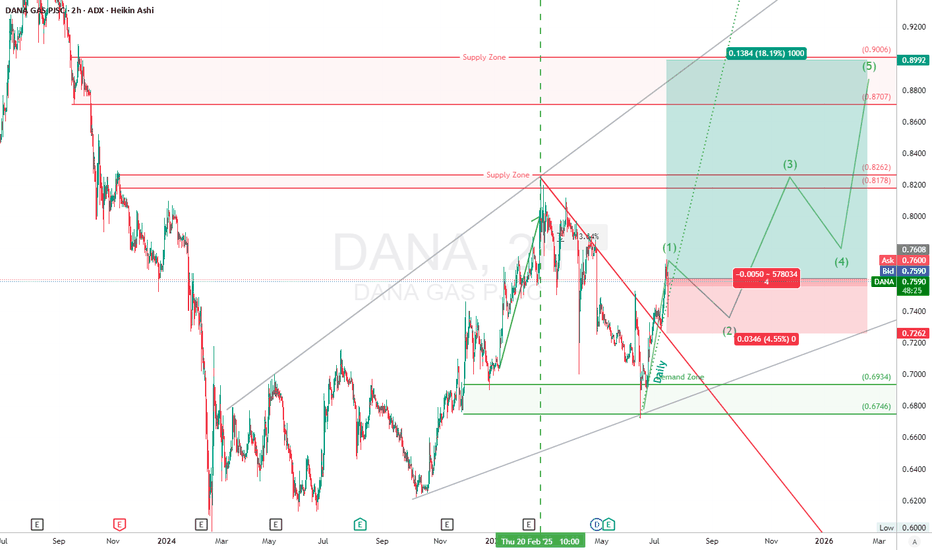

DANA GAS (DANA) ADX Long Setup“DANA just nuked that downtrend line and tagged the demand zone with precision. Now we got that impulsive (1) and the pullback’s setting up like a textbook long. Eyes on the reload zone, ‘cause bulls could lift this to 0.90 in a 3-wave rocket.”

📈 Trade Setup – 2H (Timeframe)

Wave & Structure

Wave (1) of a new bullish 5-wave sequence has just completed.

Current move is in Wave (2) pullback, likely aiming to retest the broken daily trendline or demand block (around 0.72–0.74).

Wave (3) projection targets:

TP1: 0.8178–0.8262

TP2: 0.8707–0.8992 (major supply zone)

Trendline Break:

The red downtrend line from previous high (Feb 2025) is broken with conviction.

Break + retest in play — classic confirmation pattern.

High Timeframe trendlines (gray) continues acting as macro support.

🎯 2H Trade Plan (Long)

📍 Entry Zone : 0.7600

📉 Stop Loss: 0.7246 (below last low)

🎯 Target 1: 0.8262

🎯 Target 2: 0.8707

🎯 Final Target: 0.8992

⚖️ Risk/Reward:

To TP1: ~2.5R

To TP2: ~4.2R

To TP3: ~5.0R+

⚠️ Disclaimer

This setup is for educational purposes only. Not financial advice. Always trade with proper risk management and a verified strategy.

DANA trade ideas

DANA GAS_ Next Target is Wedge Pattern Top, Achieve +99% PROFIT DANA GAS PJSC is forming a Wedge Pattern. The Next Target is the Wedge Pattern Top, Offering a chance to Achieve a +99% PROFIT. A Breakout is expected in the market once this wedge pattern is reached. This is Long-Term Analysis, must follow the Trend Continuation Technique. Guess the 2nd Target ?????

Support me; I want to Help People Make PROFIT all over the "World".

Will seasonal performance save DANA from a disappointing QuarterADX:DANA

DANA Gas has its Q1 earnings results scheduled for May 14th. Looking back on how DANA has performed, we see that it has missed 9 of its last 9 quarterly earnings. This is clearly not a good trend. Furthermore we see that analyst estimates for the upcoming quarter are only 2% less than what they expected for the same quarter last year (See fundamentals on image below for full view).

In reality the YoY results expected by analysts should have been lowered even further to account for the poor performance trend that DANA has been on. Worst, the estimates for next quarter are 45% higher than the estimates for last quarter. So Analysts are expecting a 45% increase in earnings QoQ. That's a lot of pressure on DANA.

Typically, going back since inception, Q1 earnings for DANA have been higher than Q4 61% of the time (see business cycle indicator in above figure). But still, a 45% QoQ estimate will be hard for DANA to beat or even meet, especially since it has missed for more than 2 years!

This is not necessarily all bad news though. In the black & white chart above, I show a support level below (black arrow at 62 fils) which represents great support for DANA. The gray arrow above it at 66 fils would be the minor support.

The ideal scenario for me would be for DANA to miss and then get punished with a price dip. Here I would buy DANA on the dip. One strategy is to buy at gray arrow then average down at black arrow for a two-tier entry or just buy all at the black arrow (62 fils).

The reason I expect DANA to get punished (if they miss their earnings) is because this is typically DANA's most successful quarter. So if they miss it's bad for the year!

Also because they are already fairly valued @ 70 fils according to the DCF intrinsic value model for 5 years out (see chart image above). There are better deals in the ADX.

As for the reason I expect DANA to perform well after the dip, it's due to the seasonal performance of its stock. (see seasonal performance line superimposed on black & white chart).

Here you can see that DANA is actually due for a price move upwards since February and even further up into July, but hasn't gone up much so far and instead has been consolidating sideways for 4 months.

My theory here is: once the upcoming quarter is out of the way and DANA does disappoint, the stock will sink lower then start to trend upwards to track its usual seasonal stock performance. The reason this would happen is due to promises that management make after a disappointing quarter. Remember this is usually their most successful quarter. So management has to do something to save the year.

So I'll be buying DANA at 66 fils & 62 fils and will be selling it at the resistance levels marked by the arrows (78 fils & 83 fils).

This is what I am doing with my money. You do you.

Dana GasWith the same analysis as ADNOC Gas

I think Dana Gas has also ended its decline

Firstly-

The target of the Failure Swing pattern has been reached.

secondly-

The stock has reached a very strong support area of 80 and is trading around it without a clear break except imaginary wicks that quickly push the price above the support.

Third-

The intersection of the MACD averages has completed positive and the histogram has shifted to the positive area, declaring not only the increase in buying forces, but also their dominance over selling forces.

Fourthly-

The RSI broke the downtrend line.

Dana the king of repetitions As you can see on the long daily chart, usually after golden cross Dana would retreat back under the long term line as a false breakthrough, if you are long time investor ride the rocket and wait at least 2 years to get the peak, but worthy.

The high return dividend plus the expansion in their fields are all positive signs