ACSUSD trade ideas

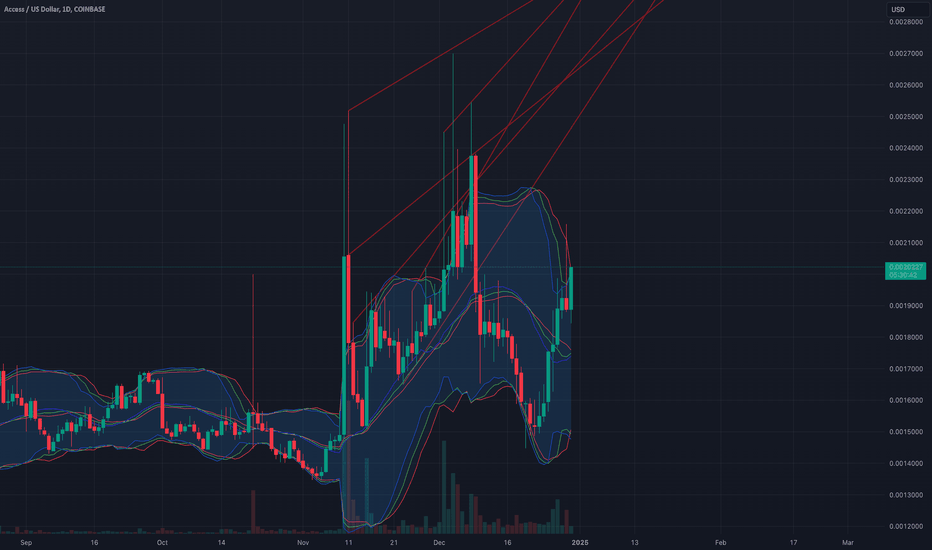

Access Protocol: Potential for 100-130% Gains?Technical (Chart) Factors:

- Attempting a Breakout: ACS is showing signs of breaking out from its extended downtrend, which could signal the start of a new upward movement.

-Stochastic RSI Crossover: A recent stochastic crossover from the oversold area adds support to this potential bullish reversal *settings of 15, 15, 4, 4 at a 3x time frame resolution* (Personal preference, works well for me)

-Buying Zone: A buying zone is marked on the chart, highlighting a possible support level where ACS may gain upward momentum if demand increases.

Macro Factors:

-Bullish Market Context: This trade idea remains favorable as long as BTC and the broader crypto market maintain a bullish outlook. A strong crypto market environment typically supports altcoins like ACS, helping drive liquidity and investor interest.

-Recovering Market Sentiment: Capital in the crypto market appears to be rotating from larger assets to altcoins, which may favor ACS as traders and investors search for high-potential projects.

-DeFi Liquidity Boost: Growing global interest in DeFi and alternative blockchain solutions is increasing liquidity in these protocols, benefiting tokens like ACS. ACS also offers a competitive staking reward of 30% per year, attracting users seeking passive income opportunities.

Fundamental Factors:

-Innovative Content Monetization Model: ACS provides a unique protocol for content creators and consumers, allowing creators to set up “paywalls” with ACS tokens. This structure encourages a more engaged and loyal user base, aligning incentives between creators and consumers.

-Token Utility and Staking Mechanism: ACS uses a staking model that requires users to stake tokens to access premium content. This staking mechanism adds utility to the token by creating ongoing demand from consumers, which can support price stability and upward pressure.

-Network Effect and Ecosystem Growth: ACS is onboarding more creators and media platforms, strengthening the network effect. As the platform grows, the value and utility of ACS increase, creating a feedback loop that supports ecosystem expansion.

-Rising Daily Active Users (DAUs): ACS has reported consistent growth in daily active users as more creators join and content consumption rises. DAU growth is a key indicator of platform success and user engagement, contributing to the platform’s long-term sustainability.

-Alignment with Web3 Principles: ACS aligns closely with Web3 values, including decentralization, creator empowerment, and minimizing reliance on intermediaries. This alignment positions ACS as a leader in the next wave of digital platforms, appealing to users interested in digital sovereignty and decentralized solutions.

***********

Disclaimer: This is a high-risk, high-reward trade idea with no guarantee of future performance. As with any crypto investment, only invest what you can afford to lose. The cryptocurrency market is highly volatile, and prices can fluctuate significantly in a short period of time.

This information is provided for educational and informational purposes only and should not be considered financial advice, an endorsement, or a recommendation to buy, sell, or hold any financial instruments or cryptocurrencies. Do Your Own Research!

Fakeouts and Breakouts to look out for right NOW in $ACSUSDLadies and gentlemen, probably the most important thing to look out for to confirm a bullish trend continuation is not just the breakout of the range, but surpassing the previous relative high, and then confirmation with a test of support located at that high.

Here on the one hour chart be immediately wary of any price action approaching the lower boundaries of the Bollinger bands, though that could lead to a very bullish bounce, just keep your eyes peeled in case it snowballs very quickly.

