Long MLP ETF & Short Micro Nat Gas Futures on Shifting SeasonaliHenry Hub Natural Gas (US LNG) prices have surged 46.2% since November 2024, driven by colder weather forecasts, rising European gas prices, increased feed gas to U.S. LNG facilities, and expectations of stronger domestic and European demand.

US LNG prices typically climb in winter as U.S. heating needs spike, with the December-March period marking a net drawdown in storage. However, the recent rally has been volatile. Shifting weather forecasts triggered fluctuations, including a sharp 7.6% one-day drop on 27/Nov.

Source: CME CVOL

Turbulent fundamentals, choppy weather, and uncertain geopolitics have forced implied volatilities on US LNG to spike to levels of 99.47 on 20/Dec, unseen over the last 12 months.

Supply concerns in Europe have further supported the uptrend. In reducing reliance on Russia, EU’s demand for US LNG has intensified, which accounted for 48% of the imports in H1 2024.

US LNG exports increased to 14 bcfd in December, up from 13.6 bcfd in November, reflecting strong activity. For 2024, US LNG shipments are projected to reach 86.9 million metric tons, about 720,000 tons (0.8%) higher than in 2023, reports Reuters .

Trump’s re-election has fired up optimism of accelerated LNG project approvals, increased drilling, & relaxed pipeline regulations, potentially boosting US LNG exports.

DATA CENTRES TO DRIVE ELECTRICITY CONSUMPTION GROWTH

The growing adoption of AI-driven technologies and the expansion of data centres are significantly increasing electricity demand, placing utilities at the forefront of powering the tech industry's rapid evolution.

Source: IBISWorld

Deloitte projects U.S. data centre electricity demand to rise sharply reaching 515–720 terawatt-hours (TWh) by 2030 (up from 180–290 TWh in 2024; CAGR of 17%).

Tech giants are turning to renewables and nuclear energy to meet rising energy needs. However, challenges with wind and solar intermittency, alongside the delayed rollout of modular nuclear reactors, make natural gas indispensable.

Source: EIA STEO

US LNG remains dominant, generating 43% of U.S. electricity. It is solidifying its role as the backbone of tech energy needs.

MIDSTREAM GAS COMPANIES PRIMED TO BENEFIT FROM TRUMP’S SECOND TERM

Trump’s support for US oil & gas is expected to push production up. LNG exports surged under his administration, rising from 186.8 Bcf in 2016 to 2,390 Bcf in 2020.

Source: EIA

While increased supply could exert downward pressure on US LNG prices, particularly as winter demand wanes, lower gas prices benefit utilities by improving cost efficiency.

Additionally, rising electricity demand supports pipeline, LNG infrastructure, & midstream gas companies, which are less exposed to price fluctuations than drillers. Performance of midstream energy stocks is a function of production volumes & pipeline capacity rather than energy prices.

Record U.S. oil production has kept pipeline utilization rates high, supporting midstream revenues. However, infrastructure deficits in key regions have created transportation bottlenecks, leading to backlogs.

The completion of new pipelines, storage units, processing facilities, and export terminals will ease these supply constraints. A Trump presidency could expedite the approval of LNG transport infrastructure.

LNG exports remain a key growth driver as new terminals and processing plants come online. Even if US LNG prices fall to USD 2/MMBtu, producers will remain profitable due to higher global LNG pricing.

The US is the largest LNG exporter and is set for further growth. The EIA projects LNG exports to rise by 15% to nearly 14 Bcfd in 2025, driven by increased capacity.

MLP ETFs CAPTURE US ENERGY OUTPUT GROWTH WITH REDUCED EXPOSURE TO PRICES

To capitalize on the expected growth in natural gas production, exports, and supply infrastructure, there are many alternatives. Investing into listed Master Limited Partnership (MLP) is one among them.

An MLP is a publicly traded entity that combines the tax benefits of a partnership with the liquidity of listed stocks. MLPs manage midstream infrastructure like pipelines, storage, & processing facilities for transporting and processing oil & gas.

The main drawback of MLPs is their complex tax form, potentially leading to higher taxes upon investment exit. To address this, an MLP ETF, which invests in a diversified group of MLPs focused on energy infrastructure, offers convenience of trading, diversification, high dividend yields, and simplified tax reporting.

The low correlation to underlying energy prices has made MLP ETFs increasingly attractive to investors over the past year. These ETFs are the only one in energy segment to attract inflows in 2024, while broader energy and other subsectors faced outflows, according to ETFTrends.com .

The largest MLP ETF in the U.S., the Alerian MLP ETF ( AMEX:AMLP ) recorded USD 1.30 billion in net inflows over the past year, while the Energy Select Sector SPDR ETF (XLE) and Vanguard Energy ETF (VDE) saw outflows of USD 3.24 billion and 745.2 million, respectively.

