Can #AAVE Bulls Sustain the Current Momentum? Key Levels Yello, Paradisers! #AAVE looks bullish on the surface—but is this setup quietly setting up for a brutal dump? Here's the key level that will trigger the next big move:

💎#AAVEUSD is currently trading around $143.66, holding inside a clear ascending channel on the 4H timeframe. The price action of #AAVE has been respecting both the ascending support and resistance trendlines, forming higher lows and higher highs—but momentum is fading.

💎A bearish divergence on the momentum oscillator is signaling early weakness despite the price climbing higher. This divergence usually marks the beginning of a bull trap, where the price appears strong just before a sharp reversal.

💎The immediate resistance to watch is in the $156. This is where price was recently rejected, near the upper channel trendline. Above that, $156 remains the key Bearish Setup Invalidation level. A breakout and hold above this would invalidate any bearish structure and could lead to a push toward $170+.

💎However, if AAVE breaks below the ascending support, currently near $140, it opens the door for a sharp drop. The first target is the $126.10 support zone, followed by the $114.35 level, which aligns with a strong historical demand area.

Play it safe, respect the structure, and let the market come to you. Discipline, patience, and strategy are what separate long-term winners from short-term gamblers

MyCryptoParadise

iFeel the success🌴

AAVEUST trade ideas

AAVE DAILY ANALYSISHi friends,

Today, we analyze AAVE in the Daily time frame.

As we had its analysis in the past weeks, the downtrend channel is still holding the price.

We have a good entry point for long positions at $156, which needs confirmation that it has broken the downtrend channel from the upper side.

Also, as mentioned in the past analysis, we have a strong accumulation area ranging from $118 to $150.

Also, the level of $118 is ideal for short positions, which in such cases, if the channel is broken from its Lower Side, we may have parabolic moves towards down.

For spot trading, we have the level of $195, which is a key turning level for gaining its bullish momentum.

As you can see, the volume has been going up in the last couple of weeks.

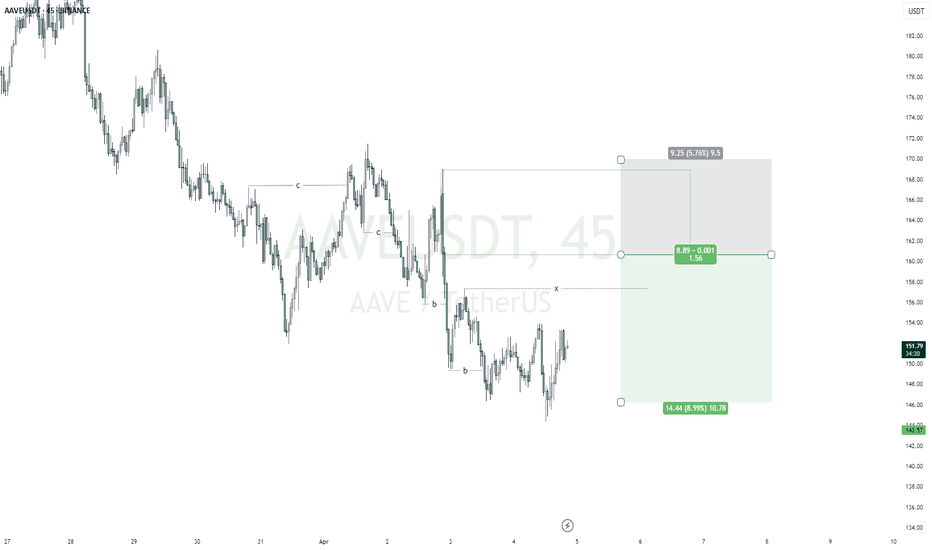

AAVEUSDTmy entry on this trade idea is taken from a point of interest above an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $160.68

Take Profit; $146.24

Stop Loss; $169.93

AAve shortWent short on #aave with wide stop.

Plan on scaling in and tightening stop when volatility decreases given trade goes according to plan.

