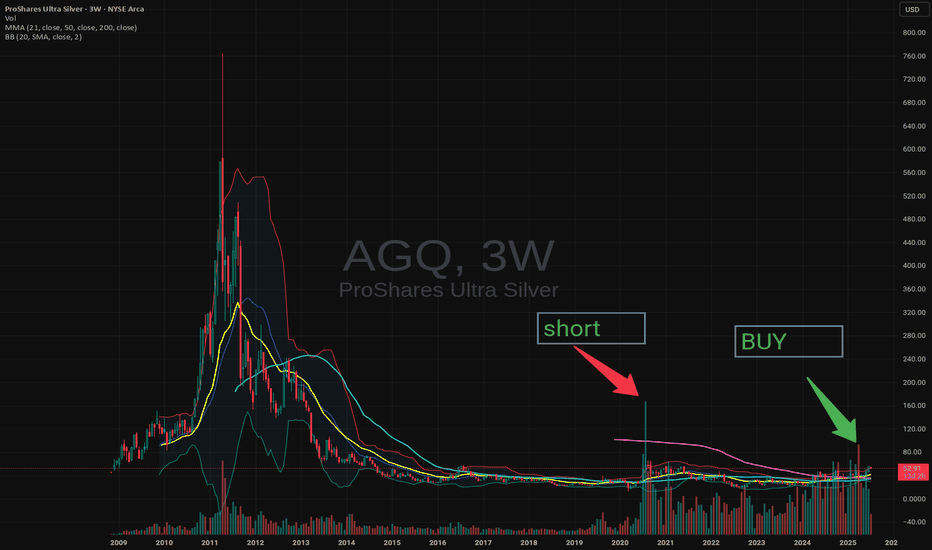

AGQ trade ideas

Chart Pattern Analysis Of AGQ

From K1 to K6,

It is a strong bullish three methods pattern,

It close upon the neck line of a potential bullish triangle.

It seems that the market will keep accelerating here.

So, I bought a small portion of AGQ at 55.35USD.

It is more and more clearly that the expensive metal such as Gold \Copper \ Ag is in the strong bullish market.

I will keep to buy in if the following candle fall to test 52.8USD area.

Long-55/Stop-50/Target-72

Long-52.8/Stop-50/Target-72

Awesome Silver trade AGQ 2X Silver BullishWe have been rallying from thre last major reversal XR we are at Piot level L4 this is a good buy level, L5 and L6 are better but it is a lte entry. I bought at XR. Silver is just underneath the 200 DMA, so we have to break though that, but I am bullish we could go to H6 @ 41.58, or weekly H5 @ 46.74 and still be beneath the upper red channel line, this trade is a swning trade plan to hold for days to get the berst price.

I suggest catastropic stops, outside the intraday range, having a lot of mall losses from tight stops is conter productive to making a profit.

The highest possibel TP is the red line at $52.62. I bought this at $32 will keep you guys updated, use a 30" or 60' chart and just be patient, wait for top price. When we get close to an H5 or an H6 risk is at it's highest, this is when you water tighter profit protecting stops.

Few normal humans have the clearheadedness to take profits when trade rolls over and falls very fast, near a top i might put my stop below the last 5' candle

I know I sound stern sometimes, but I am here to help Ya'll to profit, and share my 4 decades of experience trading online.

You will like this trade, but only You are responsible for how you manage your trade.

$AGQ to $104Operating off of a confluence of multiple signals showing a major breakout for AMEX:AGQ , there is a simple chart wedge that at the 1.618 Fib level places us firmly @ $104 / share.

- TVC:SILVER near term to hit ~$47/Oz:

- TVC:SILVER long term to hit ~$205/Oz:

The last time TVC:SILVER was at ~$48/Oz, AMEX:AGQ was around $740.

Given the level of general macro instability, weather patterns potentially damaging critical infrastructure, increasing demands for physical TVC:SILVER for semiconductors / green engineering (solar), plus the backdrop of the weakening dollar (BRICS et. al. dumping US Treasuries), AMEX:AGQ just might follow these to factors Valhalla, if my analysis is correct.

Would love to hear your thoughts

Silver will fall 10% - AGQ will fall 20% for retracementA 70% chance that silver provides a retracement next week, as the attacks on Israel by Iran are not coming out - and the West is getting desperate (I smell a false flag if Iran doesn't bite).

