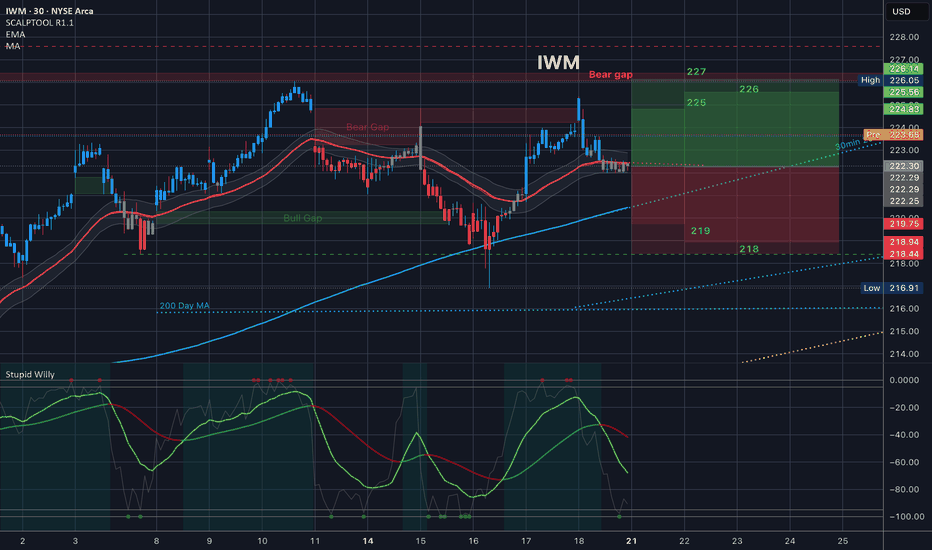

IWM Short1. Broader Market Structure 📉

1.1 Change of Character (CHoCH)

Occurred near the top (~226.70), breaking the prior higher low—signaling a shift from bullish to bearish momentum.

1.2 Break of Structure (BOS)

Confirmed by a move below that level, validating the bearish change and underlining a downtrend in progress.

2. Supply & Demand Zones

2.1 Demand Zones (Support)

Price zones where buyers have previously stepped in, marking potential reversal points:

Zone A (~223.00–223.50) – First layer of support; price tested this zone after the BOS.

Zone B (~221.80–222.20) – Mid-range demand area with historical buyer activity.

Zone C (~220.00–220.50) – Deeper support zone; last line before structural lows.

Key Takeaway: These zones represent probable stops for a short-term pullback and are ideal for long-entry decisions.

2.2 Supply Zone (Resistance)

~226.70–226.75 – Located at the level where BOS occurred; acts as near-term resistance where sellers may reassert control.

3. Price Action Inside the Bordered Area

Current Price (~224.55): Hovering between the supply and first demand zone.

Expected Movement:

A pullback into Zone A (~223.00–223.50).

If demand holds, look for a bullish reaction—forming a higher low, potentially pushing price back toward 226.70+.

Bearish Risk: A break below Zone A increases downside risk into Zone B or C, reinforcing the bearish structure.

4. Momentum & Structure Outlook

Bullish Scenario: A bounce from demand with structure preserved (~higher low) could lead to short-term upside into resistance.

Bearish Scenario: A drop below the bordered demand zone would confirm continuation of the downtrend.

Watch: Price structure around the 224–223 area and reversal cues (e.g., rejection candles, volume spikes).

