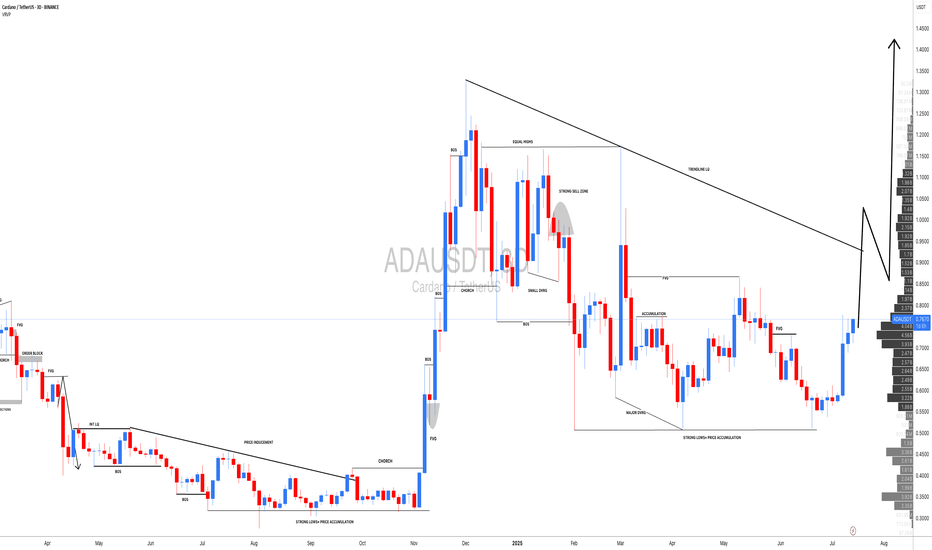

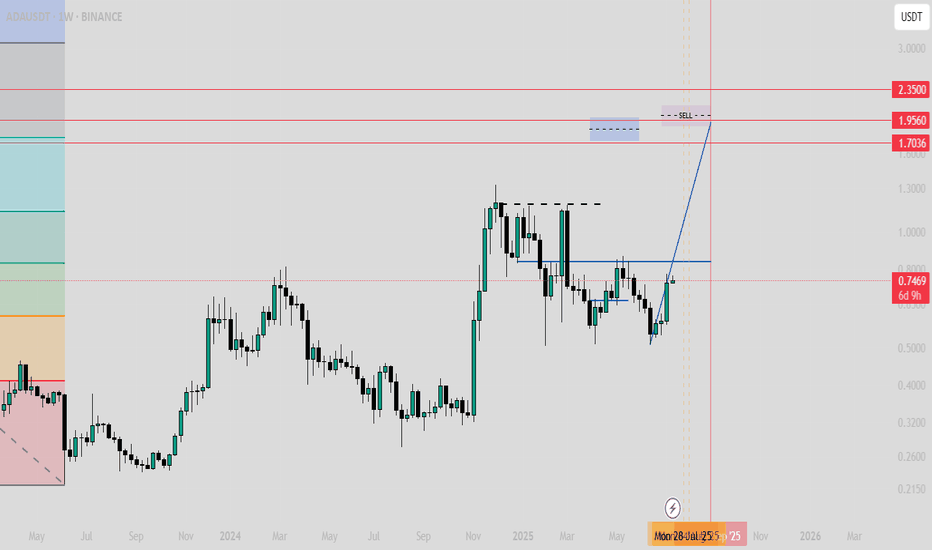

ADAUSDT: $1.50 Year End Target, Is It Possible? The price has remained steadily bullish, but we haven’t seen a strong bullish impulse in the daily timeframe yet. This suggests that we’ll likely reach the $1.50 price range. Please wait for the price to break out and then enter a trade when it shows confirmation. You can use smaller timeframes while taking any entry. Good luck and trade safely!

Like and comment for more!

