XLU Long1. Market Structure Overview

A notable Change of Character (CHoCH) occurred at 84.09, breaking below a prior higher low and signaling a shift from bullish to bearish momentum. This was followed by a clear Break of Structure (BOS) at 83.40, confirming the bearish sentiment and initiating a new lower low sequence.

2. Supply and Demand Zones

Supply Zones (Resistance):

85.00–85.55: Strongest supply zone where multiple bearish rejections originated.

84.75–85.00: Closest overhead supply zone—price is expected to react if it reaches this area.

Demand Zones (Support):

84.00–84.20: Local demand that initiated the recent bullish push; possible short-term support.

83.10–83.40: Major demand zone that sparked the latest upward move; strong buyer interest observed.

3. Current Price Action & Expectation

Price is currently trading at 84.46, moving upward from the 84.00–84.20 demand zone. The near-term outlook suggests a continued push toward the 84.75–85.00 supply zone. If price can decisively break above 84.99, bullish momentum could extend toward 85.30–85.55.

However, if price rejects from 84.75–85.00, a pullback into 84.00–84.20 is expected before another attempt higher. A breakdown below 84.00 would open downside risk toward the stronger demand at 83.10–83.40.

4. Momentum & Risk Outlook

Momentum is gradually shifting bullish after forming a swing low near 83.40. Maintaining structure above that level is crucial for a bullish continuation. Watch for a clean break and retest of the CHoCH level at 84.99 to confirm strength.

XLU trade ideas

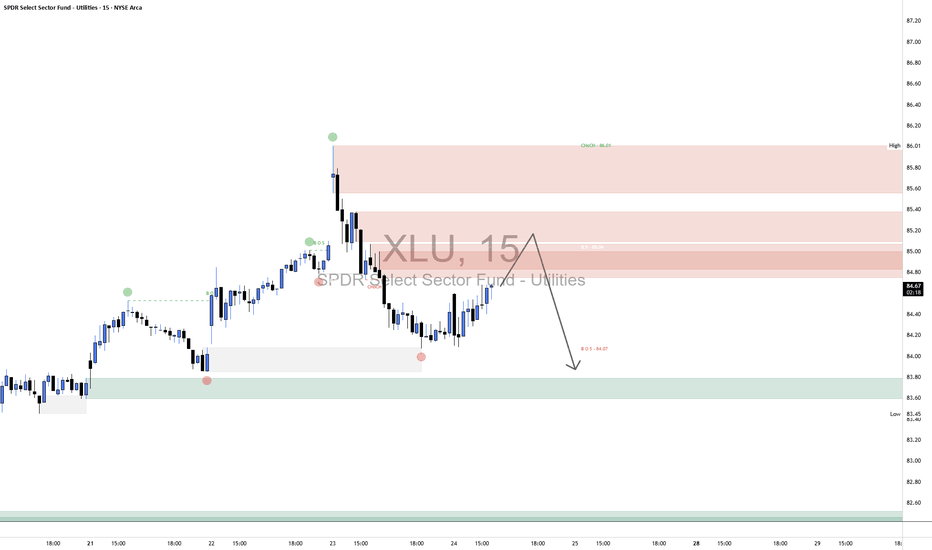

XLU Short1. Market Structure Overview

1.1 Change of Character (CHoCH) – 86.01

Marked a bearish shift after price broke below a significant higher low.

Suggests that the prior bullish trend has lost strength.

1.2 Break of Structure (BOS) – 84.07

Confirmed a bearish continuation, breaking below the previous support level.

Validates the downtrend structure following the CHoCH.

2. Supply & Demand Zones

2.1 Supply Zones (Resistance)

Zone A: 85.40–86.01

Major Supply zone created by distribution before the sharp sell-off.

Acts as strong resistance; sellers aggressively entered at this level.

Zone B: 84.80–85.20 (0.5 Level)

Intermediate Supply—likely a reaction zone for institutional sell limits.

Price could stall or reverse from this level before testing Zone A.

2.2 Demand Zones (Support)

Zone C: 83.45–83.80

First Major Demand—price reacted here previously with a strong bounce.

A break below could expose lower demand.

Zone D: 82.50–82.90

Deeper Demand—represents a high-probability buying area if Zone C fails.

3. Price Action in Bordered Region

Current Price (~84.69): Price is climbing toward supply after a local low.

Expected Move: Price is likely to:

Reach into Zone B (84.80–85.20).

Potentially reject from supply and continue downward.

If rejection occurs, price is expected to revisit Zone C (~83.50–83.80).

Bullish Scenario: If price breaks above 85.20 and sustains above 86.01, bullish continuation becomes likely.

Bearish Scenario: Rejection from current supply areas confirms continuation of the downtrend.

4. Structure & Momentum Outlook

Bias: Bearish, unless 86.01 is broken and flipped into support.

