Previous Range Values, BasicOur P.R.V (Previous Range Values)(Basic) indicator is pretty simple; it plots the previous ranges of the high/low for the structured timeframes. This helps to quickly identify the primary Historical supports and resistances according to the Gregorian time structure. Additionally, a 'custom' field allows for a wider selection other than the scripts default, however the custom selection uses the pre-defined timeframes opposed to manual inputs since the conversion is in minutes and would limit/cap the available range. The plotted lines are designed to remain "out of the way" from the current candle.

To disable a range, simply change the opacity to 0%

Additional script features allow for fully adjustable settings and configurations:

• Adjustable; Range Colors

• Adjustable; Toggles

Pivot points and levels

1+KillZoneLiteRemove plot line for a better view. I've made this to work on "US30 Global Prime" probably works on other pairs the codes left open to mod.

This Indicator shows 3 sessions to help you focus on timing. This will help you with learning pattern recognition aswell.

1. Gray zone is spreads. The gray zone will show up 30 min before spreads open up.

2. Blue is new york

3. Red is london reversal zone.

4. Look between the zones and also how price reacts within the zones and at what time.

5. This indicator also prints the sessions 1 day in advance to help with back testing aswell.

PharshK RSI and Zigzag with H/LIt is with RSI level

and Zigzag Pattern that Market goes on Maximum level and Lower Level

And it is also Showing High and Law Level of last Moving Candle so it is easy to entry and Hold

PharshK RSI and Zigzag with H/LIt is with RSI level

and Zigzag Pattern that Market goes on Maximum level and Lower Level

And it is also Showing High and Law Level of last Moving Candle so it is easy to entry and Hold

IPB_PBOThis indicator is called Indian Pivot Boss _ Pivot Based Oscillator.

This is an oscillator based on pivot level of each candle. It is based on the concept outlined in the Secrets of Pivot Boss book.

It is the average of mutual differences between fast moving average, medium moving average and slow moving average of the candle pivots. This is then plotted as an oscillator.

When Pivot based oscillator is sloping upwards, it is suggested NOT TO STAY ON THE SHORT SIDE. Staying long side or Keeping quiet are the desirable options.

When Pivot based oscillator is sloping downwards, it is suggested NOT TO STAY ON THE LONG SIDE. Staying short side or Keeping quiet are the desirable options.

This indicator has to be used in conjunction with other indicators and should not be relied on a solo basis.

Operietur ⸗ Time Range BreakoutOur T.R.B ( Time Range Breakout ) indicator is very similar to the O.R.B ( Open Range Breakout ) indicator. This script plots the high/Low within a custom time-range which then extends that plot to end-of-day. A Fibonacci extension is then drawn from that range. The default settings of this indicator set the similarities to the ORB. This script only displays the last trading day.

Due to Tradingview's singular refresh rate for the larger timeframes("resolutions"); this indicator works on timeframes LESS than 60min. Additionally, the smaller the timeframe the more accurate the price range will be.

The movements within the specified period of time define the projected Fibonacci prices associated with the allotted time's price range.

• Custom Time Range

• Fibonacci Extensions

• Up to 5 PTs

• Customizable Multiplier

Additional script features allow for fully adjustable settings and configurations:

• Adjustable; PT Colors

• Adjustable; Range Color

• Adjustable; Toggles

Contraction LevelsA contraction candle is a candle whose body engulfs both left and right candlesticks' bodies. This indicator shows those contraction candlestick patterns which consists of successive candles. Then draws a horizontal level line to its defined % of its body size and also draws +/- filter lines which are shown as dashed lines, also with an option to define those filters' percentage.

Bullish Contraction:

Whenever a new candle closes above the maximum high of 3 contraction candles pattern, that contraction is called bullish contraction and its lines are shown as green lines ( you can change the color as well)

Bearish Contraction:

Whenever a new candle closes below the maximum low of 3 contraction candles pattern, that contraction is called bearish contraction and its lines are shown as red lines ( you can change the color as well)

Volume Analysis*Sourced code from Volume Flow v3 by oh92 for Bull\Bear volume flow calculations. Thank you so much for your engineering skills!

This indicator integrates the Ma-over-MA crossover strategy in oh92's V3 DepthHouse calculation with a volume-over-MA

calculation to further narrow down "Areas of Interest" levels for a potential re-test zone to the right of the chart.

I added a Moving Average calculation for a multi-level cloud and further broke down more conditions to highlight both

volume flow crossover on the High and Extreme High MA's and also high and extreme high volume spikes on set period average

without bull\bear conditions. Original Bull/Bear Spikes are still viewable although that was the only plot from oh92's script

that was integrated.

