Spy what I see with my little eyeTraders,

Fear, trade wars, WW3, Tariffs and a bunch of I told you soo's..... "You voted for this!" just a bunch of chirping. Because this man got to being a billionaire being a silly goose yeah? What happens when them 401k's start 3x'n, what happens when we see one of the biggest bull markets we have experienced in our lifetime?

I don't know much but I know this..... the bull market may not be over. Just taking a break!

Enjoy the hopium!

Stay Profitable!

Savvy

SPY trade ideas

The "Bearish" Short-term Outlook on the marketI apologize - this video was made mid-market yesterday and took a while to download for some reason. So we did subsequently close below the gap and continue downward wherein we closed the multi-day cup at the former low.

I am shorting this overnight and allowing for the subsequent liquidity build to happen (if necessary) before shorting again. There is plenty of more room to the downside if our strong selling was proven (which it seems it was with the incoming gap down).

Happy Trading :)

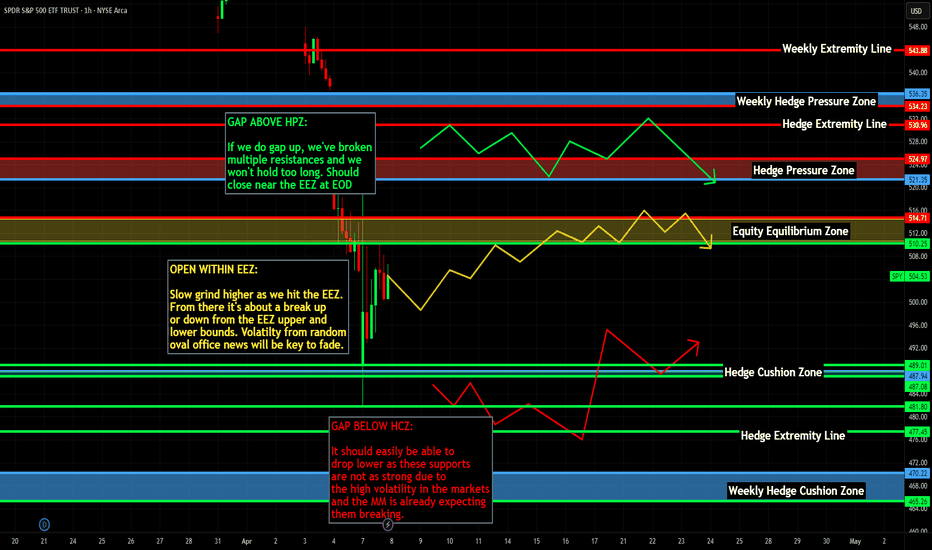

Nightly $SPY / $SPX Scenarios for April 9, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 Implementation of New U.S. Tariffs: As of April 9, the U.S. has imposed a 104% tariff on Chinese goods, escalating trade tensions and raising concerns about a potential global economic slowdown.

🛢️📉 Oil Prices Decline Sharply: In response to escalating trade tensions, oil prices have fallen nearly 4%, reaching their lowest levels since early 2021. Brent crude dropped to $60.69 per barrel, while West Texas Intermediate (WTI) declined to $57.22.

📊 Key Data Releases 📊

📅 Wednesday, April 9:

📦 Wholesale Inventories (10:00 AM ET):

Forecast: 0.3%

Previous: 0.8%

Indicates the change in the total value of goods held in inventory by wholesalers, reflecting supply chain dynamics.

🗣️ Richmond Fed President Tom Barkin Speaks (11:00 AM ET):

Remarks may shed light on economic conditions and policy perspectives.

📝 FOMC Meeting Minutes Release (2:00 PM ET):

Provides detailed insights into the Federal Reserve's monetary policy deliberations from the March meeting.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Warning Relief Rally Maybe DelayedLooking how closed tonight on that support

does not bond well for me

So if we break that low I am out long and will short SPY

Add IWM MAGS short they make new lows

Add TZA new high. Guys it breaks we will just drop few days 450 lower

We hold that good also banks Friday earnings can be a NASTY day tomorrow rest week

SPY | Things Could Get Ugly | ShortSPDR S&P 500 ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500 Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the "Portfolio"), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

SPY Technical Breakdown & Macro Context1. Big-Picture Narrative

There’s increasing talk of a “104% China Tariff,” bringing back memories of Donald J. Trump’s 1988 loss in a piano auction to a Japanese buyer—an event some speculate influenced his later calls for high import taxes. Fast-forward to today, and concerns about renewed tariff escalation add extra pressure on the markets. The user’s view: unless there’s a political shift—where Republicans become more concerned about broader voter sentiment than aligning with Trump—this could drive the S&P 500 down to 3000. While that is quite a distance from current levels, it underscores how aggressive policy moves (tariffs, trade wars) can weigh heavily on equities.