Momentum: Price is currently retracing with moderate strength. If supply absorbs buyers in Zone B, momentum will likely reverse to the downside.

Key Level to Watch: 85.00–85.20 area for reversal confirmation.

5. Supporting Financial Context

Sector Rotation: The Utilities sector (XLU) has seen recent inflows and outflows tied to market volatility and interest rate speculation.

Rate Sensitivity: Utilities are interest-rate sensitive, and the market is pricing in uncertainty around Fed cuts, adding pressure to the sector.

Recent Sentiment: Some analysts view defensive sectors like utilities as range-bound or underperforming during growth-driven rotations (CNBC, Bloomberg).

Utilities against the S&PNot a great chart for Utilities against the S&P. Below 200 week, might go down to historic support or even breach it. Frankly I view Utilities as bullish with the expected data center needs + electricity demand growth however a stagflationary environment can be negative for utilities and a higher rate environment as well.

A higher term premium with stable economic growth may be the worst environment for utilities on a relative basis. When it is put like that, utilities may continue underperforming.

Will revisit if trend picks up and the sector can break above the moving average and resistance.

XLU Could Be Headed LowerPressing on support with two major bars opening on their high and closing on there low. XLU is showing weakness after a double top bull leg in a larger bear trend. You might have to reread that a couple of time. There is also towards of pent up energy and momentum to the downside and an Anti formed on the MACD. Not a classic anti but, I think it is a great spot to form and helps the bear case here.

$XLU BullishLooking like Utilities are on a run. They are testing the $82.13 We could scalp a trade from $81.45 to $82.13 for a $0.60 scalp and hold contracts above this level. Looking at the gaps, they have all filled, so upside potential is very likely with the AMEX:SPY rising. Trade the Trend and Follow the Trend.

XLU approaches top of its trading rangeXLU is showing signs that its recent rally maybe coming to close and start selling off for a period of time

XLU is currently one of the top sector ETFs for defensive move

Its turn around over the past year shows the rotational shift away from risk to defensive

Currently its recent rally is looking to come to an end.

Best to wait before making anymore purchases of XLU

XLU is running hot right now and is due for a pullback. Best to wait on the sidelines until after its coming sell off before adding to any positions

Opening (IRA): XLU October 18th 71 Monied Covered Call... for a 70.09 debit.

Comments: For lack of something better to do, looking to grab the Sept divvy if I can. Selling the -73 delta call against long stock to emulate a ~25 delta short put with the built-in defense of the short call. This isn't the greatest entry given price action, but am willing to add should the market afford me an opportunity to do so at strikes better than the 71 ... .

The last distribution was .55/share; $55/one lot.

Metrics:

Buying Power Effect/Break Even: 70.09

Max Profit: .91 ($91) (excluding dividends); 1.46 (including divvies, assuming a .55/share distribution)

ROC at Max: 1.30%

50% Max: .46; 1.01 (including divvies)

ROC at 50% Max: .65% (1.44% including divvies)

Intuition stock $XLU longI need to make more of a practice of doing this, but I fight it for some reason. You can see prior ones were good for the most part, but I'm primarily just journaling this cuz it's working & I should keep track.

I was laying in bed before I got up on Monday morning and asked for a good stock. That's all you have to do and let your mind be completely open and neutral.

I recommend to anyone to try this sometime & just ask for a number after you think you have the ticker and see what happens.

The first time I tried it (after a psychic told me to do it), I was quite blown away as I got the low and high numbers for the week. The stock was RS, (I saw/heard the letters mentally) and I didn't know of it, but thought it might be a steel stock because of other info I received. So it went on to go up hundreds of percent over the years & others have as well.

So now I get XLU & the number 89. My dowsing said long and gave the number 91. I did get another mental number of 112.

We'll see.

Utility Buyers Getting GreedyUtility stocks have been on a tear recently. Just a few days ago, 93% of the stocks in the S&P Utilities Index were trading above their 200-day moving average, and now the breadth is deteriorating rapidly with just 80% of these constituents above their respective MAs.

After today's slide, it seems the line of least resistance is to the downside, at least in the short-term.

Utilities Getting Ahead of ThemselvesLong term bullish on Utilities, but this is quite the move over the last few weeks.

Looks exhausted with the latest Friday candle forming a -> dark cloud cover.

Also interest rates have not dipped that much to push this interest rate sensitive sector higher, perhaps hype around AI energy usage is driving this.

Trade: Short term pull back -> bear credit spreads

Utilities setting up?The daily chart on XLU provides rationale to keep a place on our watchlist. Recently it made a golden cross and seems to have broken free of a downdraft in price. Now it looks like the RSI could be searching for overbought.

One option is a momentum trade targeting the $71+ price. Personally I'd like to see it hit overbought, then that a position of it pulls back down around the 50 & 200 day MSAs. Looks like with some patience there could be 15% out there depending on how things develop.