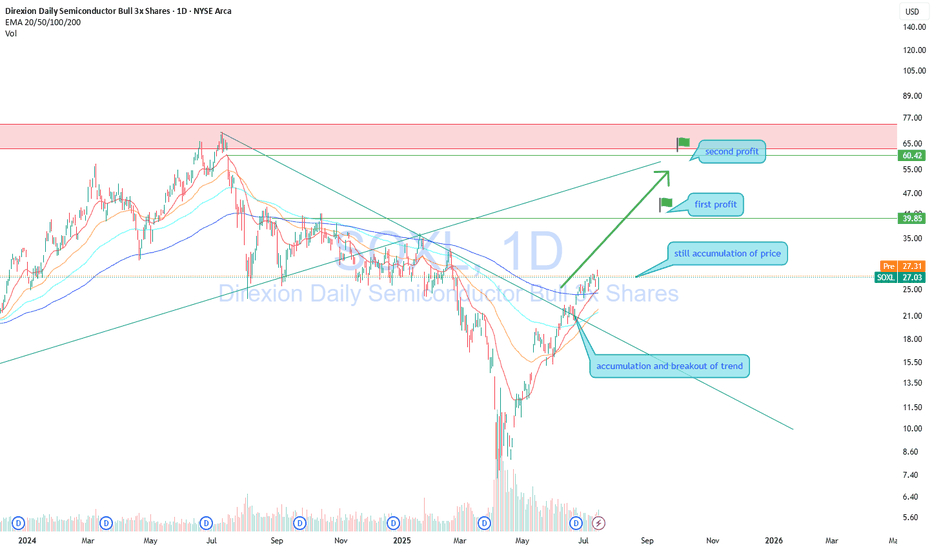

SOXL — Buying on a Strong Uptrend with 30%+ Profit PotentialDirexion Daily Semiconductor Bull 3x Shares (SOXL) continues to move in a clear uptrend after breaking long-term resistance. Price is consolidating above the breakout level, indicating sustained interest from major market participants.

Long positions remain valid.

Profit targets:

First target — 3

Key stats

About Direxion Daily Semiconductor Bull 3x Shares

Home page

Inception date

Mar 11, 2010

Structure

Open-Ended Fund

Replication method

Synthetic

Dividend treatment

Distributes

Distribution tax treatment

Ordinary income

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

Rafferty Asset Management LLC

Distributor

Foreside Fund Services LLC

SOXL is an aggressive and bullish 1-day bet on a concentrated portfolio of the 30 largest US-listed semiconductor companies, including manufacturers and providers of services or equipment associated with semiconductors. The funds index employs market-cap-weighting, with the weights of the top five securities capped at 8% and the remaining securities at 4%. The index may include ADRs, whose cumulative weight is capped at 10%. To gain exposure to the index, the fund invests in swap agreements, securities of the index, and ETFs that track the index. SOXL rebalances its 3x leverage dailymeaning over the long haul, targeted returns could look significantly different due to compounding effects of this daily rebalance. Prior to August 25, 2021, the fund tracked the PHLX Semiconductor Sector Index.

Related funds

Classification

What's in the fund

Exposure type

Electronic Technology

Producer Manufacturing

Stock breakdown by region

Top 10 holdings

SOXL Will FLY!Just look at the AD line:

With its sharp V-shaped recovery, the A/D Line (middle area) shows that the recent price rise is being driven by significant capital inflows and strong buying interest.

The Accumulation/Distribution Oscillator (lower panel) underlines this with an exceptionally high green b

Bullish Swing Trade - SOXLHey all -

Sharing my mid-term analysis of SOXL. We've reached buy levels on the daily, weekly, and monthly charts.

Ideal entry between $16.46 - $18.12.

With patience, swing up to the $25-31 dollar area. Specifically for options, I'd suggest an August expiry, with an ITM or ATM strike price.

Ha

SOXL 1D — With a base like this, the ride’s worth itOn the daily chart of SOXL, since early March, a textbook inverse head and shoulders pattern has formed and is now in its activation phase. The left shoulder sits at $16.67, the head at $7.21, and the right shoulder at $15.11. The symmetry is classic, with volume stabilization and a narrowing range

SPY and SOXX...kinda a big issue of realitySo if the SPXL tracks the SPY and is pretty chuck at the ATH....

And the SOXL tracks the SOXX and is at the ATL....

What am i missing that others get....cause when your semiconductors are said to the AI backbone and its our future.....

Why is SOXS and SOXL relatively close in price...

I mean SPX

SOXL: A so risky scenerio!SOXL: risky scenerio

-Important key level at zone 7.7, forming Head and Shouder pattern with high supply volume.

-The uptrend structure has not yet been broken out, but if this key level been through, a risky scenerio for a deep sink.

.

Wait and see!

US STOCKS- WALL STREET DREAM- LET'S THE MARKET S

SOXL....complete sweetheartWhat more could people ask for! Great ETF, great price, and short window for a major upside to a demand heavy industry. There's a lot of interest in this one. It will likely spike very quickly. Good time to get in or watch by the sidelines!

Best of a luck and always do your own due diligence! I'm w

$SOXL $SOXX BOTTOMED (ASCENDING TRIANGLE)An ascending triangle is a bullish breakout pattern that occurs when the price breaks through the upper horizontal trendline with increasing volume. The upper trendline is horizontal, showing nearly identical highs that create a resistance level. Meanwhile, the lower trendline slopes upward, indic

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

SOXL trades at 25.60 USD today, its price has fallen −0.45% in the past 24 hours. Track more dynamics on SOXL price chart.

SOXL net asset value is 25.59 today — it's risen 1.62% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

SOXL assets under management is 13.44 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

SOXL price has risen by 4.53% over the last month, and its yearly performance shows a −38.33% decrease. See more dynamics on SOXL price chart.

NAV returns, another gauge of an ETF dynamics, showed a 107.84% increase in three-month performance and has decreased by −38.94% in a year.

NAV returns, another gauge of an ETF dynamics, showed a 107.84% increase in three-month performance and has decreased by −38.94% in a year.

SOXL fund flows account for 2.16 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

SOXL invests in stocks. See more details in our Analysis section.

SOXL expense ratio is 0.75%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

Yes, SOXL is a leveraged ETF, meaning it uses borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, SOXL technical analysis shows the buy rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SOXL shows the neutral signal. See more of SOXL technicals for a more comprehensive analysis.

Today, SOXL technical analysis shows the buy rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SOXL shows the neutral signal. See more of SOXL technicals for a more comprehensive analysis.

Yes, SOXL pays dividends to its holders with the dividend yield of 1.05%.

SOXL trades at a premium (0.02%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

SOXL shares are issued by Rafferty Asset Management LLC

SOXL follows the NYSE Semiconductor Index - Benchmark TR Gross. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Mar 11, 2010.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.