SPY trade ideas

04/07 GEX + Historic VIX Highs: Extreme Volatility with OptionsWow, where to begin? We’ve just come through a week that even the most thorough analysts found surprising.

Last Friday’s brutal sell-off triggered such a massive margin call rally that even the hedge funds were forced to exit gold—which is usually considered a safe haven—on Friday.

The VIX is at a historic high — no joke. We last saw levels like this during the 2008 crisis and the COVID panic in 2020.

📌 High IV = High Theta

When implied volatility (IV) is high, theta (the time decay of options) is also high. This means that maintaining long put protection becomes extremely expensive. From a broker’s hedging perspective, if they are short expensive put options, they can gradually buy back their futures positions over time (all else being equal). As IV rises, this buyback becomes increasingly attractive for them.

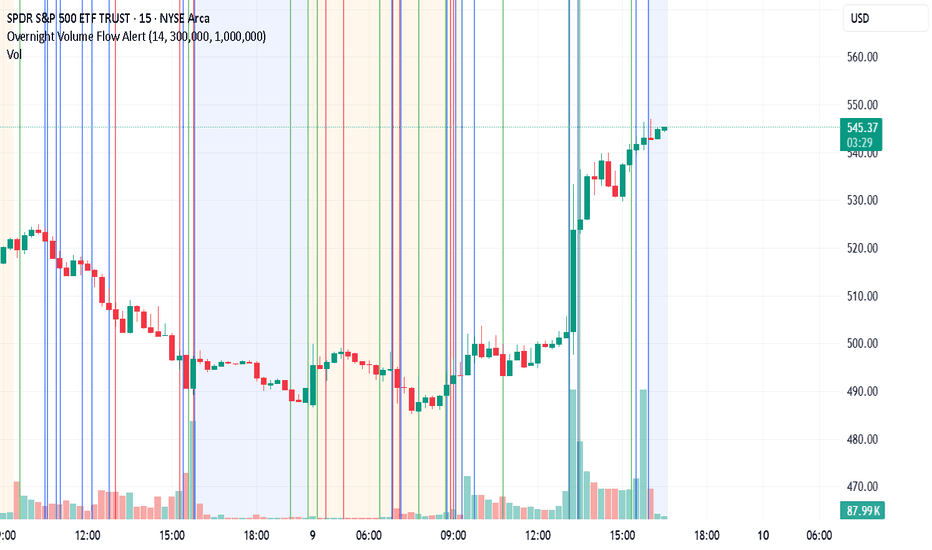

Let’s look at our weekly SPY analysis using GEX Profile (Gamma Exposure) indicator first:

It’s definitely not a cheerful chart!

* Below 520: We have strikes dominated by puts. The largest negative GEX “profit-taking zone” sits at 490. If price reaches that level and the support fails (the previous major bottom from April 2024), we could move even further down into a very wide negative squeeze zone, possibly as far as 445.

* HVL zone: 520–546: A choppy area around the gamma flip.

* Above 546: This would signal a +10-15% rally, putting us in a positive gamma zone. However, such a scenario currently seems unlikely—at least based on the gamma levels we see right now.

I won’t sugarcoat it: we’re at levels now where the market could easily move 10% in either direction. So, in my view, forget about conservative option strategies with flat delta exposure.

🤔 What Can We Do?

Important: This analysis reflects my personal opinion only. It’s primarily for those looking to speculate in this highly uncertain environment. If you’re holding put options strictly as a hedge, then this may not be directly relevant to you. In these conditions, the number one rule is to survive—hedges are meant to protect assets or guard against margin calls, not to make profit.

Currently, IV (implied volatility) and VIX are at historic highs. For them to stay this elevated, we’d need new negative headlines and further major market drops. While that could certainly happen, statistically it becomes less and less likely as time goes on.

Buying Put Options …. no way?

First off, there are plenty of challenges if you plan to buy put options right now—most of all their cost. Put options are nearly twice as expensive as calls in many cases.

Does this mean I recommend selling puts or put spreads? I’m not saying you shouldn’t, but be aware: this isn’t for the faint-hearted or for beginners (the risk is high!). It might be worth exploring butterfly or vertical debit spread strategies, as our goal remains the same as always: to maximize the risk–reward ratio.