Session backgrounds set for research purposes.

Please note: Setting MA Cloud to "None" will remove all plots calculated with the MA Cloud from the chart entirely. Turn off visuals

in the Style tab.

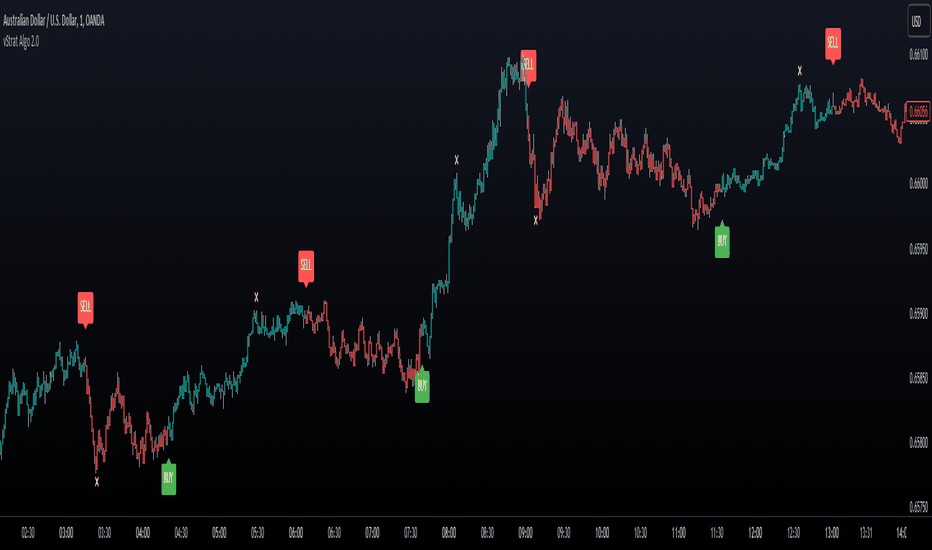

vStrat Algo 2.0vStrat Algo 2.0 is a Non-Repainting toolkit that works on any market such as stocks, crypto, forex, indices, commodities, etc. There are 8 advanced features that traders can use to help them create their own strategies. vStrat Algo 2.0 offers 10 sensitivity presets that they can choose from, making this toolkit suitable for every trading style whether it's scalping, day trading, swinging, or position trading.

I. Non-Repainting

When an indicator is Repainting , it changes its values as new data arrives, making it an unreliable indicator especially for Buy and Sell signals but this does not necessarily mean that the indicator is less accurate. vStrat Algo 2.0 does not repaint so the signals that were triggered in real time will stay the same during backtesting. If Non-Repainting is disabled, the signal that was triggered on a candle might disappear as new data arrives and once that candle closes, the signal might not even be there anymore, but it could get triggered on the next candle instead.

II. Signal Sensitivity

The Buy and Sell signals are highly accurate but the placement of each signal will differ for each selected preset. The higher the sensitivity (3.0 - 5.0), the more signals will be displayed on the chart. This setting works well when scalping using lower timeframes (1 min - 5 min). As the sensitivity lowers (0.5 - 2.5), less signals are displayed on the chart. If you are day trading or swinging, the lower presets are recommended as they are smoothed and will have less noise. Lower sensitivity works well on any timeframe.

III. Safe Mode

This feature hides any Buy and Sell signals that are triggered within the Consolidation Zones. The signals can still vary depending on the sensitivity, CZ Smoothing and CZ Length. The default setting is "3" and "7". "Unfiltered" must be unchecked for the signals to disappear.

IV. Unfiltered Signals

All Buy and Sell signals are displayed on the chart. This feature must be disabled if "Safe Mode" is enabled.

V. Trend Candle Colouring

This changes the bar colors depending on its trend. Green if it's trending up and red if it's trending down.

VI. Trend Cloud

Trend Cloud indicates the current market trend. This can also be used as a confluence to the Buy and Sell signals. Wider cloud indicates a strong momentum on either direction. As the cloud narrows, it could mean a possible reversal.

VII. Pivot Points

Pivot Points are useful for identifying significant support and resistance levels as well as identifying entry, exit, stop loss, and target profit levels.

VIII. Consolidation Zones

Consolidation Zones can be used to identify if the market is ranging. If enabled, it changes the colors of the bars that have low momentum to yellow. It is best to wait for a breakout to enter a trade but you can still be profitable when the market is ranging by trading based off Support and Resistance Levels and Imbalance Zones. Default setting is: Smoothing "3" and Length "7".

IX. Take Profit Levels

Take Profit signals are displayed on the chart as yellow "x". Once the algo detects a potential reversal, a Take Profit signal will be triggered so the user can lock in their profits. The signals can appear more than once so you have the option to keep holding as long as you know the risks. The lower the Length is, the more signals appear.

