Project Ailey's Competitive Edge in the Metaverse

In the crowded metaverse space, Project Ailey distinguishes itself through several competitive advantages. The AI-powered virtual human, Ailey, offers a level of interactivity and personalization that traditional metaverse projects struggle to match. This technological edge creates a unique user experience that can drive adoption and engagement. The project's focus on cross-industry collaborations, particularly in fashion and entertainment, positions it at the intersection of multiple high-growth sectors. Furthermore, the tokenomics and staking mechanisms are designed to align the interests of all stakeholders, from developers to users and investors. This holistic approach strengthens the project's moat against competitors and supports the long-term value appreciation of ALE tokens.

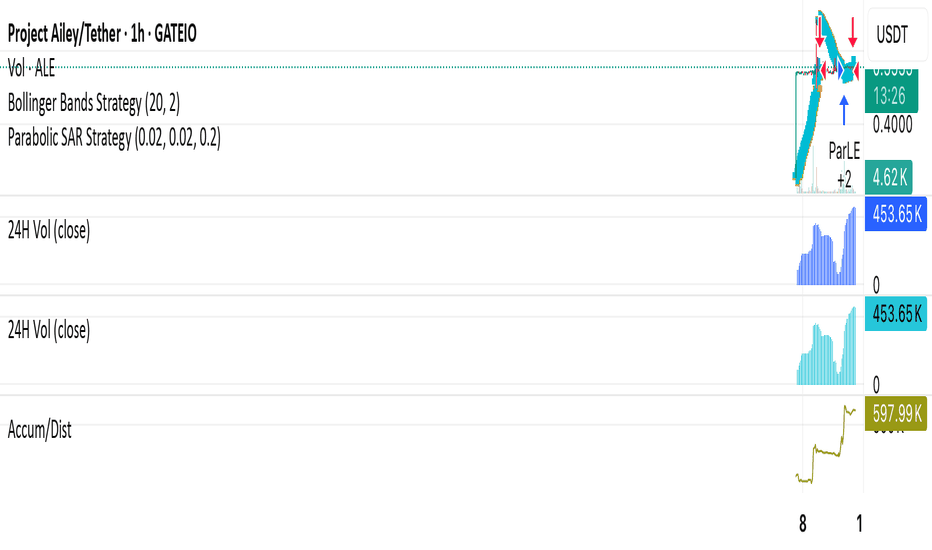

ALEUSDT trade ideas

ALE's Performance in Different Market Cycles

Analyzing ALE's performance across various market cycles provides valuable insights for traders. During bull markets, the token has shown impressive gains, often outperforming the market average due to its metaverse and AI narratives, which are highly sought after in such environments. In bear markets, while the token experiences declines like most crypto assets, its utility and community support have helped it maintain relatively higher resilience. The correlation analysis with broader market indices and other metaverse tokens reveals patterns that can be exploited using pairs trading or market-neutral strategies. Understanding how ALE behaves in different cycles allows traders to adjust their strategies, allocating more during accumulation phases in bear markets and capitalizing on momentum during bull runs.

Project Ailey's NFT Integration and Its Impact on ALE

The NFT Mystery Doors are not just collectibles; they are integral to the Aileyverse's economy. Each NFT purchased with ALE tokens unlocks unique experiences and utilities, creating a direct link between the token's value and the NFT ecosystem. The scarcity and exclusivity of these NFTs drive demand, as users compete to acquire limited-edition items and access premium content. This integration establishes a flywheel effect where increased NFT sales and engagement lead to higher demand for ALE, which in turn supports the token's price and stability. The project's ability to continuously introduce innovative NFT collections and expand the utilities tied to them will be crucial in sustaining this positive feedback loop and ensuring long-term value for token holders.