🐂 If You’re Bullish

This might sound like a ninja move, but one possibility is to buy call butterfly spreads. Yes, the market could still drop—that’s absolutely possible. But statistically, it’s becoming less likely that we’ll see another huge leg down without some form of rebound.

- Slight Move Up: In the event of a mild rise, call spreads and call butterfly strategies can significantly outperform a simple long call. The short legs in a spread/fly offset high theta costs and mitigate the negative effects of falling IV.

- Even with a +10% Move: A long call is often still not the best choice in this environment—even if the option goes deep in the money.

Where Call Spread/Butterfly Can Fail

If stocks rally 15–20% or more and IV also increases (which would be unprecedented in just a few days).

If the market crashes and VIX spikes above 100 (IV would skyrocket, raising the cost of all options further).

Cheap Bullish Calendar Spread

In a situation like this, even a cheap calendar spread can be a good play — the risk is relatively low, especially if managed well and the breakeven range is wide. Of course, if implied volatility drops, the spread could narrow, but that would likely come with a market rally, which theta can help capitalize on.

🐻 If You’re Bearish

I strongly advise against buying single-leg puts, even on a 0DTE (zero-days-to-expiration) basis. If you’re convinced the market will keep dropping, I’d only consider debit spreads, aiming for a solid risk–reward ratio (in my case, I look for at least 1:2 risk-to-reward).

⚖️ If You Want to Stay Neutral / Omni bullish

If you prefer not to pick a direction, you could try to capitalize on historically high IV with a May-expiration Iron Condor. This is the classic TastyTrade approach, with the caveat that you must monitor GEX levels and IV daily and adjust the far side as needed.

Risk Management: If the spot price threatens one of your short strikes, you probably shouldn’t wait around in this volatile environment. It’s usually better to close the position and take a small loss than to hope for a reversal—hoping can become very expensive!

Conclusion

The market is extremely volatile, and expensive options mean traditional strategies may not work as well as they usually do. Stay cautious, manage risk meticulously, and don’t be afraid to close out losing trades quickly. As always, surviving to trade another day is the most important rule.

SPY Analysis: Navigating Tariff-Induced VolatilityContinuing from my last update, market volatility remains high due to Trump's unpredictable policy decisions. After initially folding and offering economic relief, Trump pivoted sharply with a sudden 145% tariff announcement. Today, China countered strongly with a 125% tariff. These escalating tariff exchanges continue to create significant uncertainty and market fluctuations, highlighting the critical need for careful analysis and precise trade management.

Technical Breakdown (4-Hour Chart)

Current Price Zone: Around $528.45

Key Resistance Levels:

- Immediate Resistance: $536.50 (L.Vol ST 1b)

- Critical Resistance: $549.33 - $549.60 (L.Vol ST 2b)

- Major Resistance Zone (Liberation Day): Approximately $562.16

Support Levels:

- Initial Support: $523.67 (Best Price Short)

- Secondary Support: $510.84 (L.Vol ST 1a)

- Important Lower Support: $498.01 (L.Vol ST 2a)

- Strong Support Level (Trump Folded area): ~$485.18

Trading Scenarios

Bullish Scenario (Potential Tariff Tension Relief):

- Entry Trigger: Confirmed breakout and sustained hold above resistance at $536.50.

Profit Targets:

- Target 1: $549.33 (next strong resistance level)

- Target 2: $562.16 (major resistance)

- Stop Loss: Below immediate support at $523.67, carefully managing downside risk.

Bearish Scenario (Ongoing Tariff Escalation or Increased Market Fear):

Entry Trigger: Inability to reclaim $536.50, or a decisive breakdown below support at $523.67.

Profit Targets:

- Target 1: $510.84 (nearest significant support)

- Target 2: $498.01 (secondary critical support)

- Target 3: $485.18 (robust support area)

- Stop Loss: Above resistance at $536.50 to protect against potential reversals.