2. Hourly & Daily Chart Overview

Short-Term (Hourly)

Price has trended steadily downward, with each bounce finding new sellers at lower highs.

Key Levels on the chart include:

510.84 (L. Vol ST 1a) – A noteworthy pivot-turned-resistance.

498.01 (L. Vol ST 2a) – Important resistance-turned-support level that recently broke.

485.18 (H. Vol Sell Target 1a) – Currently acting as near-term support.

472.35 (Weeks High Short) – Further support below 485.

Longer-Term (Daily)

The broader trend remains bearish, with high-volume selling in the last few sessions.

RSI on the daily is dipping into the 30s, indicating oversold conditions—but remember that oversold can persist in a strong downtrend.

Elevated ATR (14) around 16 suggests volatility remains high; large intraday swings can occur.

3. Possible Trade Setups

A) Bearish Continuation (Primary)

Entry Trigger:

A failure to reclaim 498 (L. Vol ST 2a) or a decisive break below 485.18 on strong volume.

Profit Targets:

First Target: 472.35 (Weeks High Short)

Second Target: 459.52 (Half 1 Short) for a larger downside move

Extreme Target: If policy missteps intensify and no political moderation occurs, the user foresees a slide to S&P 3000—an extreme scenario but a reminder of how macro risks can extend a downtrend.

Stop Loss:

Just above 500–502 if you’re entering on a breakdown, to protect against whipsaw should SPY manage a strong recovery above key resistance.

B) Oversold Bounce (Alternative)

Entry Trigger:

A strong reclaim of 498–500 and at least one hourly close above it, indicating buyers have stepped in.

Profit Targets:

First Target: 510.84 (L. Vol ST 1a)

Second Target: 523.67 (Best Price Short level) if bullish momentum accelerates

Stop Loss:

Below 485 to limit risk in case the rally fails and downtrend resumes.

4. Macro & Political Watch

Tariffs & Trade Policy: New or increased tariffs can rapidly shift market sentiment. Keep an eye on headlines for abrupt policy changes or legislative updates.

Political Dynamics: If Republicans shift their stance or emphasize broader voter concerns over aligning with Trump’s trade approach, it might calm markets. Conversely, unwavering support for tariff policies could amplify market downside.

Economic Indicators: In addition to politics, watch earnings releases and consumer data. If the economy shows unexpected weakness amid tariff concerns, selling pressure could intensify.

5. Final Thoughts

Volatility is Elevated: Intraday whipsaws are common; stay disciplined with stop-loss placements.

Bearish Bias Persists: The trend is clearly down unless bulls can reclaim key resistance levels with conviction.

Manage Risk: Always size positions appropriately given the current volatility, and remain prepared for sudden news-driven moves.

In summary, tariffs and politics remain a focal point, with historical anecdotes highlighting how personal experiences can shape trade policy. Whether SPY crashes all the way to 300 (S&P 3000) depends on how severe and prolonged these headwinds become. Keep a close eye on technical levels, watch for policy announcements, and maintain a vigilant approach to risk management.

SPY: TA-Market Chaos Calls for Smart Eyes, Not Just Smart ChartsThe market isn't playing fair lately. Classic TA setups are getting invalidated. Support zones crumble in seconds. Even golden cross setups fizzle out.

But this isn’t the time to quit—it’s the time to get tactical.

When technicals break, the silent signals from the options market become louder. That’s where Gamma Exposure (GEX) step in. This week, we saw aggressive institutional repositioning, unexpected volatility, and coordinated rotations into both risk and safety assets.

Let’s talk about SPY, our macro compass. Then we’ll dive into stock-specific GEX sentiment and options setups that still offer alpha.

🔎 SPY – Institutional Tug-of-War

Trend: SPY is forming a falling wedge, which could break either way. Price is sitting just above $500, after tagging the Highest Negative GEX / PUT Wall around $505–$502, which held on Friday.

GEX & Options Flow:

* PUTs at 84.7% dominate the board.

* IVR is 121.8, showing high implied volatility demand.

* Strong support from PUT walls at $502, while CALL resistance at $547–$551 could suppress any upside.

Outlook:

* If $502 breaks, momentum could drag us toward $490 or even $475.

* Bulls need to reclaim $520, flipping the key Gamma Wall.

Strategy Suggestion:

For options, consider SPY put spreads if below $505, or long SPY calls above $520 for quick squeezes—preferably with tight expiry (0DTE or 2DTE) to ride the gamma wave.

