SPY trade ideas

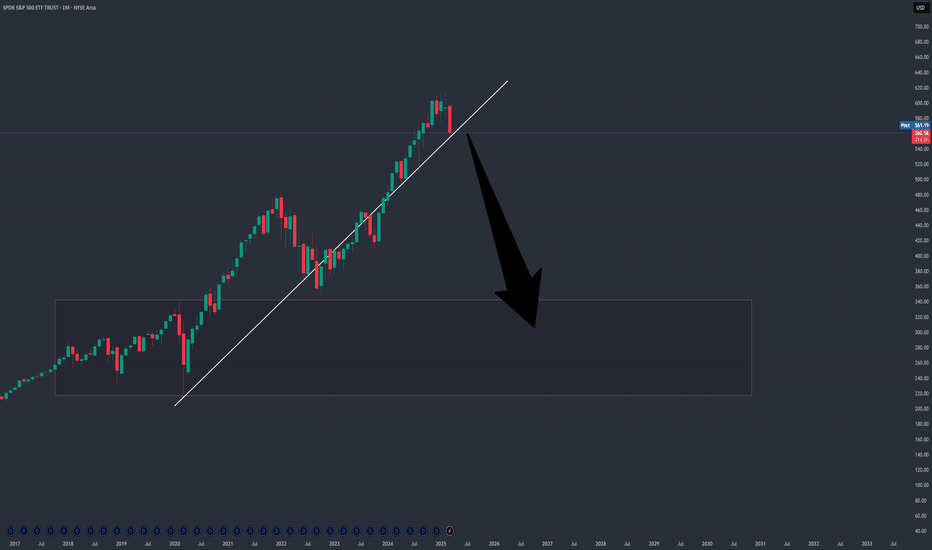

End of hibernation for the bears?AMEX:SPY is at a pivotal point and could potentially be at the top of the bullish cycle that began in October 2022. If this prediction proves accurate, I think we could see a maximum low of $510 for this year. There are a couple of caveats, including one that will be a clear indicator of whether or not this wave count is accurate, which I will explain later.

On the 1000R chart ($10), this uptrend was confirmed by Supertrend and volume activity. Volume drastically increased at the start of Wave (3) in March 2023 and did not taper off until the start of Wave (4) in July 2024. This was the strongest impulse in the trend, which is common for Wave 3. You can also see the ADX line of the DMI indicator (white line) was at its highest level during that period.

Assuming Wave (5) is already complete, we can observe that the volume in Wave (3) was considerably less than Wave (5).

Other observations supporting this wave count:

- Wave (4) retracing into the territory of Wave 4 of (3)

- Alternation in corrective patterns between Wave (2) and Wave (4); flat in (2) and straight down in (4)

- Wave (5) extending to nearly 1.618 of (1)

While the points I’ve made so far suggest that the market may be on the verge of a crash, the image gets more complicated when you take a closer look on the 250R chart ($2.50). I’ll start with what I’m counting as Wave 4 of (5). The price ended at ATH in Wave 3 and then corrected in an unmistakable five wave descending wedge pattern. This can only be a fourth wave of a larger impulse, so we can conclude with a fair amount of confidence that the wave that follows will be the last.

Here is where things get interesting. The price moved from $575 on January 13th to a slightly higher ATH of $609.24 on January 24th before being rejected again. This uptrend unfolded in a typical bullish pattern and left a notable gap at $584, which is the only gap still left unfilled. The trend change is confirmed on the moving averages. Notice the serious drop in volume that followed as well.

Despite the shift in volume, there are two issues I have with this wave count that are preventing me from calling this a confirmed correction:

1. Wave 5 of (5) was awfully short and only extended roughly $2 above the end of Wave 3 of (5). This does not break any rules, but it is unusual.

2. What I have labelled as Wave B of Wave (1) or (A) of the correction made a new ATH on Friday February 14th, which should invalidate this wave count since the end of Wave 5 of (5) should be the peak.

The second point is why some may think that we are about to resume the larger bull trend, however there is a possibility that they are mistaken based off the PA on the actual index SP:SPX and futures CME_MINI:ES1! . On the SP:SPX chart, we can see that the index did not break the ATH at $6128.18 set on January 25th, and instead rejected at $6,127.24.

CME_MINI:ES1! also failed to notch a new ATH on Friday and I have observed the price action create a nearly perfect bearish butterfly pattern. Also notice how the volume is significantly lower than in the uptrend that began on January 31st.