Team Setupsfx_

ADAUST trade ideas

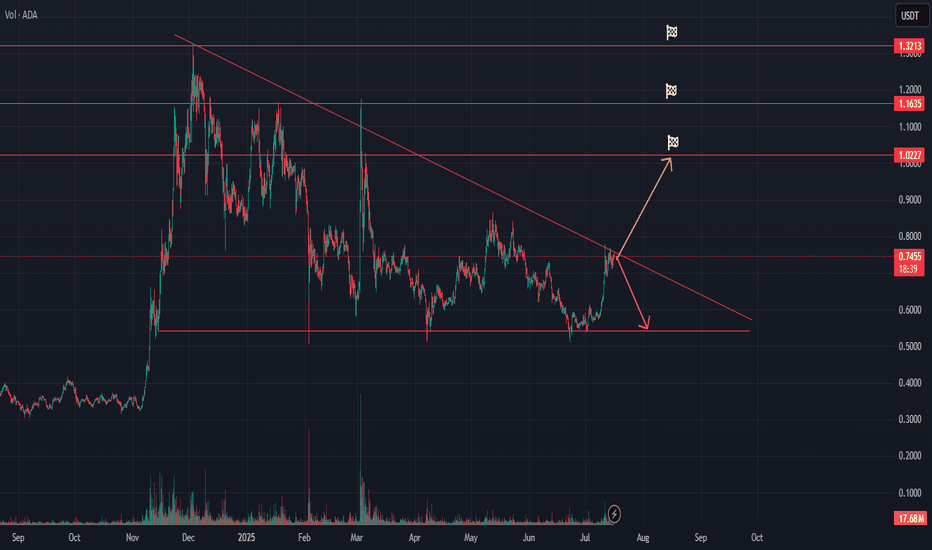

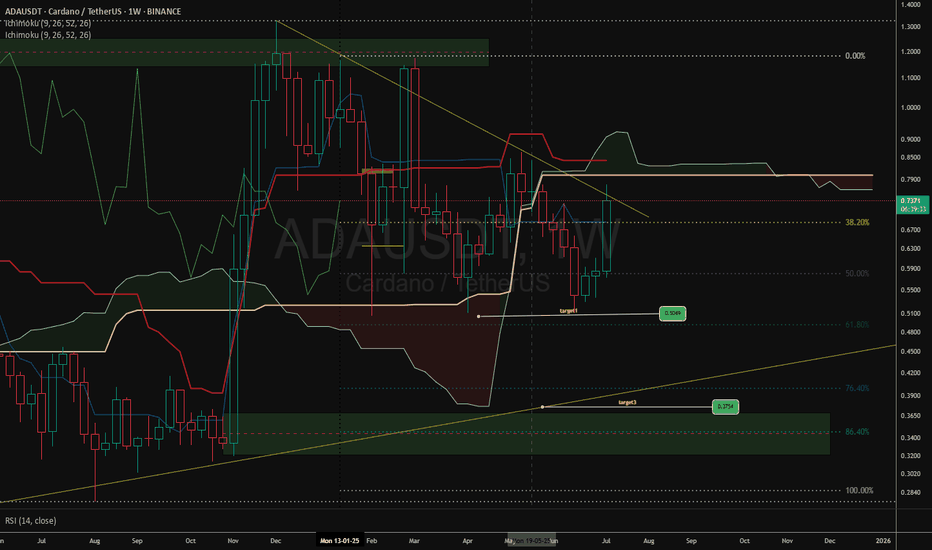

ADA/USDT Trading Ideahi traders

This technical analysis for Cardano (ADA/USDT) outlines a potential breakout or rejection scenario as the price tests a long-term descending trendline.

Key Technical Levels to watch:

Resistance:

$0.7467 (current test of descending trendline)

$1.0227 (primary breakout target)

$1.1635

$1.3213

Support:

~$0.60 (horizontal support zone)

Trendline: The chart features a long-term descending trendline from the February/March 2025 highs. ADA is currently approaching this resistance after a sustained rally from sub-$0.60 levels.

📈 Bullish Scenario:

If ADA breaks above the descending trendline with strong volume:

Expect a continuation move toward $1.0227, the nearest key resistance.

A successful breakout and hold above $1.0227 could open the path toward $1.1635 and eventually $1.3213.

This would signal a potential trend reversal and shift in momentum.

📉 Bearish Scenario:

If ADA gets rejected at the trendline:

Price may fall back toward the $0.60 support zone, where previous consolidation occurred.

This scenario suggests the trendline remains a strong barrier and that ADA may continue ranging or resume a downtrend.

*How to trade it:

Confirm breakout with volume and daily candle close.

Watch for fakeouts or failed breakouts due to market-wide sentiment shifts.

