KRE trade ideas

$KRE Swing Trade Strangle Call Debit Spread & Put Debit SpreadAMEX:KRE

Bto 6/17/25 3:48pm PDS Jul18 54/53 Paid 0.27

Open BB 8EMA at Trap bearish, with error at the gap down. keep position until confirmation to change trend.

Bto 6/25/25 3:50pm CDS Oct17 69/70 Paid 0.06

Open BA 8EMA , Confirmation pull back , and PBJ 200SMA/200EMA. This day NYSE:C NYSE:BAC Squeeze. More confirmation to go Long.

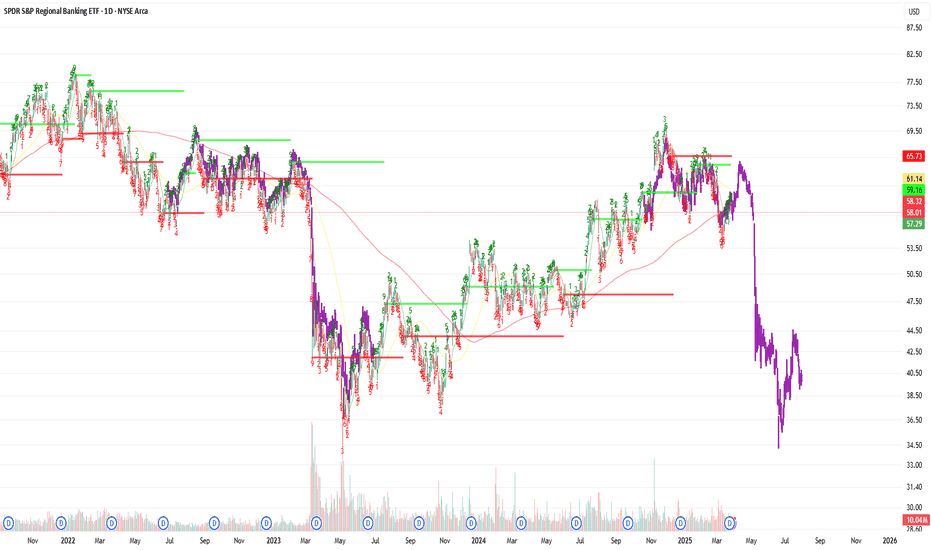

KRE Regional Banks In Trouble?KRE is starting to scream Danger! Wave 3 up ending. Multiple head and shoulders (one massive) the current uptrending is now starting to CRACK! signaling that the right shoulder will now start to form.

I see no benefit for bulls to hold on as risk is now very high. Furthermore, this is a bad sign for the overall economy and markets as regional banks are US domestic. Bad JUJU!

Don't be a dick for tick! ))

$KRE CRASH COMING ... Not yet tho..we'll find out..Regional Banks seem to be heading on a slippery path identical to the most previous crash pattern back when they needed all the loan Bailouts. Now that all the loans have stopped, I'm sure some banks may be heading towards loan restructuring perhaps, maybe defaults, I'm not sure honestly. I just know that the chart never lies and I've been watching and waiting for a long while. I predicted the first crash back then and I currently have no doubts with the current chart ahead of me. As always, I will do my best to provide the best insight possible into these speculations. Currently we have the Daily breaking trend and the bar count getting close to the previous 141 bars. The only difference is that we bounce off the 100% retracement. If we continue to lose the 1.27, we'll be headed for the 1.61..... updates soon.

$KRE REGIONAL BANK Crash? Identical Setup to March 23'Identical Setup to 23' Regional Bank Crash. As always, not sure what the trigger will be, but I will do my best to keep everyone updated as usual. Target of $58 from $60s reached. I'll be expecting a bit more come June. Watch for the sideways movement and rally until then.

Important Warning for 2025:There’s a big problem brewing in the economy. A chart shows that regional banks’ stock prices are under a lot of pressure. This means small, local banks (like those serving small towns in Pakistan) are facing trouble. If these banks struggle, it can cause problems for the overall economy. In 2025, we might see tough economic times, so anyone trading or investing should be very careful.

Instead of showing you the chart directly, I’ll guide you on how to make and understand your own chart. This way, you’ll know how to analyze and trade stocks, crypto, or gold.

What is Happening?

This chart shows the bear flag pattern and a breakdown of support levels, signaling a potential fall in regional bank stocks.

Trade Setup Details:

1. Entry Point:

• Short Entry: Enter if the price stays below $58 (confirming a breakout).

• Why? Breaking $58 means the price is likely to fall further.

2. Stop Loss:

• Set your stop loss above $60.

• Why? If the price moves above $60, the bear flag pattern is invalid, and the trend could reverse.

3. Profit Targets:

• Target 1 (T1): $54

• Why? This is the next strong support level.

• Target 2 (T2): $50

• Why? A longer-term support level from June 2024.

• Target 3 (T3): $48

• Why? If $50 breaks, $48 is the ultimate support level.

4. Risk-Reward Ratio:

• Risk: $2 (Entry at $58, stop loss at $60)

• Reward: $4-$10 (Targets $54, $50, $48)

• Why? The reward is higher than the risk, making this a safer trade.

Summary:

Regional bank stocks are showing warning signs, and this could affect the economy in 2025. Understand and practice these trade setups, manage your risk, and always analyze charts before making a decision. The more you practice, the better you’ll get at predicting trends

KRE Seems to be in troubleIts in a big trouble.

Entry Short: 61

Stop Loss: 63.60

Exit: ~36

This is a potential 40% gain in 6 months.

All the best.

Marketpanda

Disclaimer: The information provided is for general informational and educational purposes only, and does not constitute financial, investment, or legal advice. None of the content shared should be relied upon as the sole basis for making investment decisions. Prior to making any financial or investment decisions, it is strongly recommended that you consult with a qualified financial advisor, accountant, or other professional who is familiar with your individual circumstances and risk tolerance. Any reliance you place on the information presented is strictly at your own risk, and we are not responsible for any losses, damages, or liabilities resulting from your investment or trading activities.

Regional Banks - Monthly break out, shall it continue?Well, with RTY outperforming the CrackDaq and Spiders TODAY, let's see if a flight to quality takes place as we transition into 25' and the Orange Man's presidency.... tariff's if the come may not be good for larger corporations, but small business and regional banks may be a safe haven in this time of uncertainty.

Opening (IRA): KRE Oct 18th 49/57/57/65 Iron Fly... for a 4.14 credit.

Comments: High IVR/IV at 67.1/39. Another small nondirectional in an underlying that I'm not currently in while I bide my time waiting on other positions .... .

Metrics:

Max Profit: 4.14

Buying Power Effect: 3.86

ROC at Max: 107.25%

25% Max: 1.04

ROC at 25% Max: 26.81%

Is this showing us the end of regional banks in 2025?I saw a Head & Shoulder Pattern at the top of this chart. Then I saw another one on the left side. I measured the fractals of the patterns and saw a remacable match of several price actions at similar places. The ratios were nearly the same.

So i looked right. I mean on the right side of the chart and saw the potential beginning of a new similar pattern? Am I biased or is it really the beginning of a nother left shoulder of a H&S pattern. This time the right shoulder of an overarching, bigger H&S pattern. The continuation would mean that we will have a potential break down on the right side of the chart around April next year. If it plays out the KRE, regional banking ETF could go to zero.

Ok. Technically possible. What would be the story behind? Could the CBDC thing be brought in conjuncture with with the fall of the regional banks. Who would need them anymore?

Or another big never seen reason crash?

Show me a chart and I tell you the story is my motto.

What I see is just potential. Just a thought. But IF it will develop and I see signs of acontinuation of this fractal structure, I would have much more confidence in the fall of the regional banking system in the USA.

This will take time and is a long term view.

Only Time will tell...

$KRE massive H&S top?Thanks to @TORNADOF5 for reminding me about this.

A friend sent me a tweet last night about how banks are levered up on debt and that prompted me to look at the chart of KRE.

As you might remember, AMEX:KRE was one of the worst performing ETFs at the beginning of this year with the failure of a ton of local banks. But since earlier this year, I haven't heard much talk about banks being in trouble.

Well I pulled up the chart, I was surprised to see a massive H&S top forming. If price breaks $37-38, then I could see a big move down. The first target would be $29 and if price gets under that, it could get really bad.

Could see price making it all the way to the lower support levels.

Let's keep an eye on this because it'll be a great trade should it play out.

Opening (IRA): KRE Sept 20th 42 Covered Call... for a 40.73 debit.

Comments: Adding to my KRE (IVR/IV 50.4/28.6) position with a setup out in the September monthly that has a break even better than what I currently have on. Selling the -75 delta call against a one lot to emulate the delta metrics of a 25 delta short put with the built-in defense of the short call.

Additionally, attempting to grab a little more June divvy if I can, with ex-dividend not having been declared yet.

Metrics:

Buying Power Effect/Break Even: 40.73

Max Profit: 1.27 ($127)

ROC at Max: 3.12%

50% Max: .64

ROC at 50% Max: 1.56%

US Bank about to implode! Regional Banking is gonna take a hit!First you have the FDIC come out and say no matter what we can whether a large US Bank failure - out of nowhere! Japan is stuck in a corner, can't sell bonds to defend its currency, and can't raise rates enough. Like every Central Bank they're stuck. So now a large US bank will be "allowed" to fail that will give Powell the excuse to cut rates - leading to a large reinflation boost (precious metals).

Biden even hinted at rates coming down in July so this regional bank implosion has to happen soon. I don't see banking in the USA doing good long term because the banking structure needs to be consolidated to isolate and do away with cash so they can bring out CBDC's. At that point banks will be "stakeholders" which is fancy speak for fascist government control over corporations, but from an international level.

Also, TTM Squeeze indicator is loaded on every TF except Monthly, which showed that it already went off and is gathering steam for the next leg down in the breakout, but a very powerful move since this is signaling on the weekly chart.

Opening (IRA): KRE August 19th 44 Monied Covered Call... for a 42.98 debit.

Comments: Hitting a little KRE (IVR/IV 42/28) on weakness here, looking primarily to grab the June dividend (March distribution: .38; 3.19% annualized). Selling the -75 call against a one lot to emulate the delta metrics of a 25 delta short put with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 42.98

Max Profit: 1.02 ($102) ex. dividend

ROC at Max: 2.37%

50% Max: .51 ($51) ex. dividend

ROC at 50% Max: 1.19%

Will primarily look to take profit at 50% max, roll out the short call on test ... .

KRE: Regional Bank Collapse?Financials have been demonstrating some interesting price action. We believe financials in the near term could be in for some choppy negative price action.

With yields now sitting at support during the recent selloff, banks haven't done all that well.

Were now at a point in the inflation fight where we could experience an upside move in inflation.

We just witnessed today the Canadian CPI came in much hotter.

To make matters worse, were at a time when central banks like the ECB, BOC, PBOC, BOJ are all loosening policy.

However this very laxy=daisy policy is what caused Oil to bottom on June 4th.

Oil has since moved up 13% in 2.5 weeks.

This will likely cause yields to have upward pressure since its inflationary to the economy.

If the US CPI comes in hotter expect no 2024 rate cut...banks would hate that. Im eyeing the head and shoulders breakdown.

Natural Gas, Bitcoin & QQQ : Whats the next trade?Natural GAs has had a nice pullback over the last few days.

Are we going to see this correction go deeper than the last pullback?

Potentially we are observing a failed breakout on the daily chart.

Bitcoin: has triggered bearish formations on the hourly chart.

Sitting right at intermediate support, BTC needs to hold the 50MA or run the risk of flushing lower.

BTC is still chopping in a sideways range that favors lower price action until we break the neckline.

QQQ / Nasdaq : In the strongest uptrend. This looks likely to push a bit higher but its nearing major resistance in a very extended move.