EFA trade ideas

Keep an eye on this oneGood day folks,

I am currently working on my watch-list for this year, and I found this chart very interesting. Of course, this is a very long time-frame and things could change drastically, but there is information on it that raises pertinent questions about what is going on in the market ATM.

EFA is in a triangle within a larger triangle, and it just bounced from its channel support. There is 2 possibilities IMO: the market continues down, the uptrend is over and the recession hits, or the channel holds, the price goes up to the top of the triangle, hits the resistance around 70 (flattening), then reverse to crash in 2022-2023.

Is this chart going to predict the future? Maybe not, but I will certainly keep an eye on it. After all, this is a very long time-frame and the patterns are very clear, so I must give it some credit.

Thank you,

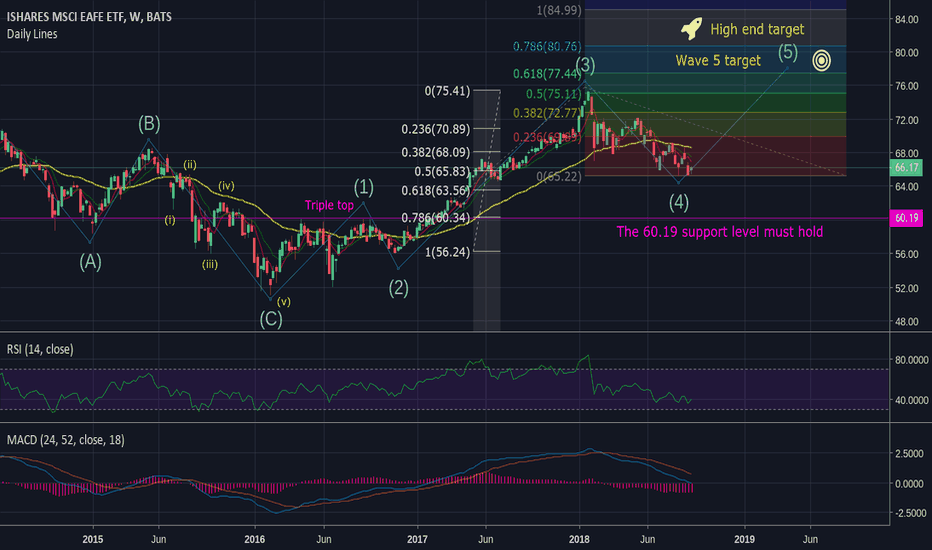

EFA: Long term price target of 77 - 85Dear all, from the years long chart with weekly candlesticks we can see that after completing the 5/15 - 2/16 correction EFA made a triple top on April as well as September (twice) 2016 before finally breaking out in March of 2017 into a powerful 3rd wave that has since given way to a wave 4 down. With EFA currently at 66.17 Wave 4 has retraced near perfectly to within 34 cents of a 50% retracement of the magnitude of wave 3 (65.83). Please see this level within the white colored narrow Fibonacci spread which represents the span of wave 3.

Though I would not be surprised to see further decline in price I would expect support at the 61.8% retracement level; 63.56, if she dips any further than that 60.19 (represented by the horizontal magenta line) must not break otherwise the wave count would be invalidated by the trough of "wave 4" dipping into the peak of "wave 1" note that I do not expect this scenario to play out. Based on current price levels we can expect with seventy percent certainty to see a wave 5 up which will take EFA to 77.44 and potentially even as high as 85. It is also plausible we would see a truncated wave 5 based on the mellow wave 1 and the notion that wave 5s resemble the wave 1 of their respective wave count, we will see. A further dip in price will require a re-calibration of the upside targets and if necessary I will do so in a few months time.

Thanks for reading this post, criticisms and question are welcome.

EFA weekly view.First I found the channel. Then I took the swing high during the week of 3-19-18, that went out of that channel and place a vertical line there to find the next potential area for support as it intersects with the lower channel. And last week's candle held up around that area @ 69.05. Then I placed a vertical line on the previous swing low during the week of 1-22-18, and where it intersects with the channel, that's where I'm looking for the next possible area of resistance @ the 70.73 area.

Neutral trade on EFA (Laddered Straddles)I didn't have any positions on EFA and With IV Rank at 47, I wanted to sell some premium. We are out of the ideal 45 days expiration window and since my portfolio theta is pretty low right now I decided to do laddered straddles.

Selling the 62 Straddle with 32 days to expiration and another one with 60 days to expiration. This will give us an avg date of expiration of 46.

I got a total of $526 in credit. This is close to a 50% chance trade, but I will look to take profit early to increase my probabilities.

EFA - 4hrUpdated with log-based fibs. White count is my basecase. Wave 2 got so deep I had to calculate sub-waves of white 3 to refine the targets (shown in green to match fibs). Nice reaction these past few days with extreme positive divergence on MACD, several timeframes.

Blue corrective count is still valid as well, so caution is warranted between ~61-65 region. Should price reach there and fail to hold support I'll revisit again. Breaking down below 56.11 would be suggestive of something like my red count, but that's not my expectation.