Thought Process & Final Thoughts

The SPY currently trades within clearly defined resistance and support bands, heavily influenced by unpredictable tariff-driven headlines. Trump's volatile policy shifts and China's assertive retaliations amplify short-term market risks. Maintain flexible trading strategies, adhere strictly to established levels, and practice disciplined risk management. Continuous monitoring and swift response to evolving market sentiment will be essential for navigating this challenging environment effectively.

"Disbelief Rally" back to 52 week HighsPrior plunges below this custom weekly Keltner channel have a good track record of highlighting buying opportunities. In simile terms.. when markets plunge too much and too fast, a great accumulation occurs with wild oscillations. After the accumulation will come a "disbelief rally" where the market will continue to rip higher in a concave down curve to the previous 52 week high leaving market participants in disbelief that we didn't retest the plunge levels again. Each dip in this "disbelief rally" becomes a great opportunity for long-style trades.

What on Earth Is a Circuit Breaker?!Every couple of days since April 2nd, everybody's been talking about a stock market halt all day. You're left there trying to Google it so you're not the only person in the group chat who doesn't know what's going on. But actually, nobody else in your group chat knows what's going on either. They're low-key Googling it under the desk. You don't have to know everything in the market to be a "seasoned" trader. What does get disappointing is when people guess instead of providing facts or a direct link to an article about market halts.

So, this is your quick-but-detailed-read article/ guide to market halts and circuit breakers. Send it to your friends in that group chat. Why today's dump happened in the first place? More on that later. It's a long story. 🥹

What is a circuit breaker?

It's simple: a circuit breaker is a 15 minute OR whole-day market-wide HALT when the market reaches 1 of 3 decline levels. It all depends on the level, how fast the decline is, and potentially other factors that we are not aware of. Keep in mind this is not something we have to deal with often.

When does it happen? And what stock does it track?

Good question. The halt is triggered following declines in the S&P 500 only . That is: AMEX:SPY SP:SPX $CME_MINI:ES1!.

If these level 1 & 2 are reached before 3:25 PM EDT , there is a 15 minute market-wide trading halt. Meaning you cannot enter or exit positions. If level 3 is reached at any time in the day, the entire day's trading will come to an end.

Level 1: -7.00% | 15 minute halt

Level 2: -13.00% | 15 minute halt

Level 3: -20.00% | Entire day halt

So when the S&P 500 index reaches -6.98%, be sure a halt is coming very soon at -7.00%. Sure, like today, "they" might pump it and use that as support and prevent a halt (we got very close to -6.35% on CME_MINI:ES1! if I'm not mistaken). But it's good to be vigilant and make sure you're not in any daytrades.

Does CME_MINI:NQ1! NASDAQ:QQQ CBOT_MINI:YM1! trigger the halt also?

No. The halt is only triggered by the S&P 500. The Nasdaq Composite famously moves much more than S&P 500, so a 7% drop in S&P is way more dramatic than a 7% drop in Nasdaq and it's highly likely at -7% in S&P that Nasdaq would be at -8% or -9%. Although, both are undoubtedly decimating for any long positions.

Why does this rule exist?

This was introduced after Black Monday of 1987 where the market was free falling ( DJ:DJI dropped 22.6%) with no safety stops in place to prevent a market-wide disaster. This prevents further panic selling and massive stop loss raids, and also gives institutional traders time to zoom out and see the bigger picture.

How close did we get recently?

Today we got within 0.7% of getting a 15 minute halt.

See for yourself:

And the intraday 15 minute chart:

FUN FACT: What if I shorted the top on CME_MINI:ES1! ?

Assuming your time machine goes back 24 hours (some time machines only go back 10 years minimum), you'd have booked 1500 ticks at $12.50 per tick. So around $19k per contract. You know that's not too bad. It's almost a Toyota Camry per contract. Do better! 😆

How do I trade this?

Do you really have to? Please do not FOMO & catch a falling knife. Trade light. The market is open for the rest of the year. Trade with a stop loss, and remember, if you FOMO'd and bought at -3% just because it's down 3%, you'd have gotten decimated. Use the charts not the % on your screen. 🔥

Hit the follow button for free educational content because knowledge is free. KD out.

Self-Sacrifice That Seems Like Self-Destruction… But Toward What🔻 SPY down 21% | IWM down 29% from ATHs as of April 7, 2025.

