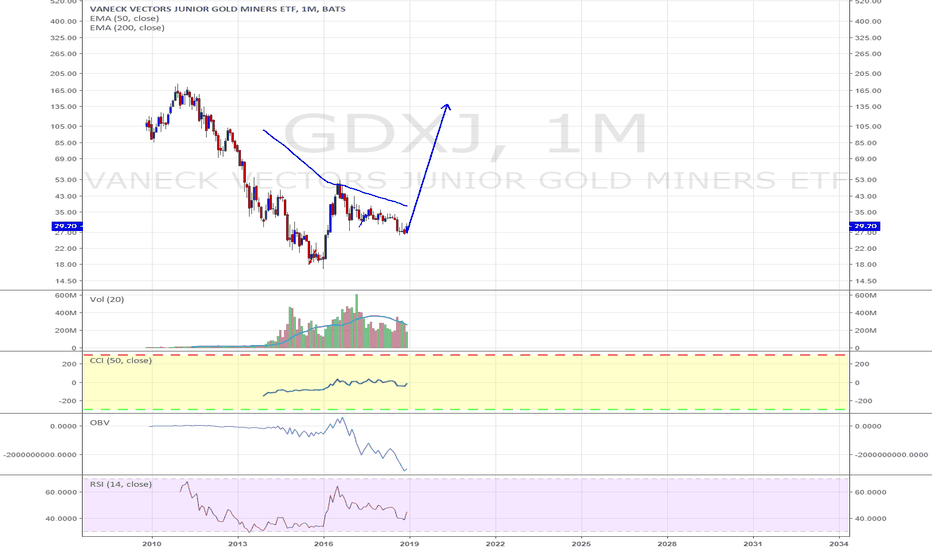

GDXJ trade ideas

FOMC layered backspreadhigh iv relatively high risk for sell on the news. i expect an initial pop then drop. backspread is a bear call with an upside call. so im legging the upside call expecting a pop post fomc but expecting a drop back into a range. it really depends on how dovish they appear. if dovish itll likely confirm the pattern. if unsure or not dovish likely to stay rangebound.

5 reasons to short GDXJ (Buy JDST) - Short Term idea. When Gold was at today's level, GDXJ was around $36 not $39.50. It is overbought

2. Gold is priced with a 59% chance of a 50 bp rate cut from the Fed at the end of the month. The Fed will likely only drop rates by 25 bp and therefore, gold will likely drop.

3. Resistance for GDXJ is at $34.5. This level will be challenged before it moves back up.

4. What goes straight up usually comes back down as fast. GDXJ

5. Double top on Gold

This means JDST should hit $25 as Target 1 and $35.50 as Target 2

This is a short term forecast. I would say days or one month tops. I will publish another one when I switch to JNUG, likely sometimes in August.

Sold GDXJ strangleSold a strangle on $GDXJ today for a buck at around the 1SD range. 20 SEP 19 48/35 CALL/PUT

Has 94% IVR, and 1.24x the year average HV,

The IV is 38% which is about the same as GE stock right now.

I may exit the trade early if I collect over half the credit or if IVR remains high enough that I can roll to the next month with about 20 days left to expiry.

Note: The chart is marked with the 46/34 trade I was also considering (but forgot to change)

THE WEEK AHEAD: GDXJ, GDX, GLD, XLU, SLVEARNINGS

FAST (41/31), PEP (19/18) and DAL (15/26) announce earnings next week, but the rank/implied metrics aren't there for me (>70 rank; >50 implied) for an earnings-related volatility contraction play.

BROAD MARKET

TLT (21/10)

IWM (12/16)

SPY (11/13)

QQQ (10/17)

EEM (7/17)

EFA (5/10)

Weak sauce.

SECTOR EXCHANGE-TRADED FUNDS

Premium selling opportunities remain in gold and the miners, with some decent background implied in the oil and gas sector and semicons:

Top 5 By Rank: GDXJ (86/37), GLD (75/15), GDX (62/32), XLU (61/14), and SLV (56/19). USO (30/36), SMH (27/25), and XOP (21/31) follow thereafter ... .

Pictured here, remarkably, is the exact same setup strike-wise that I posted last week in GDXJ in the August cycle -- the nearest the 20 delta 32/39 short strangle, paying 1.06 at the mid price with break evens at 30.94/40.06 and delta/theta metrics of 2.82/2.92.

