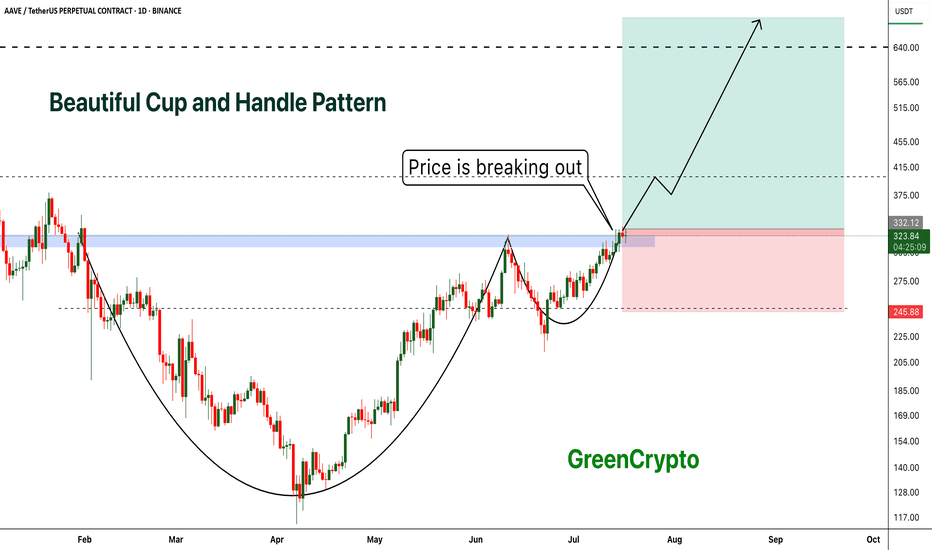

AAVE - Beautiful Cup and Handle Pattern Breakout- AAVE is breaking out from cup and handle pattern finally

- Cup and handle pattern breakout usually results in perfect trend continuation

- A huge long trade opportunity from this

Entry Price: 335 Above

Stop Loss: 245

TP1: 381.89

TP2: 429.16

TP3: 525.94

TP4: 628.78

TP5: 712.89

Max Leverage 5x:

Don't forget to keep stoploss

Cheers

GreenCrypto

AAVEUSDT trade ideas

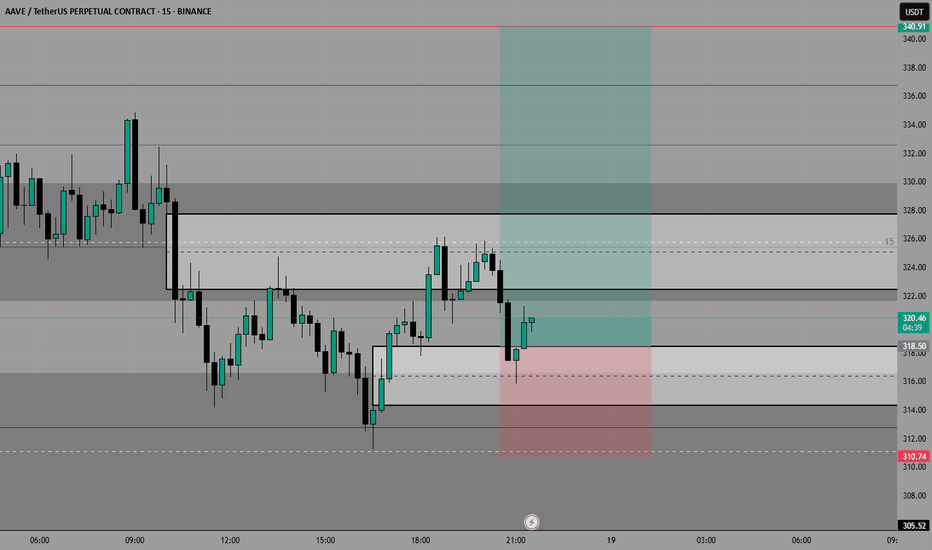

AAve Big long to $350Opened a long on aave a while ago. Setup aligns with my DTT process. Direction, target and timing.

Stop: $298.77 relatively as I anticipated little downside from here, the bulls just claimed the level a whie ago.

Let's see if they can keep it.

Tps on chart. The plan is to scale out along the way given all goes well.

