My top sector pick is oil/energyAccording to ValuEngine, one of the better analytics firms, oils and energy are the most undervalued sector right now. VE estimates that this sector is undervalued by about 32%.

Meanwhile, crude oil is in an uptrend. OPEC is looking at supply cuts, geopolitical tensions with Iran are heating up, and US crude oil inventory just posted another large supply draw. In other words, all the catalysts for this sector are pointing upward. The sector also looks bullish on its technical indicators, with MACD above signal line on both daily and weekly time scales. We've got some resistance ahead from the 200-day moving average, but we're above the 50-day after spending almost the whole month of June beneath it.

ERX trade ideas

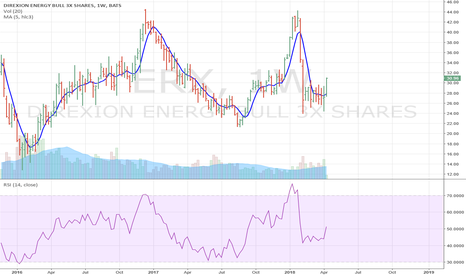

ERX might have put in a bottomERX looks like it completed a bottoming pattern similar to an inverse H&S with increasing volume. It has closed over the 50 day MA for three straight days, and the 10 day MA should close over the 50 day MA today as well. These will both be firsts since it has been searching for a bottom. Momentum is picking up as it sits at a major long term inflection point.

ERX Is An Energy ETF- BULLAre you looking for an Energy Sector Bull ETF? This might be the one, because noted bear trend run has came down from $44 to $24. MACD is crossing and purple noted BEAR trend line (still has not been broken), which would be a 100% confirmation. Last noted candlestick was around $2.00 (green).

You might want to look into this ETF, especially if SPY 500 does an bearish nose dive for rest of year (2017). This would continue to go long bullish trend and give you more stability, in your investments.

The 50% fib. ret would be back up to $34.00, which would be 1st resistance on chart.