IRA TRADES

XLU (61/14) is on my IRA shopping list with a current yield of 3.05%, but as a rate sensitive, it's ripped way higher on all this talk of cutting, cutting, cutting.* You'd think with that rank (61), it would be paying something, but the background's only at 14, so it's really no surprise that it isn't. I can either man up and sell something closer to at-the-money if I want in, and then manage the short put from there, wait for lower, sell a "Not a Penny More" at a price I'm comfortable with and then whittle away at cost basis from that point forward before taking on shares if I'm not happy with my cost basis (e.g., the Jan '20 18 delta 55),** or do something a little funkier like a 90/30 call diagonal with the long leg far out in time at a strike I'd be willing to exercise at.***

With the possibility of a no cut looming in the July cycle, I'm opting for waiting for lower. If that December "sell everything" dip is evidence of anything, it's that we'll probably have opportunities at some point going forward.

* -- So have all the other rate sensitives -- IYR, XLP, TLT, HYG.

** -- I generally do that anyways as long as it's productive.

*** -- I looked at a Jan '21 (no, that's not a typo) 50 long/Aug 16th 62 short call diagonal, but it's hard to price out in off hours with the setup being bid 7.78/ask 13.05. I'd be fine with the right to exercise at $50/share, but would need a Dick to sell me the setup for a price that results in a break even at or below where the underlying is currently trading to even consider that setup (i.e., not more 60.68 minus the 50 long strike or 10.68; the broker's saying the mid price for that setup is 10.42 with a resulting break even of 60.42 versus spot at 60.68). The additional benefit of that particular setup is that it's far more buying power efficient in a cash secured environment than short putting: the buying power effect of a 50 short put is the strike (50.00) minus any credit received with no right of exercise/assignment if the short put stays out of the money. It kind of begs the question of: "Why the hell don't I do that setup in the IRA more often as an acquisition strategy versus short putting?"

THE WEEK AHEAD: GDXJ, GLD, GDX, SLV, XLVEARNINGS

No options highly liquid underlyings announcing earnings this week.

BROAD MARKET

EEM (35/19)

QQQ (23/20)

IWM (21/18)

SPY (21/15)

EFA (15/12)

SECTOR EXCHANGE-TRADED FUNDS

There's gold premium to be had (in them there hills ... ), particularly in the miners:

Top 5 By Rank: GDXJ (86/36), GLD(86/16), GDX (63/30), SLV (62/20), XLV (60/15).

Pictured here is a delta neutral GDXJ short strangle in the August expiry, paying 1.28 (.64 at 50% max), break evens at 30.72/40.28, and delta/theta metrics of -2.5/2.9. For those of a defined risk bent, the August 16th 29/32/38/41 is paying .92, with break evens at 31.08/38.92, and delta/theta metrics of 1.08/1.02.

The XLV August 16th 88/97 short strangle is paying 3.10 at the mid, but the markets are so wide, I'm not sure how that'll price out in the New York session. Moreover, the background implied is about that of the broad market (15 versus SPY 15), so I'm unsure of whether that's worth pulling the trigger on even if markets tighten up, even though implied's in the top half of its 52-week range.

IRA TRADES

This has been a tough market if you're looking to acquire either broad market (e.g., SPY), bonds (e.g., EMB, HYG, JNK, TLT), or other divvy generating underlyings (e.g., IYR, XLU), with your basic options being to (a) wait for lower; (b) sell "not a penny more" puts and get paid to wait; or (c) throw some caution to the wind, take some risk, and sell closer to at-the-money and manage those trades reactively (i.e., rolling out for credit, duration, and cost basis reduction). I've opted for a few "not a penny mores," although the return on those isn't all that compelling even though it beats the basically 0% you get for staying in cash. (See, e.g., the HYG, SPY "Not a Penny More" Trades, below). Given my particular proximity to retirement, I'm not all that keen on acquiring a bunch of stuff at near all-time-highs, so I'm pickier and probably way more risk adverse than most, so naturally the "Not a Penny Mores" will not be for everyone since you're tying up quite a substantial piece of cash secured buying power to generate fairly mundane returns.*

But just because I've kind of thrown in the towel over acquiring stuff in the short to medium term doesn't mean I'm not managing what's already there. Inevitably, there's always a covered call that may need to be looked at and/or a hedge that might be sensible to erect to cut covered call net long delta that is inevitably there. (See, e.g., Overwriting Post, below).

* -- Although it's apparent that you can collect sufficient premium to emulate or exceed the dividend returns on some of these underlyings without actually being in the stock itself. It kind of begs the question: "Why be in stock at all?"

$GDXJ Short Strangle OpportunityImplied Volatility remains high in gold and gold miners stocks. The opportunity to sell option premium is still here with great risk/reward. Check out the breakeven range on the AUG-2 29/34.5 strangle. BIG RANGE! And as IV inevitably comes down, that range becomes less and less likely to be broken.