Trading plan for ADALast week, BINANCE:ADAUSDT showed strong upside momentum, breaking the daily timeframe downtrend line and currently holding above $0.7. We're now observing a hidden bullish RSI divergence, suggesting potential continuation toward our third monthly target at $0.82. However, a breakdown below the weekly pivot point could trigger a drop back to the trendline. Full analysis in the video

Trade safe and stay adaptive

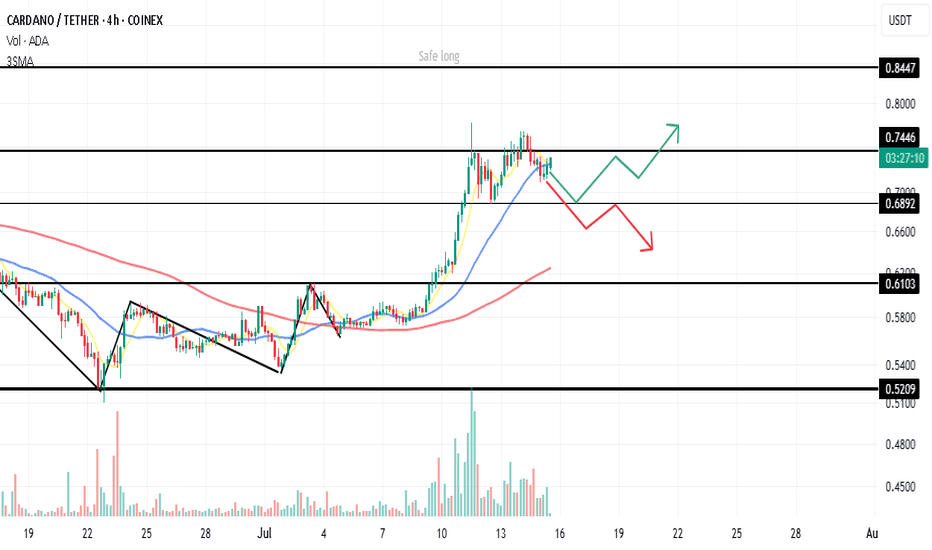

ADA / Bulish or Bearish

Hello everyone,

Here’s my analysis of ADA/USDT.

Cardano dropped back below the key level of 0.7446 after a failed breakout. Based on the current market conditions, we can consider three potential scenarios:

1️⃣ Range Scenario:

Price may consolidate between 0.7446 – 0.7041 for up to two weeks.

2️⃣ Bullish Scenario:

A new bullish move depends on a breakout of one of the following levels:

A. Riskier long position: Breakout above 0.7446

B. Safer long position: Breakout above 0.7600

🟡 Note: In scenario B, the stop-loss will naturally be wider.

3️⃣ Bearish Scenario:

A breakdown below 0.6892 could occur — but this does not immediately suggest a short setup.

❗️In that case, we must re-analyze TOTAL, TOTAL2, USDT.D, and BTC.

✅ If the overall market is bearish, a short could be valid.

🟡 Otherwise, it may simply be a deeper correction rather than a trend reversal.

---

🙏 Thanks for reading!

If you found this analysis helpful, hit the 🚀 icon to support the content.

#Cardano #ADAUSDT #CryptoAnalysis #TechnicalAnalysis #Altcoins #TradingStrategy #MarketOutlook #SwingTrade #CryptoTA #BitcoinDominance #TotalMarketCap #USDTdominance #PriceAction

HolderStat┆ADAUSD seeks to $0.774KUCOIN:ADAUSDT recently broke out of a multi-week triangle formation on the 4H chart. The clean break above 0.66 has invalidated the previous downtrend and triggered a new leg higher. With ADA currently riding within an ascending channel, the path toward 0.73–0.75 remains open as momentum continues building.

ADA - Beginning of something crazy- ADA is looking forward to the successfully breakout of the trendline resistance.

- A clean breakout from this resistance must to fuel the bullish trend.

- I'm expecting a target of 3$ from this trend.

Entry Price: 0.72

Stop Loss: 0.4838

TP1: 0.8602

TP2: 1.0342

TP3: 1.3379

TP4: 2.0144

TP5: 2.4818

TP6: 3.0329

Stay tuned for more updates

Cheers

GreenCrypto

DeGRAM | ADAUSD above the demand zone📊 Technical Analysis

● ADA is testing the confluence of the long-term support line and the 0.54-0.63 demand zone; every prior touch of this area sparked a 20-30 % rebound.

● A falling wedge within the broader descending channel is close to completion; a 16 h close above the wedge roof (~0.66) activates a measured move to the first horizontal resistance at 0.73 and the channel cap near 0.86.

💡 Fundamental Analysis

● The upcoming Chang hard-fork, which introduces on-chain governance and boosts staking utility, is scheduled for main-net in Q3 2025, lifting on-chain activity and TVL.

