AIXBT / USDT : Getting support and moving towards resistance AIXBT/USDT is currently forming a symmetrical triangle pattern and testing a key support zone. A short-term rally of around 10% towards the upper resistance is expected, leading to a potential breakout.

Bullish Scenario:

A solid breakout above the upper trendline could initiate a major rally, targeting levels around $0.18 and higher.

Watch for confirmation of the breakout for a sustained move.

Targets for the short-term rally:

Expect a move towards $0.18 before the breakout happens. A major rally will commence once the breakout occurs. 🚀

Stay patient and keep an eye on the price action for potential entry points! 📈

AIXBTUSDT trade ideas

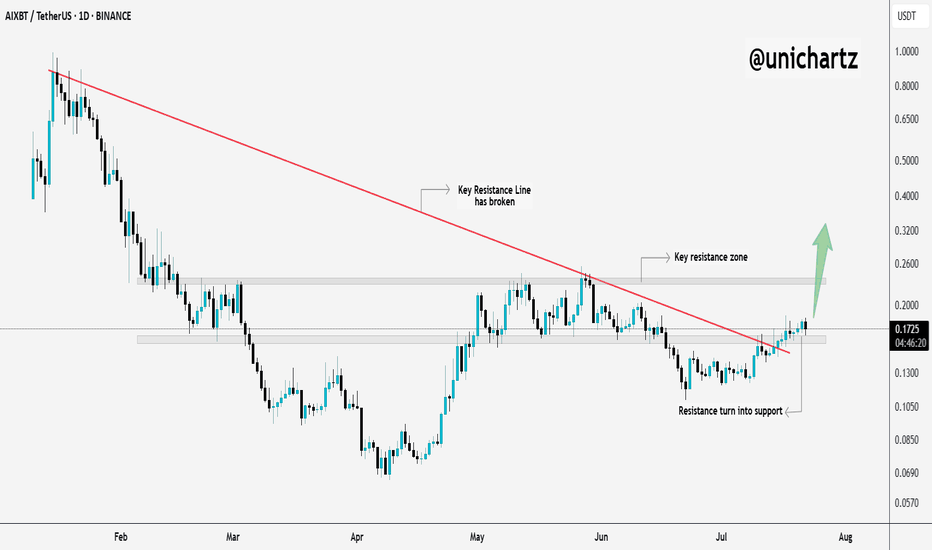

$AIXBT Breaks Trendline – Sharp Move Ahead?$AIXBT just broke out of its downtrend and flipped resistance into support, classic breakout behavior.

It’s now pushing toward a key resistance zone, and if it clears that level, we could see a sharp move up.

Momentum is shifting, this chart deserves your attention.

DYOR, NFA

AIXBT – Ready to Break Out?

This is AIXBT on the daily chart.

Price is now testing a confluence of resistance: the 50MA and the 0.5 Fib level — both aligned in the same zone.

Both systems are in long mode:

* PSAR is bullish

* MLR > SMA > BB Center

The RSI just broke out of a month-long bullish divergence, signalling fresh momentum.

Why AIXBT could outperform after the GENIUS / CLARITY / Anti-CBDC acts:

1. AI x BTC is the hottest meta — and AIXBT is riding both waves.

2. Not a CBDC, not a stablecoin — less regulatory friction.

3. Low cap + trending narrative = upside volatility.

Conclusion:

If the systems are long, I listen. AIXBT is aligned both technically and fundamentally.

I’m long: not financial advice.

Always take profits and manage risk.

Interaction is welcome.

