Accumulated Put/Call Ratio V2This is an updated version of the Accumulated P/C Ratio. Some changes include:

- Pinescript privacy changed from protected to open.

- Utilizes the "request.security_lower_tf" function for weekly and monthly charts.

- Now acquires and sums raw put volume (ticker: PVOL) and call volume (ticker: CVOL) separately, then divides the aggregate put to aggregate call to get the P/C ratio, as opposed to the original version which directly sums the put call ratio (ticker: PCC). Mathematically this calculation makes more sense, but the major drawback of this change seems to be that PVOL and CVOL don't have as much historical data as PCC.

The way to interpret the indicator is the same as the original version - higher values are bullish while lower values are bearish. A solid (0 transparency) bar means that the value is beyond 3 standard deviations within a particular period.

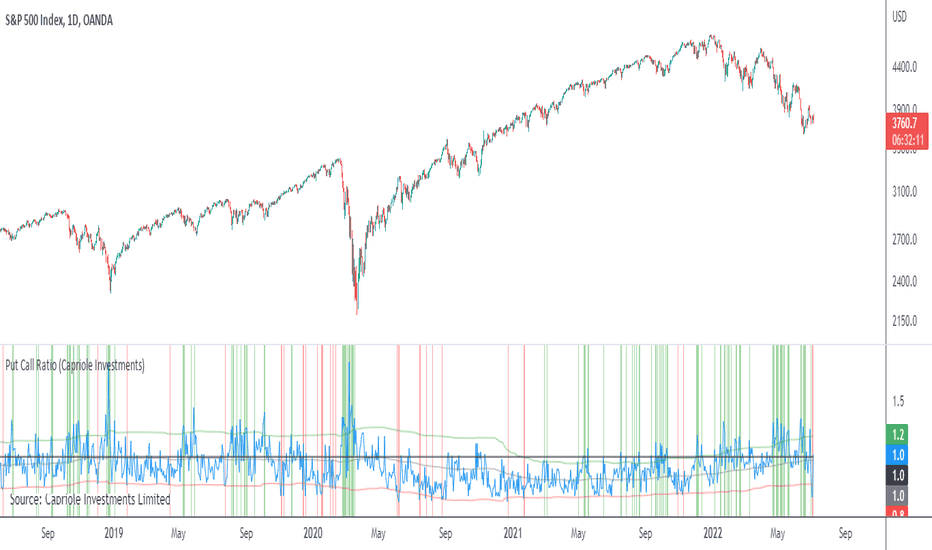

Put/Call Ratio (PCR)

Month Spread Ratio [Nic]Used for front month future contracts. Creates a ratio with the next monthly contract to detect rolling.

Put Call RatioPlots the CBOE Put Call Ratio and marks up locations of extremities.

Useful as a factor of confluence in identifying extremities in the market.

PIP BandsGot a little board due to the lock-down so I have written this little script.

It allows you to set PIP Bands at levels on the chart.

The Back Line is Close plus Spread, the Red Line is PIPs below and the Green Lines are spaced at PIPs above at equal distance.

The top four lines can be toggled off. Set off as default.

There is a toggle for JPY Currencies and also for Puts and Calls.

You can change the Spread and also the distance between bands by a set amount of PIP's.

You can either let it run at current close price or set price.

Hope you enjoy. Be safe.

Comments appreciated.

Call / All Ratio ( C / A ) - NoldoFirst of all this script inspired by MagicEins' Put/Call-Ratio-Buschi script .

What is the Put-Call Ratio

The put-call ratio is an indicator ratio that provides information about relative trading volumes of an underlying security's put options to its call options. The put-call ratio has long been viewed as an indicator of investor sentiment in the markets, where a large proportion of puts to calls indicates bearish sentiment, and vice versa. Technical traders use the put-call ratio as an indicator of performance and as a barometer of overall market sentiment. Put-call ratios on broader indexes such as the S&P 500 are also used as more general gauges of market climate.

Put-Call Ratio Interpretation

One way to interpret the put-call ratio is to say that a higher ratio means it's time to sell and a lower ratio means it's time to buy, because when the ratio is high it suggests that people are either expecting or protecting more readily against a future decline in the price of the underlying. A Put-Call ratio between 0.5 and 1 is considered a sideways trend in the markets.

Some also view the Put-Call ratio as a contrarian indicator. Traders know that derivatives are used to do more than place bets; they are used as hedges and insurance. If there's a lot of insurance being placed to the sell side, it means traders are worried about prices falling.

Some traders buy when the put-call ratio is above 1, meaning the market is out of balance to the sell side, and sell when the put-call ratio is below 1, meaning the market is out of balance to the buy side. These traders are looking to make money on the correction. The interpretation of the ratio is left to the analyst's or trader's investment philosophy.

Reference : Investopedia (www.investopedia.com)

Let' s start.

In short, calls represent "bulls" and puts represent "bears".

Some analysts do the opposite,for trend reversals the choice is up to you.

I usually look at the opposite comments in commercial positions because I look at this flow angle neutral.

If you want to do the opposite, you must create Put / All Ratio.

So i created this ratio to observe easily movements under or over 0.50 area .

Or you can take the point close to 0.50 as a horizontal trend. Many more comments can be made.I have a few ideas about this, and I'm going to publish them soon . My best suggestion is that it covers a single bar and is very volatile, so you can look for averages and strong accelerations.

