MSOS Long with 150% Upside - Cannabis Rescheduling Catalyst💠 Catalyst : Cannabis is currently classified as a schedule I drug alongside heroin, bath salts, and synthetic opioids that kill thousands every year — all while being safer than Tylenol and legal in over half the country. Cannabis is likely to be rescheduled to a schedule III drug soon after Terry Cole is confirmed as the head of the DEA. The vote to confirm him is expected to take place...TODAY

As a schedule I drug, cannabis companies can’t deduct regular business expenses for tax purposes, have limited access to banking, must transact with customers in all cash, and US multi-state operators are unable to list on the major US exchanges.

Terry Cole will be confirmed as the new head of the DEA, and when he is confirmed, the stalled process to reschedule cannabis from a schedule I to a schedule III drug should resume. If cannabis is rescheduled, that will pave the way for further research, destigmatize it, and open the door to banking and uplisting of US multi-state operators to the major exchanges in the near future.

This trade capitalizes on the fact that investors are not positioned for reform and further positive catalysts. The worst-case scenario is priced into the MSOS ETF, and when good news on rescheduling hits the tape, that should start a NEW Bull market in the MSOS cannabis stocks.

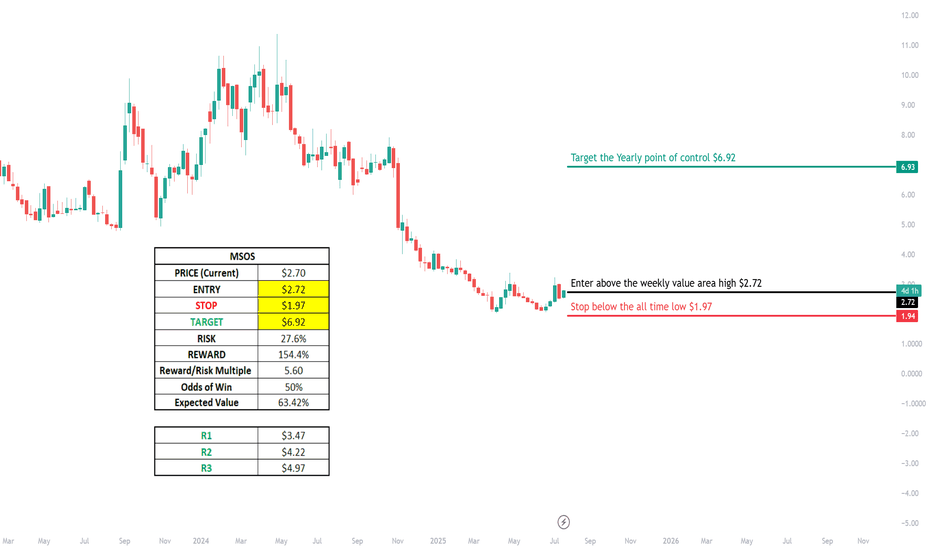

💠 Technical Setup:

Bear Market

• Multi-year bear market throughout the entire Biden administration on promises to reschedule that were never followed through on

• Capitulation when Trump won the election on the prospect of potentially another 4 years of no reform

Bearish to Bullish Technical Transition!

• LT Stage 1A Bottom Signal (Price > 50D SMA)

• ST Stage 2A Breakout (First day Price > 10D EMA and 20D SMA)

• Hourly Chart – Breaking out above Weekly Value Area

• Daily Chart – Trading above the Monthly Value Area

• Overlapping prior monthly value areas in sight!

• VPOC in sight!

• Weekly Chart – Targeting a retest of the Yearly POC

💠 Trade Plan

ENTRY: $2.72 (Break above weekly value area high)

STOP: $1.97 (Below the prior all-time-low)

TARGET: 6.92 (A retest of the yearly point of control from 2024)

RISK: 27.6%

REWARD: 154.4%

R/R Multiple: 5.6X

Probability of Win: 50%

Expected Value: 63.42%

MSOS trade ideas

MSOS Long with 150% Upside - Cannabis Rescheduling Catalyst💠 Catalyst: Cannabis is currently classified as a schedule I drug alongside heroin, bath salts, and synthetic opioids that kill thousands every year — all while being safer than Tylenol and legal in over half the country. Cannabis is likely to be rescheduled to a schedule III drug soon after Terry Cole is confirmed as the head of the DEA. The vote to confirm him is expected to take place...TODAY

As a schedule I drug, cannabis companies can’t deduct regular business expenses for tax purposes, have limited access to banking, must transact with customers in all cash, and US multi-state operators are unable to list on the major US exchanges.