IWM trade ideas

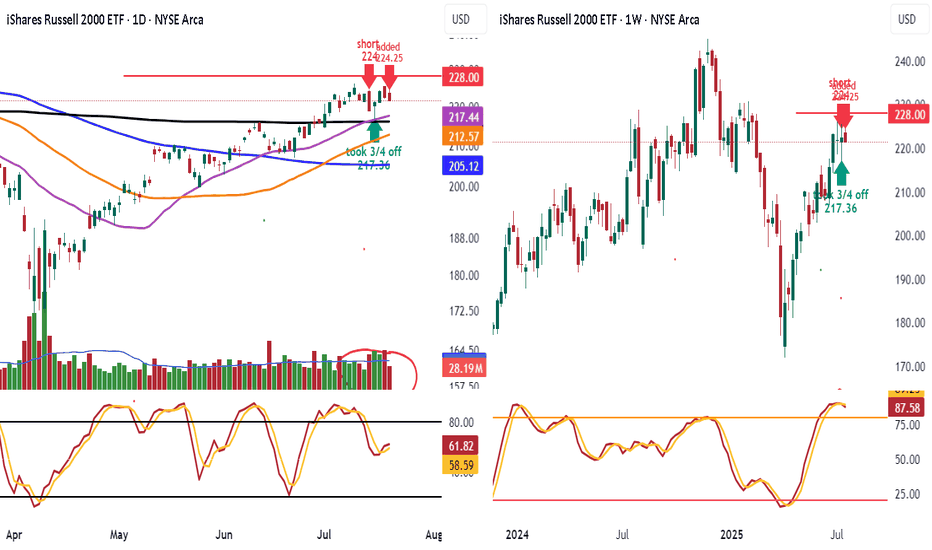

IWM short 224 and 224.25Shorted IWM going into resistance

on daily. Target is 216 I will take 3/4 off re add when breaks

the 50 day 212.57 and 100 day 205.12 watch daily stoch see they roll over

Look weekly rolling over but needs break 68%. Look weekly making lower highs

See we can get a follow thru selling today with more selling vol

Have trailing stop in place

Quantum's Missed IWM Short 8/1/25Well had a moment where I backed out of a A+++ setup. IWM had a ton of -gex pull down to 206. Would have been a massive short to end the week. I canceled my order instantly for no reason at all and missed it. Overall had a great day but this is what separates the elite from the average trader. Will work on this next week.

IWM projected pathI have three rooms full of supercomputers and then a few laptops in a spare bathroom plus a refrigerator in my wife's cardboard box running simulations 24/7 about the projected path of the Russell. Based on their findings I have determined that our previous support is now the resistance. When we come into contact with this resistance we will begin to work our way back down to fill the gap before continuing up to achieve a new all time high. When we hit resistance I have prophesized that will go mostly sideways for a numbers of days before we drop down to fill the gap. Thank you. Praise the Lord.

$IWM: Quarterly signal and Fundamental CatalystsQuarterly chart signals from time@mode show AMEX:IWM is bullish, with just 10% downside risk and over 34% upside potential into Q3 2028 or sooner.

Let's break down the key catalysts for the year ahead:

Fed rate cuts are expected to boost small cap stocks by lowering borrowing costs.

Small business sentiment is at multi year highs, supporting Russell 2000 earnings growth.

Valuations remain attractive: AMEX:IWM trades at a discount to large caps, with room for mean reversion.

Sector rotation: Money is flowing into industrials, financials, and cyclicals, core IWM sectors.

Risk reward is compelling: Upside vs risk and strong macro and earnings tailwinds make this a high conviction long idea for the next 12 months and beyond.

Best of luck!

Cheers,

Ivan Labrie.

Preponderance of (or Preposterous?) Evidence

I was just proposing yesterday staying neutral in SPY (the S&P 500 ETF). The FOMC meeting today (Jun 18th) was a big-nothing burger (so far), which supports my (non)position, but we'll see. I will update that post when the time is right (ATH, 200dma, or bust).

Today, though, the IWM (the Russell 2000 Small Cap Index ETF) and, surprisingly, a potential short position.

First, the IWM (see below) is overbought on a weekly chart, with the Stochastics being above 80 (more on Stochastics and weekly charts at a later date). For now, let's go with IWM being a little overbought, in the longer-term view.

Now, let's switch to the big daily chart at the top and look at the evidence for going short;

- IWM never really got above it's 200-day moving average (purple line),

- That same level was consistent with a lot of resistance ~213 (yellow circles),

- IWM has trailed this whole rally.

- It has broken and somewhat retested a trendline (light blue) from this most recent rally,

- It bounced off it's 61.8% Fibonacci level (orange line, not my favorite indicator for ETFs, but I often sneak a peek),

- It's at its previous resistance high around 209 (blue circles).