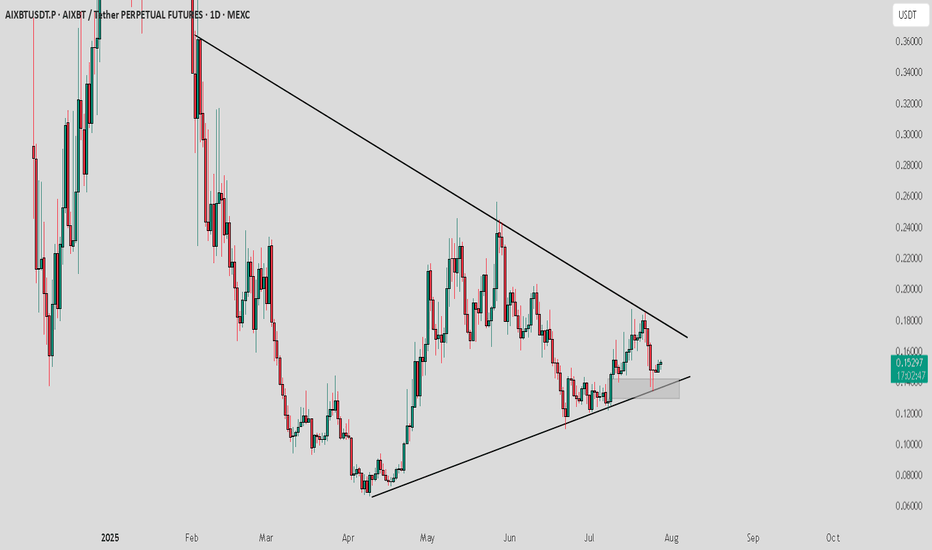

AIXBT/USDT – Symmetrical Triangle Squeeze! A Major Move is Brewi🔍 Market Structure Overview

AIXBT/USDT is currently forming a well-defined Symmetrical Triangle pattern on the 1D timeframe, signaling a tightening consolidation between lower highs and higher lows.

Price is consolidating just above a strong demand zone between $0.1200–$0.1350, suggesting accumulation by smart money. This triangle formation represents a classic volatility squeeze, where price coils before a significant breakout or breakdown.

These setups are often the calm before the storm—and they typically lead to explosive moves once price escapes the pattern.

✅ Bullish Scenario (Breakout Upwards)

If price breaks above the descending trendline and clears the $0.1664 horizontal resistance level, it could ignite a powerful bullish run toward the following targets:

1. 🎯 Target 1: $0.2255 – Previous swing high & structural resistance.

2. 🎯 Target 2: $0.3942 – Strong horizontal resistance from historical price action.

3. 🎯 Target 3: $0.5982 – Mid-term Fibonacci/volume confluence level.

4. 🚀 Ultimate Target: $0.8763 – Psychological level and former macro resistance.

> Breakout Confirmation: Look for a daily candle close above the triangle with a surge in volume for confirmation.

❌ Bearish Scenario (Breakdown)

If bulls fail to break out and the price breaks down below the triangle and loses the $0.1200–$0.1349 support zone, the following downside targets come into play:

1. ⚠️ Support 1: $0.0950 – Previous local low.

2. ⚠️ Support 2: $0.0750 – A historical accumulation zone.

3. ⚠️ Support 3: $0.0590 – Major demand floor and last line of defense.

This would invalidate the current bullish structure and signal a potential mid-term trend reversal.

📐 Pattern Highlight: Symmetrical Triangle

Nature: Neutral continuation/reversal pattern, depending on breakout direction.

Volume Behavior: Typically contracts as price nears the apex, then expands post-breakout.

Strategy: Smart entries usually occur on breakout + retest with volume confirmation.

🧠 Final Thoughts

AIXBT/USDT is reaching a critical inflection point. The symmetrical triangle formation is nearing its apex, suggesting that a large move is imminent. Whether the breakout will be bullish or bearish depends on how price behaves at the key boundaries outlined.

📢 Pro Tip: Watch for breakout direction, volume spikes, and possible retests to position accordingly. Don’t forget to set stop-losses in either scenario to manage risk effectively.

#AIXBT #CryptoBreakout #SymmetricalTriangle #TechnicalAnalysis #AltcoinSetup #ChartPatterns #VolumeAnalysis #SupportAndResistance #CryptoTrading #CryptoTA

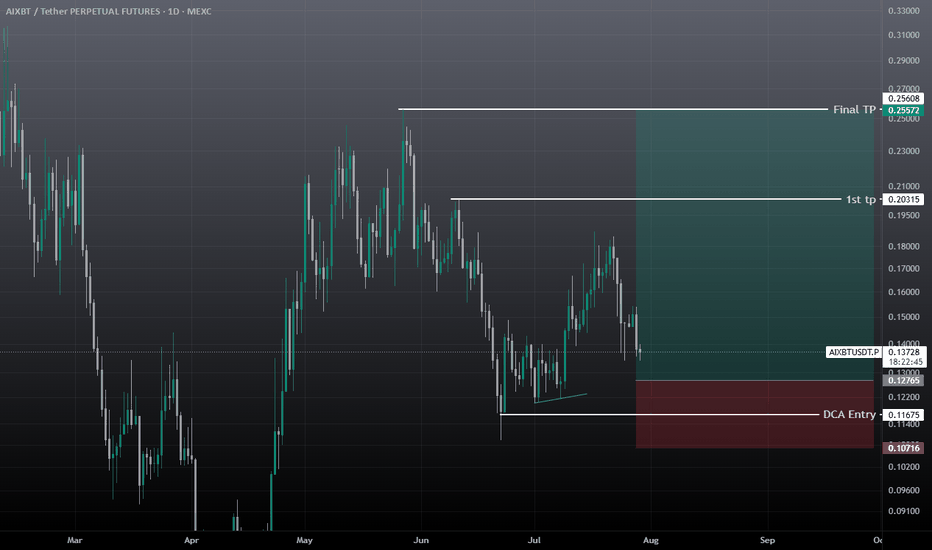

AIXBT/USDT next LegAfter forming a local top at $0.25, AIXBT/USDT retraced 55% and is now stabilizing in the $0.12–$0.14 range. This zone aligns with previous resistance, which is now acting as strong support, indicating potential accumulation. If the current structure holds, price action is setting up for a move toward a new local high at $0.30.

Entry Zone: $0.13 – $0.117 (green box)

Target: $0.30

Stop Loss: Below $0.105 (to protect against breakdown)

AIXBT USDT ready to face the highs The overall sentiment appears bearish, with the price respecting the downward trendline and facing resistance from the rejection zone. A break above the rejection zone and trendline would be necessary to signal a potential reversal. Conversely, a breakdown below the order block could lead to further declines.

$AXIBT Breakout Confirmed – 2x Potential Ahead?$AXIBT just broke above a key accumulation zone after days of consolidation.🚀

Strong volume, bullish Ichimoku support, and a clean breakout above resistance suggest this could be the start of a major move.

If this rally continues, we could see a sharp push toward the $0.50+ zone, nearly 2x from here.

Reclaiming and holding above the $0.22–$0.24 zone is crucial for confirmation.

Eyes on this one.

$AIXBT macro analysis [ ai coin having huge potential ] Hi it's me ur Raj_crypt0

Here is my view on BINANCE:AIXBTUSDT an #ai sector coin .DYOR / NFA

This is low cap high risky coin u may lose 100% before investment check ur self

Entry - $0.25 below

targets ....

¹$0.55

²$1.5

³$3.5

Note - $0.1 below stop buying ( I will update where to avg or wt to do )

If , u are risky taker $1.5 ( get ur liquid there + 1x profit )

AIXBT Forming Cup Pattern – Breakout Potential Ahead

$AIXBT is shaping a bullish cup pattern and is now approaching key resistance. A breakout and hold above this level could trigger strong upside continuation.

📍 Breakout Zone: ~$0.24–$0.25

📈 Bullish Targets:

🎯 Target 1: $0.3123

🎯 Target 2: $0.3553

Watch for volume confirmation and daily close above resistance to confirm momentum.