Terry Cole will be confirmed as the new head of the DEA, and when he is confirmed, the stalled process to reschedule cannabis from a schedule I to a schedule III drug should resume. If cannabis is rescheduled, that will pave the way for further research, destigmatize it, and open the door to banking and uplisting of US multi-state operators to the major exchanges in the near future.

This trade capitalizes on the fact that investors are not positioned for reform and further positive catalysts. The worst-case scenario is priced into the MSOS ETF, and when good news on rescheduling hits the tape, that should start a NEW Bull market in the MSOS cannabis stocks.

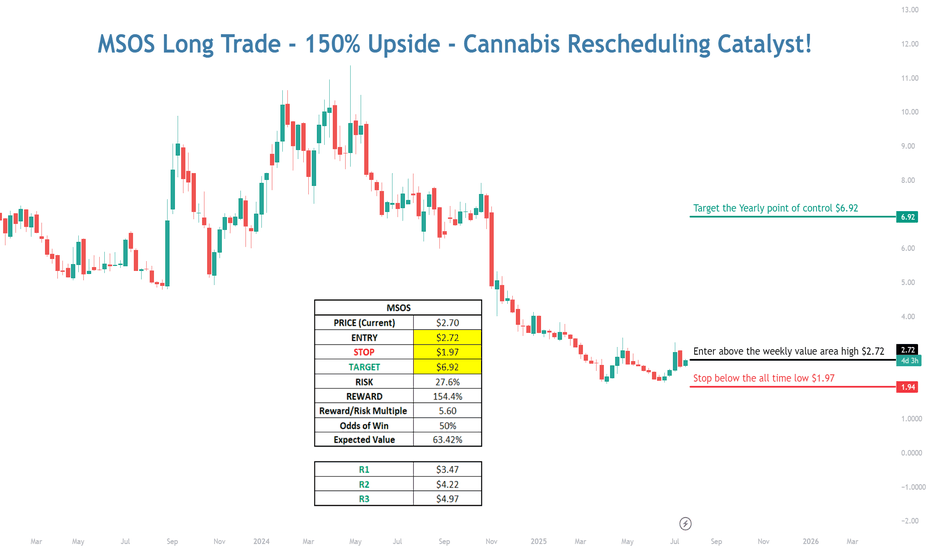

💠 Technical Setup:

Bear Market

• Multi-year bear market throughout the entire Biden administration on promises to reschedule that were never followed through on

• Capitulation when Trump won the election on the prospect of potentially another 4 years of no reform

Bearish to Bullish Technical Transition!

• LT Stage 1A Bottom Signal (Price > 50D SMA)

• ST Stage 2A Breakout (First day Price > 10D EMA and 20D SMA)

• Hourly Chart – Breaking out above Weekly Value Area

• Daily Chart – Trading above the Monthly Value Area

• Overlapping prior monthly value areas in sight!

• VPOC in sight!

• Weekly Chart – Targeting a retest of the Yearly POC

💠 Trade Plan

ENTRY: $2.72 (Break above weekly value area high)

STOP: $1.97 (Below the prior all-time-low)

TARGET: 6.92 (A retest of the yearly point of control from 2024)

RISK: 27.6%

REWARD: 154.4%

R/R Multiple: 5.6X

Probability of Win: 50%

Expected Value: 63.42%

$MSOS long term buy hereAMEX:MSOS hit my long term downside target yesterday of $2.46 and I entered a starter position down there. It's up 9% today.

There is still the possibility that we get a final capitulation move from here down to $1.55 or so, and if we get it, I'll add a much heavier position. But basically from here, I think we've bottomed long term and should see a very healthy bull market start which can take us to $29 as a first target and then potentially much higher in the future.

I think this is at least a 10X from a long term hold perspective and potentially much more.

Weed stocks over sold from tax loss harvesting?Ive traded gtbif green thumb successful before and think this might be the time to trade again. Gtbif is one of the biggest holdings inside this Msos etf.

I like the etf MSOS, the shares of GTBIF, and any of the other profitable Cannabis stocks.

Looking for mean reversion, even 2x upside potentially.

Long 3 strike calls on MSOS.

if trade in options works, I may roll back into the etf and keep for free from gains.

MSOS the cannabis trade we all need to know about Election Day in Florida is right around the corner, and Amendment 3 has got cannabis investors buzzing. If you're keeping tabs on the market, you've probably noticed MSOS popping up everywhere.