$SPY the final leg down? Bottom between $400 - $441It's looking like we're going to break the low I originally had at $481 from the top at $612.

The next most likely target is $441, and if we break that $414.

Both of those levels are good long term buys, the move should happen this week (and likely tomorrow) and that should mark the bottom for the market.

SPY/QQQ Plan Your Trade Update For 4-8 : Absolute PerfectionThank you. Thank you to all of you who follow my videos and believe in my research.

The last few days/weeks have been absolutely incredible.

My SPY Cycle Patterns, on average, are about 70-80% accurate over a 12-month span of time. There are things, like news and big events (elections, outside forces, big news) that can disrupt any market trend and completely invalidate my SPY Cycle Patterns.

But, when the markets are generally left to their own accord, the SPY Cycle Patterns play out almost perfectly.

Yes, traders need to learn to adopt a PLAN A vs. PLAN B mentality with my SPY Cycle Patterns.

If Brad is right - this will happen. And if Brad is wrong, the opposite will likely happen.

But, the comments I've been receiving over the past 20+ days have been incredible.

Thank you.

Knowing that I'm reaching a larger group of people now (than when I started doing these videos about a year ago) and knowing that some of you are really seeing some BIG GAINS following my research is simply incredible.

I started doing these videos to prove my research and tools were incredible solutions for traders. But, at the same time, I started doing this to combat some of the scammers that are out there.

In my world, watching people (or hearing from them) after they've been scammed a couple of times is heartbreaking.

Most people put a lot of time and effort into trying to become skilled traders. I get it.

That's why I'm doing this - to show you the right path and to show you that price is the ultimate indicator.

Again, thank you from the bottom of my heart. Keep sending me those success stories and...

GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Island Bottom CONFIRMED on $SPY IF we GAP up tomorrow!Island Bottom CONFIRMED on AMEX:SPY SP:SPX IF we GAP up tomorrow!

I only believe we can GAP up tomorrow if there is news of China coming to the negotiation table with the U.S. after they raise the Reciprocal Tariffs to 104%.

If this doesn't happen, then this isn't confirmed, and we see a retest of $482, IMO!

I'm not playing this as a trade until we get confirmation! Too dangerous!

Not financial advice

SPY/QQQ Plan Your Trade Update 4-8 : Counter Trend Bottom/RallyThis video was created to help you better understand why it is important to WAIT for the SPY Cycle Patterns to setup efficiently.

It is critically important that all of you learn the three basic rules of trading.

1. Never try to force a position/trade. If your research tells you some type of price event/trend is likely - don't jump into the trade too early. Wait for confirmation and wait for price to confirm your analysis is correct.

2. Start with a small position. Never GO BIG on your initial trade. If you are wrong, you can manage the trade with a small win/loss. If price moves in the direction you expect, you can add more once you get confirmation the trend will continue (potentially).

3. BOOK PROFITS early and keep BOOKING PROFITS as the trend continues higher. You can always get back into the trade with CALL/PUT options - but if you don't learn to BOOK PROFITS EARLY (20-30% profits in the trade), then you'll very likely FAIL to build your account efficiently.

(Trust me, #3 is VERY IMPORTANT)

Beyond these three simple concepts, one of the most important aspects of trading with my SPY cycle patterns is to learn to WAIT for the pattern to setup efficiently.

Today is a great example.

The BOTTOM/Rally Start pattern was in Counter-trend mode. Thus, I expected it to be INVERTED - turning it into a TOP/Selloff Start pattern.

In order for that pattern to play out, we needed to see the markets open higher (and potential trend higher for a bit of time), then roll over into a top pattern. After that tops pattern setup, the markets should continue to move into a moderate selloff trend (downward).

Think about it. Were you smart trying to SELL INTO the rally this morning or were you smart to wait for the ROLLOVER and sell into the breakdown trend?

IMO, smart traders waited for the top to setup/confirm and started selling as we got into the breakdown trend phase.

Again, I'm trying to help you learn to become a better trader.

I hope this video helps.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$SPY POTENTIAL BOTTOMAMEX:SPY is at a pretty interesting spot here—right around the same level we saw during the last two major drops over the past 5 years. Both of those times, price either held or quickly bounced off the weekly 200 EMA, and RSI was oversold.

Could there be more downside? Sure. But if I were someone looking to start positioning near a potential bottom—or at least close to one—this is the kind of level I’d be watching and putting some funds to work.

Trade with me! Walkthrough as I short SPY on a 1 min chartThis is a long video and unfortunately we got cut off at the 1 HR mark right before the ensuing dump toward our TP level (currently 5 minutes after the video up 30% on the position).