The arrows are common examples of how price might behave in Fakeout/Breakout/Breakdown scenarios... Be wary of price getting married to a support or resistance line and not moving when previously anticipated, pay close attention to which side of the line it is on and if the range is tightening or getting loose and messy. COINBASE:ACSUSD CRYPTO:ACSAUSD

$ACSUSD 56% Train departing nowLadies and gentlemen, the train is leaving station $0.00201 with our first stop at $0.00315, time en-route one to two weeks. Be ready to disembark as we approach the station, especially if we make great time of less than one week, because we may change tracks and head back to pick up any remaining passengers who missed the ride, but likely to fly through to destinations further down the line after that.

All aboard for 56%

ACSUSD 12/6/2024ACSUSD Daily Chart Analysis

Overview:

After topping out between March and April 2024, ACSUSD experienced a steep downtrend, respecting the 50-day and 200-day EMAs until late October 2024. However, a reversal began in early November with strong signals pointing to bullish momentum.

________________________________________

Key Observations:

1. Reversal Pattern:

o On November 4th and 5th, a Tweezer Bottom pattern formed, signaling a potential trend reversal.

o Confirmation came the following day, supported by a significant volume spike.

2. Breakout and Pullback:

o November 10th saw a massive +60% move, breaking through the 50-day EMA and briefly surpassing the 90-day EMA.

o Price has since retraced below the 90-day EMA but holds firm at the 50-day EMA, establishing it as support.

3. Bullish Structure:

o A trendline has emerged, guiding price upwards alongside support from the 10-day EMA.

o Volume remains elevated, and the MACD continues to trend higher in bullish territory, further validating upward momentum.

4. Current Setup:

o Price is sitting at a confluence of supports (trendline and 10-day EMA), presenting a strong risk-reward entry point.

________________________________________

Trade Plan:

• Entry: 0.0021550

• Stop Loss: 0.0017915 (-16.87%)

• Target #1: 0.0032318 (+49.98%, 2.96 RR ratio)

• Target #2: 0.0044041 (+104.99%, 6.32 RR ratio)

________________________________________

This setup aligns with a continuation of bullish momentum, supported by technical indicators and favorable market conditions.

Breakout from Symmetrical Triangle Pattern - ACSAUSD Trade SetupThis chart shows a symmetrical triangle breakout on the ACSAUSD 30-minute timeframe. The price has broken above the resistance line of the triangle, confirming a potential upward trend. Key levels include:

Entry Point: Near the breakout level marked by the yellow zone.

Stop Loss: Below the triangle at 0.0017974 to manage risk.

Take Profit: Target set at 0.0019953, aligning with the next resistance zone.

The trade setup has a favorable risk-to-reward ratio and is backed by trendline support and volume confirmation. Monitor closely for sustained momentum above the breakout level.

ACS/USD IF YOU HAVE ENOUGH PATIENCE LONG TERM SPECULATIONAfter the recent market activity its not impossible that we will have the following scenario on the long run. We have a lot of speculative activity on the market, picking up low market cap coins pushing them into unrealistic valuations. I also see a lot of thing happening with ACS, but do not consider this analysis as an investment advice. I will give a try on my own risk.

Classic Cup & Handle Breakout & Re-testVery simple - a classic cup and handle formation, already confirmed and re-testing a breakout:

- has already broken out of the handle forming a 2nd smaller cup

- and since broken above and held above the weekly cup's neckline

It has held above for several weeks and is now re-testing that neckline.

Targets are TP 1 and 2, measured from the length of the bottom of cup to its neckline, from its neckline up (TP 1) and then a half length above that (TP 2).

Conditions for hitting take profit targets are:

A.) holding the neckline or

B.) a weekly candle close with a pullback below that quickly reclaims it in the following week or so.

ACS- SECRET MOONBAGIf you are looking for a new moonbag in solana ecosystem,check out Access protocol..

Have some sort of partnership in creating and distributing the coingecko pass Nft.

I have a strong pre,omition that if CG decides to launch their platform token anytime in the future, ACS might have a big roll to play on it..

Its kind of token you buy and forget you did but wake up one day to see the sweel in your wallet.

Also content creators and artists friendly Nft platform

NFA..so DYOR!

FYI- If you EP in on FWB:WOO and still holding,good trade!!

Access Price Analysis (On Phone)As you can see I used the bar pattern tool, to basically make my chart look really cool.

Besides that, I usually just allow price to react off my levels and drink a cold smoothie along the way.

Warm, warm summer, how now’s a good time for some Seltzer Martinis on an Refrigerated beach.

Nice.

Chart n Dart baby.

Chart and Dart (Race Car Emoji * Smoke Emoji* City Night Skyline Emoji)

wave 3 protocol 600% extension gotta put some text in here for trading view's fascist gab police so i will keep typing till it lets me

post a simple impulse followed by a abc correction to be followed by another impulse buy low sell high

and ring the bell eat some tacos are these enough words or should i keep typing