Currently fed powell is speaking. So far he sounds very bearish and uncertain due to tariffs which is great for shorts and uncertaintly tend to drive panic

AAVE 1W SMA SETUPBINANCE:AAVEUSDT is testing a key long-term support zone — both technically and structurally.

The 200-week SMA aligns with the $120–140 range, offering a potential high-RR long setup:

🔹 Price is sitting on the 1W 200MA — historically a strong bounce zone.

🔹 Confluence with weekly demand: $120–140

🔹 Clean mean-reversion potential toward mid-range and beyond

⚖️ Risk/reward here is favorable for swing longs, as long as price holds above $120.

Watch for weekly confirmation and volume reaction — this could be the base for a mid-term reversal.

🖼 Chart: Weekly AAVE/USDT with SMA confluence + RR zones

Important section: 155.69-180.14

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

(AAVEUSDT 1M chart)

The important support and resistance section is 155.69.

If it falls without support at 155.69, it is likely to fall to around 81.44.

If it rises with support at 155.69, it is expected to rise to around 332.71.

The 155.69 point is the HA-High indicator point on the 1M chart.

-

(1W chart)

If it falls from 155.69,

1st: 115.70

2nd: 64.26-81.44

We need to check for support near the 1st and 2nd above.

If it rises from 155.69,

1st: Fibonacci ratio 0.236 (202.92)

2nd: 302.67

We need to check for support near the 1st and 2nd above.

This shows that the area around 155.69 is an important support and resistance area.

-

(1D chart)

Therefore, the area we should be interested in is checking for support near 155.69-180.14.

Since the OBV indicator is renewing the low line, the key is whether it can rise above 155.69 this time.

Therefore, if possible, when it is confirmed to be supported near 180.14, it is the time to buy.

An aggressive buy is when it rises above 155.69 and receives support.

If it fails to rise above 155.69, if possible, it is recommended to not buy and watch the situation.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

AAVEUSDTmy entry on this trade idea is taken from a point of interest below an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $154.07

Take Profit; $163.94

Stop Loss; $150.96

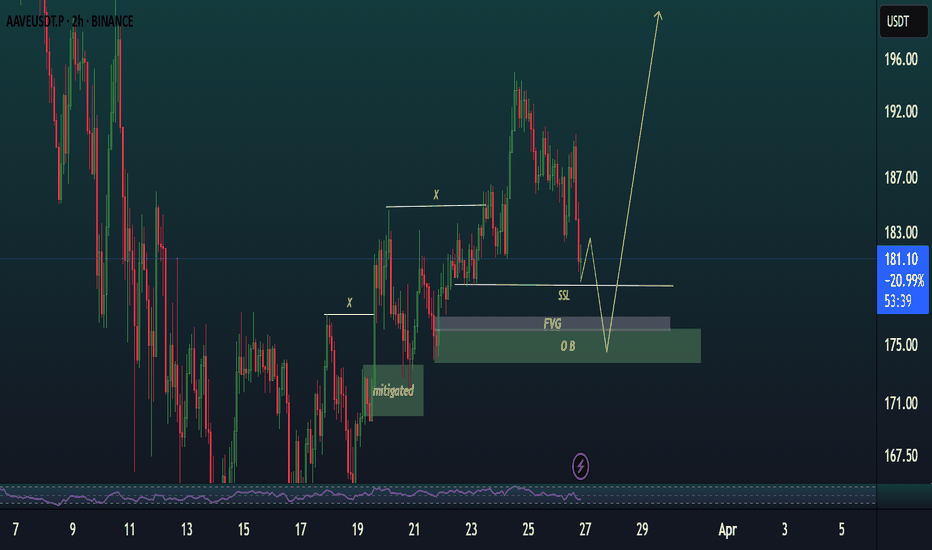

AAVEAAVE has an excellent buying zone between $169 and $172. It is expected to reach the target within the day, God willing, with strong upward momentum (wave iii) supported by the indicators' momentum, alignment of moving averages, and positive harmonic patterns. Our target range is $190.50 to $193.5. The stop-loss zone is at $161. Good luck to everyone!