Asia (ChIndia - China & India) are hodling silver and gold and will provide the impetus for the forward price of precious metals.

TTM squeezes normally see price bounce off the opposite end as a fakeout before its continuation. I see that on multiple smaller TF's and a retracement to the middle BB on higher TF's.

I see a huge boost of silver miners coming up shortly, but for now I see a consolidation happening. Options for AMEX:AGQ was .05 for $36 June, so I see this going up to $1 or 20x if all goes as planned.

Then time to reload for metals blasting off!

AGQ- A Silver on steroids ETF LONGAGQ a leveraged ETF of silver and its futures, spent mid-March to mid-April on a great

uptrend from which it pivoted down in a 50% Fib. retracement which took two months

to complete. After a bit of consolidation and sideways channeling, it has finally launched

into bullish continuation as shown on the daily chart. The Lorentzian AI machine learning

indicator printed a buy signal today as it reacted to a green engulfing candle crossing the

mean VWAP anchored from the pivot low of mid-March. This indicator has extreme accuracy

in its signals as demonstrated on its tables. On the MTF RSI indicator, the low TF RSI has been

riding above the higher and crossed the 50 level one week ago. The zero-lag MACD is

confirmatory. Overall AGQ is ready for a swing long trade which I will take. I will zoom

into a 30-60 minute time frame and look for a pivot low from which to enter. My target

is the line showing two standard deviations above the anchored mean VWAP presently

about 36.3 representing at least 20% potential upside and profit. The stop loss will be

narrow with the price presently at the mean VWAP and POC line of the visible range

volume profile I will set it at 29.85. ( The risk to reward is approximately 1:40 )

DYODD !

Silver Breakout In The Works - Big Move ComingSilver broke out of a descending wedge, a consolidation after its February 2022 run. The 2X silver fund AGQ is looking great here with a technical breakout retest. A bullish MACD cross will likely send this to $50 + then it is going much higher with silver. Precious metals are about to have their moment as stocks and crypto sell off.

AGQ be prepared If Silver manages to break its all time high, I believe AGQ will pass the $400 resistance and reach the next level of resistance at $2500. This will leave us with a 6000% gain. This play all depends on Silver breaking new ATH. I'd still rather own physical silver, but I've definitely thrown money into this incase it plays out the way I envision it.

Long Silver/AGQentry time: 06/14/2021-06/23/2021

entry price: AGQ ~$53 (mine DCA is around 48)

account position: 25%, + 3-5% option

price target: ~60-100% profit , AGQ 80-100

stop loss: will only buy more with big dips (change position into long term, wait for breakout either end of 2021 or in 2022)

AGQ- Time to push higherPlease check my previous ideas on AGQ, why I like to invest in it and the potential there is.

AGQ is a 2x leveraged Silver ETF. Instead of utilizing swaps like most geared funds, AGQ invests in silver futures and forward contracts—this also means the fund is structured as a commodities pool, so it will distribute a K-1 form.

Since I expect silver to go higher, holding some AGQ shares is another way to invest /speculate on the price of silver rising.

the FXPROFESSOR

Long AGQ multi-month tradeThe silver sentiment is much better than gold. Gold/silver bull run should start somewhere end of this month and next month. Start adding position on AGQ around 44-48. a weekly close below 55 MA should be stop loss (around 42 currently). profit target depends on the time frame rather than the price target.

Note: The only thing to be aware of is the USD cycle --- whether we are in a new multi-year-long rising or falling USD cycle (check DXY). With infinite QE, I would bias towards a falling USD cycle, as of 2020. But if USD continues to rise then we will different sentiment.

Timing is right for big moveFor last 5 years the price has been so boring. Since now the price has broken out of the supply line, this ETF can move up quickly from this stage. It is also giving us a low-risk entry at this level too. People need to have patience to hold this for 6 months minimum and reap its potential. Can run to $200 level (4x) in about 12-18 months per my prediction model.

Historic set up in play.Lets get real here, the system we have know and that has brought us many wonderful things and a whole lot of corruption is approaching its curtain call. This is a play that I see being better than average in happening. The down side? None. At some point there will be a reset of the system and at that point Big Bro will pick up the ball and go home leaving us to have a plan B. In the mean time good luck to all and know that everything is just an experience.