After months of tracking the Trump tariff narrative and comparing it with the 2018–2019 playbook, we're now living the sequel. But this time, it's happening on steroids, faster and with more chaos.

🧠 Context: Why This Isn’t Just Another Correction

It’s not purely about macroeconomic numbers or earnings calls anymore. The market's volatility is now emotionally and politically driven — centered around one dominant voice:

Donald Trump.

He’s not just reacting to the market — he’s orchestrating the market. And every tweet or announcement can change the direction of the S&P in real time.

🔁 2018–2019 vs. 2025: Chart Overlay Insights

📉 In 2018, the first round of tariffs triggered a -20% drop in SPY — followed by a powerful reversal.

📉 In 2025, the same pattern repeats — another ~-21% drop from highs.

SPY printed a nearly identical two-bottom structure

This sharpens my conviction that we may have already bottomed — barring another external macro event outside the tariff story.

🧩 The Tweet Timeline

Initial Setup Tweet:

"THIS IS A GREAT TIME TO BUY!!! DJT"

A tweet that initially seemed random, but now clearly was a setup.

The Main Policy Drop:

On the same day, hours later, Trump officially dropped the real bomb: a massive 125% tariff hike on China, coupled with a 90-day relief for all other nations.

📈 The market exploded: SPY ended the day +10.5% — one of the biggest intraday reversals in recent history.

Fake Tweet Incident:

Just a few days prior, a fake “90-day pause” tweet circulated, reportedly backed by a journalist referencing a major bank. It turned out to be false — but it caused a sharp 20-minute rally, followed by a dump when it was denied.

🪙 That wasn’t the “Golden Tweet.” But it was what I call a Silver Tweet — a smaller catalyst that injected brief optimism.

👉 Silver Tweets bring air back into a suffocating market. But the real bounce… needs a Golden Tweet.

🧨 And Then the Wildcard:

Despite the massive selloff, the 10-year yield went up, not down — likely the result of a powerful player dumping bonds to counter Trump’s objective of yield suppression.

But that’s not the only possible force at play:

Hedge funds are now facing margin calls.

This has triggered forced liquidations across equities, bonds, and even certain safe-haven positions.

That’s why we’re seeing the unusual combination of rising yields and rising gold — while broader equity markets were still heading aggressively lower.

This suggests:

A hidden battle of titans

Broad rebalancing under pressure

And that Trump may no longer be fully in control of the chaos he set in motion.

🔭 Trade Zones

📌 IWM

Entry: $179–185

Short-Term Target: $195–205

Mid-Term Target Target: $270–280 (or Retest ATH)

Max Downside Estimate: -5 to -7%

Stop-Loss: Weekly close below $171

📌 SPY

Current Level: $517.99

Short-Term Target: $548–556

Mid-Term Target: Retest ATH ($612+)

Max Further Downside Estimate: -3 to -5% from low

Stop-Loss: Weekly close below $485

📌 Note: Volume on reversal was highest since Covid crash, signaling serious accumulation.

📉 What This Could Mean

Trump’s pressure campaign is likely aimed at forcing the Fed to cut rates.

The 90-day pause was meant to cool global reaction — while keeping pressure on China.

However, if yields keep rising and inflation picks back up, the Fed might get stuck, causing even more market instability.

This isn't just a tariff tantrum — it's a chess match with real capital on the line.

🔮 Final Word

We're in the middle of the unraveling, and the market is still testing the gains made during the relief rally. But I’m more confident than ever in my thesis — unless another macro shock comes into play.

📉 We now have:

2 matching 20%+ drops (2018 + 2025)

Matching double bottoms

Trump-driven catalysts unfolding

📲 The markets will react more to Trump's feed than to Powell’s tone or CPI reports.

That said, this isn't a guarantee. If Trump loses control of this chaos, or geopolitical escalation spills over — the downside isn't out of the question.

The only certainty right now: The market is watching one man.

#TrumpIndex #SPY #IWM #MacroNarrative #GoldenTweet #SilverTweet #MarketCycle #Fibonacci #Tariffs #TradingViewIdeas

SPY/QQQ Plan Your Trade For 4-10 : FLAT-DOWN PatternToday's Flat-Down Pattern suggests the SPY/QQQ will struggle to move away from yesterday's big open-close range.