So the question remains: are we at a tipping point or will the bulls regain control? Right now it’s unclear, but I will keep my bearish sentiment until SP:SPX makes a new ATH, which will invalidate this theory. Since only the ETF that tracks it only made a slightly higher high on low volume, I’m skeptical of the PA on AMEX:SPY at the moment. This is why I entered puts on Friday.

If the trade plays out, I expect the price to quickly move to fill the gap at $584, which is still conveniently located at what I cam considering the 1.236 extension of Wave A, which is a common target extension in flat corrections. I will keep my puts open until this idea is invalidated, as the Wave C drop will likely be caused by a news event that could come at any time. Let me know if you guys are seeing the same thing or something different. Good luck to all!

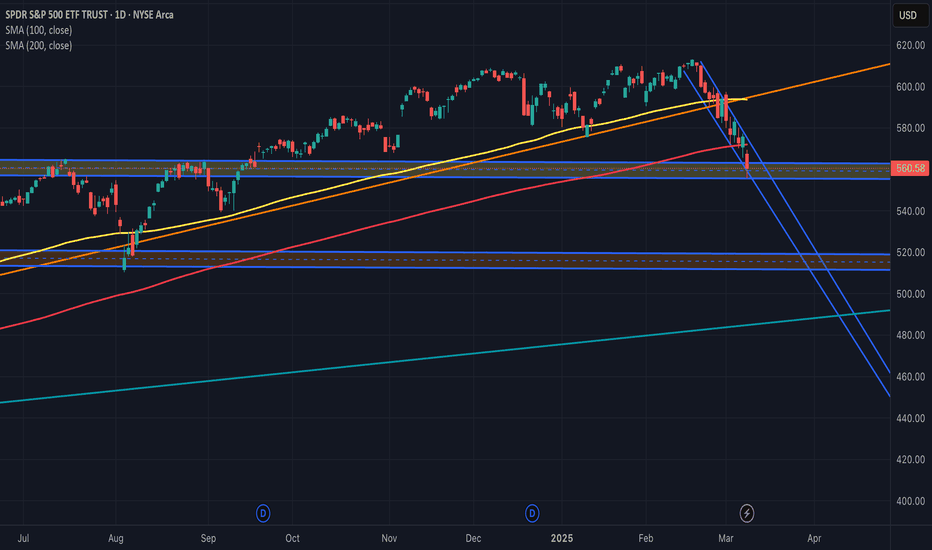

SPY Possible next movesOrange Line - Trendline since November 2024

Blue Line - Trendline from 2020

SMA - Red (200) as a moving floor

SMA - Yellow (100) as a moving floor

1st Strong Floor - Resistance range 562 - 555

2nd Strong Floor - Resistance range 518 - 511

Downtrend Channel between blue lines

If the downtrend channel is broken with strength and volume, we could experience a retracement to the 584 - 595 range and then wait. However, if it is not broken and the strong downtrend continues, breaking the first floor range (wait for candlestick confirmation with bearish volume) and/or experiencing a false breakout (breakout without volume to the upside), we could expect a drop to the second floor range. It is important to wait for confirmations and execute the corresponding trades accordingly.

-------------

$SPY Short Term Bullish atm.. idea for BullsWell... seeing is we hit my target, I thought I might bless the Bulls with a little bit of Eye Candy.... This is what you want...

The Fib breakdown of the Golden Pocket above at the 1.61... we hit the retracement... and now back to the .78

We hold here and it can get bullish quick.

Bearish Path in Next post... otherwise we make a lower high and fall to $525 and fast.

Nightly $SPY / $SPX Scenarios for March 11, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇯🇵🤝 Japan-U.S. Trade Discussions 🤝: Japanese Trade Minister Yoji Muto is visiting Washington from March 9–11 to engage in discussions with U.S. officials. The talks aim to strengthen economic ties and address trade concerns, including potential exemptions for Japanese exports from proposed U.S. tariffs. These negotiations could influence sectors such as automotive and steel, impacting market dynamics.

🇨🇳📊 China's National People's Congress (NPC) Developments 📊: The 2025 National People's Congress is underway in Beijing from March 5–11. Key economic targets and policy directions set during the NPC may affect global markets, including the U.S., especially in areas related to trade, technology, and foreign investment.

