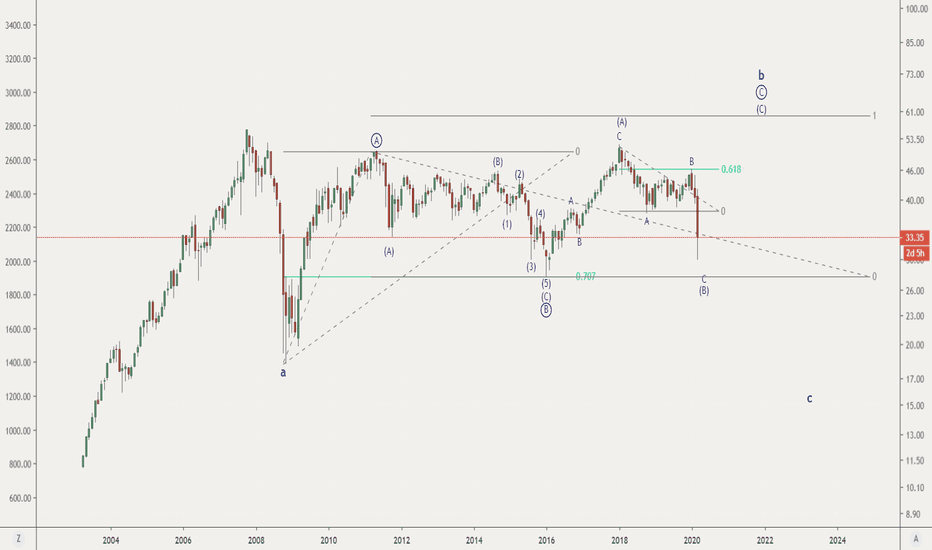

EEM - bullish and bearish emerging marketsPrice action of the last few weeks has really opened up all sorts of possibilities regarding chart patterns going forward. Is this count possible? It suggests that while there is still room for further decline in this index this could be followed by a pretty decent uptrend.

EEM trade ideas

EEM testing resistanceIf you're looking to get short the equities market, EEM may be a good place to start. Emerging Markets are testing the previous support trend line. This should now act as resistance. It's worth waiting to see if this hammer candle gets follow through or if it turns into a Hanging Man.

Global Emerging Markets - Macro Outlook & CommentaryTraders & Investors,

We anticipate emerging markets to be vulnerable to a macro slowdown following the virus outbreak in China. Emerging Markets have a high dependency on Chinese demand and consumption which often creates a very strong correlation between domestic activity/trade and the performance of these markets.

The effects of the virus are prominent with analyst expectations of substantial drops in Chinese Q1 GDP, dovish positioning of the Monetary Authority of Singapore, sell off in Crude/Brent, gaps lower in Asian Equities and flows into risk-off assets.

Following the euphoric bull run in 17'/18' and pullback into fair value, we see price correcting for a move lower into our buyside floor and macro swing targets of 34.0x.

We have added sellside exposure across both our macro and directional portfolios

-------------------------

We look forward to continuing to provide market leading analysis to traders & investors alike across the TradingView platform.

Like, subscribe and leave your comments below!

Until next time,

Portier Capital

Macro Strategy & Portfolio Management

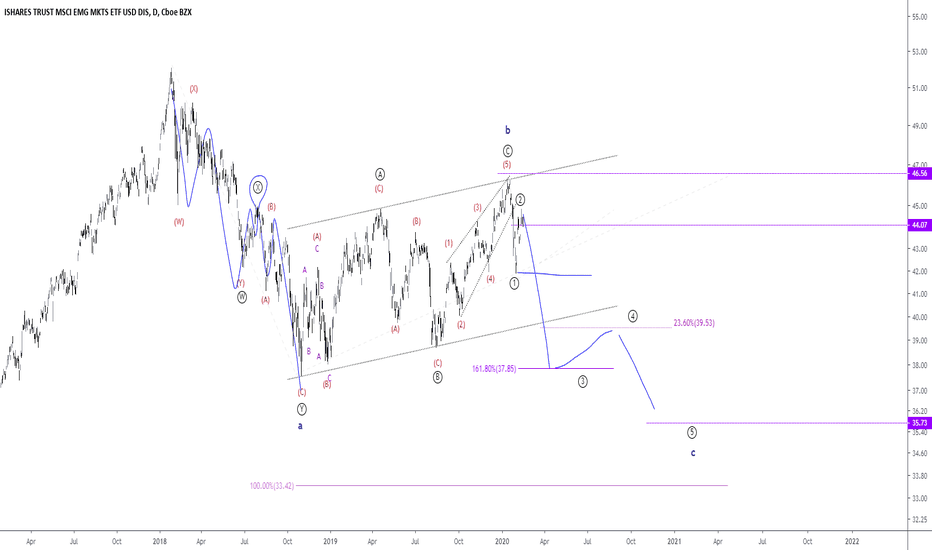

EEM - DAILY CHART Hi, today we are going to talk about iShares MSCI Emerging Markets ETF and its current landscape.

The emerging markets today can face an increase of volatility and perhaps pessimism as Trump's stated that will reinstate Steel and Aluminum tariffs for Brazil and Argentina since, in his perspective, both countries are devaluating their currencies to be "unfairly" competitive in the sale of agricultural goods, which is negative for U.S farmers. We must remember that since the beginning of the Trade War, China has stepped into the gas pedal in buying Brazilian agricultural goods, and the Brazilian currency has reached new record lows against the U.S dollar, which theoretically bases Trump's argument. This could be bad news for the market if imply a new Trade War front against these Latam countries, that doesn't have China firepower to sustain a tariff battle against the U.S.

Trump's movement could be clearly interpreted as an endeavor to take these competitors of the road, to try to suffocate China's lifeline of agricultural goods, and maybe force them to become more friendly with the idea of expanding their spending on U.S agricultural goods.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

Emerging Markets Lag PlayI see emerging markets and US small caps lagging with the rest of equity market. I would like to see emerging markets grind higher over the next two weeks to a new 52 week high. This recent dip looks like a technical sell off and we are at a low risk entry point to go higher.

I will be watching that...EM...4200MSCI Emerging Markets enjoying the fact that the only 2 tweets coming from Trump, wasn't his usual “great and unmatched wisdom”. For now, there is a "partial deal" between the US and China, which got all the bears running for some short covering. While the SPX is up 1.7%, the MSCI Emerging Markets Index is enjoying the news A LOT more, increasing 2% since yesterdays close.

A break and close above the $42 mark, break a very strong resistance level; namely the top of a Descending Triangle. This could be very bullish for the #ETF. Next resistance level would then be $43.20, with a break and close above these levels suddenly bringing $45 as next target.

$EEM Long Term Wedge BreakOut, Parabolic SAR Buy turning UpChart Looking Bullish

EEM Lagging U.S. Markets this Year, Fund Managers that Made Their Money & Preformance In U.S. may look to take Profits In U.S. markets & Sling some at an Under Performer.

With China A Shares Moving Up to 30% of EEM, & Destined to Become the Global Super Power in the Next 15 Years, They'll Probably Want In Early.

Ray Dalio, Who Runs the Biggest Hedge Fund In the World Bridgewater Associates.. .Went Heavily Bullish On China In the Last Week