DBA trade ideas

DBA looking bullishWe like the agriculture sector here with the one of the if not the largest flooding in history for the Midwest. The chart is extremely oversold on weekly and monthly time frame, the daily pattern has a lot of potential and the fundamental could be changing quickly with this flooding (more rain coming and melted snow from up north not arrived yet).

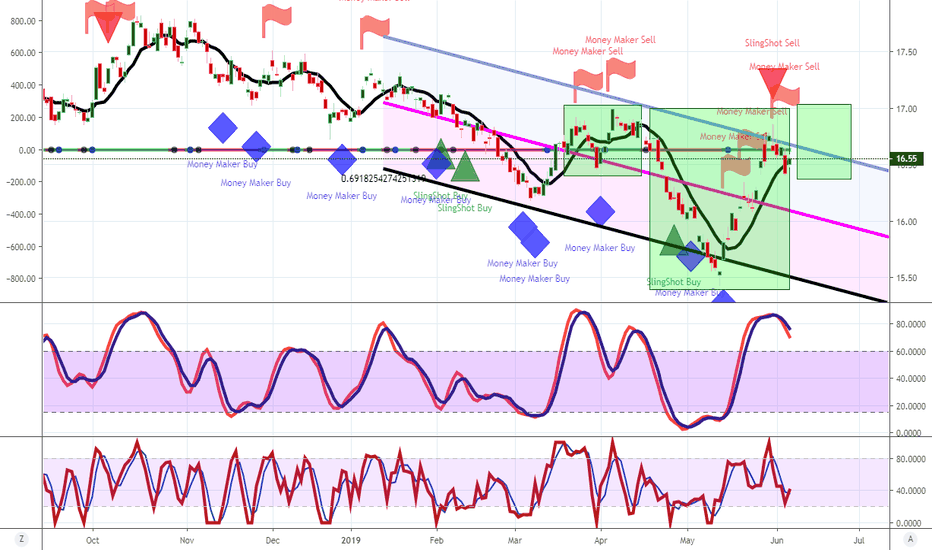

DBA agricultural commodities.....can they get much cheaper?I bought a call vertical today in an agricultural E.T.F. as a way to get a cheap hedge. Assuming if inflation rises or supply gets disrupted for some unknown reason. I am a little unclear of the cost to carry of the futures that it holds and was unable to write cash secured puts in my Fidelity SDA as I was told it was structured as an M.L.P. (master limited partnership) So I paid 1.32 for the 17/20 call vertical out to January 2020, as there was no other way to get long this name without tying up too much money and I.V.R. was low (24ish %) Not sure I needed to go out that far but moves really slow and is not a product I am very familiar with so staying small. SosGrande did trade some through the Bob the Trader app so I am hoping this would be a good entry and I have plenty of time. Dollar strength seems to be weighing heavily on this as well......but I will now be more interested in watching what tends to move these products as I have money on the table. Wish me luck.

UPDATE: Soft commodities have the answers for all assets s/t DBAHi guys, thank you for the support! I will have this analysis out each weekend as well as daily updates throughout the week, if you guys like what I'm doing hit the "follow" button and you will get a notification each time I post a video or chart!

Have a great day everyone!

Expecting a bottom in Agris!!!Hello traders

Take a look at monthly chart of DBA. Downside momentum is exhausted and I expect some moves to upside now. Still a bearish chart. But no momentum in macd now. Weekly chart is constructive and getting better. I am looking for plays in grains such as corn and wheat to the upside. Will see how it plays out. Stocks and commodities ratio is interesting as well. Change in trend???

Just wanted to share some thoughts in case some of you want to play it.

Bullish breakout It looks like Bulls finally gain power.

- Initial bullish Kumo breakout. (To confirm it has to make a higher high and Chikou cross above past Kumo)

- Breakout from major bullish wedge

- Hekin-Ashi gives a buy signal

We'll wait for today close and if momentum holds, we start to leverage our long position.

ADB longWhen something is hated and oversold, it is time to buy it. There is not yet clear conformation for bullish trend, but it will be very interesting when two trendlines meet on weekly chart. Risk reward is on bulls side. And with ever increasing prices, it is only matter of time before actual food become more expensive.

TRADE IDEA: DBA APRIL 20TH 18/20 LONG CALL VERTICALMetrics:

Probability of Profit: 38%

Max Profit: $140/contract

Max Loss: $60 contract

Break Even: 18.60

Notes: With the underlying at all-time lows, going for a small directional shot. Going out to April to attempt to take advantage of potential seasonality. Fills look to be pesky, with the bid/ask on this setup at .55/.65 (mid .60) ... . I would also note that the short call isn't taking much off the top in terms of debit paid (bid .10/ask .15), so this may be one of those cases where you might just want to go Plain Jane long call (bid .70/ask .75) and not cap out max profit with the shortie ... .

DBA weekly : have some patience...DBA had a retrace after breaking out of this declining wedge. I am now watching price behaviour around this base area and setting some alerts ( 21.00USD ). If the macro assessment is correct we should see Agrobusiness follow the pro-inflation-fear environment, which means that precious metals, commodities and Agrobusiness should provide considerabel gains in to 2017 and 2018. Long-term appreciation expected. However one has to have enormous patience. Once the big players catch up on this ( they did already in Gold and Silver ) we should be well positioned.