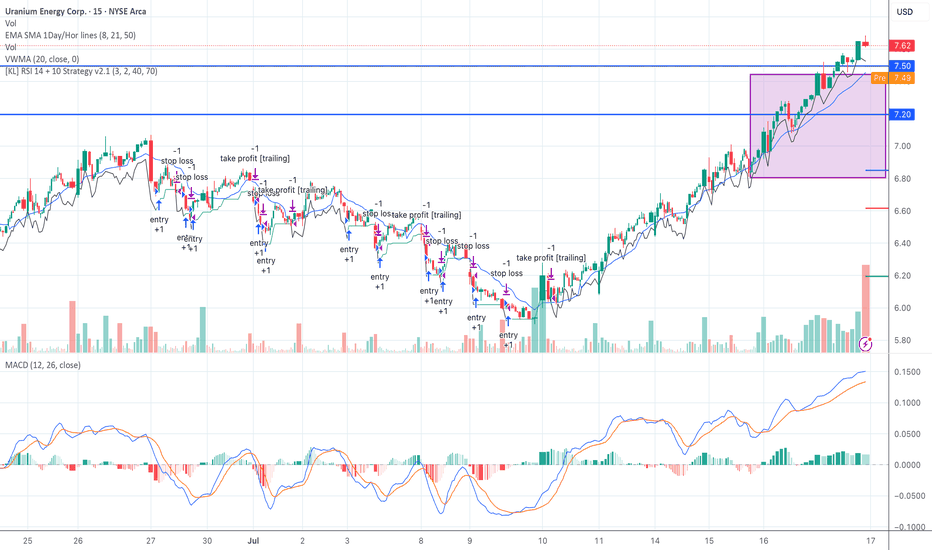

UEC Box Breakout Confirmed – Riding VWMA on VolumeUEC broke out of the $6.80–$7.45 box with volume and is holding strong. VWMA rising, MACD trending, and RSI strategy taking partials.

Watching $8.00 for target, $7.20 as trailing stop zone.

Classic Seed System box breakout — low risk, clean structure.

#UEC #SeedSystem #BreakoutTrade #VolumeConfir

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.18 USD

−29.22 M USD

224.00 K USD

433.18 M

About Uranium Energy Corp.

Sector

Industry

CEO

Amir Adnani

Website

Headquarters

Corpus Christi

Founded

2003

FIGI

BBG000LCK3Q2

Uranium Energy Corp. engages in the provision of uranium and titanium mining and related activities, including exploration, pre-extraction, extraction, and processing of uranium concentrates, and titanium minerals. It operates through the following geographical segments: Wyoming, Texas, Saskatchewan, and Others. The company was founded by Alan P. Lindsay and Amir Adnani on May 16, 2003 and is headquartered in Corpus Christi, TX.

Related stocks

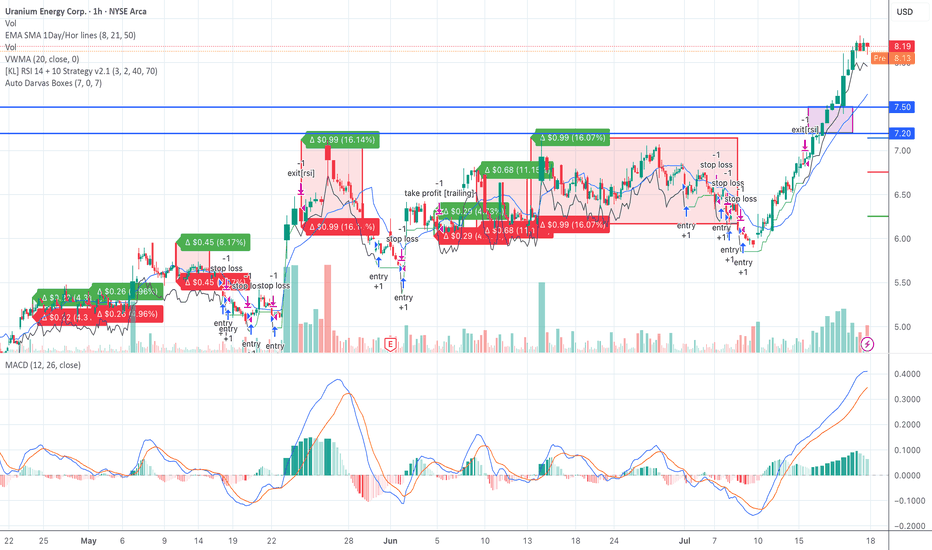

UEC Breakout Confirmed — Seed System Entry Active Above $7.50UEC confirmed a breakout above the $7.20–$7.50 Darvas Box we've been tracking.

