safe haven swingBought some weeklies today to see if gold breaks out. Will probably keep rolling out & up if the s**t hits the fan.

I can get behind the argument there's too much liquidity and rolling corrections to continue, but when the ^TNX slides like this that scapegoat-speak only lasts as long as the stimmys, we have some structural issues on the horizon. There's some weird fits & starts on certain sectors today, but all things being equal, valuations looked exhausted...a proper 12%+ downdraft really in the cards, or at least the talk of losing your shirt should be discussed...

GDX trade ideas

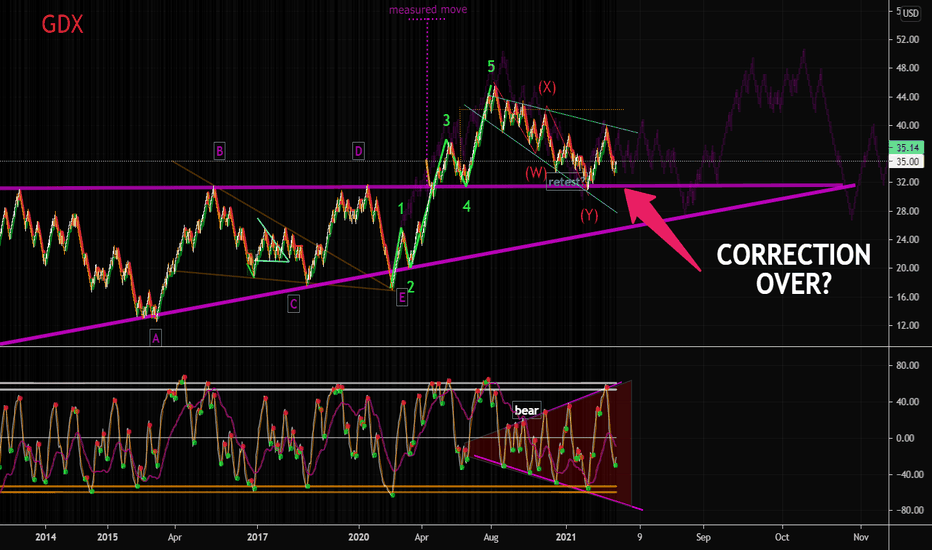

GDX HAS COILED ENERGYThe metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden bearish pattern that will eventually break. When it breaks, GDX is likely to move up incredibly strong. Perhaps one more push lower? I don't know... But I'll be ready if it drops again.

For me, I have some medium-longer term targets over 55-60.

Are we at a bottom for miners?Miners may finally be at or near a medium term bottom. They were up nicely today while gold was down. Also the technical are good. They are at the primary trendline, and there is a bullish RSI divergence. There is major support around 31, but not sure it will get down there.

GDX - the beginning of the endThe GDX Gold Miners is one of my personal favourite, and I have had been following it closely over the last couple of years. Since August 2020, where 95% of position was cleared, there was hardly any sustainable long term rally, albeit the March to June 2021 rally that I actually missed. Since then, it pulled back, and is about to revisit the last major lows. This is the beginning of the end... as in, the bearishness is ending. Now, this could take months to pan out and perhaps about 5% downside risk to go.

The daily chart had prices at a lower range having gapped down early in the week. Unlike equities, the recovery was mild, if at all, with Friday gapping down instead. In the form of a megaphone, the range is now going to widen, but am expecting more downside to the target of about 31.50-32.00.

Technicals support the weakness, albeit not extremely weak... just not strong. Looking for a higher low, with MACD bullish divergence in the month to come. Would not be surprised if it breaks down of the megaphone and then breaks back in again to be super bullish.

Until then... I am sitting on my hands.