Since 2015, on average, AMEX:AMLP has gained 2.7% in January, while $Henry Hub has increased by 6.8%.

Additionally, the ETF has exhibited a lower standard deviation, indicating less volatility.

AMEX:AMLP tracks the Alerian MLP Infrastructure Index ( LSE:AMZI ), which comprises North American-based energy infrastructure MLPs generating most of their cash flow from fee-based midstream activities. With an AUM of USD 9.6 billion, AMEX:AMLP is the second-largest energy ETF. The ETF has a yield of 7.87% and an expense ratio of 0.85%.

The ETF’s largest holdings are major MLPs, such as ENERGY Transfer, NYSE:MPLX , and ENERGY Products Partners, among others.

HYPOTHETICAL TRADE SETUP

The AMEX:AMLP gained significant investor attention post-Trump’s re-election, with net inflows of USD 518.2 million from 06/Nov to 20/Dec, including USD 152 million on 06/Nov—the highest in the past year.

Its appeal lies in a healthy yield, low sensitivity to interest rates, and a fee-based model that stabilizes cash flows, making it less volatile than other energy subsectors.

Looking ahead, MLP yields are expected to remain attractive as interest rates decline.

However, since the start of December, AMEX:AMLP fell sharply while the $Henry Hub gained 17%.

This correction in the AMEX:AMLP prices offers a compelling entry-level, given the favourable macroeconomic conditions and positive seasonality going into January. Bullish drivers aside, risks to the downside exist from policy shifts and weather linked price volatility.

Portfolio managers who wish to invest into AMEX:AMLP ETF could consider hedging the downside risk using CME Micro Natural Gas Futures. Each lot of Micro Natural Gas Futures represents 1,000 MMBtu.

CME Micro Natural Gas Futures contract expiring in February 2025 (MNGG2025) settled at 3.412/MMBtu last Friday. On that basis, each lot of MNGG2025 represents a notional value of USD 3,412. For the spread trade to be effective, a portfolio manager will require 72 shares of AMLP ETF to hedge against one lot of CME Micro Natural Gas Futures.

This paper posits a hypothetical trade setup consisting of long 72 shares of AMEX:AMLP and short 1x CME Micro Henry Hub Natural Gas February Futures Contract (expiring on 01/Feb).

An entry at 13.9 coupled with a target at 16.1 and stop-loss at 12.6 delivers a 1.27x-1.62x in reward-to-risk ratio.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

AMLP trade ideas

A New Long Opportunity In Energy: $AMLPEveryone knows that $XLE has been out performing for the last two years. If you missed the move here's an opportunity at a new comer to the breakout in energy, $AMLP.

This ticker is an ETF that tracks a basket of MLP stocks. It's concentrated at just 17 holdings and its currently boasting a yield of 7.4%. The monthly chart looks a lot like its cohorts in the energy space did just a few months ago. This is a monthly candle chart with no annotations or judgements by me. The 36 Month SMA served as resistance until recently. That resistance was flipped and tested. The flip was successful and former resistance is now confirmed as support. The ETF is now convincedly above is 10 Month EMA for the first time in years. There's also a long term gold cross forming as the two moving averages converge. On the daily chart its fighting some resistance in the $38 to $41 range for sometime now. This looks like a good one for the watch list.

Alerian MLP ETFAlerian MLP ETF risks falling to 2021 low

ETF Alerian, after updating the two-year high of $42 per contract as part of a long-term uptrend, began a rapid flight to the $30 support level, breaking through the trend line of the two-year uptrend channel. The current downward dynamics of Alerian's decline puts investors in a stupor, the presence of gaps only confirms pessimistic moods. Pending buying demand is below the $30 support level, which could well be the starting point for a subsequent correction with the potential to recover with a renewed high of $50 per contract.

