinin havada durması sorununu düzelttim.

- İsterseniz BUY/SELL etiketleri gizleyebileceğiniz bir ayar ekledim.

- BUY/SELL durumları için barları boyadım, ayarlar bölümünden açıp kapatabilirsiniz.

- Her strateji scriptinde yaptığım gibi, strateji testi için başlangıç ve bitiş tarihi ekledim. Ayarlar bölümünden çalışmasını görmek istediğiniz aralığı belirleyebilirsiniz.

- Ek olarak hacimsiz sembollerde OTT çizgisinin sıfıra indiği durumlar mevcuttu; kodda ufak bir değişiklik yaparak bu durumu değiştirdim. Kıvanç Bey'e konu ile ilgili soru sordum, cevabına göre güncelleme yapabilirim.

Not : Strateji BUY/SELL etiketleri ile indikatör BUY/SELL etiketleri aynı barda işlem yapmamaktadır çünkü indikatör etiketleri kendisinden sonraki bar oluşunca eklenmektedir. Barları replay yaptırırsanız oluşumlarını gözlemleyebilirsiniz.

Optimized Trend TrackerA brand new indicator from the developer of MOST (Moving Stop Loss) indicator Anıl Özekşi.

Optimized Trend Tracker OTT is an indicator that provides traders to find an existing trend or in another words to ser which side of the current trend we are on.

We are under the effect of the uptrend in cases where the prices are above OTT ,

under the influence of a downward trend, when prices are below OTT

it is possible to say that we are.

The first parameter in the OTT indicator set by the two parameters is the period/length.

OTT will be much sensitive to trend movements if it is smaller. And vice versa, will be less sensitive when it is longer.

As the period increases it will become less sensitive to little trends and price actions.

In this way, your choice of period, will be closely related to which of the sort of trends you are interested in.

The OTT percent parameter in OTT is an optimization coefficient. Just like in the period

small values are better at capturing short term fluctuations, while large values

will be more suitable for long-term trends.

In addition, when OTT is used with the support line in it, buy and sell signals

it will become a producing indicator.

You can use OTT default alarms and Buy Sell signals like:

1-

BUY when Prices are above OTT

SELL when Prices are below OTT

2-

BUY when OTT support Line crosses over OTT line.

SELL when OTT support Line crosses under OTT line.

3-

BUY when OTT line is Green and makes higher highs.

SELL when OTT line is Red and makes lower lows.

Note: A small coverage with English subtitles will be available on my Youtube Channel soon.