GUSH trade ideas

GUSH to the moonToday, Houthi rebels blew up half of Saudi Arabia's oil production. Oil is up 9% tonight, which means GUSH, ERX, and other oil and gas securities (i.e., GE, RIG) are going to go to the moon tomorrow. I'll be buying at the open of the premarket session.

Gold and other metals should also benefit from the general sense of international insecurity, so NUGT, JNUG, and FCX are also decent buys.

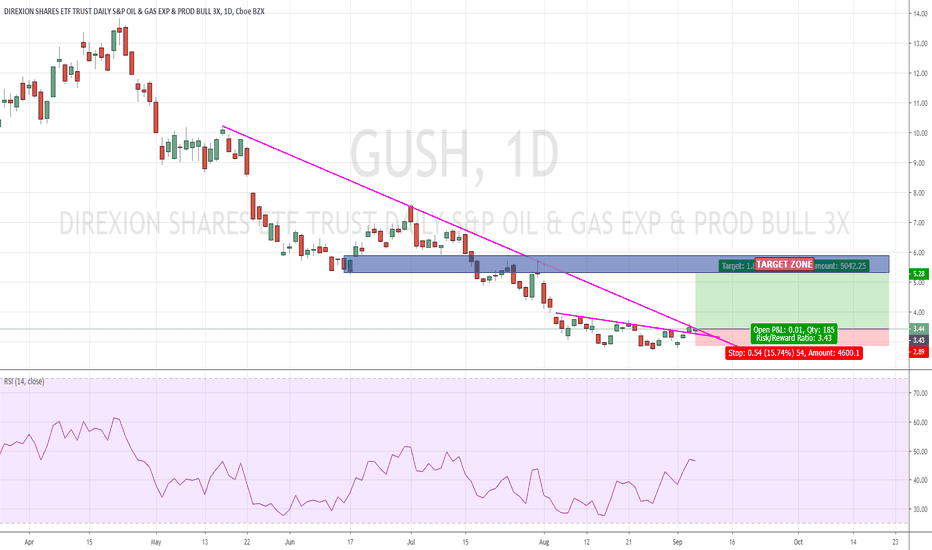

It might be time for Oil and Nat Gas to turn: Watching $GUSHGUSH Reversal?

An idea I'm considering but its a bit complicated to trade this one. 3X ETF containing a bunch of nat gas an oil stocks. Very high correlation with XOP. Watch out for decay if you plan to hold. HONOR YOUR STOP and don't be greedy yet.

Here is a screenshot of the 3 tickers shown in the idea cart.

i.imgur.com

Oil (/CL), Nat Gas (/NG), and XOP have all been in sold downtrends for quite some time now. We are entering winter (elevating factor). Trade tensions are reaching a breaking point (over reaction might be ending, new reaction could come soon). Gush has slowed its decent and is possibly reversing along with 3 other key charts.

If you are trading alone join our discord and share what you know with us. There are no GURUS and you probably should not trade based on others calls but lets push ourselves to become the best trader we can be. Its free so join in and follow your passion with others like you.

discord.gg

Like this idea no matter what and don't forget to subscribe for my private ideas.

Don't get too excited about good news in the oil marketToday oil surged on news of a huge US crude oil inventory draw. The draw was big enough that oil may continue upward for the rest of the week.

Other good news today included higher-than-expected compliance from OPEC members for production cuts and higher-than-expected oil imports to China from Iran. That means demand is a little stronger than expected, and supply is a little weaker than expected.

However, there's some bad news offsetting the good. Morgan Stanley cut its average WTI oil price outlook for the rest of the year from $58 to $55. That's below the current price of $55.86. Global demand for oil seems to be falling even as the US and China oil markets are picking up. Meanwhile, US shale producers are increasing production, and so are Venezuela and Kenya.

Oil might be good for a very short-term trade late this week, but it's unlikely that it will show any medium-term strength until the US makes progress in trade talks with China.