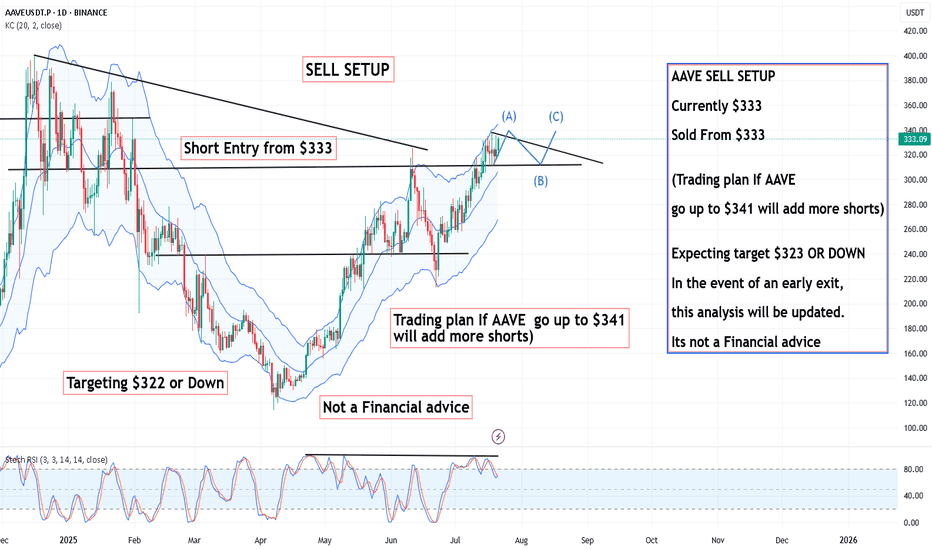

AAVE prepares for the back-test

After a sharp decline, AAVE formed a textbook spring, signaling that strong buying demand has returned to the market.

The recent bullish leg appears to have completed a 5-wave impulse structure (H4 timeframe), suggesting a high probability that a corrective phase may follow.

Currently, EURONEXT:AAVE is testing the resistance boundary of its ascending channel. I’m looking for signs of an upthrust here, with two primary scenarios in mind:

Scenario 1: If the recent surge to $300 is confirmed as an upthrust, we could see a mild correction back to the $279 area for a support back-test—possibly forming a secondary spring within the rising channel (lower probability).

Scenario 2: If price wicks above $300 but then reverses, I anticipate a back-test at $289, which could set the stage for a new rally to break ATHs (targeting $325) and potentially reach the $370 area.

RSI is approaching overbought territory, but there’s no clear sign of a reversal yet. It’s crucial to watch for divergence signals at this stage.

Key Points:

AAVE is in a strong bullish phase, but a short-term pullback to retest the $279–$289 support zone could offer the optimal entry for the next leg up.

Risk management first: Keep stops tight below $275 to protect capital.