X. Alerts

Buy and Sell signal alerts can be created by clicking the three dots in the vStrat Algo 2.0 indicator tile.

Disclaimer:

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed, or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. Conduct your own due diligence or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed, or implied herein, are committed at your own risk, financial or otherwise.

Auto Round levels by Script051This indicator is designed to show psychological levels/round levels.

The difference between this version and the others is that :

It will automatically show round levels for each symbol you select without having to enter "tick value" manually.

Settings

Gap : If the value is equal to zero, the round levels will be found automatically, but if you change the value, the gap between the lines will be adjusted based on the value you specified.

X2 and /2 : doubles or halves the distance between round lines

Number of lines : Specifies the number of lines to be displayed

Day Week Month High & LowThis is a small little script that helps visually mark the high and lows of the DAY, WEEK or MONTH (of your choosing). It's best when paired with my High and Low Fibonacci Pivot Points indicator to help emphasize the high and lows of the day, week or month.

Turk Pivot Candle Order BlocksOrder Blocks based on pivot reversal candle

When a pivot High or Pivot Low is found and confirmed, a box will be plotted on the open and close values of that pivot candle

You also have the ability to change the amount of candles the box stretches over as well as the colors of the bullish and bearish boxes

How To Use:-

Pivot points often provide Support and Resistance points on their own,

one way of marking up order blocks is by taking the pivot candle and marking that up as a resistance area where you could be looking for price to reverse

Customizable Pivot Support/Resistance Zones [MyTradingCoder]This script uses the standard pivot-high/pivot-low built-in methods to identify pivot points on the chart as a base calculation for the zones. Rather than displaying basic lines, it displays a zone from the original pivot point to the closest part of the available body on the same candle. The script comes in handy by utilizing Pinescripts available input.source() function to allow for an external indicators output value to be used within the indicator. Make sure to read all of the TOOLTIPS in the indicator settings menu to get a full understanding of what each setting does, and how it can affect the results that end up on the chart.

By enabling the custom filter in the indicator settings, you will notice you have the ability to filter out zones using an external indicator such as an RSI. Maybe you only want zones to be calculated/drawn when the RSI is overbought or oversold, or maybe you only want the zones to calculate/draw if the Supertrend is green or red. The list of possible filters that you can implement is too many to count. Feel free to play around with the indicator however you like, and configure something that you find to be the most useful for your trading.

On top of everything listed above, the indicator has pre-programmed built-in alertconditions so that you can potentially automate trading, or get a notification to your cell phone when a zone is being touched/broken.

High and Low Fibonacci Pivot PointsThis is a standard fibonacci retracement level indicator and free to use for all. I couldn't find any decent retracement levels that works for me (and definitely wasted money on paid script access that didn't work so well for my trading style), so I created this for my own use and now sharing it with the TradingView community. Fibonacci retracement levels help traders predict key areas where a stock/security may find support or resistance. The common ratios are available, such as 23.6, 38.2, 61.8 and so forth. You can choose from Day, Week or Month for your fibonacci retracement lines. In order to keep in sync with my particular style of keeping charts nice and clean, I've created this indicator with defaults to use friendly color schemes. You can of course, choose another color, etc... that fits your own taste. All of my published scripts utilize TradingView's version 5 scripting.

Main Features:

- Show or hide pre-market high and lows (the pre-market high & lows are hidden by default)

- Show or hide the 1-hour 20 EMA line (hidden by default, as this is more uncommon than the 1-hour 50 EMA line for potential support or resistance)

- Show or hide the 1-hour 50 EMA line

- Show or hide the fibonacci retracement lines (the 50% line is hidden by default)

- Option to allow the fibonacci retracement lines to start out the first few minutes of market open to use the pre-market high & low. Once the stock/security price breaks either the pre-market high or pre-market low, it reverts to using the day's high and low. This only works on chart timeframes under the daily time frame.

FYI:

All customizable settings have a help/info window. Please refer to the help/info window, if you're unsure of what a setting does what. Also, note that I wrote and published this script after market close, so I haven't had the chance to check/test if everything works, which can only be fully verified during market open hours (for non-crypto securities).

* Please note that this script is in its early beta stage and there could be bugs. This is being provided as is and the information provided by this script is meant for informational/entertainment purposes only.

Pivot Points with Slopes - By Necromancer█ OVERVIEW

- This script draws array-based Pivot Points with the calculated slope on the next connecting point.

- The script works left to right, but could be be modified.

- Looks best with Label-Style on Diamonds, without Slope Text drawn.

█ Thank You!