Normally, I would suggest the Flat-Down pattern will be a small, somewhat FLAT price move.

But, after yesterday's big move, the Flat-Down pattern can really be anywhere within yesterday's Daily Body range.

So, we could see very wild volatility today. That means we need to be prepared for general price consolidation (which suggests somewhat sideways price trending) and be prepared for some potential BIG price trends within that consolidation.

These BIG price trends would be more like bursts of trending, while still staying somewhat consolidated overall.

Watch today's video to learn how the Excess Phase Peak pattern is dominating the trend right now (in the Consolidation Phase).

The same thing is happening in BTCUSD. BTCUSD has been in an EPP Consolidation phase for over 35+ days now.

Gold and Silver are setting up a CRUSH pattern today. That could be a VERY BIG move higher (or downward). Given my analysis of Gold acting like a hedge (a proper hedge for global risk levels), I believe today's move will EXPLODE higher.

Gold is already in an early-stage parabolic bullish price trend. When gold explodes above $3500, I believe it will quickly gain momentum towards the $5100 level.

Right now, Gold is recovering from the Tariff news and about to explode upward (above $3200) if we see this CRUSH pattern play out well.

Thank you again for all the great compliments. I'm just trying to share my knowledge and skills with all of you before I die. There is no need to carry all of this great information and technology to my grave.

So, follow along, ask questions, learn, and PROFIT while I keep doing this.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Nightly $SPY / $SPX Scenarios for April 10, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 U.S. Tariff Pause and Increased Tariffs on China: President Donald Trump announced a 90-day pause on tariffs for most trading partners but increased tariffs on Chinese imports to 125%. This move led to a surge in global stock markets, with the S&P 500 rising by 9.5% and the Dow Jones by 7.9%.

🇨🇳📈 China's Retaliatory Tariffs: In response, China imposed additional tariffs of 84% on U.S. goods, escalating trade tensions and impacting global markets.

📊 Key Data Releases 📊

📅 Thursday, April 10:

📈 Consumer Price Index (CPI) (8:30 AM ET):

Forecast: 0.1%

Previous: 0.2%

Measures the average change over time in the prices paid by consumers for goods and services, indicating inflation trends.

📉 Initial Jobless Claims (8:30 AM ET):

Forecast: 219,000

Previous: 225,000

Reports the number of individuals filing for unemployment benefits for the first time, reflecting labor market conditions.

🗣️ Fed Governor Michelle Bowman Testifies to Senate (10:00 AM ET):

Provides insights into the Federal Reserve's perspective on economic conditions and monetary policy.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

text book definition of Support Just another classic example of what support is: Support happens at the point where a downtrend is expected to pause due to a concentration of demand

support can be horizontal just like it can be rising support (Ascending). This example show supports being respected during Covid lows, the 2022 Bear Market, the 2023 correction and now the 2025 correction.

This is why you never skip the basics.

Sean SPY ChartResistance lines which have been hit every crash show where the market may bounce off of in the future. If the main upward sloping trendline breaks and a major stock market crash happens then 3000 would be a major level of resistance and probably wont break; thats if it even gets that low in the first place.

SPY Analysis & Tariff TurmoilLast Friday, the market pressure was intense, and my bullish call option, targeting $537.64 on SPY, seemed overly ambitious as tariffs and political uncertainties peaked. I stated, " AMEX:SPY Trump went all in thinking he had the cards. We were getting sent back to the McKinley era," wondering when or if Trump would fold under international pressure and market realities.

Fast-forward to Wednesday, April 8—Trump didn't just blink; he folded utterly, reversing the harsh tariff policies he initially defended aggressively. Prompted by China's aggressively dumping of U.S. Treasuries and stark recession warnings from Goldman Sachs, BlackRock, and JPMorgan, Trump pivoted significantly:

• Base tariffs: 10%

• Tariffs on China: Increased to 125%

• Tariffs on U.S. goods entering China: Increased to 84% starting April 10

While temporarily bullish, these sudden, dramatic policy swings underline ongoing instability and volatility. However, with big bank earnings on deck this Friday, short-term momentum looks positive.