AAVE Longterm pickNot going to dive too deep, but I genuinely believe DEFI is set to explode in the future! AAVE is definitely one of my favorites, along with UNI and a couple of others that are on my radar. Anyway,

Looking at the long-term Fibonacci targets, they suggest (850-1300-1750) will happen eventually. I’m not sure how long it will take, but I’m all about keeping my eyes on the prize!

What are your thoughts? Let’s get a discussion going! Don’t forget to like and share! 🚀💥

AAVE DAILY ANALYSISHi guys,

Today we are analyzing AAVE in the Daily time frame, as marked on the chart, we have an important daily support level at $156, also we have A 16% accumulation area for buyers.

Also, as marked on the chart, we have a downtrend channel and a key turning level at the price of $195, which is a perfect entry for long positions and spot purchasing.

keep your eyes on AAVE Hello Traders 🐺

In this idea, I want to talk about AAVE’s price, because in my opinion, there's already a very good buy opportunity in the market. Want to know why?

Stick with me until the end—I promise it’s worth it! 🔥

As you can see, AAVE is already inside a gigantic triangle pattern, which means it’s currently accumulating more and more liquidity for the upcoming Altcoin Season.

Now I know... everyone’s saying:

“There’s no Altcoin Season. We’re still in a bear market. Maybe for another 4 years!”

Come on! 😅

If you understand market psychology and know how the crypto market cycles work, you probably know that we go through 3 major phases.

Let me break it down for you—then I’ll talk about the AAVE price target.

Because if I start with the target now, and you don’t understand where we are in the cycle, you won’t be able to feel the actual conviction to buy or even trade it.

🔄 Phase One: BTC Dominance Rises, BTC Takes the Spotlight

In this phase, everything except BTC suffers. Why?

Because money flows out of other coins and into BTC. That’s why BTC.D goes up sharply.

🔁 Phase Two: BTC.D Corrects, Alts Take the Lead

ETH and Altcoins begin to outperform BTC, at least for 4–5 months in a row.

This is the phase we’re still waiting for… and it's inevitable.

After every downtrend, there’s an uptrend—that’s just how markets work.

Altcoins are heavily undervalued right now, and once BTC.D starts correcting (because it can’t go up forever)—we’ll witness a massive Altcoin Season.

🧠 Phase Three: The Final Pump Before the Bear Market

Everything becomes overbought, and smart money starts distributing before the actual bear market begins.

They sell overvalued assets to non-professional traders and investors.

Brutal? Yes. But real.

To take profit, someone else has to take the loss.

80% of people lose money—but you’re here because you want to be in the top 20%.

And thanks to all of you, we’re building a very strong community. 💪🐺

📉 Now Back to AAVE...

Currently, AAVE is trading inside a falling wedge pattern, which is a bullish setup.

We still haven’t had a lower low, so we can stay bullish and start accumulating AAVE at these levels.

Even if the price dips further, the maximum pain would be around 30%, which is nothing compared to the potential upside.

From here, the market can only go up, and you can hold your AAVE until BTC.D reaches at least 40%, which in my opinion is a good zone to take partial profit. 🎯

Thanks for reading my idea, I hope you enjoyed it—and as always:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

Aave Technical AnalyzeTrend: Aave is also following an ascending channel, with the price approaching the lower support.

Support: The green support zone at 150–175 is key. A breakdown could lead to further downside.

Resistance: The resistance at 465–490 is the next major barrier.

Volume: Volume is gradually decreasing, which could signal a pause before a breakout or breakdown.

Price Action: Watch for price testing the lower support. A bounce could target the upper resistance levels, but if it breaks below the green zone, further declines could occur.

AAVE - Amazing PERFECT Signal/TA YesterdayBOOM. 9 % 👌 🎯

Original TA from yesterday :https://www.tradingview.com/chart/AAVEUSDT.P/M3HGP1df-AAVE-Possible-Good-Short/

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

AAVE - Possible Good Short I had drawn my lines and marked the blue trend line and box with yellow mark. But i forgot AAVE. Now it has broken the lines like text book and testing it.

High possible Short right here :)

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️