Depth of market (DOM): what it is and how traders can use it

Depth of market is a tool used by traders to gain an understanding of market supply and demand trends. Below, we’ll tell you more about the tool, how it works, and how to integrate it into your trading strategy.

Contents

- What is depth of market?

- How the DOM works

- How to start using depth of market

- What are the key features you need to know?

- What data is used for the DOM?

- How to place an order

- How to change an order

- What do all these labels and colors mean?

- How to track and manage open positions

- How to cancel an order

What is depth of market?

Also known as DOM or the order book, depth of market is a tool that allows traders to see the number of buys and sells for an asset at different prices, giving a wider understanding of supply and demand. It’s often used as an indicator of market liquidity, with more orders indicating more liquidity. DOM is also commonly known as the order book as it acts as a digital book of orders for assets.

How the DOM works

Let's take a random asset that is currently priced at $1. The DOM will show how many orders there are for prices of $0.90, $1.10, and so on. In doing so, it shows the supply and demand for this asset, without having to switch tabs or manually track.

How to start using depth of market

To start using the DOM, you’ll need to connect your account to a broker that supports Tier 2 data. Next follow these steps.

- Click on the “Trade” button in the trading panel

- A new tool will appear at the right part of your screen. You can choose between two tabs — Order and DOM

- If you click on the DOM tab, you will see the depth of market for the asset selected on the chart

If there’s no data displayed, this could indicate that this symbol is not traded through the selected broker.

What are the key elements you need to know?

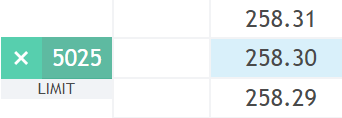

[1] — placed orders.

[2] Asks / [3] Bids — the volume of orders available on the market.

[4] — cells for placing orders. When clicked commonly, a limit order is placed in them; when clicked while holding ctrl, a stop order is placed.

[5] — buttons for canceling all limit or stop orders placed on the current instrument.

[6] — centering button.

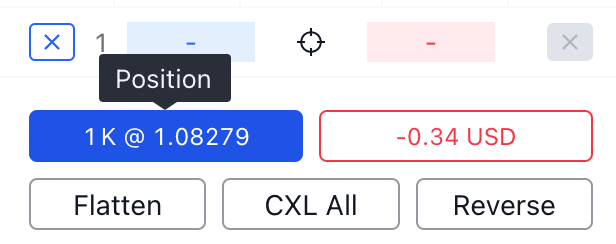

[7] — the size of all open positions.

[8] — profit/loss for all open positions. You can change the display setting by clicking on this element to money, pips, or percentage.

[9] — closing a position.

[10] — position reversal.

[11] — button for canceling all orders on the current instrument.

[12] — the Quantity field shows how many securities will be purchased or sold when placing an order.

What data is used for the DOM?

Data for the depth of market originates from the broker. However, data displayed in the DOM and on the chart may vary slightly as various data sources are used.

The DOM displays data in static mode. This means that the price series is fixed. Meanwhile the price moves between these values — above and below the designated range.

You can always apply centering at the current price to view this information. To do so, you need to click on the centering button [6].

How to place an order

Knowing how the DOM works is one thing, knowing how to place or change an order is another. Here’s how it works.

- To place a market order, click the Buy Mkt or Sell Mkt button. The number in the Quantity field indicates how many securities will be purchased or sold. You indicate this at the bottom of the DOM window [12].

- To place a limit order, click on the cell next to the desired price — in the left column to buy and in the right column to sell.

- To place a stop order, hold down the Ctrl key on Win or the Command key on Mac and click on the cell with the price you need — in the left column to buy and in the right column to sell

- Also, all these order types will be available to you after right-clicking (or the Ctrl key + right-click on Mac) on the cell next to the price you are interested in. After this, you will see a window with the options to choose — market, limit, or stop order.

If you don’t want to see a confirmation pop-up every time, you can disable this in the settings.

How to change an order

To change your order, you can do one of the following things.

- Click on the placed order in the order book [1]. A window will open where you can change the parameters you need. Done? Click “Modify order.”

- Drag your order to a different price level. The same dialogue box that opened previously will appear.

That’s it, now you know how to change your order.

What do all these labels and colors mean?

Green “Limit Buy” or “Limit Sell” orders are active.

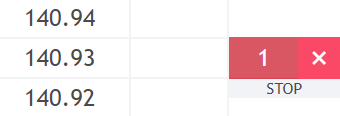

Red “Stop Buy” or “Stop Sell” orders are active.

Yellow “StopLimit Buy” or “StopLimit Sell” are active. In these orders, the limit level is duller than the stop level.

How to track and manage open positions

Tracking and managing order positions gives you better control over your trading strategies. It works like this.

If you have open positions on a selected asset (buy or sell), the total size of these positions will be shown as a number at the bottom of the DOM.

For long positions (buy), the field will be blue, and if you are in a short position (sell), it will be red.

Here’s what a long position (where you believe the price will rise) looks like.

Likewise, here is how a short position (where you believe the price will fall) appears.

To close or reverse a position, use the “Flatten” [9] or “Reverse” [10] buttons at the bottom of the DOM.

How to cancel an order

Canceling an order is a straightforward process. Depending on what you need to cancel, you can follow the steps below.

- Cancel a single order — click the cross next to its label.

- Cancel all purchase orders — click on the cross under the blue purchase column on the left.

- Cancel all sales orders — click on the cross under the red sales column on the right.

- Cancel all orders — click on the CXL ALL button at the bottom of the DOM window.