JNUG LONG TRIGGER TARGET ON THE DAILYThere is a wolfe wave setup on the Daily time frame. The projected target is calculated by extending a linear line between pivot 1 and 4 and projecting the line. This is represented as the green perforated line, as shown in the chart. The projected target is approx $75 which is expected to reach this price target within 12 days.

JNUG trade ideas

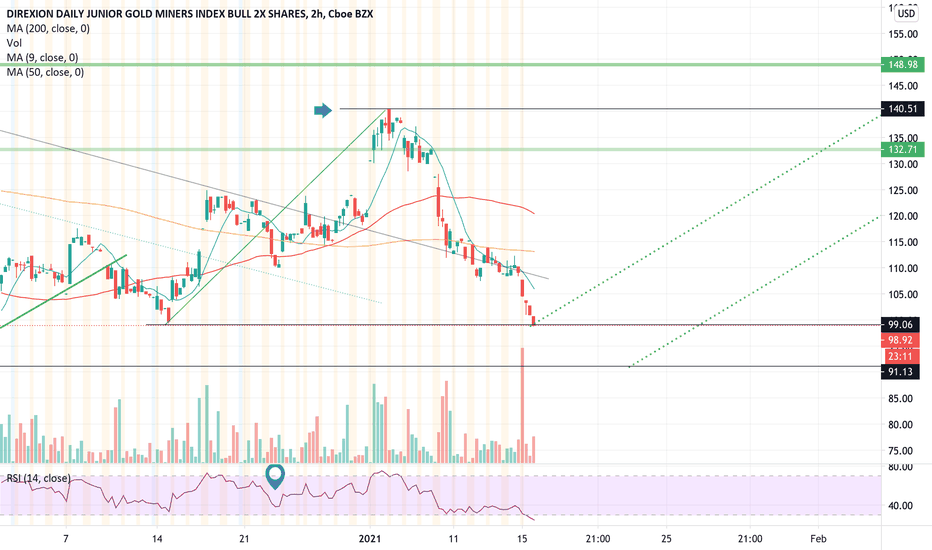

Possible Rally in JNUG?Relatively new to TA so would appreciate any constructive feedback/correction but go easy on me as I'm still learning.

Possible swing for JNUG in the near future.

-RSI oversold territory

-MACD divergence coming soon

-Below 50 and 200 MA

-Still in downward channel

-Gold is up-trending

Mainly positing to get feedback about the double bottoms. If anyone wants to shed some light if those are actual double bottoms please lmk

Thanks!

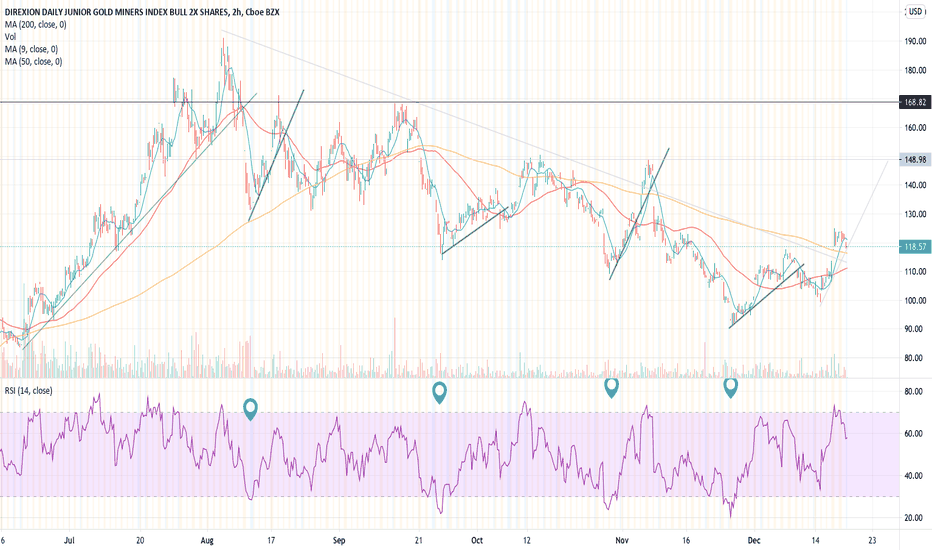

$JNUG - Quantitative Easing | 1-Year Low | Long on BricksThe government is printing money like it is going out of style right now. The US National debt is almost at 28 TRILLION, which is roughly 128% of our GDP!!! If this does not alarm you I don't know what will. Do you hear any plans to fix this or just hear more plans to spend more money? This problem started when we went away from the gold standard in 1973, at this point the dollar was backed by? NOTHING aka the Fed, who can just print as much as they want. Seriously how is there not a limit to money printing? The value of the USD is now near 5-year lows.

It is for all these reasons that I am a huge Crypto/BTC enthusiast - you can't just print more, there is a finite amount. No one governs it, it is more easily broken down into small quantities, the list of things you can buy is growing, no one person or company controls it, and you know transactions can't be tampered with or changed.

We are here to talk $JNUG right? LOL. To me, BTC is the new gold, but that does not mean Gold is going anywhere, they will coexist. The last time I traded $JNUG was March 2020 and I experienced exponential gains, this won't be that dramatic, but we have a great opportunity in front of us.

JNUG provides geared exposure (2x) to the Market Vectors Junior Gold Miners Index—a market-cap-weighted index of global gold mining companies that derive at least 50% of their revenue from gold or silver mining activities.

Technical Analysis

- Strong Resistance @$94

- We can't break $88 or we break the uptrend and we need to re-do our TA.

- Options or share entry @$94-$96

- Price Target #1: $112 (Strong Resistance)

- Price Target #2: $131 (Weak Resistance)

- Price Target #3: $154 (Strong Resistance)

- Price Target #4: $190 (1-Year High)

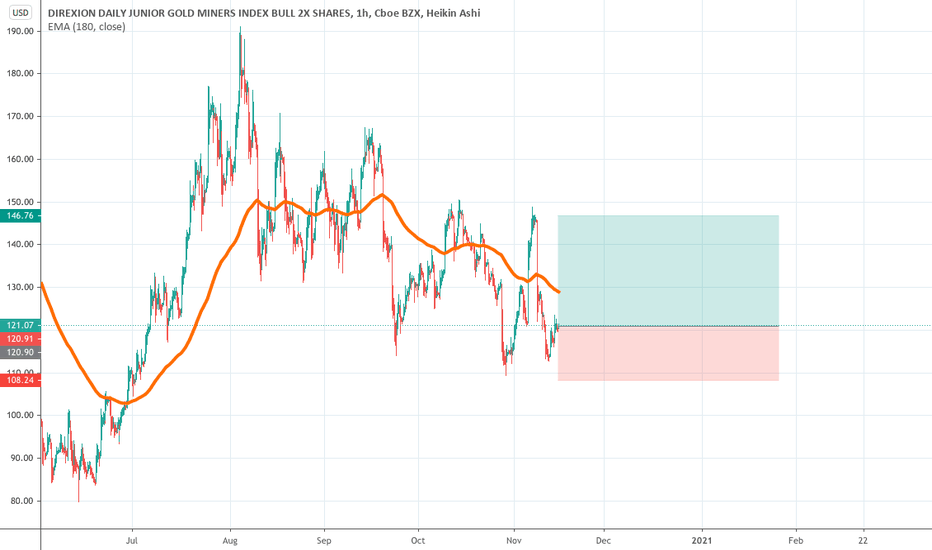

BUY $JNUG - NRPicks Ene 10Direxion Shares ETF Trust - Direxion Daily Junior Gold Miners Index Bull 2X Shares is an exchange traded fund launched by Direxion Investments. It invests through derivatives and through other funds in stocks of companies operating across materials, metals and mining, gold, silver sectors. The fund seeks to track 2x the daily performance of the MVIS Global Junior Gold Miners Index.

Technical:

Support in Fib retracement 0.236 ($117.00)

Support in 200 MA vs 50 MA

Elliot Impulse Wave (5)

Accumulation Zone

JNUG Bull FlagAMEX:JNUG Bull flag in play here.

Long over $148

None of the content published constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Information provided in this correspondence is intended solely for informational purposes and is in no way guaranteed.For financial advise seek appropriate investment advice from a licensed Industry representative.

LONG Gold Miners on Consolidation Breakout & Close on D1Long all four names on pullback/retest just above consolidation breakout zone on continued earnings flow & dividend increases sector-wide. Initial stop below most recent swing low below the breakout zone. Hold long position through further price markup into monthly R2 pivot resistance line, at which point reduce exposure by 1/3 just below monthly R2 level and bring stop to above break-even average cost-basis price, targeting December 2020 monthly pivot point R2 zone. Not advice but does appear to be higher probability setup as the Gold Miner should continue to print big revenues & earnings into early next year. Keep eye on NUGT & JNUG as they are 2x levered to the GDX & GDXJ respectively. Not for faint of heart, but is attractive nonetheless; however, only with proper rigorous risk-management by experienced trader should these even be considered. The safer (non-levered) play here (in my humble, non-expert view) would be the SGDM & SDGJ, as they are not levered ETFs.

Potential breakout on gold, JNUG to 190JNUG and MACD rising after every rejection off 161. Recently have had another retest of the resistance line, and have successfully broken, and maintained above the 38.2 Fibb Level. Should this hold, potential breakout in gold on the way. Alt is gold falling below the 38.2 Fibb level, and going to retest the support lows. Copyright Rohan Karunaratne.