📊 Key Data Releases 📊:

📅 Tuesday, March 11:

📄 JOLTS Job Openings (10:00 AM ET) 📄:This report provides data on job openings, hires, and separations, offering a comprehensive view of the labor market's dynamics.

Forecast: 7.71 million

Previous: 7.6 million

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY Stock Chart Fibonacci Analysis 031025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 549/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

$SPY: Possible Bullish Reversal [LONG]Sentiment indicators and volume patterns all point to a local bottom forming on the 4H chart. These signals, along with supporting technical indicators, strongly suggest that $555 marks a local bottom and a reversal from the current lows can be expected.

Watch closely for confirmation as SPY potentially starts moving higher from here.

$SPY - We could see a bounce within this weekSince the uptrend began in November 2023, the AMEX:SPY has experienced a drawdown of approximately 9-10%, with 11% being the maximum drawdown.

Similarly, drawdowns have typically overshot below the 200-day moving average (200DMA) by an average of 3%.

By this measure, the worst-case scenario for this drawdown could see AMEX:SPY fall to the $544 to $542 range.

I think we could see a bounce within this week.👀

SP:SPX

Market Crash? No: Sector Rotation!The news is catching up (two weeks late) to the stock market heading into bear territory but that is NOT the whole picture! Investors need to know that there are winners out there in quality stocks as the risky YOLO plays (tech, crypto) are losing. This specific rotation perfectly fits the model of the stock market rolling over into bearish territory.

Follow the money!

SPY - Liking the 560 areaThe fibs lined up just under 560 for a few time frames so I'm entering at this point.

Many expected a Primary Wave 4 to occur before a fifth wave higher. Can't be sure how long this will last but surprised that people might be spooked by recession talk. Seems that we have been in a recession for quite a while, although it hadn't been reflected in the stock market numbers. Certainly, jobs data for the previous year seemed unbelievable and manufacturing has been in a recession for quite a while.

Spy $544? I believe liquidity will be taken and a lot of people are going to get recked in this move i think its going to be violent and semi fast I give this 20-35 Trading days to Play out... I see as low as $544 then up up and away she goes heading to $620... Keep in mind we dont have to hit $544 , $550ish could be the bottom before heading higher , In the meantime trade safe be safe and see you there

SPY FORECAST " CORRECTION IN PLAY "Right now, SPY is entering a corrective phase after completing a strong five-wave impulse sequence. Based on Elliott Wave Theory, we are now in an A-B-C correction, and here’s what I expect according to my analysis.

WAVE STRUCTURE EXPECTATION

- Wave A is in motion and is expected to hit support at $511 by March 18, 2025.

- Wave B will likely bring a relief rally toward $535 by March 24, 2025, before sellers take control again.

- Wave C is projected to finalize the correction at $487 by April 1, 2025, aligning perfectly with Fibonacci retracement levels.

HOW GANN CONFIRMS THIS MOVE

Gann Squares & Angles provide additional time and price validation:

- The breakdown below $562 confirms that SPY has lost key trend support.

- Gann's 1x1 and 2x1 angles are pointing to the same price zones where Elliott Wave suggests support.

- This means we are in a structured, time-based correction rather than a random sell-off.

WHAT THIS MEANS FOR TRADERS

- Short-term bearish bias until Wave C completes.

- If the price holds $511 (Wave A target), expect a bounce toward $535 (Wave B).

- A break below $511 signals more downside, with Wave C targeting $487 as the final correction zone.

FINAL THOUGHTS

market is moving exactly as expected, and this forecast is based on historically reliable market cycles. Whether you trade stocks or options, knowing where the market is headed helps you position yourself smarter.

SPY target 563I do dowsing with a pendulum on stocks and indexes, and am trying to use my intuition more, but I have a hard time sitting still. I did "tune in" for a minute to ask about SPY this morning & got the mental visual of a kind of peak and strong reversal down, and then the number 63 kept flashing at me.

After a few minutes, I realized that 562-63 is my dowsing target from after we hit the high at $613 (which I posted as a target & hit to the dollar).

So, this is to say, this work can be legit & way more than coincidence or luck.

When I had asked about when the 562 area would hit (on 2/23), my answer was 11 days. That date comes in on Thursday.

If price and time can align, results may be sublime. I seriously had to do that, but it is true & ideal if they coalesce. I do have some dates coming for Wednesday as well, so it could be off. But I have strong conviction 562-63 hits & then some kind of bounce, which I will update.