Entry triggered at $7.51 on rising volume. Price is holding above VWMA ($7.64) and the EMA stack (8, 21, 50). MACD is showing strong momentum, and RSI remains in a healthy range.

Target 1: $8.50

Target 2: $9.00

Stop los

Long Uranium and Nuclear via UECMy price targets for UEC. Based on the US Government's newly restored enthusiasm for Nuclear power & their borderline hostility towards dependance on other nations for much of anything, I think this All-American uranium company is ripe for a big run. I believe it will go way past my price targets an

UEC: Close to a Substantial Bottom? Bullish Outlook!The current pullback, which began in December, is still unfolding. Right now, the market is testing the white wave 2 support zone between $4.80 and $5.46, but the chart doesn’t yet look ready for an upside reversal. Even in the white scenario, a bit more downside is likely with some small downward m

Uranium Energy is it right time to buy?Price Levels and Trends

1. Resistance Levels:

$7.70: The price has faced resistance at this level recently.

$7.68: Another resistance point that the price recently touched but failed to break.

2. Support Levels:

$5.83: The current support level, which has held the price from falling

Trade Idea | UEC | Uranium Energy Corp | Long Long Entry: $7.50

Stop: $6:00

We will be taking this trade right after a minor pullback from this current level of $8.56.

I think there will be more potential upside on this stock as every countries are increasing the power demand due to AI development.

We are now seeing nuclear power revival as u

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of UEC is 8.91 USD — it has increased by 2.45% in the past 24 hours. Watch Uranium Energy Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on AMEX exchange Uranium Energy Corp. stocks are traded under the ticker UEC.

UEC stock has risen by 10.80% compared to the previous week, the month change is a 35.78% rise, over the last year Uranium Energy Corp. has showed a 60.83% increase.

We've gathered analysts' opinions on Uranium Energy Corp. future price: according to them, UEC price has a max estimate of 12.25 USD and a min estimate of 7.75 USD. Watch UEC chart and read a more detailed Uranium Energy Corp. stock forecast: see what analysts think of Uranium Energy Corp. and suggest that you do with its stocks.

UEC stock is 7.45% volatile and has beta coefficient of 1.83. Track Uranium Energy Corp. stock price on the chart and check out the list of the most volatile stocks — is Uranium Energy Corp. there?

Today Uranium Energy Corp. has the market capitalization of 3.96 B, it has increased by 23.82% over the last week.

Yes, you can track Uranium Energy Corp. financials in yearly and quarterly reports right on TradingView.

Uranium Energy Corp. is going to release the next earnings report on Sep 26, 2025. Keep track of upcoming events with our Earnings Calendar.

UEC earnings for the last quarter are −0.07 USD per share, whereas the estimation was −0.06 USD resulting in a −16.52% surprise. The estimated earnings for the next quarter are −0.03 USD per share. See more details about Uranium Energy Corp. earnings.

Uranium Energy Corp. revenue for the last quarter amounts to 0.00 USD, despite the estimated figure of 0.00 USD. In the next quarter, revenue is expected to reach 17.00 M USD.

UEC net income for the last quarter is −30.21 M USD, while the quarter before that showed −10.23 M USD of net income which accounts for −195.21% change. Track more Uranium Energy Corp. financial stats to get the full picture.

No, UEC doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 94 employees. See our rating of the largest employees — is Uranium Energy Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Uranium Energy Corp. EBITDA is −56.07 M USD, and current EBITDA margin is −24.27 K%. See more stats in Uranium Energy Corp. financial statements.

Like other stocks, UEC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Uranium Energy Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Uranium Energy Corp. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Uranium Energy Corp. stock shows the strong buy signal. See more of Uranium Energy Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.