Technical Levels & Trade Ideas

Hourly Chart

The hourly chart reveals a critical zone—dubbed "Liberation Day Trapped Longs"—between $544.37 (H. Vol Sell Target 1b) and $560.54 (L. Vol ST 2b). Bulls trapped here from recent highs may now look to exit on a relief rally.

• Bullish Scenario:

• Entry: SPY reclaiming and holding above $544.37.

• Target 1: $560.54 (top of trapped longs)

• Target 2: $566.54 (next resistance area)

• Stop Loss: Below recent lows near $535 to limit downside.

• Bearish Scenario (if tariffs intensify again or earnings disappoint):

• Entry: Breakdown confirmation below $535.

• Target 1: $522.20 (Weeks Low Long)

• Target 2: $510.00, potential further support

• Stop Loss: Above $544.50 to manage risk effectively.

Daily Chart Perspective

The broader daily chart shows SPY stabilizing around key lower supports after significant volatility. Recent price action suggests cautious optimism for an upward bounce, but considerable headwinds remain if tariff escalations resume.

Final Thoughts

The rapid tariff reversals and heightened volatility are unsettling. The short-term bullish move offers potential quick upside trades into earnings, but caution remains paramount. You can continue managing risks prudently and watch closely for political or economic headlines that could quickly shift market sentiment again.

Analyzing SPY's Current Technical SetupAfter a strong downward momentum observed on the daily timeframe, SPY has shown signs of a potential reversal on the lower timeframe (65-minute chart).

Here's the breakdown:

SPY has seen a significant bearish move recently, breaking through key support levels and establishing a new recent low around the critical Half 2 Short target at $486.41. This sharp bearish action indicates strong selling pressure, as evidenced by high volume spikes accompanying the down move. The Relative Strength Index (RSI) on the daily has reached oversold territory (around 20), suggesting potential for a short-term bounce or consolidation.

65-Minute Chart Analysis:

On the shorter timeframe, SPY is showing a recovery phase, with the price reclaiming the Half 1 Short level at $508.91. The upward price action is supported by rising RSI, now trending upward above the mid-level (50), signaling short-term bullish momentum. Volume is moderately strong, suggesting buyer participation.

Trade Idea and Levels:

- Bullish Scenario:

- Entry: I deally, an entry would be considered on a confirmed hold above $508.91.

- Profit Targets:

- First target: Weeks High Short at approximately $520.16.

- Second target: High Sell Target around $531.41 (more optimistic scenario if bullish momentum strengthens).

- Stop Loss: Clearly set a stop below the recent pivot low at approximately $497.50 for risk management.

- Bearish Scenario:

- If price fails to sustain above $508.91 and reverses downwards:

- Entry: Consider short entry upon confirmed rejection below $508.91.

- Profit Targets:

- First target: Recent pivot low at $497.50.

- Second target: Half 2 Short at $486.41.

- Stop Loss: S et stop above $513, allowing for minor volatility without compromising risk control.

Final Thoughts:

Given the current oversold conditions on the daily timeframe and emerging bullish signs on the shorter timeframe, cautious bullish entries with tight stops could present favorable risk-to-reward setups. However, remain flexible to shift to a bearish stance if the price action fails to sustain the critical $508.91 level. Always manage risk accordingly and adjust positions based on ongoing market confirmation.

SPY/QQQ Plan Your Trade For 4-9 : Top/Resistance UpdateToday's big rally, prompted by Trump's Tariff comments, presents a real learning opportunity for traders and followers of my videos.

Everyone wants to know what's going to happen next.

This video will tell you what I believe is NEXT for the markets and why.

It should also reinforce the construct that price is the ultimate indicator and the use of the EPP/Cradle patterns as a mechanism for using price structure to attempt to identify where opportunities may exist.

As much as this video is an analysis of price action and a prediction of what may come next, it is also a tutorial showing you how to use price patterns, structure and context to attempt to plan for your next opportunities.

Ideally, the next phase of the market is to establish a consolidation range.

