Russell2000 rising wedge in downtrend?Key Support and Resistance Levels

Resistance Level 1: 1980

Resistance Level 2: 2039

Resistance Level 3: 2076

Support Level 1: 1850

Support Level 2: 1813

Support Level 3: 1785

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USARUS trade ideas

RUSSEL / IWM IDEAovernight bounce off 15m demand im sized im very lightly due to it being an over night trade (I have a high loosing percentage trading Asia Session.) Simple play if volatility can kick in towards London/NY session. No PT if this starts working, I will just let it run until 5m structure is broken.

Bearish Bat Pattern .Get ready, market watchers!

The Russell 2000 is flashing some exciting signals!

We're seeing a potential Bat Pattern formation at the 1910 level, which could indicate a future pullback.

Keep a close eye on this index, because if the pattern plays out as anticipated, we could be looking at a fantastic opportunity to capitalize on a potential downward move!

This is definitely something to keep on your radar and factor into your trading strategies – the Bat Pattern might just give us the edge we need to navigate the markets like pros!

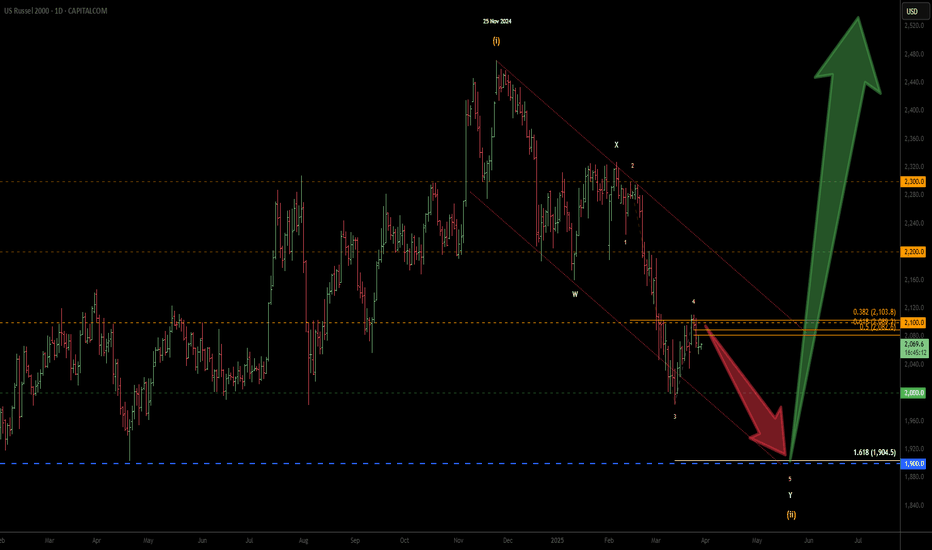

Russell 2000 - Sell till late May & Buy in Early June?

Wave (ii) is still in progress. Slight update to the primary wave count from the previous one below.

200 & 100 SMA's are sloping firmly to the downside therefore I will continue to keep selling at technical levels. Late May or early June would be a good time to go long...

Support levels are shown in green.

"US2000/RUSSEL" Index Market Money Heist Plan (Day / Scalping)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000/RUSSEL" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1900.0) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (1820.0) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1990.0

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸"US2000/RUSSEL" Index CFD Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👆👆👆

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score...... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Russell2000 INTRADAY bearish below 1940Key Support and Resistance Levels

Resistance Level 1: 1940

Resistance Level 2: 1965

Resistance Level 3: 2000

Support Level 1: 1783

Support Level 2: 1700

Support Level 3: 1640

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 - one more drop to complete the correction?Looking for the double zig zag correction to complete (Y) leg in the blue zone. Will be looking for five waves to the downside for the target.

Updated the wave count from my previous chart below...

This drop from the 25th November 2024 to the expected target zone would be more or less similar to the Covid drop in terms of percentage.

RUSSELL 2000 INTRADAY oversold bounce back Key Support and Resistance Levels

Resistance Level 1: 1889

Resistance Level 2: 1920

Resistance Level 3: 2000

Support Level 1: 1700

Support Level 2: 1640

Support Level 3: 1590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 - 5th wave of Y leg may already be in progress... The rejection at 2100 price level also happens to be the 38.2% Fib of the decline from the 14th of February 2025. The decline from 6th of February 2025 counts beautifully as waves 1, 2, 3 & 4. If this wave count is correct, then the Russell is currently in wave 1 of 5 of Y of (ii).

This is my primary wave count as long as the 2100 resistance is not breached.

This changes my initial wave count from a complex WXYXZ to a simple WXY.

Click on the link to see the previous wave count which is still valid and is now an alternate wave count if the 2100 resistance is breached:

Only updating the wave count. My bias and direction remain the same.

Wave Y is possibly in progress. Looks like we are going to have a bearish April & possibly May as well. Selling corrective rally is still the way to trade for now. Take profit at 1905/1900, which is where technically, the Russell 2000 will possibly turn up for wave (iii).

Stop Loss can be placed above wave 4, well out of the way in case of any wild swing on this PCE Friday.

Russell 2000 - time to Buy pullbacks...Shorts were good while it lasted... looks like a good time to buy pullbacks.

It would be wise to wait for a clear 3 wave correction though.

Elliot Wave Analysis shows a larger degree wave IV was completed in March 2020.

Since then, the Russell 2000 has been nesting within a bullish rectangle chart pattern, possibly working its way up to the larger degree wave V.

Seasonality Chart shows a bullish April with a possible correction in May.

Nevertheless, I will not commit to long trades till the chart clearly shows that we are out of the woods. A clear 3 waves move down closer to 1800 in the hourly/4 hourly time frame would be a good setup.