On the not-bearish side;

- The daily chart is less overbought (this has to happen on weakness, though),

- There's (a little) support at 199 but not really again until 172,

- I still feel like the All-Time-High (ATH) is a magnet for the S&P (but IWM has trailed).

That's (a lot) more (and better) points for being bearish.

I'll go short (via a ~90 day ITM put position*) if IWM breaks below 207.50, between that and 202. If it opens lower than 202, I'll wait for a pull-up.

The stop will be a close above the 200 day.

The target is 172 (the previous tariff low), but I will lighten/tighten up (by selling OTM puts* and/or moving stop down) as IWM drops (if it drops).

It may seem a bit duplicitous to be neutral on SPY while being bearish on IWM.

But sometimes you have to go with the Preponderance of Evidence (or will it prove Preposterous Evidence?)

An update will be coming.

*Sorry for bringing up options. One can just go short IWM. I will explain my option choice one day.

My ideas here on TradingView are for educational purposes only. It is NOT trading advice. I often lose money and you would be a fool to follow me blindly.

Market Update - 6/29/2025- Strong close on Friday especially in consumer related names

- Most excited about retail/consumer/DTC names, especialy NASDAQ:ODD , NASDAQ:NAGE , $YSG.

- AI names are back on the radar, and quantum computing has been for a while -> speculation money is back

- Breadth and market in general looks very constructive, so we will likely continue going higher

- Been very protective with my account, keeping losses below 0.1% as the market has been choppy since May 12

- However, if we start another leg higher, I'll go much more aggressive, maybe 0.5-1% of my account in strong names

The Ghost of 1986-1987 Stock Market Overlay onto $IWMThe 1986-1987 stock market advance was 48% as measured by the S&P500 Index SP:SPX from the low in late 1986 which peaked in August 1987 and crashed into October 19th's spectacular 20% decline in one day.

The advance in the Russell 2000 Index from the low in 2023 to the high in 2024 was 51%, topping the 48% gain in the SP:SPX and the meltdown wasn't as spectacular, but it was similar.

There were similar patterns in fears of trade wars, US dollar declines, new tax laws going into effect back then and tax laws sunsetting this time. Those you can go into by reviewing my other charts I have published over the years here.

I stretched the 1987 pattern to fit the low to the high, so it isn't "exactly" the same time day-to-day for this pattern.

I found it interesting because the chart of AMEX:IWM all by itself had the same "look" to me as the 1987 bull market and crash so I decided to put it together for you all here to see.

I would expect a choppy market from here on as people adjust to the new uncertainties. Sellers of this decline will be shy to reinvest anytime soon and buyers are likely afraid to step up and get aggressive with so much uncertainty.

Sentiment as measured by AAII shows an extremely fearful and reluctant investor class, which is typical to see at major market bottoms.

Wishing everyone peace and prosperity!

Tim West

11:17AM EST April 24, 2025

Small Caps about to get SlammedThe IWM has been trading inside this upward sloping wedge/bear flag for a few months. It just broke the bear flag this week and then tested the underside of it as resistance before getting rejected. This area also happens to be a golden pocket retracement zone from a Fibonacci I have drawn from the all-time highs made in November of last year to the lows made 2 months ago in April. The next probable move is back down to target 1 at the bottom of the Fibonacci retracement at $171. These golden pocket retracements have a very high probability of moving back down to the bottom of the retracement, sometimes breaking lower. This area at $171 has a lot of support but if it breaks, I expect it to come down to the orange line which is an upward sloping paralell channel that the IWM has been trading in since the financial crisis of 2008. The bottom of said channel connects the 2009 lows through the covid lows of 2020. This area also happens to be the -0.618 Fibonacci retracement area, it would be the 3rd hit of the bottom this major weekly channel and would very likely contain the lows for the current bear market.

IwmInteresting spot here ...

Bulls see Inverted H&S

Bears see , rising wedge

I see an inflection point.

We are sitting at the bottom of a wedge.. depending on what happens the next 2 days

We either test 204 or 217

Below 208.00 and iwm goes straight to 204.00

Above 212.00 and 217 comes ...

209 is daily 200ema

216 is daily 200sma and weekly 50ma

So 209-216 is chop....