GDX gold miner ETF7.18.21 GDX : This market can be a tradable market. You can look at the daily and weekly charts and see this. There is a more important reason to talk about this market. There are things a trader can do that can actually sabotage the ability to be profitable because the trader is so risk adverse, that trader will add indicators and filters that result in avoidance of taking trades because of an overwhelming fear of losing trades. This decision could even be conscious or unconscious, and even unintentional, but the end result will create a lot more work, and fewer trades as well as losing trades. The impact of taking trades that have a high probability of be stopped out and not producing acceptable targets can result in strategies that will slow down the trading, but they never really address a meaningful understanding of market dynamics that actually help you find a good trade with a reasonable stop and a decent target. If you really fear the market, you will find ways to slow down your trading. The problem is that this will not help you find a high Quality trade. I believe that certain strategies show that the trader is trying to avoid losing trades, and stress, but may also indicate that he may not have an effective awareness of price dynamics, or structure, and other factors that would be helpful in finding quality trades. However, you can certainly work hard, and have good intentions, but never really figure out how to find the trades that are more reliable, and therefore give you more confidence because they will find your trade location, and result in a decent target in a manner that will give you a higher probability for success. It is important to avoid losing trades, and it is important in finding trades that give you a good profit for the risk you are taking. Choosing bad tools can ruin you as a trader.

Gold Miners Have Had a Golden CrossThe Market Vectors Gold Miners ETF has one of the most interesting charts in the market.

Notice the steady decline from last summer, followed by a bump in the spring. It then gave back almost all those gains but still managed to drag the 50-day simple moving average (SMA) above the 200-day SMA.

That results in a strange situation with both SMAs falling – yet still in a bullish sequence.

Next, the recent drop erased most but not all the earlier bounce. It has managed to register a higher low (notice the weekly chart below).

Third, MACD has turned positive in the last few sessions.

Finally, stochastics on the weekly chart show an oversold condition:

The other catalyst could be the Federal Reserve because Jerome Powell was more dovish than expected yesterday. The U.S. dollar has trended upward lately, but in March GDX turned higher about two weeks before the greenback rolled over. So we could be at a start of a new pattern, with a dovish Fed lifting precious metals and dragging on the dollar.

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

GDX bottom pickerI think this move down in /GC is overdone and offering an opportunity to buy miners.

My dowsing is suggesting tomorrow morning for a buy entry on a dip. I'm not sure it takes out today's lod, but I suspect it'll be one of those dip and rip kinda jobs. I hope, anyway!

Actually, now that I look at /GC I can see it needs to clean up the lows around 1773. So if I see GC break that, reclaim it and look constructive on the upside, GDX will be good to go imo. And, so will /GC for that matter.

This is a serious low I'm looking for here that will send GDX up to the $54 area in September.

I like it, but wth do I know? We'll just watch and see.

GDX Gold Miners Hard DropHave not been posting nor updating publicly... but private circle saw the recent run up, and my suspicion that it would not hold. Circles were target points that were "surprisingly" met. (I dont know how to post the snapshots here, but anyways...)

Then this last week saw that GDX cut right through a target level earlier than expected.

A new support target is set, but I still suspect that there is more to come.

Gap Downs are hard, and on very high volume.

This down move is exacerbated with a spiking USD, falling Gold prices and Equities at risk.

Not yet ripe. Wait for it.

GDX : RESET / POSITION TRADE / HEDGEDuring the last three-month trading period, the VanEck Vectors Gold Miners ETF (GDX) has generated net inflows of 731.35 million. More importantly, we can see that the greatest selling pressures emerged after the Pfizer vaccine news was released on November 9th.

This suggests that the market is simply undergoing a temporary reaction to a news event and that further downside in GDX seems unlikely because any additional vaccine announcements would probably do little to change the underlying environment.

Moving out to an even longer-term view, we can see further evidence that these assertions are accurate because the VanEck Vectors Gold Miners ETF has actually generated net inflows of 2.37 billion during the last three years.

All together, these trend divergences tell us that investors might have an opportunity to profit from recent paradigm shifts in the precious metals markets. While this short-term enthusiasm might be moderately favorable for U.S. stock benchmarks into the end of 2020, we think that the prospects for economic deterioration during the first-quarter period of 2021 might be enough to send investors right back into safe-haven assets.

Ultimately, the VanEck Vectors Gold Miners ETF provides an alternative strategy for investors that are interested in moving deeper into the precious metals sector and its expense ratio of 0.52% remains near the middle of the range for the category as a whole.

SOURCE : INCOME GENERATOR, THE INCOME MACHINE / SEEKING ALPHA

seekingalpha.com