Recommend watching on 2x, 3x, 4x speed if you want but also a lot of insights as to what I'm looking out for through my typing. I would have liked to do this with a mic but I'm in a loud environment and wanted to get this out to you.

Hope you enjoy and aren't bored (which sometimes, trading is just boring!)

Happy Trading :)

Understanding the Downside Market and who controls priceA downtrend starts with Dark Pool Buy Side Institutions slow rotation to lower inventory of a stock or ETF. The rotation bends the trend into a rounding pattern that is visible on the stock or ETF chart. The goal of the Dark Pool rotation is not to disturb the uptrend while they are slowly selling shares of stock over several months time. The bending of the price is a signal that the Dark Pools are in rotation. If a chart has Peaks and Valleys trendline pattern that is NOT Dark Pools. Controlled TWAP orders are automated and controlled by the events of that day.

At some point professional traders and the Sell Side Institutions will recognize the hidden rotation and start setting up sell short trades.

The upside requires more and more buyers to keep the trend moving upward. However, the downside does NOT require more and more sellers. All that is required is a void of buyers and the stock will start a downward correction on the short term or intermediate term trend.

A void of buyers also creates the opportunity for High Frequency Trading companies who are Maker/Takers to sell short. The sell short orders fill the queues of the market before it opens and then the computers of the stock exchanges gap the stock down to a first level of some buyers. HFTs, Hedge Funds and Big Money Center Banks Sell short and place their automated buy to cover order way below causing the stock price to plummet.

Then smaller funds VWAP orders trigger and the stock collapses.

What I am trying to teach is the sell side and the buy side are totally different.

They are NOT mirror images of each other.

can bulls hold the line? or nahwatch this spy 489-497 support zone, if support holds into the close we could see a major bounce to the 550 level where a sold my shares 1-2 weeks ago 🎯

if we cant hold then the downside continues, theres not much short term support below here.. boost and follow for more 🔥

SPY/QQQ Plan Your Trade For 4/8 : Bottom/Rally Start - CounterFirst off, today's pattern is in a COUNTER TREND mode. Think of that as the pattern being INVERTED to the current price trend.

Next, the Bottom/Rally Start pattern is usually a base/bottom type of pattern that prompts a fairly strong bullish/rally phase in price.

This time, because it is inverted (in Counter-trend mode) and is forming within the broad consolidation phase of the current EPP pattern, I believe this Bottom/Rally Start pattern will really be a Top/Selloff start type of pattern.

Where price will find resistance in early trading, form a rollover top, and start to move back downward towards the 500-505 level on the SPY.

I don't believe this downward price move will attempt to break below 480-485 today. I believe today's move will be a moderate pullback in the trend.

Although any BIG news could disrupt the current support near $480, so be aware that any big news event could crush the markets (again) and send the SPY trying to retest the $480 support level.

Gold and Silver appear to be basing - perfect. I'm watching for Metals to really start to reflect the FEAR in the markets and rally above $3200 (Gold)/$39 (Silver).

BTCUSD appears trapped in the breakdown stage of the current EPP Consolidation phase and the new CRADLE pattern. No matter how I try to identify if I'm wrong with BTCUSD, I keep seeing the breakdown as the more dominant trend.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$SPY short term top downside from $521 to $481AMEX:SPY is looking like it put in a short term top here. I originally only thought that we had the potential to fall to $545 or so, but now looking at the chart, I think we have the possibility of falling farther.

The two targets that I'm looking for on the downside are $524.35 and 481.18.

Let's see if they get hit over the coming weeks.

If they hit, it'll be the ultimate buying opp as I think from there, we're likely to see SPY over $700 in the coming year or two.

buy the dippity dip of the dipTechnically, charts are near previous highs from 2021-22,

As the great investooore ser unlimited meals buffett said

"if you eat when others are hungry, you will get fat. but if you starve when others are eating you will get all the chix."

its just a correction, not a recession .

buy the dip fm

Nightly $SPY / $SPX Scenarios for April 8, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📊 NFIB Small Business Optimism Index Release: The National Federation of Independent Business (NFIB) will release its Small Business Optimism Index for March at 6:00 AM ET. This index provides insights into the health and outlook of small businesses, which are vital to the U.S. economy.

🗣️ Federal Reserve Speeches:

San Francisco Fed President Mary Daly is scheduled to speak at 8:00 AM ET.

Chicago Fed President Austan Goolsbee will deliver remarks at 7:00 PM ET.

📊 Key Data Releases 📊

📅 Tuesday, April 8:

📈 NFIB Small Business Optimism Index (6:00 AM ET):

Forecast: 100.7

Previous: 102.8

Assesses the health and outlook of small businesses, which are vital to the economy.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis