Key stats

About Pacer US Export Leaders ETF

Home page

Inception date

Jul 23, 2018

Structure

Open-Ended Fund

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

Pacer Advisors, Inc.

Distributor

Pacer Financial, Inc.

PEXL offers investors a clear thesis on international trade. The strategy is to hold US companies that have significant exposure to foreign trade, a strong presence globally, and healthy balance sheets. The underlying index is constructed by screening the large- and mid-cap universe for 200 firms with the highest annual foreign sales as a percentage of their total sales. From there, the list is narrowed down to approximately 100 companies that have had the highest free cash flow growth over past five years. Index constituents are equally weighted, reconstituted and rebalanced quarterly.

Related funds

Classification

What's in the fund

Exposure type

Electronic Technology

Producer Manufacturing

Technology Services

Health Technology

Stock breakdown by region

Top 10 holdings

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

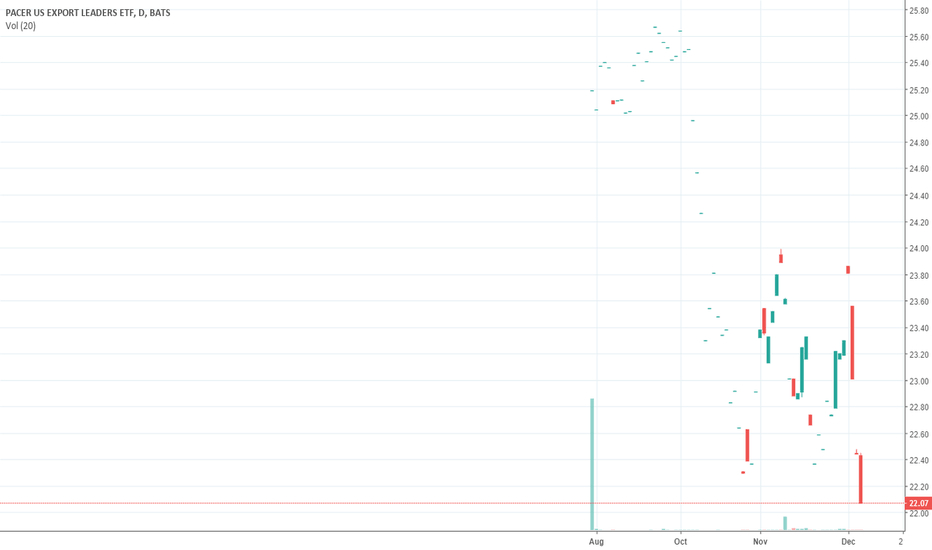

PEXL trades at 53.43 USD today, its price has risen 1.08% in the past 24 hours. Track more dynamics on PEXL price chart.

PEXL net asset value is 53.59 today — it's risen 7.16% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

PEXL assets under management is 34.44 M USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

PEXL price has risen by 6.63% over the last month, and its yearly performance shows a 7.21% increase. See more dynamics on PEXL price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 7.16% over the last month, showed a 27.25% increase in three-month performance and has increased by 4.49% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 7.16% over the last month, showed a 27.25% increase in three-month performance and has increased by 4.49% in a year.

PEXL fund flows account for −31.64 M USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

PEXL invests in stocks. See more details in our Analysis section.

PEXL expense ratio is 0.60%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, PEXL isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, PEXL technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating PEXL shows the buy signal. See more of PEXL technicals for a more comprehensive analysis.

Today, PEXL technical analysis shows the buy rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating PEXL shows the buy signal. See more of PEXL technicals for a more comprehensive analysis.

Yes, PEXL pays dividends to its holders with the dividend yield of 0.37%.

PEXL trades at a premium (0.10%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

PEXL shares are issued by Pacer Advisors, Inc.

PEXL follows the Pacer US Export Leaders ETF Index. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Jul 23, 2018.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.