If the 480-525 lower consolidation range does not hold - then it will likely become a precursor of the July breakdown (support) level. Remember, we still have the July/Oct lows to deal with.

I fully expect the 550-575 consolidation range to become the new dominant consolidation phase for the current EPP pattern.

It makes sense to me that, absent any crazy tariff war, the most likely outcome will be for the markets to recover back to the 550-575 level and to consolidate further.

The last component we have to consider is the recent lows near 480 could have been a very quick breakdown to an Ultimate Low. If that is the case, then we'll most into a mode of seeking the next higher resistance level and I believe the 550 or 575 level would be the obvious next resistance level.

So, at this point, I believe the continuation of the Excess Phase Peak pattern is likely, but the price is actively seeking the consolidation range between the lower consolidation level and the upper consolidation level.

Price MUST establish the consolidation range, or INVALIDATE this pattern, in order to move onto the next pattern/phase.

Get Some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Spy ... Reload?The question over the next 2 days will be is this move up real or not.

First, let's look at the position things are in now.

1.Seasonality is very bullish around this time

2. Technicals are oversold and market bounced off some solid supports.

3. Earnings season is about to begin, and in my experience you usually don't see that market crashing in the middle of earning season..

So those are the 3 reasons to want to be long.

Now

look at Spy weekly chart, Zoom out to 2016 and then add your weekly 50ma; what you'll notice is that in every serious correction the Spy has suffered since 2016 the bear market only ends when Spy can close the week back above the Weekly 50ma

The weekly 50ma is currently at

565 , throw in the gap close at 565 and the price action resistance and you got a power line of resistance

I would exit any longs near this area here. We may not knife back down extreme but we could shop and trade between 540-565 and in a extreme bear scenario the short back to 400.00 after rounding off a right shoulder with a couple of weeks of consolidation

But that's an extreme bear scenario and the only reason I'm entertaining it is because what I see on the TVC:DJI and TVC:NYA

Here's TVC:NYA weekly chart

This is probably the biggest rising wedge you'll ever see. Dating back 15yrs , if this was to fall out this would mark the end of the bull run from 2009.

Zoomed in

And you'll see that the weekly 50ma and the prior Wyckoff neck are at the same spot which makes this a power line resistance! I don't expect this to make it back across and I'd be looking at a major short entry here that should coincide with spy tagging its weekly 50ma

TVC:DJI

Exact same chart as NYA

Zoomed in , same scenario as NYA

AMEX:XLK

The biggest sector on AMEX:SPY and a leading indicator on Tech is showing same thing

Weekly chart (Log scale)

So the bad news is in the coming weeks, I think we will be tested and this rally may be a bull trap that stalls out at the weekly 50ma. The good news for bulls is we may have another 3-4% pump before we have to bail 😂..

But first Spy needs to break over 553 or 20sma..

Over 553 and it's a 80% chance 565 comes next. Until then 552-537 is chop so ignore any pullback unless we break back below 525

Personally I think we have enough juice to tag 567 by end of next week.

Remember 537-550 is chop and don't look too much into it

If spy closes any week back above 565 then it's a 75% chance we are headed back to 600...

Let's see what happens

spy had a meaningful run today with strong institutional activiySPY Pre-Market Breakdown – April 9, 2025

Phase 1: 4:00 AM – 5:30 AM – Early Accumulation

The pre-market session began with SPY trading around the 490 level, showing cautious price action in a consolidation pattern. During these early hours, price maintained a relatively tight range between 489 and 491, with minimal directional commitment. Volume remained light during this period, typical of early pre-market hours, but began building steadily as we approached 5:00 AM.

Around 5:00 AM, we observed the first meaningful price movement as SPY began testing higher levels with several green candles pushing toward 494. This early strength coincided with increasing volume, suggesting genuine buying interest rather than just thin market conditions. The price action formed a series of higher lows, establishing a short-term uptrend channel.

What's particularly noteworthy in this phase was the balanced options exposure, with call and put exposure roughly similar , indicating no strong directional bias from options traders yet. This balance suggested market participants were still positioning themselves, waiting for clearer signals before committing to a direction.

Phase 2: 5:30 AM – 7:00 AM – Positioning Builds

The second phase showed increased momentum and clearer directional bias. SPY continued its upward trajectory, breaking through the 494 level and eventually challenging the psychologically important 495 level. Volume began increasing significantly during this period, adding credibility to the price advance.

Around 6:00 AM, we noticed the first significant divergence between call and put activity. Call exposure began increasing relative to put exposure, signaling growing bullish sentiment. The chart is indicating aggressive call buying or put unwinding. This shift in options flow provided an early signal that institutional traders were positioning for higher prices.

Price consolidation occurred between 495-496 with increased volume, suggesting accumulation rather than distribution at these higher levels. The market was digesting gains but showed no signs of significant profit-taking or reversal. The price action formed a pattern of shallow pullbacks followed by renewed buying interest, a behavior often seen when institutions are accumulating positions.

Phase 3: 7:00 AM – 8:45 AM – Execution

The final phase demonstrated the culmination of the positioning seen earlier. Around 7:00 AM, price momentum accelerated with SPY pushing decisively through the 496 level and challenging 497. This breakout was accompanied by a significant increase in volume, confirming the validity of the move.

Options flow data showed an explosion in call activity during this period, with call exposure reaching over 9 million contracts while put exposure remained relatively stable.

Between 7:30 AM and 8:30 AM, we witnessed classic breakout behavior with price establishing itself firmly above previous resistance levels. Any shallow pullbacks were quickly bought, demonstrating strong conviction from buyers. The market is showing some put unwinding alongside continued call buying, suggesting traders were removing downside protection while adding to bullish positions.

The Level II quotes showed a notable imbalance developing with buyers willing to pay up and fewer willing sellers. This order book imbalance further confirmed institutional interest in higher prices.

Final Bias: Bullish

The pre-market session demonstrated a clear bullish bias supported by multiple factors:

Price Structure: A series of higher lows and higher highs throughout the session, breaking through multiple resistance levels with conviction.

Volume Confirmation: Increasing volume on advances and lighter volume on pullbacks, suggesting genuine buying interest and minimal profit-taking.

Options Flow: Progressive increase in call exposure relative to puts, with the final phase showing overwhelming call dominance, indicating institutional positioning for upside.

Order Flow: Aggressive buying on breakouts with minimal selling pressure on pullbacks, suggesting strong hands accumulating positions.

Late Session Stabilization: Price holding gains near session highs with continued buying interest, rather than fading into the regular market open.

Institutions appeared to be positioning for a higher open and potentially continued upside during the regular session. The methodical building of positions throughout the pre-market, rather than a single aggressive spike, suggests this was not merely a reaction to overnight news but rather deliberate positioning ahead of anticipated strength.

Trade Setups with Entry, Stop, Target

Trade 1: Breakout Continuation (High-Conviction)

Entry Zone: 496.50-497.00 on first pullback after market open

Stop-Loss: Below 495.75 (below pre-market consolidation)

Profit Target: 499.50-500.00 (psychological level and round number)

Rationale: Strong pre-market accumulation with increasing call flow suggests continued momentum into regular hours trading.

Trade 2: Dip-Buying Opportunity (Medium-Conviction)

Entry Zone: 494.80-495.20 if market pulls back to test breakout level

Stop-Loss: Below 494.00 (previous resistance becomes support)

Profit Target: 498.00-498.50

Rationale: Pre-market volume and options flow indicate institutions positioned for strength, likely to defend key levels on pullbacks.

Markets bottom on fearA short term relief is due in the coming days.

I will buy QQQ at the opening of the market, for a few days.

Only the fundamentals (and Trump) will decide if it will be the bottom of a correction or the first bottom of a huge market crash.

I am using here:

- The RSI(14), weekly (below 40).

- The ROC(2), daily (below 10%).

- One other personal indicator

- My personal quant strategy

SPY LongSPY Long and Neutral

Down 9% in 2 days, near demand Zone,

Long entry 513

no Stop ,

Target 530

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

Sell SPY 250417 P500, Limit 11.31,

Delt= -0.37, expire in 13 days.

No stop, willing to buy SPY at 500 after 15% down from the top, for long term investment