- Many more to come which will utilize these fundamentals!

🅝🅔🅒🅡🅞🅜🅐🅝🅒🅔🅡

Grid Settings & MMThis script is designed to help you plan your grid trading or when averaging your position in the spot market.

The script has a small error (due to the simplification of the code), it does not take into account the size of the commission.

You can set any values on all parameters on any timeframe, except for the number of orders in the grid (from 2 to 5).

The usage algorithm is quite simple:

1. Connect the script

2. Install a Fibo grid on the chart - optional (settings at the bottom of the description)

3.On the selected pair, determine the HighPrice & LowPrice levels and insert their values

4.Evaluate grid data (levels, estimated profit ’%’, possible profit ‘$’...)

And it's all)

Block of variables for calculating grid and MM parameters

Variables used regularly

--- HighPrice and LowPrice - constant update when changing pairs

--- Deposit - deposit amount - periodically set the actual amount

Variables that do not require permanent changes

--- Grids - set the planned number of grids, default 5

--- Steps - the planned number of orders in the grid, by default 5

--- C_Order - coefficient of increasing the size of orders in the base coin, by default 1.2

--- C_Price - trading levels offset coefficient, default 1.1

--- FirstLevel - location of the first buy level, default 0.5

--- Back_HL - number of candles back, default 150

*** For C_Order and C_Price variables, the value 1 means the same order size and the same distance between buy levels.

The fibo grid is used for visualization, you can do without it, ! it is not tied to the script code !

You can calculate the levels of the Fibo grid using the formula:

(level price - minimum price) / (maximum price - minimum price)

For default values, grid levels are as follows:

1 ... 0.5

2...0.359

3 ... 0.211

4...0.0564

5...-0.1043

Short description:

in the upper right corner

--- indicator of the price movement for the last 150 candles, in % !!! there is no task here to "catch" the peak values - only a relative estimate.

in the upper left corner

--- total amount of the deposit

--- the planned number of grids

--- “cost” of one grid

--- the size of the estimated profit depending on the specified HighPrice & LowPrice

in the lower left corner

--- Buy - price levels for buy orders

--- Amount - the number of purchased coins in the corresponding order

--- Sell - levels of profit taking by the sum of market orders in the grid

--- $$$ - the sum of all orders in the grid, taking into account the last active order

--- TP - profit amount by the amount of orders in the grid

Kustom Sessions Opening PricesPlots the opening price of custom session(s) as defined by the user

The time parameter(s) can be used for widely know session times or session times defined by the user

The time(s) used in this indicator can serve as an indication of levels the market's price action respects

Automating these allows gives the user a chance to focus more on price action.

There is also an option to keep previous days values which can prove valuable as price tends to respect prior days' levels

Settings:

A. Time Zone(s)

B. Opening Time(s)

C. Line Color(s)

D. Text Time(s)

E. Text Color(s)

F. Width & Length of Line(s)

G. Number of Days

CHS Zig ZagCHS ZigZag stands for Changeable Source ZigZag

The original ZigZag indicator offered by TradingView doesn't have the ability to measure the tips and troughs based on closing prices (line chart), however, this indicator is capable of receiving an input from user that determines the price source used for further calculations.

The default inputs of the original ZigZag indicator have been also changed in order to make it adapt to pivots formed on line chart but users can change arbitrarily.

Flag DetectorThis script attempts to find consolidations or retracements within the context of a previous uptrend - basically looking for flag type patterns. It first measures an initial move (referred to as the flag pole in this script) and then looks for consolidation after that move within a certain range. If the consolidation is within the rage, it plots a dot under the candle to show you the consolidation areas. It's not fool proof, but seems to do a decent job of identifying pullbacks and sideways consolidations reasonably well.

CME OpenThis indicator prints CME open line price on chart.

Please choose the right time to input depending on the broker you are using in Tradingview.

List of brokers:

OANDA 0620-0621

FOREX.COM 0620-0621

SAXO 0620-0621

GLOBALPRIME 0620-0621 (Working only on 1 minute chart)

VANTAGE 0620-0621

EASYMARKETS 0620-0621

PHILLIPNOVA 0620-0621

FXCM (FX) 0620-0621

CURRENCYCOM 0620-0621

CAPITALCOM 0620-0621

FXOPEN 1220-1221

PEPPERSTONE 1020-1021

SKILLING 1020-1021

EIGHTCAP 1320-1321

BLACKBULL 1320-1321

nifty gann & 100 levelsnifty gannlevels with 100 points defference

gann levels with manual entry of cuurent gann level

manual entry of diffeence between two gann levels

InstitutionalZone ( INTRA.)this is a very useful indicator to understand resistance and support levels in the charts