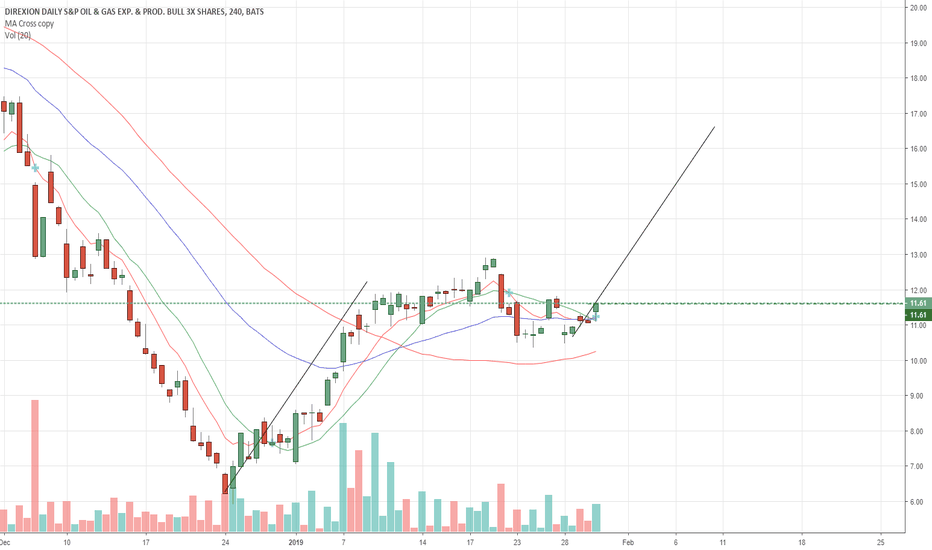

My top sector pick is oil/energyAccording to ValuEngine, one of the better analytics firms, oils and energy are the most undervalued sector right now. VE estimates that this sector is undervalued by about 32%.

Meanwhile, crude oil is in an uptrend. OPEC is looking at supply cuts, geopolitical tensions with Iran are heating up, and US crude oil inventory just posted another large supply draw. In other words, all the catalysts for this sector are pointing upward.

Although crude prices are up today, oil and gas exploration stocks are down. That's partly because of pessimism about a Fed rate cut, and partly because of resistance from down-trending moving averages. But once the GUSH fund pushes above its 50-day MA, it could pop a lot higher as the sector corrects to reflect the recent movement in crude prices.

$GUSH ; Could this be it?TraderNoxtreme here. $GUSH has been falling HARD the last two weeks roughly and people have been longing this hard on the way down. The media is now really starting to HYPE the trade war which is leading to increased uncertainty in oil/nat gas. $GUSH is a 3X ETF that has a bunch of oil and NG companies in it.

It just bounced off a 3 YEAR low this week at around 5.90...

Trump just tweeted this

"BIG NEWS! As I promised two weeks ago, the first shipment of LNG has just left the Cameron LNG Export Facility in Louisiana. Not only have thousands of JOBS been created in USA, we’re shipping freedom and opportunity abroad!"

i.imgur.com

Oversold on the hrly, 4hr, and daily!

I will likely double down at the pink line if we break it first thing tomorrow.

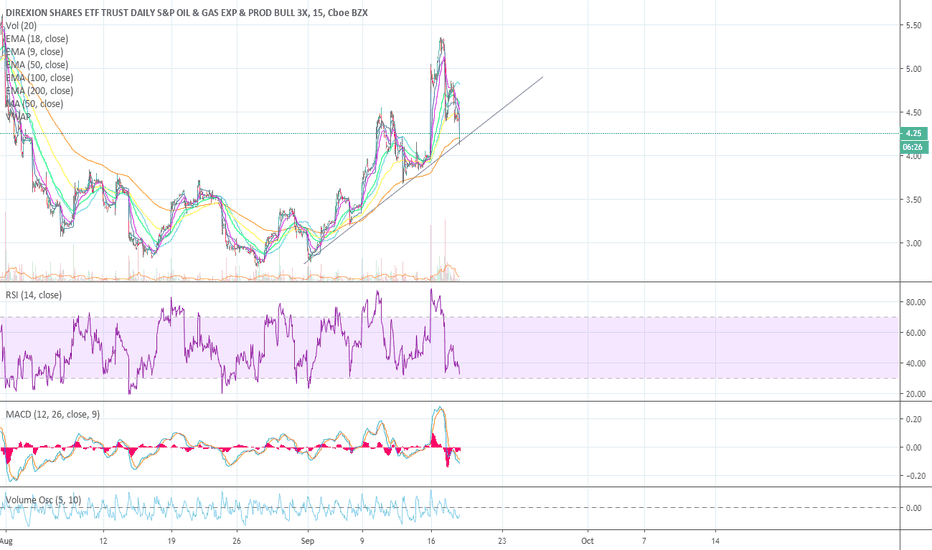

Gush is a clear buy $GUSHTechnical Indicators

The RSI isn't even close to being overly bought.

Moving averages are very bullish

Volume is bullish

I will hop out at $14.00, although this thing will prob only see resistance at $14.22 next.

What will jar me out of this trade is any sudden headline risk, or a gap down on the S&P.

GUSH LongOver correction to U.S. allowing Iran to export oil for 6 more months. Saudi Arabia meets with Russia. Russia has a budget surplus and Saudi Arabia potentially nearing bankruptcy in the next 2 years. U.S. pulls out of Yemen and Syria. Trump's arms deal not finalized. Saudi Arabia budget seems lofty. Saudi Aramco delays IPO. Expect more financial stress on Saudi Arabia as all these factors compound. Expect a return to $40 levels as SA and Russia cut oil productions and Iranian Embargoes go into full effect.