MSOS, short for the AdvisorShares Pure US Cannabis ETF, isn't your average investment fund. It's more like a front-row ticket to America's green rush. This ETF is loaded with derivatives tied to the most promising U.S. cannabis companies, perfectly positioned to catch the next big wave. And that wave? It might just be breaking in the Sunshine State.

If Florida votes yes on Amendment 3, we're not just talking about a new market for legal weed. We're looking at a potential earthquake in one of America's biggest states. The aftershocks could send MSOS through the roof.

But let's get real for a second. This isn't a guaranteed win. The cannabis market is about as stable as a house of cards in a hurricane. One wrong move from Washington or a shift in public opinion, and MSOS could crash faster than you can say "bad trip."

Still, for those of you with nerves of steel and a appetite for risk, MSOS could be the play of 2024. It's essentially a bet on U.S. cannabis, with Florida's vote as the potential spark to light the fuse.

Just remember, I'm not a financial guru – I'm just a guy with an opinion and a keyboard. Don't go betting your life savings based on what you read here. But if you've got some cash you're willing to gamble with and you believe legalization is inevitable, MSOS might be worth checking out.

Me? I'll be glued to my screen on election night, snacks at the ready, maybe with a small stake in MSOS for good measure. Whatever happens, it's gonna be one wild ride. Hold onto your hats, folks!

Could rally over $11 in 4 to 6 weeks IMHOReclassification is here - it's right around the corner.

Overall, rescheduling ain't gonna do much. It will classify marijuana as a drug that has

potential for abuse, while still being acknowledged for its medicinal benefits.

The kicker though is the tax and banking implications.

1. Reclassifying cannabis to Schedule III will move it out of the purview of IRC Sec. 280E

2. In the states where marijuana is legal, these cannabis companies can deduct their ordinary business expenses for purposes of their state income tax.

3. All or most of MSOS's holdings will have a better tax advantage = more money in their

pockets...

4. Although safebanking is still needed - I guarentee you that bank servicing of cannabis companies will move foward with reclassification

5. Compound this with lower interest rates in the next 6 months. Small cap rotation.

6. Last 4-5 buy signals outta 10 saw 30-50% gains

6. ONE HUGE CAVEAT = The elections and what direction Trump will go.

Just some thoughts. Good luck ya'll

MSOS Long 7/13/24Anticipating the completion of wave following the development of a diagonal wave .

A rapid impulsive reversal should confirm wave is complete and wave is in progress towards and through 11.37. Alternatively, if price fails to develop in an impulsive manner, it may signal wave is not yet complete.

Short term Bullish on MSOSMSOS felt from its channel 2 weeks ago, but I see good potential for a bounce:

1. High probability it will back test lost support, which is around 9-9.20 mark.

2. Bullish divergence on 1H

3. Oversold on 4H

4. Gap filled at 7.72

5. Good volume yesterday comparing past few weeks

6. Sitting at the bottom of Bollinger 1-4H

7. Double bottom across past 5 days

8. Good news / GOP Congressional Committee Removes D.C. Marijuana Sales Ban And Adds Cannabis Banking Protections In Key Spending Bill

My target is 9, where I am going to sale half of my position, stop loss with the rest is 7.55

MSOS - Ascending Wedge- Downward MoveI actually would like to see MSOS move upwards.

The only thing that has me worried is this ascending wedge that is pretty obvious.

Classic move downwards to the .786 Fib around $6.28 range.

The only thing that would catapult it up would be the reclassification to Schedule 1.

I would like to see it break and test the ~$12 area.

The is not trading advice, just something I happened to notice and wanted to share.

Double Top?Double top or can this turn into a double bottom?

I have the strange feeling that the DEA may not reschedule due to lack

of data or some other bs lame reason. If this happens, I can see this double

top playing out and stock dropping back down to the $4-$5 area.

If the DEA does reschedule marijuana - I can see a double bottom playing out

from neckline and stock going to $16-$20

If stock drops close to the neckline in the next week or two, I'm going to buy a

options straddle into July and possibly Sept. ATM long straddle, perhaps even OTM too.

This is a news driven stock, so what ever the DEA does is going to create a shit

ton of volatilty.

I own shares at around $6.5 average.

MSOS - Buy The DripLooking to add to my #MSOS position in the event it reaches the .5 Fib. If it breaks lower, would take the loss and average into a longer swing trade position on daily consolidation. The strength of the breakout pivot is impressive. Aggressive bulls will be delighted with broader market strength. AI driving the market, so eyes are there for indications of trend changes.