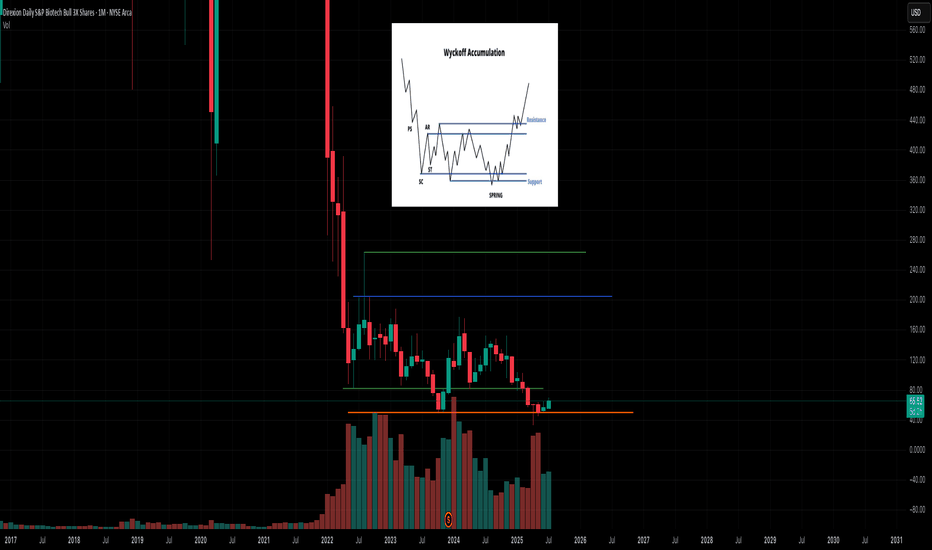

If you can hold for 2 years could be a nice entry around here haLooks to be in a very SLOW accumulation process. We will have a BIO-tech revolution it's inevitable; just make take years before it actually manifests in the sector. I have psoriasis and the should be a FKIN cure by now rofl. BS. AI will make it happen. MONTHLY CHARY

Key stats

About Direxion Daily S&P Biotech Bull 3X Shares

Home page

Inception date

May 28, 2015

Structure

Open-Ended Fund

Replication method

Synthetic

Dividend treatment

Distributes

Distribution tax treatment

Ordinary income

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

Rafferty Asset Management LLC

Distributor

Foreside Fund Services LLC

LABU is a daily 3x leveraged bet on an equal-weighted index of US biotech stocks. The vast majority of the fund's exposure is to biotechnology and medical research but also captures significant exposure to pharmaceuticals as well. As a leveraged product, the fund is not a buy-and-hold investment. It gets its leverage exposure through a portfolio of derivatives contracts that gets rebalanced at the end of each trading day. Because of that, the fund's return for periods longer than a day becomes path-dependent and is likely to be different from 3x the return of the index for the same period. This makes LABU suitable primarily for short-term traders. Over time, compounding effects can lead to profound differences in expected returns relative to the index.

Related funds

Classification

What's in the fund

Exposure type

Health Technology

Cash

Stock breakdown by region

Top 10 holdings

NKE Pump to ~70The Pump & Dump King (PNDK) just announced they will be pumping and dumping

during press conference with Canadian PM Mark Carney.

The pump is happening Thursday or Friday.

Nike NKE sets up perfectly for a rally to ~70

May the Fork be with you!

NotTradingAdvice

YourOwnRisk

ResearchFractals

PitchFo

LONG LABUThere is a great potential reward to risk ratio on LABU that is trending in a parallel channel.

The idea is to buy at the bottom of the channel an sell at the top on un uptrend.

Buy 124

Stop loss 119 ((just below the most discernable low)

Take profit 149 (at the top of the channel that coincides

LABU Stock Chart Fibonacci Analysis 032124Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 136/61.80%

1) Find a FIBO slingshot

2) Check FIBO 423.60% level

3) Hit the top = 57/423.60%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep ris

LABU a 3X leveraged ETF of biotechnology stocks LONGLABU on a 240-minute chart has been in a trend up gaining 100% in 3 months. Both the fast and

slow ( green and red) are above the 50 level. Biotechnology is expected to be a hot subsector

this year as healthcare recovered further from the COVID pandemic anything from startups to

big pharma-

LABU / LABD Ratio Anchored VWAP over /under LABU LONGOn the weekly chart a LABU / LABD ratio is plotted with anchored VWAP bands and a volume

profile overlaid. I wanted to analyze this to affirm the highest of prospects for the

Biotechnology sector for 2024. LABU is triple leveraged Up while LABD is the inverse Down.

A good unleveraged biotech

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

LABU trades at 65.52 USD today, its price has risen 0.31% in the past 24 hours. Track more dynamics on LABU price chart.

LABU net asset value is 65.44 today — it's risen 11.91% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

LABU assets under management is 683.06 M USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

LABU price has risen by 11.35% over the last month, and its yearly performance shows a −52.78% decrease. See more dynamics on LABU price chart.

NAV returns, another gauge of an ETF dynamics, showed a 18.93% increase in three-month performance and has decreased by −51.73% in a year.

NAV returns, another gauge of an ETF dynamics, showed a 18.93% increase in three-month performance and has decreased by −51.73% in a year.

LABU fund flows account for −65.03 M USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

LABU invests in stocks. See more details in our Analysis section.

LABU expense ratio is 0.93%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

Yes, LABU is a leveraged ETF, meaning it uses borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, LABU technical analysis shows the buy rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating LABU shows the sell signal. See more of LABU technicals for a more comprehensive analysis.

Today, LABU technical analysis shows the buy rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating LABU shows the sell signal. See more of LABU technicals for a more comprehensive analysis.

Yes, LABU pays dividends to its holders with the dividend yield of 0.50%.

LABU trades at a premium (0.13%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

LABU shares are issued by Rafferty Asset Management LLC

LABU follows the S&P Biotechnology Select Industry. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on May 28, 2015.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.