AIXBT should take a coffee break...AIXBT has done super well with the move up. An exchange of hands should be expected, and perhaps a test of lower levels to pick up bullish bits. The divergence in the momentum suggests fresh longs could be risky without a proper structure.

Full TA: Links in the BIO

Alikze »» AIXBT | Formation of the valley pattern - 4H🔍 Technical analysis: Formation of the valley pattern - 4H

📣 BINANCE:AIXBTUSDT currency is moving in an ascending channel on the 4-hour time frame, which is currently in the supply zone and the middle of the ascending channel.

🟢From a classical perspective, a valley has formed that can break the current supply zone in the green box area by removing liquidity under the previous leg and grow to the next supply zone.

💎 Second scenario: The current supply zone break, depending on the number and frequency of hits to the supply level, can break it and continue its growth to the next supply zone, which is also the ceiling of the ascending channel, and then encounter a correction that, after a pullback to the previous supply zone, continues its path to the next target.

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

Thanks for your continued support.🙏

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

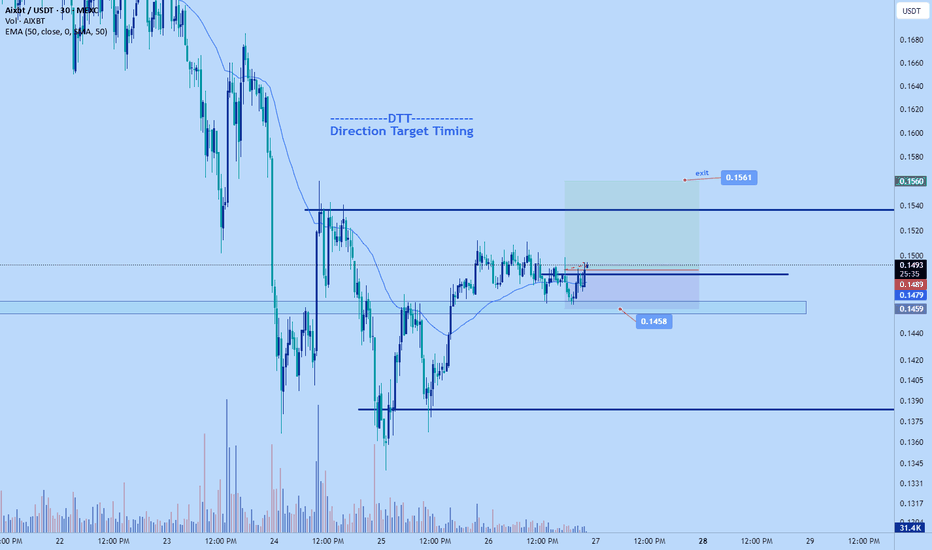

AIXBT/USDT 1H: Markup Phase – Long Setup Above $0.1540AIXBT/USDT 1H: Markup Phase – Long Setup Above $0.1540

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $0.1553, showing strong bullish structure after breaking above Fair Value Gap (FVG).

Hidden bullish divergence spotted on RSI, reinforcing bullish continuation potential.

Market Makers completed accumulation phase between $0.0750 – $0.0800, entering markup

phase.

Trade Setup (Long Bias):

Entry: $0.1540 – $0.1555 zone.

Targets:

T1: $0.1650

T2: $0.1700

Stop Loss: $0.1480 (below recent swing low).

Risk Score:

7/10 – Strong breakout supports the setup, though minor pullbacks into FVG retest remain possible.

Key Observations:

Strong support around $0.1300 (equilibrium zone).

Volume profile confirms breakout strength and new bullish order flow.

Break of structure aligns with Smart Money Concepts for continued upward movement.

Price action suggests potential for rapid expansion during markup phase.

Recommendation:

Long positions favored within entry range with tight risk management.

Consider securing partial profits at $0.1650 and trailing stop for potential extension towards $0.1700.

Monitor price action on any pullback into the FVG zone for additional entries.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!