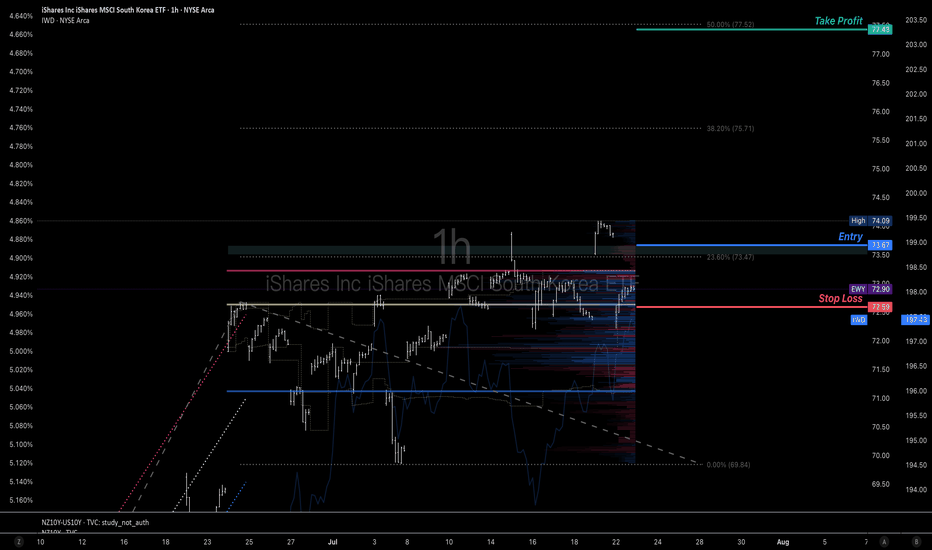

A potential chance to get long position of Korean equity marketsKorean economy and stock market emotion are well boosted by their regulation reform and new president elect. Many global traders miss the previous uptrend and the price is about to test the current resistance again.

Imma use a buy stop order @73.67 to try to get in the train to diverse my long posi

Key stats

About iShares Inc iShares MSCI South Korea ETF

Home page

Inception date

May 9, 2000

Structure

Open-Ended Fund

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

BlackRock Fund Advisors

Distributor

BlackRock Investments LLC

EWY provides unbiased exposure to the Korean equity market with significant exposure to Samsung. The fund tracks an index that ignores most small- and micro-cap stocks. To ensure diversification, the index applies certain investment limits with no single issuer exceeding 25% of the Underlying Index weight, and all issuers with a weight above 5% not cumulatively exceeding 50%. These limits are imposed on regulated investment companies (RICs) under the current US Internal Revenue Code. The index is rebalanced quarterly to coincide with the reporting requirements of RIC-compliant funds.

Related funds

Classification

What's in the fund

Exposure type

Electronic Technology

Finance

Producer Manufacturing

Stock breakdown by region

Top 10 holdings

Opening (IRA): EWY July 18th 35C/February 21st -55C PMCC*... for an 18.17 debit.

Comments: Back into EWY, after missing out on the dividend due to my shares being called away. Since there is no longer a dividend to be had, going with a Poor Man's Covered Call/long call diagonal, buying the longer-dated 90 delta strike and selling a shorter-dated call t

Opening (IRA): EWY January 17th 52 Covered Call... for a 51.50 debit.

Comments: Primarily in this for the dividend, since the ROC %-age without it kind of blows chunks. The last four distributions were: .63, 1.68, .70, and 1.65. Would appreciate something in the neighborhood of 1.00 (please and thank you) ... .

Metrics:

Buying Power Effect

Korea bullish trend, buying dipsThesis: South Korea is being considered as an AI startup hub as well as a chip source for AI.

it has a bullish trend. i am waiting for price to reach the lower end of the lower dynamic volatility range to start incrementally building a position in 0.25-0.5 basis points

ETF - Go Long on South Korea! $EWY The ETF on ASX is $IKO South Korea, iShare MSCI South Korea.

This ETF tracks $EWY in the US Market.

I like this wedge chart pattern here, we are still trading sideways since the start of the year.

A breakout is coming,

currently, the price is still above all three moving averages, (21,50,200).

Korean pumptardednessEWY posted the same pattern as it did before the last 2 big drops. Entered into some puts today for next week.

There's still room for it to go hit resistance and ATH, the 2 lines I've drawn. If it goes up from here, look for a similar pattern before shorting.

I'm bearish for Monday, but who know

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

EWY trades at 73.55 USD today, its price has risen 0.36% in the past 24 hours. Track more dynamics on EWY price chart.

EWY net asset value is 73.77 today — it's risen 0.28% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

EWY assets under management is 5.23 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

EWY price has risen by 2.00% over the last month, and its yearly performance shows a 21.12% increase. See more dynamics on EWY price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 0.28% over the last month, showed a 26.37% increase in three-month performance and has increased by 26.76% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 0.28% over the last month, showed a 26.37% increase in three-month performance and has increased by 26.76% in a year.

EWY fund flows account for −342.53 M USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

EWY invests in stocks. See more details in our Analysis section.

EWY expense ratio is 0.59%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, EWY isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, EWY technical analysis shows the strong buy rating and its 1-week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating EWY shows the buy signal. See more of EWY technicals for a more comprehensive analysis.

Today, EWY technical analysis shows the strong buy rating and its 1-week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating EWY shows the buy signal. See more of EWY technicals for a more comprehensive analysis.

Yes, EWY pays dividends to its holders with the dividend yield of 1.77%.

EWY trades at a premium (0.30%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

EWY shares are issued by BlackRock, Inc.

EWY follows the MSCI Korea 25-50. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on May 9, 2000.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.