Russell 2000 INTRADAY oversold bounce back Key Support and Resistance Levels

Resistance Level 1: 1889

Resistance Level 2: 1920

Resistance Level 3: 2000

Support Level 1: 1700

Support Level 2: 1640

Support Level 3: 1590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

RTY (Russell 2000) – High-Quality Long Opportunity Forming!📍 Entry Zone: $1,630 – $1,730

⛔️ Stop-Loss: $1,629

🎯 Targets:

T1: $1,970

T2: $2,210

T3: $2,470+

🔁 Raise SL to Break-Even one price reaches: $1925

🧠 Reasoning (3-Step Confluence):

Weekly HTF Demand Zone: Originated a powerful bullish move, clearly causing a Break of Structure (BOS).

Key Flip Zone: Price retesting a crucial HTF level previously acting as resistance, now potentially strong support.

Volume Shelf: High-volume node at this zone confirms significant institutional activity, further validating this area as a high-probability entry.

Reminder: Wait patiently for clear lower timeframe (LTF) confirmation—No chasing trades!

US2000 / RUSSELL2000 Index Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US2000 / RUSSELL2000 Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1900) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (1780) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2030 (or) Escape Before the Target

💰💸💵US2000 / RUSSELL2000 Index Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Russell 2000: How deep can the Bear Market go?As the markets navigate uncertainty, the Russell 2000 appears to have entered a #bearmarket, contrasting with other indices that are still correcting. A pressing question looms: Has the market correction concluded, or are we on the brink of a broader bear market?

Last Friday's market turmoil saw panic-like sell-offs, deeply affecting major U.S. and European #stocks with losses ranging from 6% to over 10%. Such widespread sell-offs suggest a panic reaction, possibly indicating a market bottom. However, panic alone cannot confirm this hypothesis.

To evaluate the likelihood of a deeper bear market and potential buying opportunities, several factors need consideration.

Currently, the Russell 2000 is approximately 30% down from its previous all-time high. Technically, it rests in a horizontal support zone. However, the strength of this zone is debatable. Let’s explore why.

The initial moves by President Trump to impose reciprocal tariffs have already been felt, but the reactions of other nations remain unpredictable. Should other countries react strongly or if further tariffs and legal changes are introduced by President Trump, we could be heading toward a global trade war. Such a development could compromise the support zone, potentially driving the Russell 2000 down by 50%, reminiscent of the COVID-19 pandemic drop in 2020. A target range of 1250–1200 points could thus be realistic.

If the situation deteriorates further and we revisit pandemic lows, the Russell 2000 could plummet by nearly 60%, reaching as low as 950 points, mirroring the 2020 scenario.

I've recently suggested that this scenario may be the right time to cautiously start building small positions, considering additional declines could occur. A cautious and incremental market entry is a wise strategy during such uncertain periods.

We hope this focused analysis on the #Russell2000 provides valuable insights as you navigate these turbulent times.

US2000 Small Caps DANGER!Fully formed rising channel ready to collapse.

-Where do I begin with this chart? Wave 3 up ending.

-Multiple Double Top (Daily time frame and 4 hour.)

-Head and Shoulders

-Multiple CRACKS already in place.

-Consolidation at the bottom of the structure

All screaming DANGER to bulls!!

Russell Crab pattern Continues its descentThe continued decline in the Russell America index seems to be following the pattern of the Crab algorithm, potentially heading toward the golden level.

It's fascinating to see how these market movements align with such technical strategies,

isn't it?

Let’s keep an eye on this trend and see if it truly reaches that golden point!

Russell 2000 INTRADAY ahead of tariff announcement Donald Trump’s team is finalizing options for a reciprocal tariff plan, with proposals including a tiered system and a customized approach. Markets await clarity from the president’s 4 p.m. Rose Garden announcement, which could impact trade and financial markets.

Resistance Level 1: 2028

Resistance Level 2: 2045

Resistance Level 3: 2080

Support Level 1: 1980

Support Level 2: 1944

Support Level 3: 1900

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bitcoin (2024-2025) vs. Russell 2000 in (2017-2018)Bitcoin (2024–2025) is tracing a structure similar to the Russell 2000 (2017–2018). On the slide: BTC on top, RUT below - both showing near-identical consolidation patterns just before a major breakout.

Both periods were marked by macro stress:

• 2018 + 2025: Trump tariffs + rising global trade friction

Back in 2018, RYY rallied 22% into a blow-off top, tagging the 1.618 Fib. If BTC repeats the move, that projects a 70% rally - bringing us right to the $130K target we've been tracking.

Same structure. Same season. Similar stress. Different ticker.

Russell 2000 H4 | Pullback resistance at 50% Fibo retracementRussell 2000 (US2000) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 2,046.13 which is a pullback resistance that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 2,095.00 which is a level that sits above the 78.6% Fibonacci retracement and a swing-high resistance.

Take profit is at 1,984.80 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

"US2000 / RUSSELL 2000" Indices Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / RUSSELL 2000" Index CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (2120) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 2H timeframe (2060) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

✂Primary Target - 2180 (or) Escape Before the Target

✂Secondary Target - 2230 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US2000 / RUSSELL2000" Index CFD Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

RUSSELL 2000 INTRADAY reaction to US PCESlightly hawkish as Core PCE remains elevated—could delay Fed rate cuts.

US Equityes may face short-term selling pressure as yields react.

If risk appetite holds, dips could present buying opportunities in growth stocks.

Watch Treasury yields & Fed commentary for further market direction.

Key Support and Resistance Levels

Resistance Level 1: 2113

Resistance Level 2: 2131

Resistance Level 3: 2167

Support Level 1: 2060

Support Level 2: 2022

Support Level 3: 1987

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.