ACH/USDT at a Historical Pivot Zone — Is a Major Reversal🔍 In-Depth Weekly Chart Analysis of ACH/USDT

ACH/USDT is currently retesting a critical historical demand zone between $0.01876 – $0.02263, which has consistently acted as a major accumulation area since late 2022. This zone has served as the launchpad for multiple bullish moves in the past and is now being tested once again.

Interestingly, price action appears to be forming a long-term consolidation base, potentially a triple bottom pattern or a classic accumulation phase, which often precedes significant impulsive rallies.

✅ Bullish Scenario (High-Probability Reversal)

If price successfully:

1. Holds above $0.01876, and

2. Breaks above minor resistances at $0.02263 and $0.02867

Then a bullish reversal is likely, with price targeting the following resistance levels:

🔸 $0.02867 — structural resistance

🔸 $0.03441 — neckline zone of the accumulation pattern

🔸 $0.04075 — key psychological level

🔸 $0.05059 — full measured move target from the base pattern

Should momentum and market sentiment align, ACH could even test the $0.065–$0.098 range, especially if volume supports a breakout continuation.

Key confirmation: A weekly close above $0.02867 with strong volume would signal a clear breakout from accumulation.

❌ Bearish Scenario (Breakdown from Critical Support)

On the flip side, if price fails to hold:

A weekly breakdown and close below $0.01876 will invalidate the bullish structure.

This could lead to a decline toward:

$0.01400 — minor support

$0.01000 – $0.00720 — historical bottom zone

This would likely reflect a capitulation phase, particularly if accompanied by negative macro sentiment across the broader crypto market.

📈 Technical Pattern Structure

📌 Triple Bottom + Long-Term Accumulation = Early Reversal Signal

📌 Multiple rejections off the support zone = Buyer defense still strong

📌 Increasing volume near lows = Signs of smart money accumulation

📌 Formation of higher lows in the coming weeks will reinforce bullish momentum

💬 Market Psychology Insight

After prolonged sideways action, many retail traders tend to exit

This creates ideal conditions for smart money to accumulate quietly

A breakout from this zone could trigger mass FOMO, accelerating price action

🧠 Conclusion

ACH/USDT currently offers a highly attractive risk-to-reward setup, especially for swing traders and medium-term investors. The zone being tested is a make-or-break level that could dictate the next major trend. A confirmed breakout could mark the beginning of a powerful expansion phase.

#ACHUSDT #CryptoAnalysis #AltcoinReversal #BullishSetup #TechnicalAnalysis #TripleBottom #BreakoutTrade #SwingTradeOpportunity #CryptoOpportunities

ACHUSDT trade ideas

#ACH/USDT#ACH

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.01800, acting as strong support from which the price can rebound.

Entry price: 0.01878

First target: 0.01925

Second target: 0.01970

Third target: 0.02025

ACH Update!Hello Traders, 👋

I hope you're all doing well!

Here’s a quick update on ACH on the weekly timeframe 🕒:

ACH is currently forming an ascending triangle, a bullish pattern that often leads to a breakout once price clears the resistance trendline. On higher timeframes, this setup tends to perform well — and if it plays out, we could see up to a 60% gain as it approaches the resistance level 📈.

🔹 Trading Strategy:

~ Entry: CMP or $0.021

~Type: Spot or 2–3x leverage

~ Holding Period: Until end of June 2025

📝 Note: Always do your own research and analysis before investing.

Best regards,

Dexter ✌️

ACH/USDT - Potential Bounce Incoming 30%+ Gains PossibleI'm analyzing the ACH/USDT 4-hour chart and spotting signs of a potential rebound. Here’s what I’m seeing:

✅ Support Zone: Price is testing a key support level around $0.02119, which has held strong in the past. The market appears to be accumulating in this area.

✅ EMA Crossovers: The chart shows a bearish crossover between the 12 EMA and 20 EMA, but watch for a bullish reversal as price approaches this support. Potential for a rebound if the EMAs cross back to the upside.

✅ Volume Delta Analysis: There's a notable increase in volume with a Delta Volume of 28.42%, indicating heightened interest at these levels.

✅ Reversal Probability: The chart shows an impressive 85.6% reversal probability, suggesting a strong chance of a bullish move soon.

✅ Targets: Looking for a potential 30%+ bounce towards key resistance levels at $0.02559, $0.02657, and $0.02845.

📉 Risk Management: Setting a stop loss slightly below the $0.02119 support level to minimize risk in case of further downside.

📈 If support holds and momentum shifts, a strong move upward could follow. Stay vigilant!

🚨 Not financial advice. Always do your own research.

Long Entry Signal for ACH/USDT - Bullish Setup (Daily Chart)

Symbol:

Timeframe: Daily

Analysis:

MLR > SMA: The MLR (blue) is above the SMA (pink), signaling a bullish trend.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), showing strong bullish momentum.

PSAR: PSAR dots (black) are below the price, reinforcing the uptrend.

Price > SMA 200: Price is above the 200-period SMA (red), indicating long-term bullish strength.

Trade Idea:

Entry: Consider a long position at the daily close.