✨ Summary

Long 0.58-0.63; wedge breakout >0.66 targets 0.73 ➜ 0.86. Bull bias void on a 16 h close below 0.54.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

Can we break above the 0.8063-0.8836 range?

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ADAEUSDT 1D chart)

ADA is forming a long-term rising channel and is showing an upward trend as it breaks above the mid-term high downtrend line.

We need to see if it can rise above 0.8836 and maintain the price to rise above the previous mid-term low trend line.

-

The DOM(60) indicator is showing signs of being newly created.

Accordingly, we need to see where the DOM(60) indicator is formed.

Since the HA-High indicator is formed at 0.8063, in order to continue the upward trend, it must rise at least above 0.8063 to maintain the price.

Accordingly, the key is whether the price can be maintained above 0.6328.

-

It is possible to show a mid- to long-term upward trend only if it breaks through the HA-High ~ DOM(60) section of the 1W chart upward.

Therefore, the 0.8836-1.1936 section is likely to be the resistance section.

-

Based on the current price position, the support section is the 0.5824-0.6328 section.

However, since the positions of the HA-Low indicator and the DOM(-60) indicator are switched, if it shows a downward trend, there is a possibility that a new HA-Low indicator will be created.

If a new HA-Low indicator is created, it is important to determine whether there is support near it.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

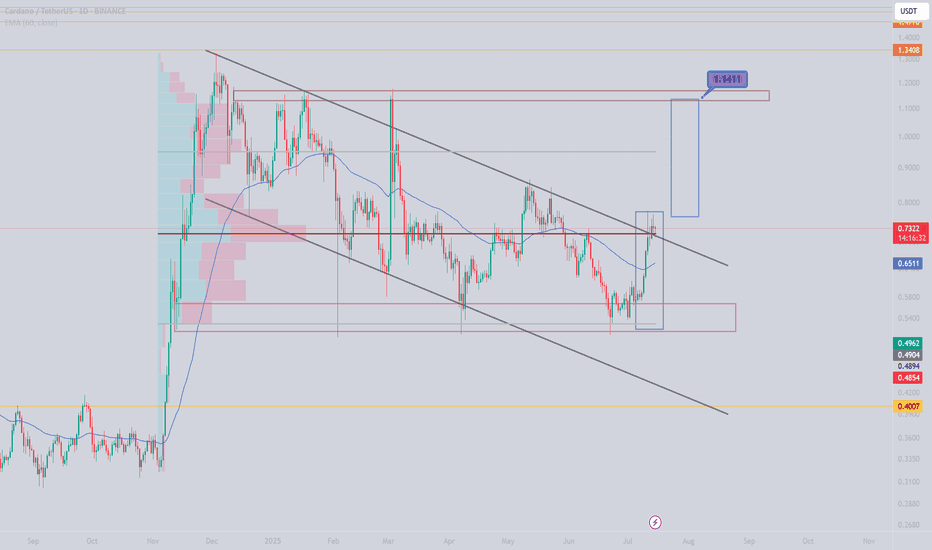

ADA/USDT – Bullish Breakout & Retest ConfirmedCardano (ADA) has broken out of a long-standing descending channel and successfully retested the breakout level, showing signs of strong continuation.

Key Observations:

Price broke above the upper trendline of the multi-month falling channel

Retest of breakout zone around 0.74 held firmly

Momentum building after reclaiming key resistance at 0.8158

Entry: Current zone around 0.74–0.75 (post-retest)

Targets:

0.8158

1.0876

1.3159

1.8958

Final target: 2.7652

Stop Loss: Below 0.70 (based on retest invalidation)

This setup has a macro upside potential of over 285% based on the channel breakout projection.

As long as ADA holds above the breakout zone, this structure remains valid and could lead to a sustained rally.

DYOR | Not Financial Advice

ADA/USD Thief Trading Plan – Bullish Snatch & Run!🚨 ADA/USD HEIST ALERT! 🚨 – Bullish Loot Grab Before the Escape! (Thief Trading Strategy)

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

🔥 THIEF TRADING STRIKES AGAIN! 🔥

💎 The Setup:

Based on our stealthy technical & fundamental heist tactics, ADA/USD is primed for a bullish loot grab! The plan? Long entry with an escape near key resistance. High-risk? Yes. Overbought? Maybe. But the heist must go on!

🎯 Key Levels:

📈 Entry (Vault Cracked!) → Swipe bullish positions on pullbacks (15m-30m precision).

🛑 Stop Loss (Escape Route) → Recent swing low (4H basis) at 0.5290 (adjust per risk!).