Technical Analysis: ALE's Key Support and Resistance Levels

On the weekly K-line chart, ALE has established key support and resistance levels that traders should monitor. The primary support level is at $0.05, which has held firm during previous pullbacks. A break below this level could indicate a shift in market sentiment and potentially lead to further downside. Conversely, the resistance level at $0.10 has acted as a psychological barrier. A sustained close above this level, accompanied by increased volume, could signal a bullish breakout and attract more buyers into the market. The accumulation of buy orders near the resistance level suggests that market participants are anticipating a potential upward move. Traders using technical analysis should also consider the volume profile and order book dynamics to confirm the validity of these levels and make informed trading decisions.

ALE's Long-Term Price Projection

From a long-term perspective, ALE's price trajectory is influenced by several key factors. The project's expansion into virtual fashion, entertainment, and metaverse applications creates multiple revenue streams that could drive demand for the token. As the metaverse concept matures and gains mainstream adoption, projects like Ailey are well-positioned to capture a significant share of this emerging market. The token's utility in cross-chain transactions and its integration with various DeFi protocols further enhance its value proposition. Historical price data shows that during bull markets, metaverse-related tokens tend to outperform the broader crypto market. While short-term volatility is inevitable, the fundamental drivers suggest a positive long-term outlook for ALE, provided the project continues to execute on its roadmap and deliver on its promises.

Staking ALE: Yield OpportunitiesStaking ALE tokens offers an attractive yield for holders, with annual percentage yields (APYs) ranging from 5% to 15% depending on the staking platform and duration. This passive income stream incentivizes holders to lock their tokens, reducing circulating supply and potentially supporting the price. However, staking comes with its own set of risks. The illiquidity risk means that staked tokens are locked for a specific period, during which market fluctuations could erode the value of the principal. Additionally, the project's performance and the overall crypto market conditions can impact the sustainability of these yields. Traders should evaluate their risk tolerance and investment horizon before committing to staking, considering factors like the project's fundamentals, market trends, and alternative investment opportunities.

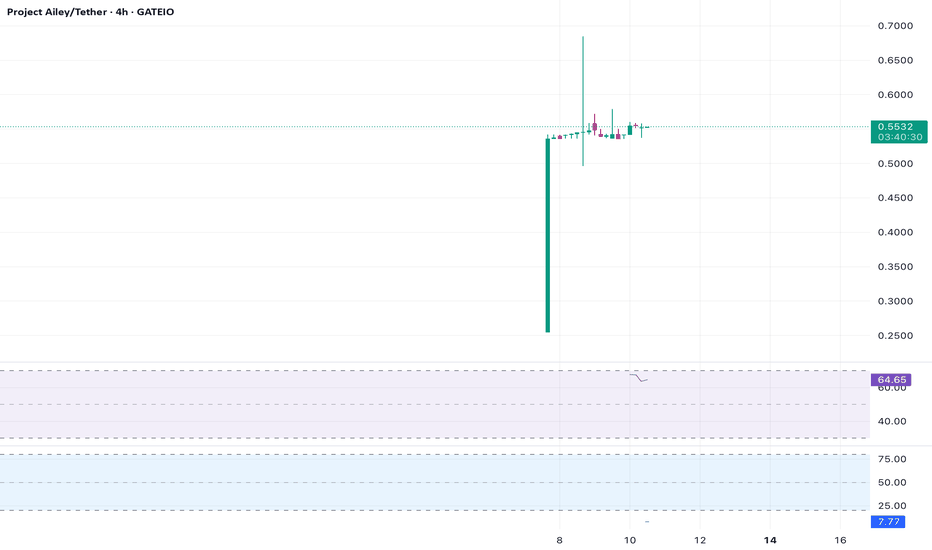

ALE Price K-line Analysis: Short-Term Trends

Looking at the daily K-line chart of ALE, we can observe a consolidation phase after a significant rally. The recent Gate.io listing has introduced new buying interest, as seen by the increasing volume spikes on upward movements. Technical indicators like the RSI are showing a neutral reading, suggesting that the market is not overbought or oversold at this juncture. The moving average convergence divergence (MACD) is showing a bullish crossover, indicating potential upward momentum. Traders should monitor the support and resistance levels closely. A break above the resistance could signal a continuation of the uptrend, while a drop below support might indicate a short-term correction. The order flow analysis shows clusters of buy orders near the resistance level, which could act as a catalyst for a breakout if market sentiment remains positive.

