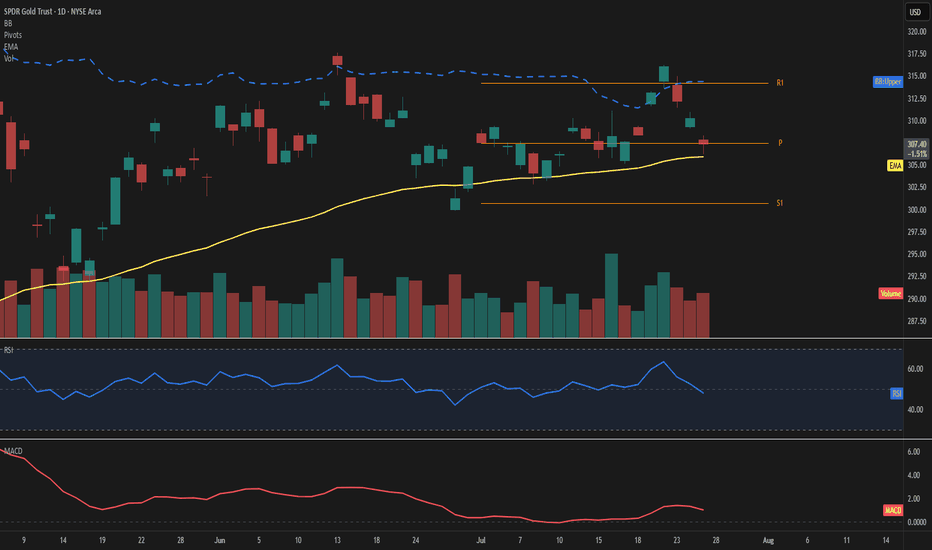

GLD – Price consolidates at highsPrice is hovering just above the 50-day EMA at 307, showing signs of short-term hesitation near the Fibonacci pivot. The upper Bollinger Band sits at 314, leaving moderate room for expansion if momentum picks up.

The RSI reads 48, reflecting a balanced setup without clear directional bias. MACD remains slightly positive, suggesting a still-constructive but soft momentum.

Key levels to watch include the pivot at 307 and the support at 301. On the upside, the 314 area aligns with both R1 and the upper band, acting as the next challenge.

Volume is up sharply (+22%) despite a mild -0.9% price pullback, indicating possible accumulation beneath the surface.

As long as price holds above the 50-day EMA, the structure remains intact.

A move away from the pivot zone will likely define the next directional wave.

GLD trade ideas

$GLD short term top in $260-148 target on the downsideAMEX:GLD looks a bit extended here. I could see the possibility of GLD falling back to the $260 support at a minimum and maximum all the way down to $148

The $209 support would be the 50% retracement of the recent run. I like that as a level for a bounce.

Let's see where we end up.

GLD – Why Gold Is a Clear Short to MePrice moved from the Lower Median Line (L-MLH) up to the Centerline, fulfilling the 80% rule.

Then we had two Hagopians, which sent price right back to the Centerline.

After the breakout above the Centerline, the next target was the Upper Median Line Parallel (U-MLH), which was reached rather quickly.

Finally, price broke above the U-MLH and was pulled up toward the Warning Line (WL).

Is this the end of the happy story?

I think so—because Gold has now reached its 2nd standard deviation, and there’s probably no more gas left in the tank.

The Trade:

- A logical target is the U-MLH.

- A secondary target is the Centerline.

At the very least, if you're long, this might be a good time to take some profits—because no tree grows to the moon.

For further details, I will follow-up with a Video explanation - See my Signature.