Stop Loss: Place SL at the current PSAR level to limit downside risk.

Follow Me: Follow me for exit or profit-taking opportunities.

Outlook: All indicators align for a bullish move. Stay alert for reversal signals or trend shifts.

Risk Warning: Not financial advice, trade at your own risk

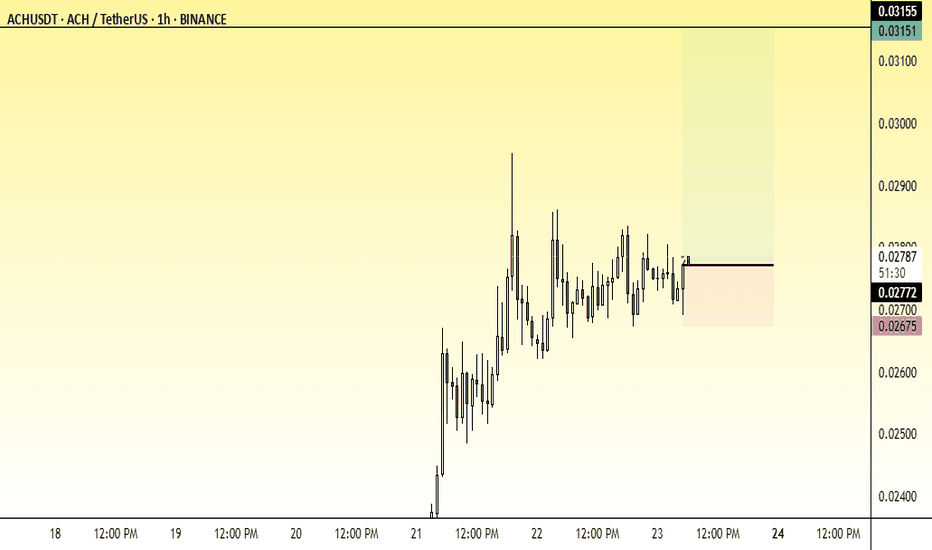

ACHUSDT (1H) - Technical Analysis & Trade Setup📌 Market Overview:

The price is currently at 0.02783, forming a range-bound consolidation after an initial bullish move.

A potential breakout setup is visible, with an entry at the current market price (CMP).

The risk-to-reward ratio suggests a bullish trade setup with defined stop-loss and take-profit levels.

📈 Trade Plan: Long Position (BUY Setup)

🎯 Entry: At Current Market Price (CMP) ~0.02783

🎯 Take Profit Targets:

First Target (Resistance Level): 0.03155

🔻 Stop-Loss:

Below 0.02675, as a drop below this level could trigger further downside.

🔴 Bearish Scenario (Trade Invalidation)

If price fails to hold above 0.02700, a breakdown could lead to further downside.

A drop below 0.02675 may invalidate the bullish setup.

Bearish opportunity in ACH1. We want price to at least head to the order blck meanthreshold

2. We have structure shift in H1

2. We have turtlesoup confirming liquidity grab

4. We are at H1 Orderblocks

ALTERNATIVE SCENARIO;

We have very clean buyside in 0.024228 and 0.024228 That pose a risk to downside orderflow

IS ACH A DEAL?When you look at the chart, this crypto is hit or miss. I used to enjoy the spikes, but as time has passed, I would like to see ACH mature in its growth. With all of ACH's recent news, you would expect the moves to start lasting longer, and in a way it has. I will call these growing pains, but with all that being said, ACH has broken through the .786 on the fib and is approaching its channel bottom. We could see a nice move up, given that March going into April is ordinarily decent for crypto. It seems we are all waiting for our Alt season to take off so we can take our profits. I'm bullish only because everyone is bearish with FUD. I look forward to the day when ACH surpasses its .20 and reaches a new ATH.

ACH on the Hourly is oversold, which is one of the big keys to trading this crypto. You need to look for your timing, and know when it spikes, to take profits. ACH will boom again really soon, so hang on!

Long Signal Entry for ACH/USDT

Based on the daily chart for ACHUSDT on Bybit, here's a concise analysis:

MLR vs. SMA: The MLR (blue) is above the SMA (pink), indicating a bullish trend.

MLR vs. BB Center: The MLR is above the BB Center Line (orange), suggesting bullish momentum.

PSAR: The PSAR dots (black) are under the price, confirming a bullish trend.

Price vs. SMA 200: The price is above the 200-period SMA (red), supporting a long-term bullish trend.

Current Strategy: Since all entry conditions for a long position are met (MLR above SMA, MLR above BB Center, PSAR under price, price above SMA 200), you might consider entering a long position. You can enter now or wait for the close of the day, depending on your availability. Waiting for the close of the day would be preferred to confirm the trend.

Stop Loss (SL): Set the stop loss at the current level of the PSAR dots to manage risk.

Monitor My Idea: Keep monitoring my idea for any changes in trend or potential profit-taking opportunities.

ACHUSDT UPDATEACHUSDT is a cryptocurrency trading at $0.03285. Its target price is $0.06500, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about ACHUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. ACHUSDT is poised for a potential breakout and substantial gains.