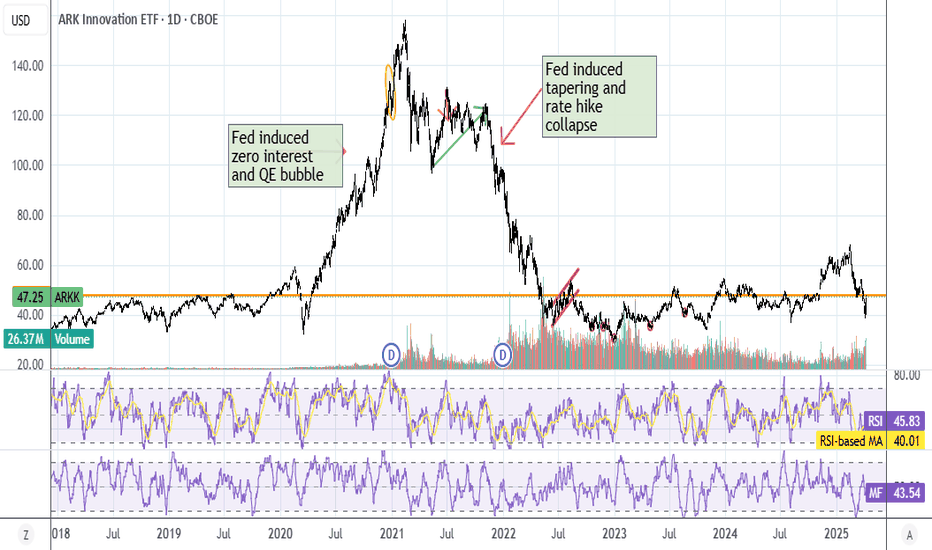

Cathie Wood Sucks ARKKI always like to mock Cathie, so just throwing up a plot for fun. Orange line is today's close after a 10% market day. If you invested in ARKK in 2018, congrats, you broke even today, lol.

She got a reputation from picking a bunch of speculative stocks during the COVID days, you can see the performance since just plain out sucks. 12% of her holdings is still in TSLA, lol. ARKK also owns 10% of PD float (as in 10% of the whole company). She singlehandedly pumped PD during COVID, and now she's stuck with that, there's no liquidity.

The worst part about this? If you had invested in TSLA instead of ARKK in 2018, you'd be up 10x right now. 4X if you bought AAPL. Why even bother with this fund?

Note: No position, just hate listening to her pump TSLA all the time, $2600 in 5 years, lol.