Project Ailey's Tokenomics Deep Dive

ALE token's distribution and allocation play a pivotal role in its value proposition. A significant portion is reserved for the community, ensuring widespread adoption and engagement. The allocation for the development team is locked for a considerable period, preventing any immediate sell-off pressure. Additionally, the token's utility within the Aileyverse, such as accessing exclusive NFT Mystery Doors and virtual events, creates a consistent demand. This demand is further bolstered by partnerships with major brands and platforms, which require ALE tokens for collaborations and transactions. The tokenomics are designed to foster a self-sustaining ecosystem where the token's value is intrinsically linked to the project's growth and user participation.

ALE Price K-line Analysis: Short-Term Trends and Long-Term Looking at the daily K-line chart of ALE, we can observe a consolidation phase after a significant rally. The recent Gate.io listing has introduced new buying interest, as seen by the increasing volume spikes on upward movements. Technical indicators like the RSI are showing a neutral reading, suggesting that the market is not overbought or oversold at this juncture. The moving average convergence divergence (MACD) is showing a bullish crossover, indicating potential upward momentum. Traders should monitor the support and resistance levels closely. A break above the resistance could signal a continuation of the uptrend, while a drop below support might indicate a short-term correction. The order flow analysis shows clusters of buy orders near the resistance level, which could act as a catalyst for a breakout if market sentiment remains positive. From a long-term perspective, ALE's price trajectory is influenced by several key factors. The project's expansion into virtual fashion, entertainment, and metaverse applications creates multiple revenue streams that could drive demand for the token. As the metaverse concept matures and gains mainstream adoption, projects like Ailey are well-positioned to capture a significant share of this emerging market. The token's utility in cross-chain transactions and its integration with various DeFi protocols further enhance its value proposition. Historical price data shows that during bull markets, metaverse-related tokens tend to outperform the broader crypto market. While short-term volatility is inevitable, the fundamental drivers suggest a positive long-term outlook for ALE, provided the project continues to execute on its roadmap and deliver on its promises.

Project Ailey's Tokenomics and Market DynamicsProject Ailey's tokenomics are strategically designed to foster a thriving ecosystem. A significant portion of the ALE tokens are allocated to the community, ensuring widespread adoption and engagement. The development team's allocation is locked for an extended period, reducing immediate sell-off pressure. The token's utility within the Aileyverse, such as accessing exclusive NFT Mystery Doors and virtual events, creates consistent demand. This demand is further bolstered by partnerships with major brands and platforms, which require ALE tokens for collaborations and transactions. The tokenomics are designed to create a self-sustaining ecosystem where the token's value is intrinsically linked to the project's growth and user participation. The recent listing on Gate.io and inclusion in Launchpool have introduced new buying interest, as seen by the increasing volume spikes on upward movements. Technical indicators like the RSI are showing a neutral reading, suggesting that the market is not overbought or oversold at this juncture. The moving average convergence divergence (MACD) is showing a bullish crossover, indicating potential upward momentum. Traders should monitor the support and resistance levels closely. A break above the resistance could signal a continuation of the uptrend, while a drop below support might indicate a short-term correction. The order flow analysis shows clusters of buy orders near the resistance level, which could act as a catalyst for a breakout if market sentiment remains positive.

$ALE: Volume Surge Signals StrengthGPW:ALE is in the spotlight with Gate.io #Launchpool: Stake CRYPTOCAP:ETH or GPW:ALE to Earn 92,594 GPW:ALE (06:00, Apr 8th–Apr 18th UTC, 412.34% APR). Stake at www.gate.io for auto-rewards. The 4-hour chart shows a volume surge as GPW:ALE holds above the 100-day EMA. RSI is climbing past 60, reflecting growing bullish momentum. The price is nearing a key resistance—breaking it could spark a 12–18% move. The MACD is trending bullish. Stake early and monitor for a breakout!