This code is open source under the MIT license. If you have any improvements or corrections to suggest, please send me a pull request via the github repository github.com

Stay tuned , best regards.

CBOE PCR Factor Dependent Variable Odd Generator This script is the my Dependent Variable Odd Generator script :

with the Put / Call Ratio ( PCR ) appended, only for CBOE and the instruments connected to it.

For CBOE this script is more accurate and faster than Dependent Variable Odd Generator. And the stagnant market odds are better and more realistic.

Do not use for timeframe periods less than 1 day.

Because PCR data may give repaint error.

My advice is to use the 1-week bars to gain insight into your analysis.

This code is open source under the MIT license. If you have any improvements or corrections to suggest, please send me a pull request via the github repository github.com

I hope it will help your work.Best regards!

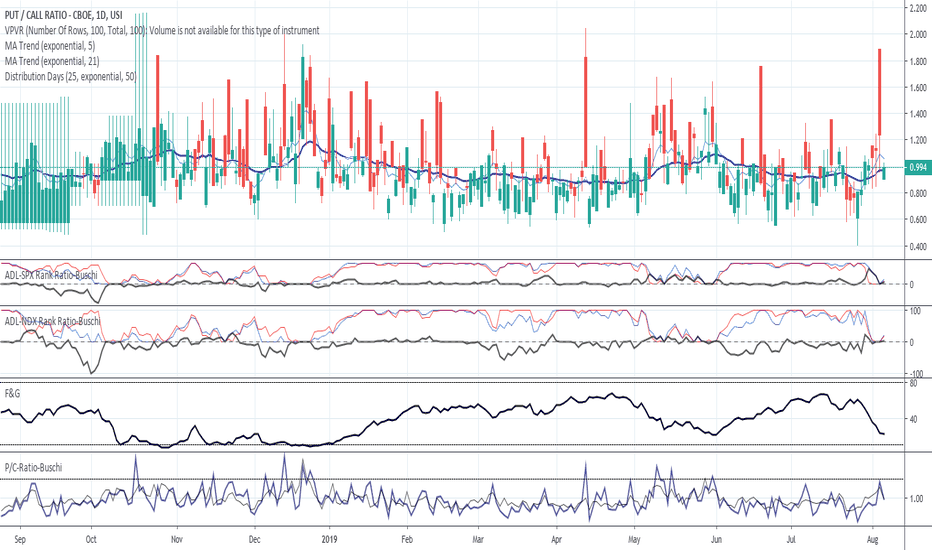

Put/Call-Ratio-Buschi

English:

This script shows the Put/Call-Ratio as seen on the Cboe-Website: www.cboe.com

A higher Put/Call-Ratio means a higher trading volume of puts compared to calls, which is a sign of a higher need for protection in the market.

For best reflection of the Cboe's data, which is shown in 30 minutes intervals, a 30 min-chart is recommended.

30 min-data as well as end-of-day data are shown.

Deutsch:

Dieses Skript zeigt das Put/Call Ratio, wie es auf der Cboe-Website angegeben ist: www.cboe.com

Ein höheres Put/Call Ratio bedeutet ein höheres Handelsvolumen von Puts gegenüber Calls, was ein Zeichen für Absicherungsbedarf im Markt darstellt.

Um die Cboe-Daten bestmöglich wiederzugeben, die in 30 Minuten-Intervallen herausgegeben werden, wird ein 30 min-Chart empfohlen.

Es werden sowohl die 30-Minuten-Daten als auch die Tagesenddaten angezeigt.

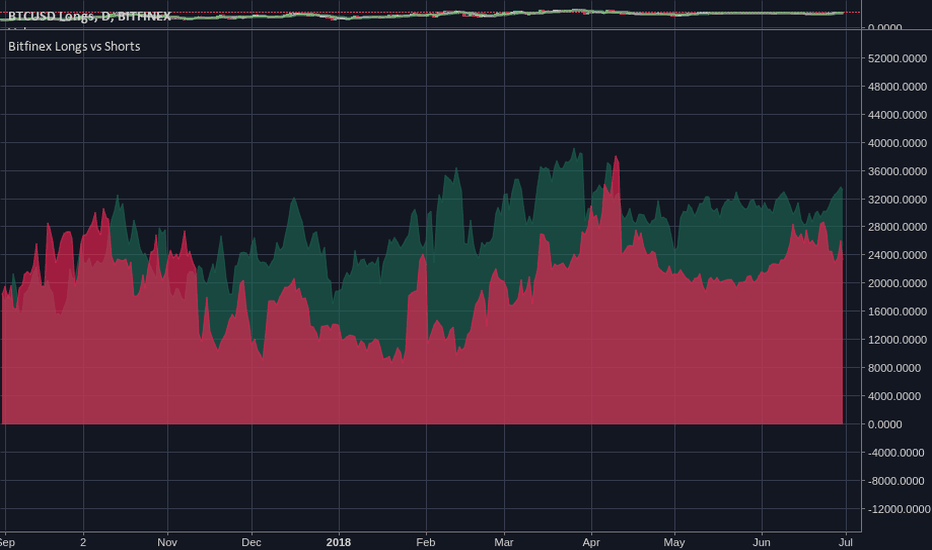

Bitfinex Longs vs Shortssexy view of the current long/short positions on Bitfinex. I saw some pay-for, hidden-source-code version of this and thought: "oh man."