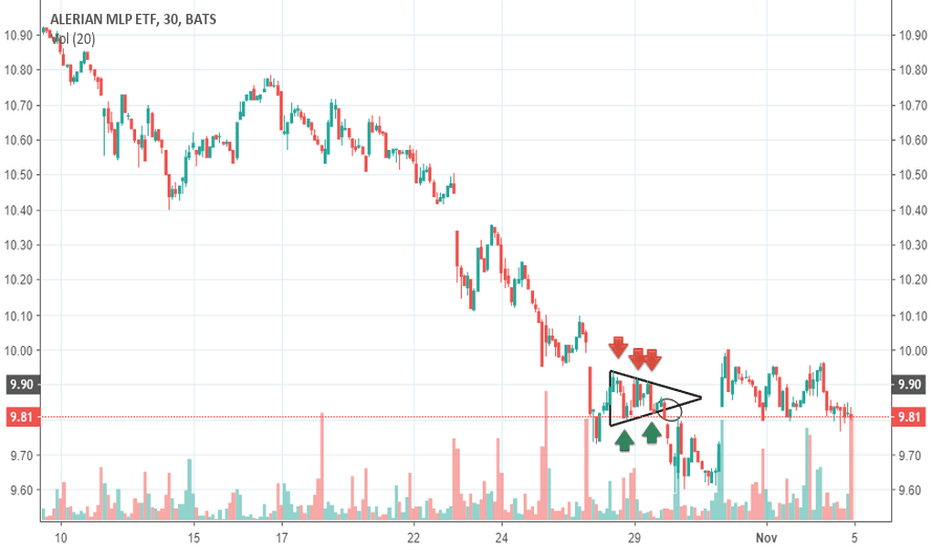

Alerian MLP ETF (AMLP) Symetrical TriangleAlerian MLP ETF (AMLP)

A symetrical triangle is shown, between 26 and 29 oct 2018. Is a continuation pattern; trend lines are touched by the chart two and three times (see arrows) . At two thirds of the triangle, a breakout ocurred, continuing the previous trend (bearish).

SYMMETRICAL TRIANGLE on AMLPThe ALERIAN MLP ETF chart, in a 1D timeframe, has formed a symmetrical triangle. This pattern depends on the break, if the break is in the top line of the triangle (following the green arrow) it is recommended to open a long position, on the other hand, if the break is in the lower line of the triangle (following the red arrow), open a short position.

AMLP Offers Attractive Entry PointShares of the AMLP, which tracks a basket of MLP's (master limited partnerships), has been a stellar holding since mid-April both in terms of price and total return, thanks to its rich 7.8% dividend (at current prices).

This advance has now pulled back to the 61.8% retracement , which is ideal for a continuation of the advance. I've been aggressively buying over the past few months and have done quite well it it, but now it's offering an opportunity for more buying.

Mind you, this is not a trading vehicle. It's a long-term holding that you want to reinvest dividends (unless you're retired and looking for dividends as a payment). In addition, it's the perfect ETF to sell covered calls against, again, something I've been doing to increase the yield of my investment. On that point, try to stick with near-dated contracts because an unforeseen spike in oil could make this thing rally hard, thus eating away any premiums you collect selling calls against in.

In short, I'm a buyer (and already a holder of a sizeable position), and I'll be adding today on this pullback to the 61.8% retracement. It's also showing oversold readings on the R.S.I., suggesting a bounce of sorts is due. I suggest you consider this ETF as a part of your own diversified portfolio.

PS - I've added some upside targets to show the potential, the 127.2% and 161.8% extensions, the latter of which will take us to about $12.30, or almost 25% higher from here. Plus, that 7.8% dividend and selling covered calls against it will further boost your return!

Oh, and don't get caught flat-footed on this selloff... this could be big!

Happy trading (and investing)!

AMLP TO CONTINUE TO MELTUP ON TRUMP'S EXPANDED OIL FIELD ACCESS www.zacks.com

Q4 Earnings Growth Likely to be Impressive

Among all the 16 Zacks sectors defining the S&P 500 index 0.55% , <$$$energy will likely witness the strongest earnings growth in the fourth quarter$$$>, per our latest Earnings Preview. In other words, energy will likely be the only Zacks sector to report triple-digit earnings growth.

www.forbes.com

Prepare For A Rally

Energy companies have rallied since August as oil prices have climbed higher. But because the new tax law will disproportionately benefit the energy sector, all else being equal the sector should outperform the S&P 500 because of expectations for higher earnings.

seekingalpha.com

Trump to 'sharply' expand offshore drilling, including Pacific Ocean

AMLP Alerian MLP Ready for Melt UP as New Tax Cuts Starts Mondaywww.barrons.com

More importantly, under the new law, taxable income for MLP investors is now allowed a 20% deduction, which when coupled with a lowered maximum individual tax rate of 37% vs. 39.6% prior results in a tax liability for MLP investors of approximately ~$30 vs.~$40 on $100 of taxable income. In short, we see the new tax regime as a net positive for MLP investors.

www.etf.com

20 Biggest ETF Cash Cows

Ticker Fund Name ER AUM ($B) Implied Annual Revenue ($)

EFA iShares MSCI EAFE ETF 0.33% 81.72 269,676,000

EEM iShares MSCI Emerging Markets ETF 0.70% 38.12 266,840,000

SPY SPDR S&P 500 ETF Trust 0.09% 247.8 223,020,000

GLD SPDR Gold Trust 0.40% 34.82 139,280,000

AMLP Alerian MLP ETF 1.42% 9.65 137,030,000