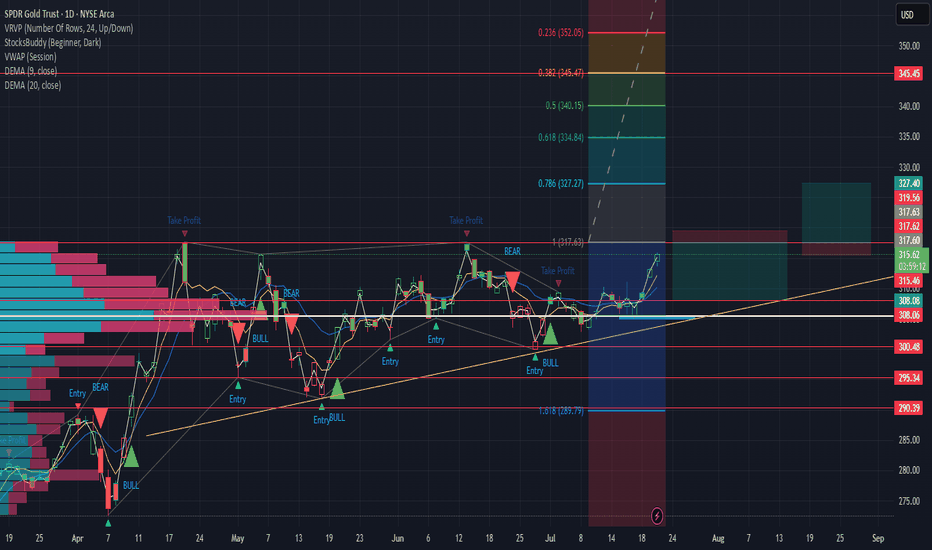

GLD up or down plan OK, tell me if this makes sense. if it rejects off of the 317.60ish area i would trade back to the down side to $308.10 ish - 4.80 R/R. If it breaks out and retests I would be trading to 327 area. 4.5 R/R - Let me know what you see and your thoughts. i'll try to share what i did.

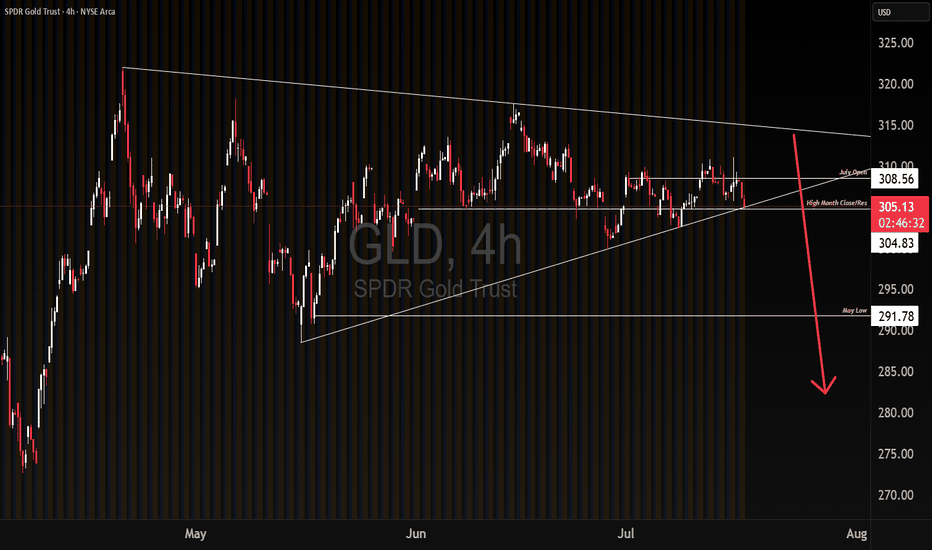

GLD potential break downWe could be experiencing a break down on GLD based on capital outflows, going into riskier markets. If this larger time frame range break down holds, and we get continuation lower on downside momentum, we get a measured move target of May's low. Will be watching to see if the breakdown is a bear trap first. If it is not a bear trap, I will buy OTM Jan 26 puts. Targeting May's low

Short Goldbeen entering puts every time gold surges on any War headlines. it's getting sold into by smart money. it's been successful three to four times in a row. I currently have 11 open puts for the $300 strike expiring August 15th. I picked them up when we were pushing high 309 on Wednesday. high potential to be in the money if we continue to slide. all of the worst doom war news still couldn't get this thing higher, we are going down.

Have you noticed Gold and Silver Miners lately?No doubt you are aware of the serious run Gold made so far in 2025, and you might also be aware that Silver is catching up fast lately. But have you thought to take a look at Gold and Silver mining stocks and the ETFs that track them? As Robin might have said (but never did), "Holy prospectors Batman, these stocks are flying higher!"

It is a real question whether this trend will continue, but if it does, GDX/J SIL/J are the ETFs to watch.

GLD Weekly Trade Setup — June 16, 2025🪙 GLD Weekly Trade Setup — June 16, 2025

🎯 Instrument: GLD (SPDR Gold Shares)

📉 Strategy: Short Bias via Puts

📅 Entry Timing: Market Open

📈 Confidence Level: 65%

🧠 Technical & Sentiment Snapshot

Current Price: $311.78

5-Min Chart: Below EMAs (10/50/200); RSI ≈ 34 → short-term oversold

Daily Chart: Above 10EMA ($309.94), RSI ≈ 56 → neutral-to-bullish

Bollinger Bands: Near lower band on M5 → volatility likely

Support/Resistance:

• Support: $311.68 / $307.28

• Resistance: $312.20 / $313.00

🗞️ Market Sentiment Overview

VIX: Elevated at 20.82 → high risk premium environment

Options Flow: Heavily put-weighted near $305–$310 strikes

Max Pain: $285 → bearish options bias into expiration

News: Geopolitical tensions increase flight-to-safety temporarily, but fading momentum fuels retrace setups

🔽 Recommended Trade: GLD PUT

Parameter Value

🎯 Strike $307.00

💵 Entry Price $0.84

🎯 Profit Target $1.25–$1.70

🛑 Stop Loss $0.50

📅 Expiry June 20, 2025

📏 Size 1 contract

⚖️ Confidence 65%

🧷 Trade Plan

📥 Entry: At market open

📈 PT Zone: $1.25 to $1.70 premium, based on drop to $306–307

🛑 Stop: If premium drops to $0.50 OR GLD breaks above $313

💰 Risk Mgmt: Keep exposure <2% of total account equity

⚠️ Key Considerations

Upside Risk: Sudden bullish shift or risk-off headlines can drive reversal

Time Decay: Premium erosion risk is higher if GLD consolidates

Volatility Drag: VIX dropping could suppress put premiums quickly

🧾 TRADE_DETAILS (JSON)

json

Copy

Edit

{

"instrument": "GLD",

"direction": "put",

"strike": 307.0,

"expiry": "2025-06-20",

"confidence": 0.65,

"profit_target": 1.25,

"stop_loss": 0.50,

"size": 1,

"entry_price": 0.84,

"entry_timing": "open",

"signal_publish_time": "2025-06-16 16:15:17 UTC-04:00"

}

💡 If GLD struggles to reclaim $312.20 at the open, the put setup becomes attractive. Breakout above $313? Exit quickly.

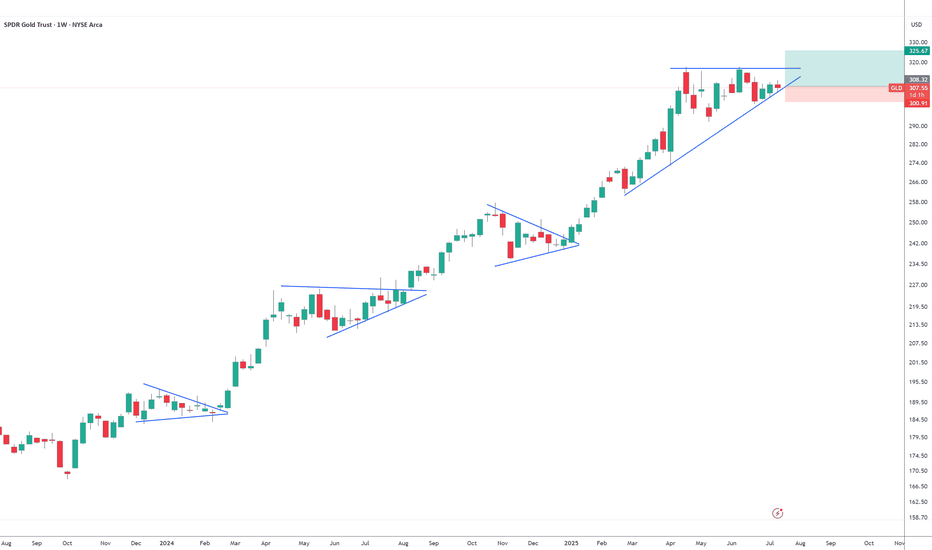

GOLD poised for breakout GLD & /gcAfter going on a huge run to 317 we have spent a significant time now basing out and consolidating we’ve come down into that 300 range and tested and built up quite a bit of support

With the Iranian intentions we could kickstart the next move in gold 317 is the breakout. I am looking to play this breakout on an intra day pull back with some calls one month out for a swing Trey looking at the 320 or 325 strike price

Gold - Falling VolatilityI've been selling option premium as momentum has fallen. Money is leaving gold and moving into silver.

As price reaches lower band, I'll be adding delta in anticipation of moves to much higher levels. Gold appears to be at the bottom on a long-term, rising channel and is providing positive long term opportunities.

Three drive GLD setup, to simple?Gold is in a lot of media right now and everyone probably has some exposure, i myself am here and as are you. Im taking my chips and placing it on a short setup before a run if there is one. Three drives pattens on candles with bearish sentiment TA, LL, LH, opex is over, yada yada.

