XLU trade ideas

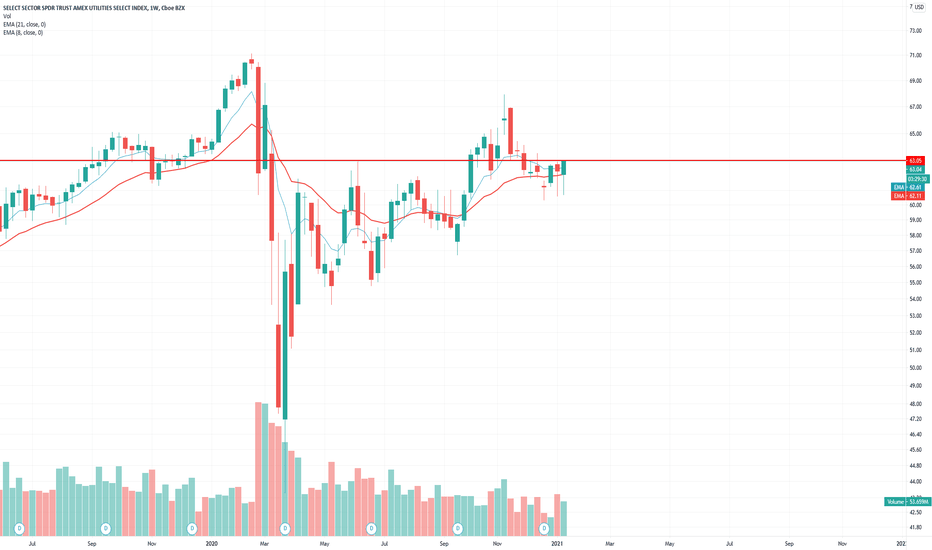

XLU gonna be a great short again Remember I was short it and took all my profits

Daily wants to rally stoch up

Weekly not so still heading down has not turned up so with that the daily stoch rally will be weak

unless the weekly turns up, so in terms swing trading is a short still

with a small bounce

daily look lower highs like res short 66

➡️ Market crash 2021 MAJOR UPDATE: Intermarket analysis.. 📉 Hi mates, i sharing my thoughs about markets from last week and my view for week ahead.Today i bring some more focus on intermarket analysis in this post. So lets start with last week recap:

Summary of last week:

We had busy week for macro, that shows worsening US economy by COVID-19

Dissapointing retail sales for December at Friday: Core Retail Sales m/m: -1.4%, Retail Sales m/m: -0.7%

Dissapointing Uneployment claims: 965K vs. 785K

CPI numbers just in line with expectation

New $1.9 Trillion stimulus proposal by president-elect Joe Biden

Earning season started by Banks NYSE:JPM NYSE:WFC NYSE:C

SPY Chart commentary:

On this chart you can see AMEX:SPY and XLU/SPY

OPENING (IRA): XLU FEBRUARY 19TH 56 SHORT PUT... for a .56/contract credit.

Notes: Selling premium in XLU, which for some reason has popped to the top of my screener, with 30-day is at 44.3%. This one's a modest yielder (2.942%), so, as usual, fine with taking assignment, getting paid to wait, and selling call against if that happens. 1.0% ROC on capital at max; 8.1% annualized.

This time is...⏰ Market exuberance:New secular bear market? 🐻Hi mates, stock market is probably near top and next huge market meltdown is next door . Why i think so?I want to share with you some pieces of my analysis:

📌S&P500 vs. Utilities sector ratio

It seems it could forecast short and mid term corrections in stock market but it looks like its good indicator of broader market cycles as secular bear/bull markets. A secular market trend is a long-term trend that lasts 5 to 25 years and consists of a series of primary trends. A secular bear market consists of smaller bull markets and larger bear markets; a secular bull market consists of larger bull markets and smaller bear markets.

📌Yield spread

Inverted yield curve is leading warning indicator of future recession.

The basic principle is whe yield spred inverted (was in negative territory) you can expect recession in next 12-months.It happened when Dot.com bubble bursted in 2000-2001 and so in Great financial crisis in 2007- 2008 as you see in chart.

📌Put/Call ratio

The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options.

You can use it as contrarian indicator to determine how much Bullish/Bearish the market is.

An extremely low ratio means the market is extremely bullish. A contrarian might conclude that the market is too bullish and is due for a pullback.

Contrary extremely high ratio means the market is extremely bearish.

In my analysis i using 20day MA of Put/Call Ratio an looking up for divergencies.

📌VIX divergence of 20 MA

📌Nasdaq vs Russlel 2000

Just so similar pattern on monhly chart of Nasdaq and Russell 2000

📌Other factors

Margin debt acceleration is another sign of speculative frenzy in the market

Margin debt is not a technical indicator for trading markets. What margin debt represents is the amount of speculation that is occurring in the market. In other words, margin debt is the ‘gasoline,’ which drives markets higher as the leverage provides for the additional purchasing power of assets. However, ‘leverage’ also works in reverse as it supplies the accelerant for more significant declines as lenders ‘force’ the sale of assets to cover credit lines without regard to the borrower’s position. Here is chart

Total market cap of negative earnings of IT firms near $1 trillion its more than 2000 -2001 Dot.com bubble. Source:KailashConcepts

If you like the idea, do not forget to support with a 👍 like and follow.

Leave a comment that is helpful or encouraging. Let's master the markets together.

ABC BullishJust over long entry level..

I think this is an ETF I keep for safety..

Not a recommendation

Top 10 Holdings

NextEra Energy Inc

17.26%

Duke Energy Corp

7.69%

Southern Co

7.41%

Dominion Energy Inc

7.01%

American Electric Power Co Inc

4.72%

Exelon Corp

4.70%

Sempra Energy

4.20%

Xcel Energy Inc

4.00%

Eversource Energy

3.39%

Public Service Enterprise Group Inc