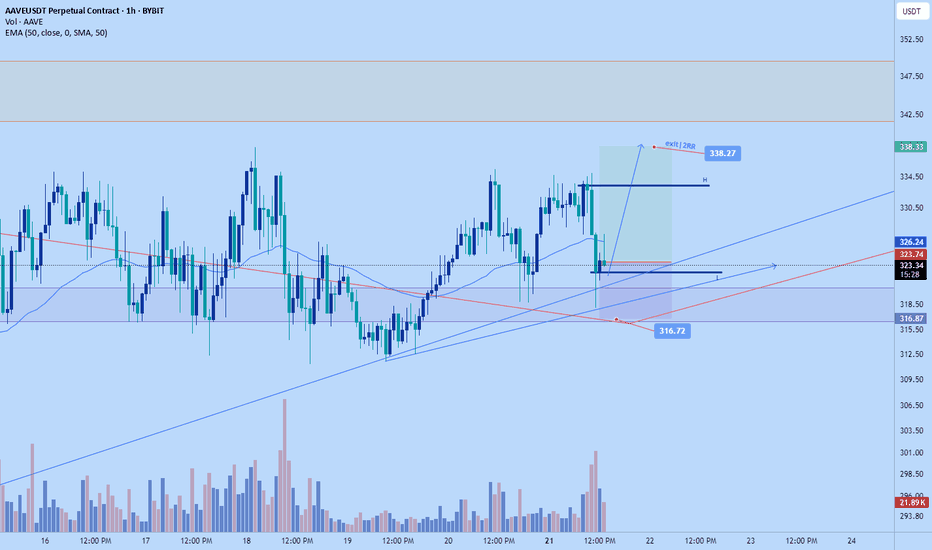

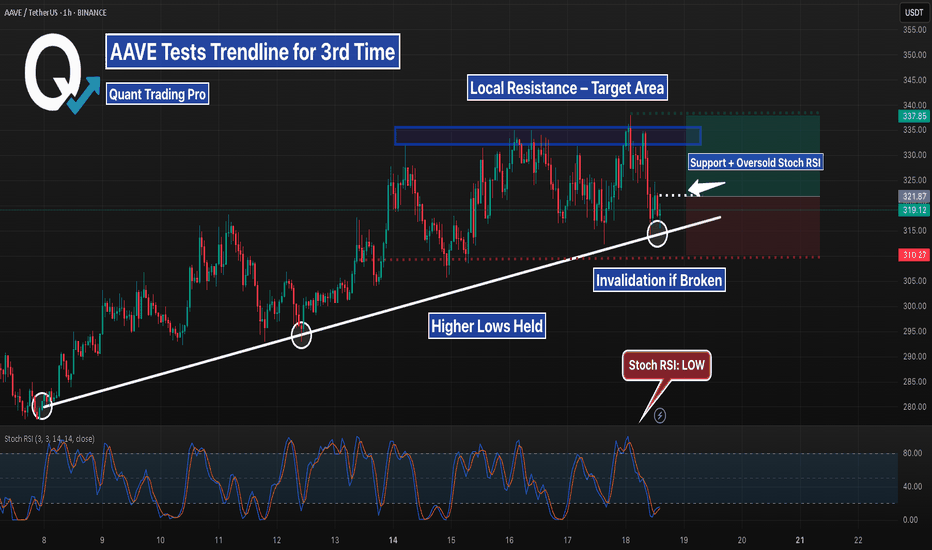

AAve scalp long to $338.27Just now opened a scalp long position on aave. I anticipate that the bulls will attempt to make new highs again soon, we're at at good level and structurally market is likely at a LL point on the hr tf, definitely not a good place to short if I was a bear

Sl: $316.72 good invalidation stop

Roughly 2RR trade.

AAVE Breakdown Could Trigger Major DropYello Paradisers — did you spot the bearish setup forming on AAVEUSDT? If not, you might already be a step behind, but there’s still a high-risk-reward opportunity on the table — if you approach it with discipline.

💎Currently, AAVEUSDT is looking increasingly bearish. The asset has confirmed a bearish Change of Character (CHoCH), broken down from a rising wedge pattern, and is showing clear bearish divergence on the chart. These combined signals suggest that the probability of further downside is increasing.

💎From here, there are two main scenarios we’re monitoring. First, AAVE could attempt a pullback to fill the Fair Value Gap (FVG) above, which would offer a clean short-entry zone with strong risk-reward potential. Alternatively, price could reject directly from the nearby Bearish Order Block (OB), offering another chance for well-structured entries. Both setups depend on confirmation and timing, so patience is key.

💎However, if AAVE breaks and closes decisively above the current resistance zone, the bearish thesis becomes invalid. In that case, the best move is to wait on the sidelines and allow new, higher-quality price action to form before re-engaging.

💎This market demands patience and discipline. You don’t need to catch every move — just the right ones. Stay sharp, stay focused, and let the market come to you.

Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

AAVE 2100$Aave

AAVE is the largest decentralized non-custodial liquidity market protocol on Ethereum Virtual Machine.

The currency has been moving in an upward trend since its launch.

This is in conjunction with ongoing development of the currency and a strong team.

The currency is considered non-inflationary.

Circulating Supply

AAVE 15.17M

(94.8% of Max Supply)

Monitor prices closely to benefit.

I wish everyone abundant profits.

Like and follow

for more.

AAVE Potential 1-2/1-2I´m keeping an eye on a quick pullback on AAVE for a potential 1-2/1-2.

The thesis is that black 2 finished in the 50% pullback and we´re currently finishing blue 1.

Blue 2´s pullback would be a great opportunity for long trades with a very tight stop loss.

The gray zone, with gave us a fake breakout for black 1, may be the temporary resistance for blue 1.

AAVE Daily – 0.618 Fib Reclaimed

AAVE on the daily has reclaimed the 0.618 Fib level after dropping below it and retesting the 200MA.

MLR > SMA > BB center — structure looks constructive.

If price holds this Fib level, there’s a good chance of targeting the 0.5 Fib around $350.

Always take profits and manage risk.

Interaction is welcome.

Aave (AAVE): We Might Get Good Bounce From Here | BullishSeeing a good chance for AAVE to have proper MSB and bounce very soon. We are looking for a local support area near $257, which would also mean that the price will fill the CME gap. From there, we will start looking for proper upward movement towards our target in the upper area.

We are also keeping an eye on the liquidity zone, as if we see the pricefall further, then our SL will be extended, but if we get proper MSB near support, then the SL remains the same!

Swallow Academy

AAVE - Short Plutus signal: Wyckoff- Up - ThrustReading the chart:

1. Fib 61.8 perfect location for sellers to enter

2. Fast up wave with 5.4 SI -Fake Break

3. Pull back with price having a hard time to move up with 38.1 SI (abnormal Speed Index) and then double signal short Wyckoff Up-thrust and PRS.

Enjoy!