🏴☠️ Target (Profit Snatch!) → 0.6500 (or bail early if bears ambush!).

⚡ Scalpers’ Quick Heist:

Only scalp LONG!

Big wallets? Charge in! Small stacks? Ride the swing!

🔐 Lock profits with Trailing SL!

📢 Breaking News (Heist Intel!):

Fundamentals, COT, On-Chain, Sentiment— All hint at bullish momentum!.

🚨 ALERT! News volatility ahead—Avoid new trades during releases! Secure running positions with Trailing SL!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to fuel our next market robbery! 🚀💰

🎯 Profit taken? Treat yourself—you earned it!

🔜 Next heist incoming… Stay tuned, pirates! 🏴☠️💎

Will Cardano’s breakout drive a 15% surge to $0.80?Hello✌

let’s dive into a full analysis of the upcoming price potential for Cardano 📈.

BINANCE:ADAUSDT has broken out of its descending channel with strong volume, indicating a potential bullish reversal. Price is currently near a key support level, setting the stage for further upside. A move toward the $0.80 target, offering at least 15% gain, looks likely. 📊🔥

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

$ADA/USDT — Potential Long-Term BreakoutCardano is showing a major breakout from a long-standing descending channel on the daily timeframe.

Structure:

Downtrend channel respected for ~7 months

Breakout confirmed with a strong bullish daily candle

Price hovering around $0.7192, above previous resistance

Support Levels:

$0.60

$0.5299

Resistance / Long-Term Targets:

$0.8158

$1.0876

$1.3159

$1.8958

Ultimate target (Fib extension): $2.76+

Outlook:

The 285% potential move mirrors ADA’s past rally from similar conditions. If market sentiment continues improving and BTC holds above key levels, ADA might repeat history.

A pullback to $0.60–$0.66 could offer re-entry opportunities.

Bias: Bullish (long-term)

Caution: Not a trade setup—strictly an outlook. Watch BTC/ETH correlation.

DYOR | Not financial advice

ADA Daily Update · Moving Averages · 262% Target ExposedGood morning my fellow Cryptocurrency trader, I know you are having a wonderful day because the market is doing great. We looked at Cardano together on the weekly timeframe and this is a big picture but what about short-term? Where are prices headed next? The next target, resistance/support and the moving averages of course.

I've been looking at the moving averages lately and this is a theme that I will continue for a few days, or weeks, once we exhaust it we use other indicators. You know we also like the RSI and MACD, candlestick reading, volume, chart structure, chart patterns, market cycle, etc. Marketwide action, subtle signals, market sentiment, on and on.

Cardano is already trading above many major moving averages but this is a recent event. First consider the fact that in late 2024 ADAUSDT grew 320% right after breaking above the same EMAs that I am showing you now.

ADA closed just recently above EMA89, EMA233, EMA55, etc. Only MA200 is missing and this is an important one but will soon break. I am not showing it here because the action is still happening below.

There is a rounded bottom. This alone is a reversal signal already confirmed because the action is happening above the base of the pattern. In April we had a triangular bottom and here we can see an alternation. In February it was a straight line. A straight line, a triangle and then a circle; interesting.

The bullish bias is confirmed and we are seeing straight up, the next target is 0.8194. Cardano has been green four days straight. Go back to November 2024... The possibility exist for continued growth. Day after day after day. At some point there will be a stop, can be a retrace or correction. Know that when this stop happens it is not the end. There will be several stops along the way but we are set for a strong new all-time high. You will need to be patient while holding but just make sure to aim high. Don't get greedy of course. If at some point you start to feel anxious, read on the topic, go out into nature or simple sell a small portion until you feel better. The best choice is to be prepared and this can be done by studying the charts and the market. If you have a good plan and a nice map you will do fine. If you are an advanced trader, I am sorry, let's get back to the chart.

$1.01, $1.30, $1.15. These are all resistance. So there will be some challenge around this price zone. Once it is conquered though the advance should be swift until 1.83. Another stop and then 2.65 which is the main target for 262%. Depending on how this level is handled we will update the chart and the targets. For higher targets look at earlier analyses or those on the weekly timeframe.

Thank you for reading.

Namaste.

ADA broke the bull market support band and to the moonBINANCE:ADAUSDT

Typically this should be the first test after the broke out of bull market support band, I would expect it to be 5-10% around (at 4 h level) 20 EMA/SMA or Bollinger band MID. I will buy when 1 h RSI keeps nicely above 50 with a golden cross of stochastic RSI.