GL

GLD Swing Trade Setup – 6/18 $320 Call for 5–10 Day Breakout Mov🟡 GLD Swing Trade Setup – 6/18 $320 Call for 5–10 Day Breakout Move

📅 Trade Date: June 4, 2025 | 📈 Timeframe: 5–10 Day Swing

🎯 Playing a bullish continuation with defined risk & strong confidence

🧠 Multi-Model Consensus

Model Bias Strategy Strike Entry PT SL Confidence

Composite Mod. Bullish Long Call 320 1.68 2.52 0.84 75%

🔎 Technical & Sentiment Overview

Weekly Chart: Price > EMAs, clean bullish MACD crossover

15-min Chart: Consolidating near $311–$313 support, breakout forming

Sentiment: Bullish news tailwinds (gold demand, USD weakening)

Max Pain: $308 = short-term pullback risk

Implied Volatility: Stable with limited crush risk

Options Flow: Moderate OI build in $313–$325 calls, upward bias

🎯 Trade Setup – Long GLD Call

Instrument: GLD

Direction: CALL (LONG)

Strike: $320.00

Expiry: 2025-06-18

Entry Price: $1.68

Profit Target: $2.52 (50% gain)

Stop Loss: $0.84 (50% loss)

Size: 1 contract

Entry Timing: Market open

Confidence: 75%

⚠️ Risk Management & Considerations

🛑 SL Discipline: Exit if premium drops to $0.84

🕒 Time Stop: Exit within 7–10 days if trade stagnates

🔁 News Risk: Watch for economic releases and dollar strength reversals

⚖️ Support Check: Must hold $310.50 zone on M15 chart

✅ Trade Thesis Summary

With GLD holding bullish structure on higher timeframes, models show strong agreement on upside continuation. We're targeting the $320 breakout with a controlled-risk weekly option.

Neutral - GLD (Short-term) & Short (Long-term)A. Short-term: NEUTRAL

Daily chart pattern: Double top

RSI: Close to 50. Needs to cross 50 to turn bullish momentum

1. Double top confirmation

- Fib 0.382 rejects at $299.85

-> Enter PUT option for PT: ~$280.5

2. Failed double top

- Pass fib 0.382 at $299.85 to gap up

-> Enter CALL option for PT1: ~$303

PT2: ~306.5

B.Long-term: PUT

Overall long-term opinion: LEAP PUT for GLD with expiration date more than 1 year. PT: ~200

GLD where to?My dowsing work suggested a high around $288 on GLD, which obviously worked out (see prior idea). There's often a decent reversal opportunity once levels are hit. This one was golden... Wah-wah.

I'm trying not to over ask on things because with my work, I think it opens the door for misleading information or confusion on my part.

Simply put, the guidance was to get a date from the past, which was Jan. 10th. Look to revisit that price, which happens to correlate with the area of the 200 sma. When I asked what price from the H/L of that day, I get $249.

I drew a line to show the reference candle from January.

I ask what date this may occur by & get May 15th, but another date came of July 26th. There's some big stuff I think happening in indexes too in June/July. Dates are often reversals, but can be nothing. You just never know, but odds are more often they are something.

Why Traders Chase — and Always LoseHard truth:

You don’t miss opportunities. You chase noise.

Let’s break down the real reason you keep “missing moves”:

1. FOMO is not urgency — it’s confusion.

When you enter because “everyone’s talking about it,” you’re not trading a setup. You’re reacting to social proof.

2. Volatility ≠ opportunity.

Big moves look attractive, but if they’re not in your plan — they’re distractions, not trades.

3. The market rewards patience, not activity.

Every click, every chart, every refresh feeds your dopamine — not your edge.

🚫 Solution?

Stop scanning. Start filtering.

Use tools that prioritize structure over noise. That’s why we built TrendGo — to give clarity in chaos and help you avoid traps masked as opportunity.

📌 Don’t chase. Build your edge.

Gold - Time for a BreatherHigh probability that GLD will move to the 20 day moving average at 295. The BBW indicator shows that momentum is softening. At this signal, prices generally revert to the mean or in some cases, sell off quickly to the -2 standard deviation.

I've been using the futures to hedge my positions. Interesting that the CME has come out with a 1 oz gold future. The gold casino is really starting to open up.

GLDGold has extended slightly passed the 2.618 extension fib and then began to fall back down. It is too early to tell if price has finally topped or not. It is no coincidence though that it started moving lower as the market started moving higher. I believe that any drop in price for gold is only temporary. It will, IMO, begin to move higher again around the time this larger consolidation of the indices completes.

Should price start to move higher again, we will need to look towards the 2.786 & 3.0 for points of resistance. However, if a local top is in fact in place, we would then continue lower in an overlapping/choppy fashion. I will update as it warrants.